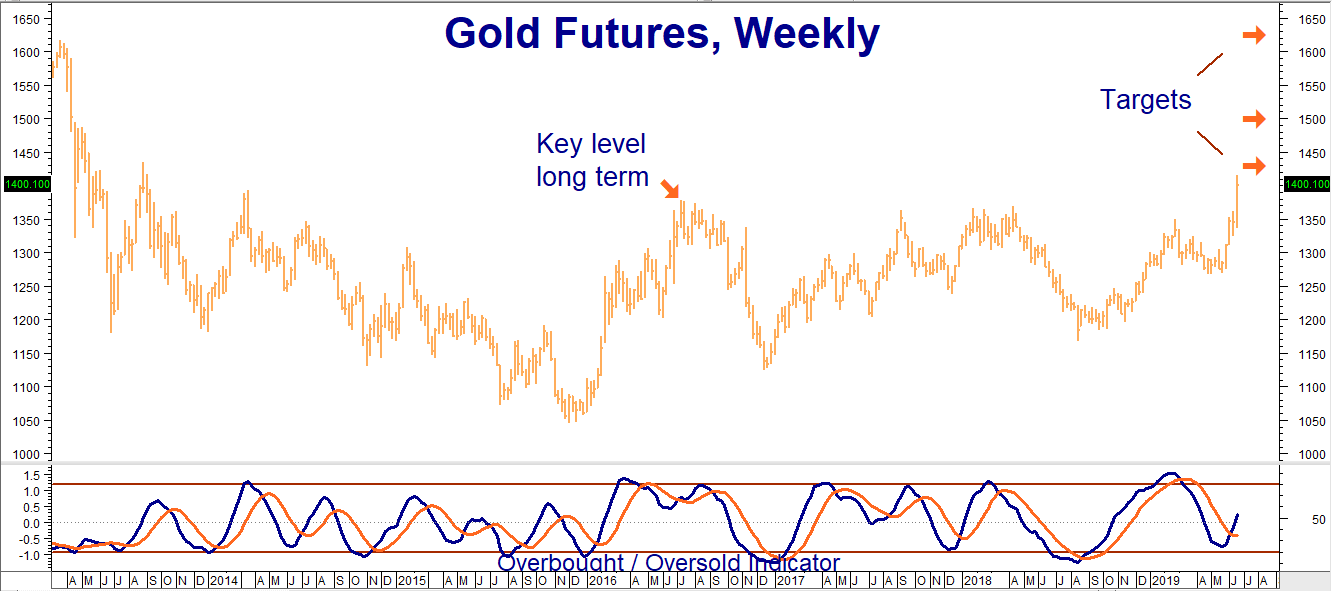

That didn’t take long… Powered by the growing prospects of war with Iran, gold cut through its 4-year high of $1,378 per ounce like a hot knife through butter. Currently trading for $1,419, gold is within $15 of our first upside target of $1,434 per ounce. Multiple closes above this level would put our second upside target of $1,500 per ounce in play. Last week’s positive price action, combined with recent developments in Iran, means we’ve added a third upside objective of $1,625 per ounce.

Data Source: Reuters

RMB Group trading customers who followed our recommendation to buy December 2019 $1,400 / $1,450 bull call spreads for $600 or less using the COMEX gold options should consider exiting their positions on a move above $1,430 in the front month futures contract. Our December spreads are currently going for $2,000 each. Continue to hang on to your June 2020 $1,450 / $1,500 spreads if you have them.

Please be advised that you need a futures account to trade the markets in this post. The RMB Group has been helping its clientele trade futures and options since 1991 and are very familiar with all kinds of option strategies. Call us toll-free at 800-345-7026 or 312-373-4970 (direct) for more information and/or to open a trading account. Or visit our website at www.rmbgroup.com.

* * * * * * * *

The RMB Group

222 South Riverside Plaza, Suite 1200, Chicago, IL 60606

This material has been prepared by a sales or trading employee or agent of R.J. O’Brien & Associates (“RJO”)/RMB Group and is, or is in the nature of, a solicitation. This material is not a research report prepared by a Research Department. By accepting this communication, you agree that you are an experienced user of the futures markets, capable of making independent trading decisions, and agree that you are not, and will not, rely solely on this communication in making trading decisions.

DISTRIBUTION IN SOME JURISDICTIONS MAY BE PROHIBITED OR RESTRICTED BY LAW. PERSONS IN POSSESSION OF THIS COMMUNICATION INDIRECTLY SHOULD INFORM THEMSELVES ABOUT AND OBSERVE ANY SUCH PROHIBITION OR RESTRICTIONS. TO THE EXTENT THAT YOU HAVE RECEIVED THIS COMMUNICATION INDIRECTLY AND SOLICITATIONS ARE PROHIBITED IN YOUR JURISDICTION WITHOUT REGISTRATION, THE MARKET COMMENTARY IN THIS COMMUNICATION SHOULD NOT BE CONSIDERED A SOLICITATION.

The risk of loss in trading futures and/or options is substantial and each investor and/or trader must consider whether this is a suitable investment. Past performance, whether actual or indicated by simulated historical tests of strategies, is not indicative of future results. Trading advice is based on information taken from trades and statistical services and other sources that RJO/RMB believes are reliable. We do not guarantee that such information is accurate or complete and it should not be relied upon as such. Trading advice reflects our good faith judgment at a specific time and is subject to change without notice. There is no guarantee that the advice we give will result in profitable trades.