“It’s getting late. Soon it will be too late.” That’s how we began last week’s blog post. We are now 8 days further into the planting season and the outlook has changed. “Soon” is now. It is too late.

Today’s United States Department of Agriculture’s (USDA) Crop Progress Report made it official. It shows 58% of the corn crop planted versus 90% last year. Only 32% has emerged from the ground compared with 69% last year. The numbers for soybeans are equally as dismal. Only 29% of soybeans are planted compared with 74% last year. A paltry 11% of soybeans have emerged versus 44% last year.

Dangerous thunderstorms and wet weather not only spoiled Memorial Day parades and rained out barbecues across the American Midwest, they also washed out any hope that planting numbers would improve in any significant way soon. They effectively ended any hope that this year’s corn crop will come close to meeting estimated planting intentions.

It is now too late in the season to plant corn in large swaths of the American breadbasket. And while there is time and hope (albeit fading) for soybeans, Mother Nature does not seem to be in the mood to cooperate.

Mother Nature Always Gets the Last Word

Futures traders have spent most of 2019 preoccupied with the negative impacts of the strong dollar and Trump’s trade war, but Mother Nature had other ideas – proving, once again, that she ALWAYS gets the last word when it comes to the price of agricultural commodities. The dollar has gotten stronger at the same time the fading prospects of a trade deal have significantly increased the odds that China’s retaliatory tariffs will be with us for a while longer. Both of these remain factors. But Mother Nature has changed the rules of the game.

Planting is now so far behind that many growers will probably choose not to plant and collect crop insurance or the additional $16 billion in new farm aid recently announced by the Trump Administration. This will effectively end the six-year streak of North American bumper crops in corn and soybeans, reducing global stockpiles to the point where tariffs could become an afterthought.

The globe’s ever-expanding population – now in excess of 7 billion – means more mouths to feed. Growing global wealth has altered diets to include more meat which require larger amounts of grain. This additional demand has helped keep a lid on global stockpiles despite 6 years of back-to-back bumper crops in the American Midwest – one of the richest growing areas of the world.

Fall Armyworm May Put China’s Corn Crop in Danger

Last September we wrote about the emergence of African swine fever in China. Now it is all over the news. The Chinese have slaughtered over 200 million pigs in a seeming futile attempt to slow the virus. It is now spreading all over pork-loving Asia, including Vietnam and Thailand. 200 million pigs are probably more than will be produced in the US this year. (Note: we’ll have more on this in a future blog post, hopefully including a “set it and forget it” fixed-risk trade suggestion.)

As if this isn’t enough to worry about, Chinese farmers have been alerted to a new threat from Africa. The fall armyworm has been detected in 13 provinces. The larvae of the fall armyworm moth are voracious eaters. Chinese authorities are worried that the fall armyworm could spread across most of their prime growing regions over the next year. This pest has the potential to dramatically lower yields in China’s large corn crop. Soybeans, cotton and rice could be damaged as well.

Data Source: Reuters

How High Can Corn Go?

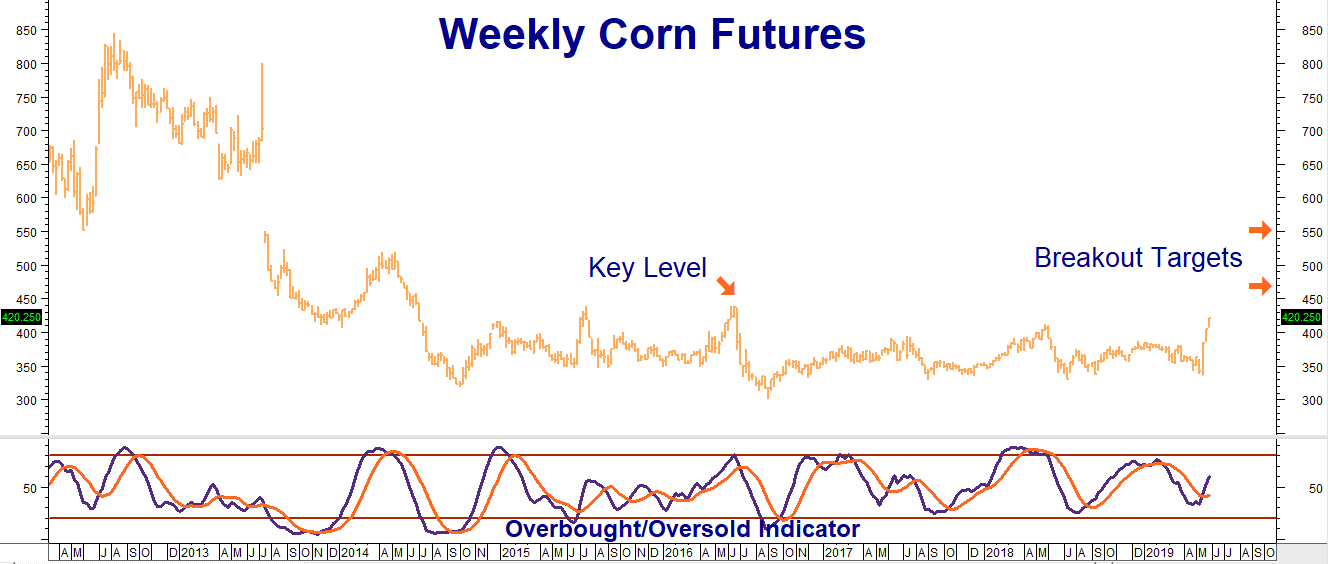

Only Mother Nature knows for sure. Our long-term targets of $4.60 and $5.50 per bushel remain intact. New crop, December corn futures closed yesterday at $4.3750, putting price well within striking distance of our first objective. Front month futures closed at $4.2075, well above old swing highs at $4.10 per bushel and are homing in on the key $4.39 per bushel level. The price of front month corn futures has not been above this since July 2014. A dramatic breach of this level increases the odds that our $5.50 target in corn will be reached.

However, remember that June/July is typically an inflection point for corn. Not much is known about the probable prospects of the corn crop until then. Both corn and soybeans tend to build in a “weather premium” during the spring that can peak in midsummer as prices reverse on the first bit of good news.

The lack of “weather premium” made corn and beans great buys 3 weeks ago. Now that it’s back, corn doesn’t look so cheap. Will “good news” for corn growers be forthcoming? It doesn’t look like it, but there is a sliver of hope. We recommend caution in any case.

RMB Group trading customers who took our suggestion to buy December 2019 $4.20 corn calls for $1,000 or less have been helped immensely by Mother Nature’s soggy disposition. These calls closed for $2,100 yesterday. Depending upon today’s opening prices, you may want to exit half of your position for double your initial entry level or higher. If filled, you take your entire initial risk “off the table.” Hold the balance in anticipation of more fireworks this summer.

Planting Chill Is Warming-up Soybeans

RMB Group trading customers who were filled on our suggestion two weeks ago to buy July 2020 $10.00/$11.00 bull spreads in soybeans may have caught a bottom. Yesterday’s big rally was certainly helpful. It was also beneficial to those who own the November 2019 $10.00 /$11.00 and $10/$12.00 bull spreads we suggested buying last July. Like Lazarus, they appear to have risen from the tomb and, depending on the whims of Mother Nature, could wind up being a pleasant surprise.

If you do not own a bullish position in corn or soybeans and would like to establish one, beans are still relatively inexpensive. Should the big rallies we are seeing in the overnight market – December corn is up 11 cents to $4.48 and November soybeans are up 20 cents to $9.02 as we write this – hold up, they may not do so much longer. Contact your RMB Group broker for the latest.

Please be advised that you need a futures account to trade the markets in this post. The RMB Group has been helping its clientele trade futures and options since 1991 and are very familiar with all kinds of option strategies. Call us toll-free at 800-345-7026 or 312-373-4970 (direct) for more information and/or to open a trading account. Or visit our website at www.rmbgroup.com.