It’s getting late. Soon it will be too late. Pounding spring rains and devastating floods have made it impossible for farmers to plant across wide swaths of the American grain belt. Saturated soils are making it impossible to use mechanized planting machinery in some of the most productive farmland in the US, adding to the already tough-to-swallow tariff troubles of Midwest farmers. The longer it takes to get crops in the ground, the less time there is for them to mature enough to withstand the withering heat of July and August.

The latest United States Department of Agriculture (USDA) progress report released yesterday afternoon added even more concern. In a typical year, most states show mid-May planting progress for soybeans and corn far greater than 50% of total intended acreage. None of the big producing states cleared that last week, making this the slowest planting season in history.

Iowa was the only big producer to crack the 50% level in corn this week. According to yesterday’s report, it had 70% of its corn crop in the ground compared with 83% last year, but only 24% of its soybeans planted compared to 54% last year.

Data Source: Reuters

Data Source: Reuters

But things are much worse in some of the other big-producing states. Illinois had 95% of its corn and 79% of its soybeans in the ground at this time last year. This year it has planted only 24% of its corn and 9% of its soybeans. Indiana had planted 86% of its corn and 70% of its soybeans this time last year. This year’s plantings are 14% and 6% respectively. Ohio had 69% of its corn and 40% of its soybeans in the ground last year. This year it has 9% and 4% respectively.

Data Source: Reuters

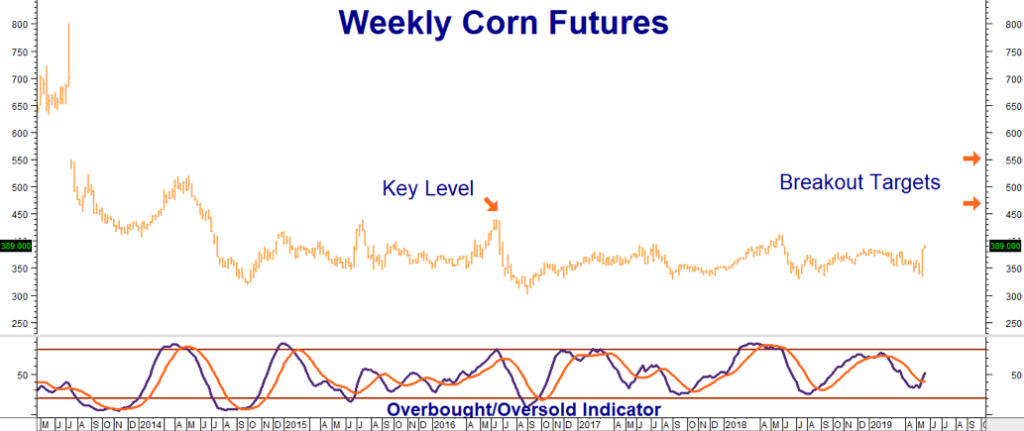

We are well into planting season. Conditions need to improve quickly to avoid potential yield damage down the road. Not surprisingly, this is getting factored into prices. Both corn and soybeans (see charts above) have rallied smartly over the past week, adding a little “umph” to the bullish corn and soybean options positions we’ve recommended over the past 7 months. Both markets are up again this morning.

Cracks in Trump’s Tariff Wall

The Trump Administration recently decided to focus the force of his tariff campaign on China by dropping tariffs on Canadian and Mexican steel and aluminum. Both nations responded by immediately dropping their retaliatory tariffs on American agricultural products. This was a bit of good news for American farmers who haven’t seen much of it lately. China remains the biggest market for American grain, but every little bit helps.

Will the rally in grains continue? It depends on the weather and the ultimate outcome of America’s trade war with China. An agreement between the world’s number one and number two economies could be the rocket fuel grains have been longing for. It depends how much President Trump will bend to keep his rural base and how much China will bend to avoid slipping into recession.

One thing is clear; corn and soybeans are still inexpensive, even with recent rallies off of last week’s punishing lows. RMB Group trading customers not already long may want to consider using options to construct low-risk bullish positions. Our long-term technical targets are $4.60 and $5.50 per bushel in corn and $11.00 per bushel in soybeans. Contact your personal broker for trade suggestions.

Please be advised that you need a futures account to trade the markets in this post. The RMB Group has been helping its clientele trade futures and options since 1991 and are very familiar with all kinds of option strategies. Call us toll-free at 800-345-7026 or 312-373-4970 (direct) for more information and/or to open a trading account. Or visit our website at www.rmbgroup.com.

The RMB Group

222 South Riverside Plaza, Suite 1200, Chicago, IL 60606

This material has been prepared by a sales or trading employee or agent of R.J. O’Brien & Associates (“RJO”)/RMB Group and is, or is in the nature of, a solicitation. This material is not a research report prepared by a Research Department. By accepting this communication, you agree that you are an experienced user of the futures markets, capable of making independent trading decisions, and agree that you are not, and will not, rely solely on this communication in making trading decisions.

DISTRIBUTION IN SOME JURISDICTIONS MAY BE PROHIBITED OR RESTRICTED BY LAW. PERSONS IN POSSESSION OF THIS COMMUNICATION INDIRECTLY SHOULD INFORM THEMSELVES ABOUT AND OBSERVE ANY SUCH PROHIBITION OR RESTRICTIONS. TO THE EXTENT THAT YOU HAVE RECEIVED THIS COMMUNICATION INDIRECTLY AND SOLICITATIONS ARE PROHIBITED IN YOUR JURISDICTION WITHOUT REGISTRATION, THE MARKET COMMENTARY IN THIS COMMUNICATION SHOULD NOT BE CONSIDERED A SOLICITATION.

The risk of loss in trading futures and/or options is substantial and each investor and/or trader must consider whether this is a suitable investment. Past performance, whether actual or indicated by simulated historical tests of strategies, is not indicative of future results. Trading advice is based on information taken from trades and statistical services and other sources that RJO/RMB believes are reliable. We do not guarantee that such information is accurate or complete and it should not be relied upon as such. Trading advice reflects our good faith judgment at a specific time and is subject to change without notice. There is no guarantee that the advice we give will result in profitable trades.