Tariffs, schmariffs… When it comes to the price of agricultural commodities, weather trumps politics every time. China’s retaliatory tariffs, a major source of pain for grains this spring, no longer matter. Mother Nature holds all the cards. Historically wet weather has wreaked havoc on this year’s planting season, delaying both corn and soybeans. While there is still hope for bean yields, corn production will definitely be adversely affected.

Global demand for corn and soybeans is largely a function of the number of mouths to feed and what those mouths are fed. Exploding world population and the economic transformation of China has locked in increasing demand. The world’s most populous nation has transformed itself from an economic backwater to a middle class society. Chinese people are eating more meat. More meat requires more grain.

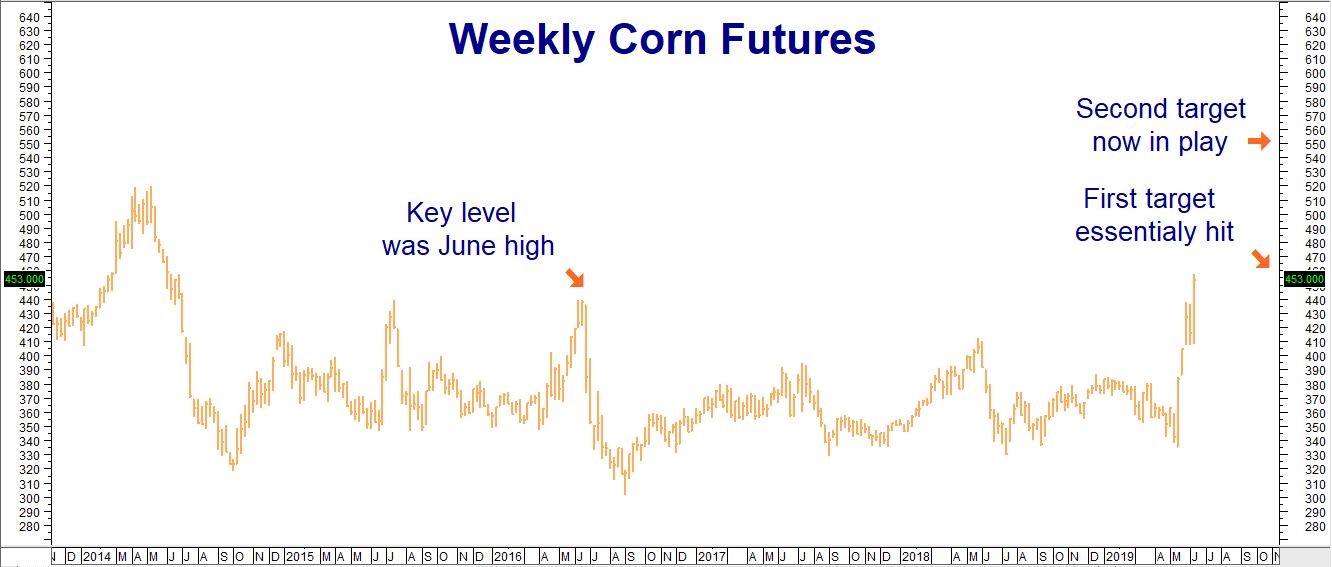

Six consecutive years of North American bumper crops helped meet this increased demand and kept grain prices low. After this spring-from-hell for farmers, traders are pretty certain there will be no North American bumper crops this year. The weekly chart below illustrates this.

Data Source: Reuters

Prices exploded following the USDA’s mid-May planting report and haven’t looked back. The front-month, old-crop futures soared from a low of $3.35 per bushel to Friday’s high of $4.5725 – a gain of 36% in just five weeks. Corn came close enough to hit our first technical price target of $4.60 per bushel for us to consider our first target reached.

The bullishness RMB Group expressed as early as last October, and then re-affirmed in our blogs of May 21 and May 28, appears to be playing out in spades. Now that the market has cleared the key level of $4.39 per bushel and hit our first upside objective of $4.60 per bushel, our second target of $5.50 is fully in play.

Will corn hit our second target? We certainly think it is possible given the weather and havoc it has wreaked on the American heartland. Conditions could be much worse than the market currently anticipates, making our $5.50 objective not only achievable but low, depending on how the growing season plays out. Only half the corn is in the ground in Ohio and just two-thirds in Indiana. Yields are already expected to suffer substantially. Projections are for a skimpy 166 bushels per acre compared with a 3-year average of 176.

Mother Nature Giveth and Also Taketh Away

We need to remember that the last time corn rallied to this level was in 2016 at almost the same time seasonally. Weather expectations improved and as the chart above illustrates, prices tanked. There is no doubt that the effects of this year’s weather are potentially far more bullish than those in 2016, but years of experience tell us what Mother Nature giveth, she can also taketh away.

That’s why we recommend RMB Group trading customers holding the December $4.20 calls we suggested purchasing for $1,000 or less last October to consider exiting half of their positions for twice their initial entry level or higher. Hold the rest of these calls for a potential run at our second target of $5.50 per bushel. December $4.20 corn calls settled for $2,881.25 on Friday. A rally to $5.50 will make them worth at least $6,000 each.

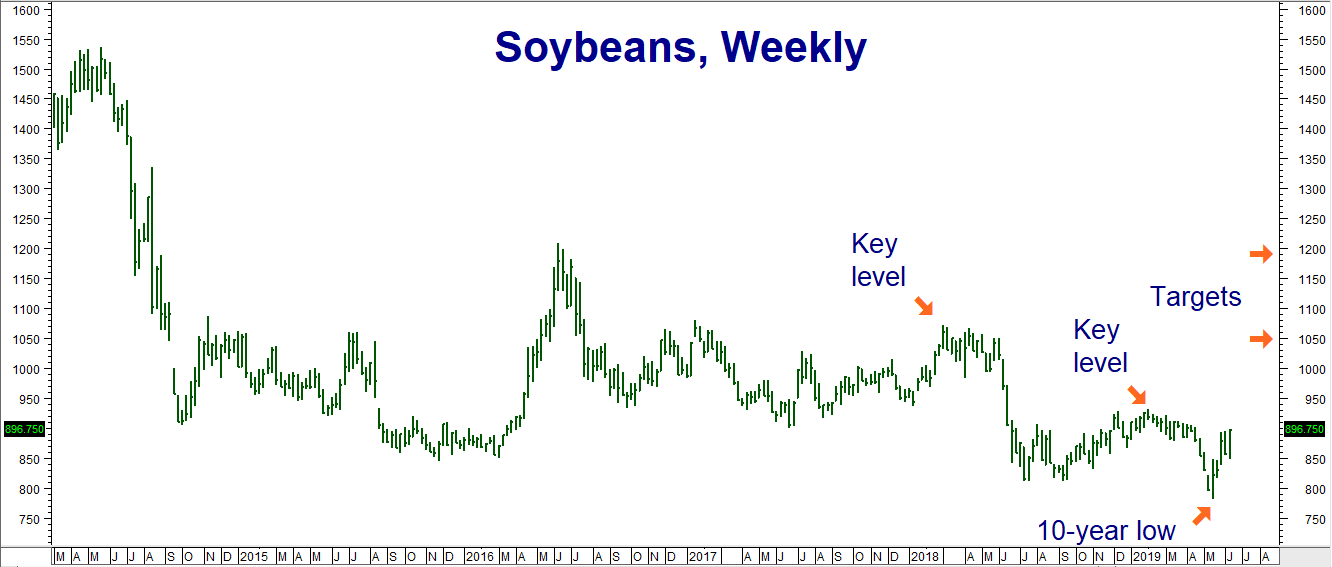

Soybeans Lagging, But Certainly Not Bearish

Because they require a shorter growing season than corn, soybeans are lagging as farmers plant beans in acres they were unable to plant corn. But that doesn’t mean soybean price action is bearish. Beans have recovered nicely from 10-year lows and are currently encountering resistance at the $9.00 per bushel level.

The upside outlook will improve dramatically should beans take out swing highs at $9.31, marked as a “key level” on the chart below. A couple of solid closes above this level could set the stage for a move to our first price target of $10.50 per bushel. We’ve adjusted this target down from our original upside objective of $11.00 per bushel due to the levels of solid resistance currently above the market.

Like corn, growing conditions could be much worse than forecast. That’s why we’ve added a second, longer-term target of $12.00 per bushel. A breach of our second key level of $10.71 per bushel will open the door. RMB trading customers who took our suggestions in previous blogs to purchase November 2019 and November 2020 bull spreads using CBOT soybean options should continue to hold their positions.

Data Source: Reuters

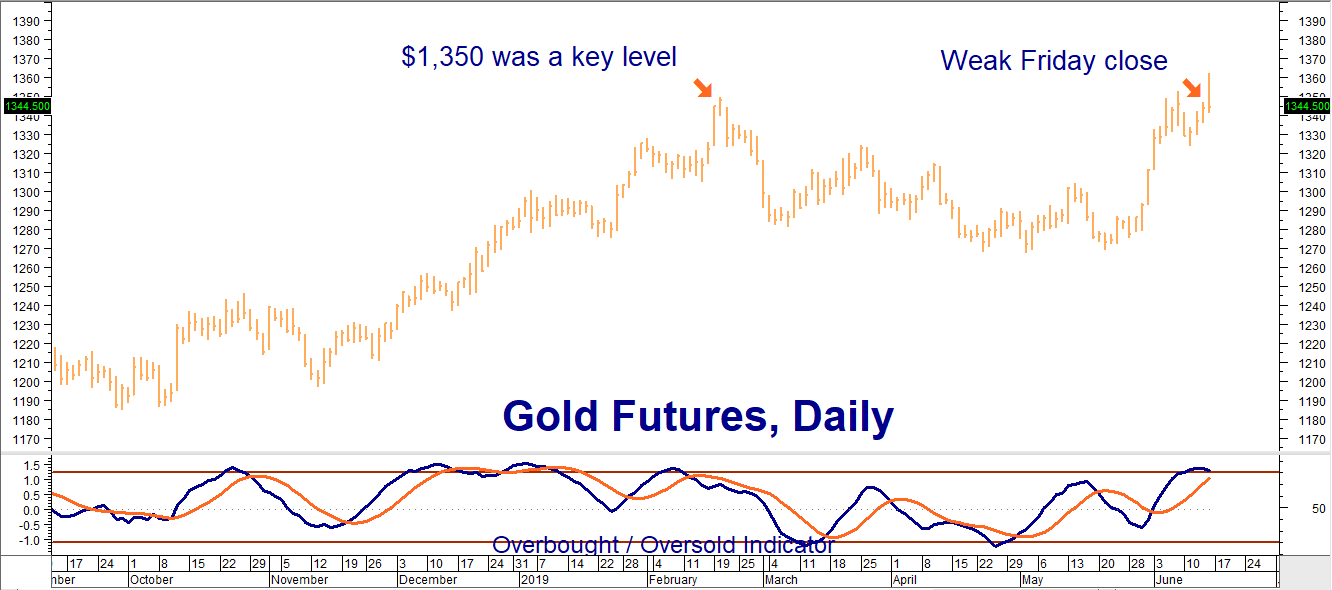

Key Level Breached in Gold

Friday brought good news and bad news to the gold market. The good news was the yellow metal’s ability to breach the key $1,350 level. The bad news was its inability to hold above it. Instead of pumping their fists in the air, gold bulls are anxious as their favorite metal fails to follow through yet again. Bulls have even more reason for concern. Gold is overbought and, given Friday’s weak close, extremely vulnerable to near-term declines.

Data Source: Reuters

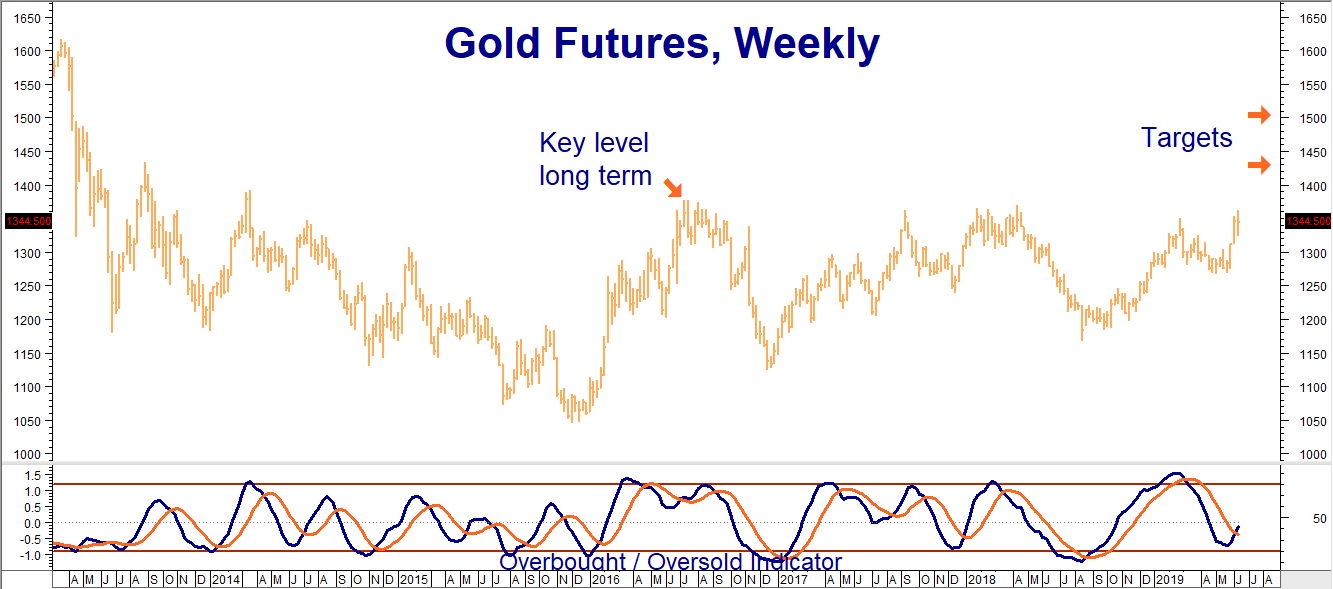

But all is not lost. Tensions between Iran and the US are growing. The seemingly inexplicable desire of the latter to repeat the terrible mistakes of the Iraq war is helping to turn up the heat on a pot that is dangerously close to boiling. Gold is also the tale of two charts: the daily chart above could mean bad news given Friday’s close; the weekly chart below could spell good news – albeit on a longer term price horizon.

Data Source: Reuters

Gold is as oversold on the weekly chart as it is overbought on the daily chart. Gold is making higher highs and higher lows and rallying despite the strong dollar. This indicates that investors’ desire to use gold as a hedge against potential global catastrophe is currently stronger than the classic downward pull of a strong dollar. Gold’s four year high at $1,378 per ounce is the new key level to watch. Our upside targets of $1,434 and $1,500 per ounce remain unchanged.

RMB Group trading customers without a bullish position in gold may want to use any significant decline, resulting from Friday’s poor close, as an opportunity to establish one. Give your broker a call for the latest recommendations. If you took our suggestions in previous blogs to purchase December 2019 $1,400/$1,450 or June 2020 $1,450/$1,500 bull spreads, continue to hold them.

Please be advised that you need a futures account to trade the markets in this post. The RMB Group has been helping its clientele trade futures and options since 1991 and are very familiar with all kinds of option strategies. Call us toll-free at 800-345-7026 or 312-373-4970 (direct) for more information and/or to open a trading account. Or visit our website at www.rmbgroup.com.

* * * * * * * *

The RMB Group

222 South Riverside Plaza, Suite 1200, Chicago, IL 60606

This material has been prepared by a sales or trading employee or agent of R.J. O’Brien & Associates (“RJO”)/RMB Group and is, or is in the nature of, a solicitation. This material is not a research report prepared by a Research Department. By accepting this communication, you agree that you are an experienced user of the futures markets, capable of making independent trading decisions, and agree that you are not, and will not, rely solely on this communication in making trading decisions.

DISTRIBUTION IN SOME JURISDICTIONS MAY BE PROHIBITED OR RESTRICTED BY LAW. PERSONS IN POSSESSION OF THIS COMMUNICATION INDIRECTLY SHOULD INFORM THEMSELVES ABOUT AND OBSERVE ANY SUCH PROHIBITION OR RESTRICTIONS. TO THE EXTENT THAT YOU HAVE RECEIVED THIS COMMUNICATION INDIRECTLY AND SOLICITATIONS ARE PROHIBITED IN YOUR JURISDICTION WITHOUT REGISTRATION, THE MARKET COMMENTARY IN THIS COMMUNICATION SHOULD NOT BE CONSIDERED A SOLICITATION.

The risk of loss in trading futures and/or options is substantial and each investor and/or trader must consider whether this is a suitable investment. Past performance, whether actual or indicated by simulated historical tests of strategies, is not indicative of future results. Trading advice is based on information taken from trades and statistical services and other sources that RJO/RMB believes are reliable. We do not guarantee that such information is accurate or complete and it should not be relied upon as such. Trading advice reflects our good faith judgment at a specific time and is subject to change without notice. There is no guarantee that the advice we give will result in profitable trades.