Talk is cheap, especially when it comes to trade. Stock market bulls were confident that widely-expected trade deal between China and the US would be the catalyst that would spark a FOMO (fear of missing out) melt-up in stocks. Commodity investors were counting on a deal to lift the dark cloud hovering over key US agricultural exports like wheat, corn, hogs and soybeans.

Talks failed on Friday, torpedoing both of these expectations. Not surprisingly, stocks and commodities got hammered when the trade deal fell through. But there is a big difference between the two. The stock market is declining from new highs following the longest bull market in history. Commodities are declining from already dirt-cheap levels, driving prices beneath the costs of production, even in states with some of the richest farm land.

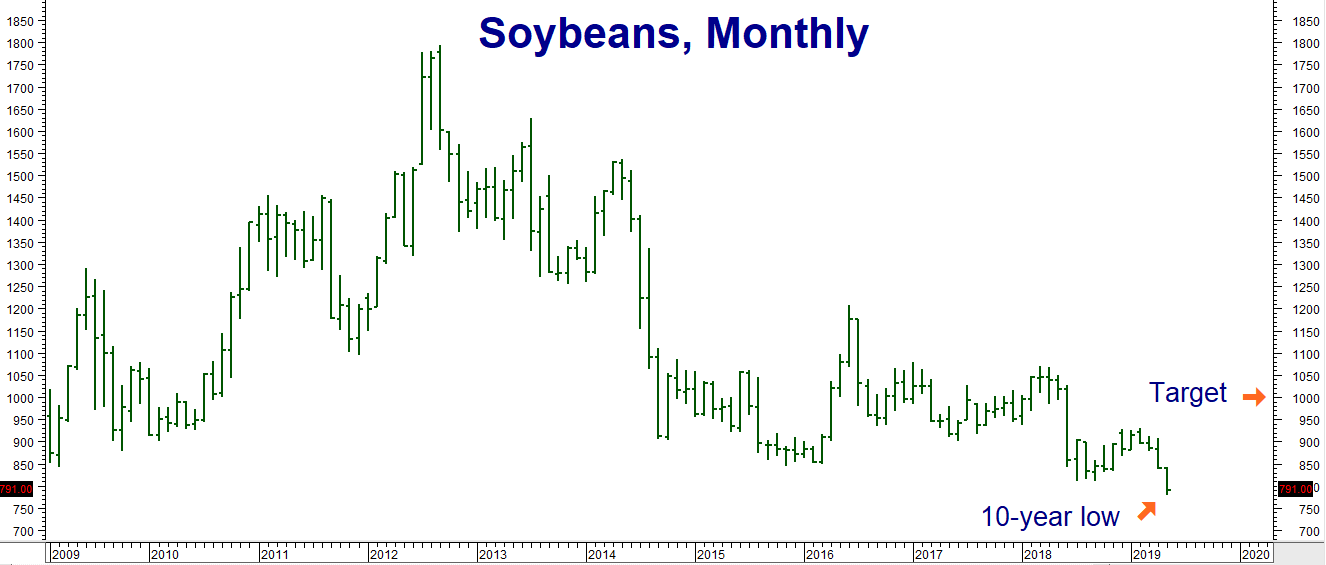

The cost of producing 1 bushel of corn in Iowa is expected to be between $3.98 and $3.83 per bushel. The December “new crop” corn futures contract traded on the Chicago Board of Trade are currently going for $3.71 per bushel. The cost of producing a bushel of soybeans in Iowa ranges from $8.63 to $8.58. November “new crop” futures closed Monday for $8.23 per bushel. The price of the front month soybean future contract dropped as low as $8.03 on Monday – a ten-year low.

Data Source: Reuters

Farmers economize when prices dip below the cost of production, cutting back on seed, fertilizer and acreage. This can affect crop yields in future years. Consequently, we would not be surprised to see lower yields and higher prices next year due to the effect of abnormally low prices this year. For example, the seasonal spring “weather premium” typically built into corn and soybeans is nowhere to be found because of tariff pressure, leaving both markets extremely vulnerable to bullish weather surprises.

Stock Indexes and grains are making attempts to rally this morning after yesterday’s drubbing. Which is the better buy? The S&P 500 has dropped just 4.8% from a new high. The current bull market in stocks is the longest in history and the overall stock market is expensive. Corn and soybeans have declined from already dirt-cheap levels and are now below the cost of production. As far as we are concerned, the answer is obvious.

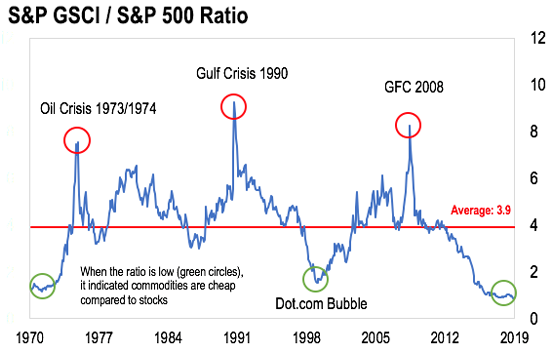

The Perfect Time to Diversify Into Commodities?

Source: Bloomberg

The chart above is one of the most interesting ones we’ve seen lately. It compares the Goldman Sachs Commodity Index with the S&P 500. When the ratio between them gets extremely low, it indicates a good time to diversify into commodities. This ratio is now lowest we’ve seen going all the way back to 1970.

One of the ways to diversify is to add individual commodities to one’s portfolio using options, like the soybean bull call spread we are recommending for RMB Group trading customers. (See below.) Another way to add commodities to your portfolio is via professionally managed futures accounts. You can select managed programs that focus exclusively on commodities and get the benefit of expert management.

Commodity money managers are called Commodity Trading Advisors (CTAs) and must be registered with the Commodity Futures Trading Commission (CFTC.) Each advisor will supply a Disclosure Document (similar to a prospectus) to each prospective customer which will include an audited track record of that advisor’s performance. To find out more about professionally managed futures accounts you can call us at the numbers listed at the end of this blog. Download our free report Opportunities Outside the Stock Market to learn more.

Use Options to “Farm” Soybeans for Pennies on the Dollar

With the price of soybeans now well-below the cost of production, the time has come to dip our toes in the water. Soybeans are sharply higher this morning following yesterday’s drubbing due to oversold conditions and forecasts of potentially disruptive weather. Our upside target for the July 2020 futures contact is $11.00 per bushel. (See soybean chart above.)

We are going to use the soybean call options traded on the Chicago Board of Trade to construct a bullish position. RMB Group trading customers may want to consider buying a July 2020 $10.00 call options while simultaneously selling an equal number of July 2020 $11.00 call options for a net cost of $600 or less. This, plus transaction costs, is your maximum risk. Our bull call spread could be worth as much as $5,000 if the July 2020 futures contract hits our $11.00 per bushel target on or prior to option expiration day June 26, 2020.

Please be advised that you need a futures account to trade the markets in this post. The RMB Group has been helping its clientele trade futures and options since 1991 and are very familiar with all kinds of option strategies. Call us toll-free at 800-345-7026 or 312-373-4970 (direct) for more information and/or to open a trading account. Or visit our website at www.rmbgroup.com.

The RMB Group

222 South Riverside Plaza, Suite 1200, Chicago, IL 60606

This material has been prepared by a sales or trading employee or agent of R.J. O’Brien & Associates (“RJO”)/RMB Group and is, or is in the nature of, a solicitation. This material is not a research report prepared by a Research Department. By accepting this communication, you agree that you are an experienced user of the futures markets, capable of making independent trading decisions, and agree that you are not, and will not, rely solely on this communication in making trading decisions.

DISTRIBUTION IN SOME JURISDICTIONS MAY BE PROHIBITED OR RESTRICTED BY LAW. PERSONS IN POSSESSION OF THIS COMMUNICATION INDIRECTLY SHOULD INFORM THEMSELVES ABOUT AND OBSERVE ANY SUCH PROHIBITION OR RESTRICTIONS. TO THE EXTENT THAT YOU HAVE RECEIVED THIS COMMUNICATION INDIRECTLY AND SOLICITATIONS ARE PROHIBITED IN YOUR JURISDICTION WITHOUT REGISTRATION, THE MARKET COMMENTARY IN THIS COMMUNICATION SHOULD NOT BE CONSIDERED A SOLICITATION.

The risk of loss in trading futures and/or options is substantial and each investor and/or trader must consider whether this is a suitable investment. Past performance, whether actual or indicated by simulated historical tests of strategies, is not indicative of future results. Trading advice is based on information taken from trades and statistical services and other sources that RJO/RMB believes are reliable. We do not guarantee that such information is accurate or complete and it should not be relied upon as such. Trading advice reflects our good faith judgment at a specific time and is subject to change without notice. There is no guarantee that the advice we give will result in profitable trades.