2019 has not been kind for natural gas. Crude oil prices may have soared but natural gas deflated, tumbling as much as 34% from its highs in mid-January despite increasing demand and historically-low stockpiles. Part of this decline is due to seasonal factors. Natural gas has two seasons: injection and withdrawal.

During the late spring and summer when heating demand is at its lowest, natural gas is injected into underground formations deep within the earth. During the late fall and winter when heating demand is at its highest, it is withdrawn from storage. Prices tend to rise in anticipation of winter withdrawals during the fall and decline during spring in anticipation of sharply-reduced demand during injection season.

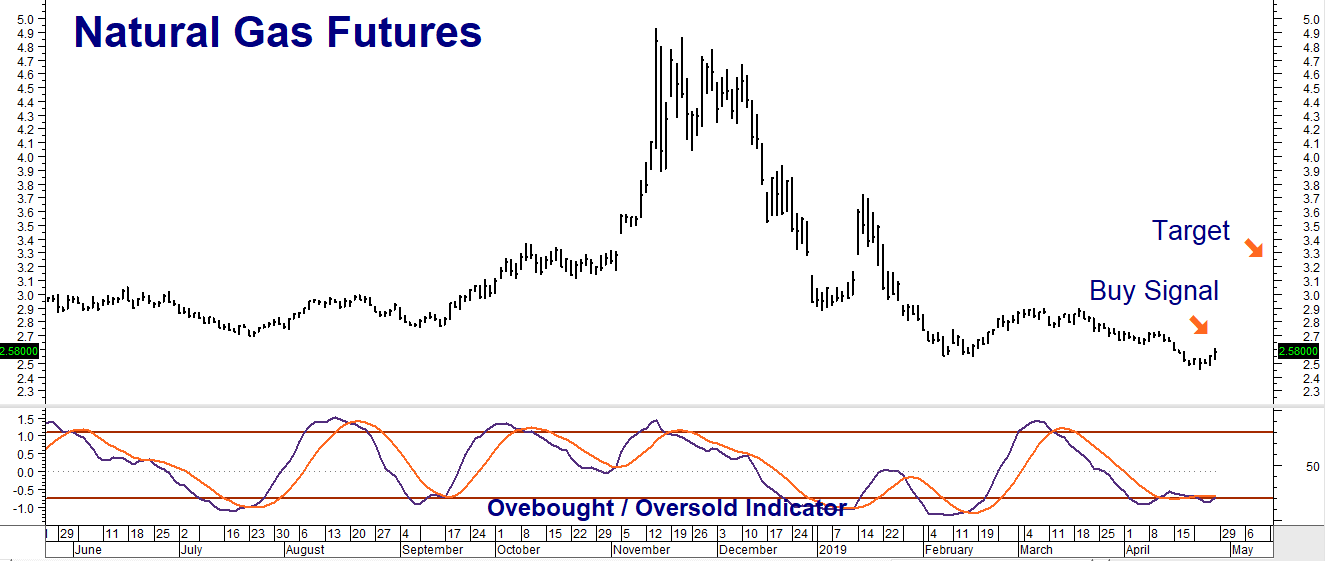

The classic seasonal spring decline in natural gas is readily evident in recent price action. (See chart below.) Have prices dipped too low? We believe they have. As of last Thursday, there were 1.339 trillion cubic feet of natural gas in underground storage in the US. That may sound like a lot, but it is 22% below the 5-year average.

Natural gas is also burned to generate electricity. A hot summer means higher demand for power-intensive air conditioning. One of the reasons natural gas sank was forecasts for milder-than-expected weather. Increasing heat could put a weather premium back into prices in a hurry.

Natural Gas Overtaking Coal Globally

Natural gas is now cheaper than Powder River Basin coal. This will accelerate the move to natural gas from coal by power companies here in the US, boosting demand. China is making this move as well. Its air pollution problem leaves it no other choice. China’s cities are suffocating in unhealthy air.

China’s imports of liquefied natural gas (LNG) soared 32% in 2018, making China the world’s largest importer of LNG. Demand is expected to rise another 11% in 2019. While the US does not have enough LNG conversion capacity to take advantage of rising Chinese demand yet, we expect it will become more of a bullish factor as more capacity comes on line.

We believe low prices and relatively subdued volatility are creating a bullish opportunity in the near-term. As the chart below illustrates, natural gas is testing long-term support at the $2.50 per million BTU level. Two consecutive closes above previous day highs indicate strength following natural’s brief dip below the old swing low of $2.5430. A hotter-than-expected summer may be all that is needed to propel price to our $3.25 objective.

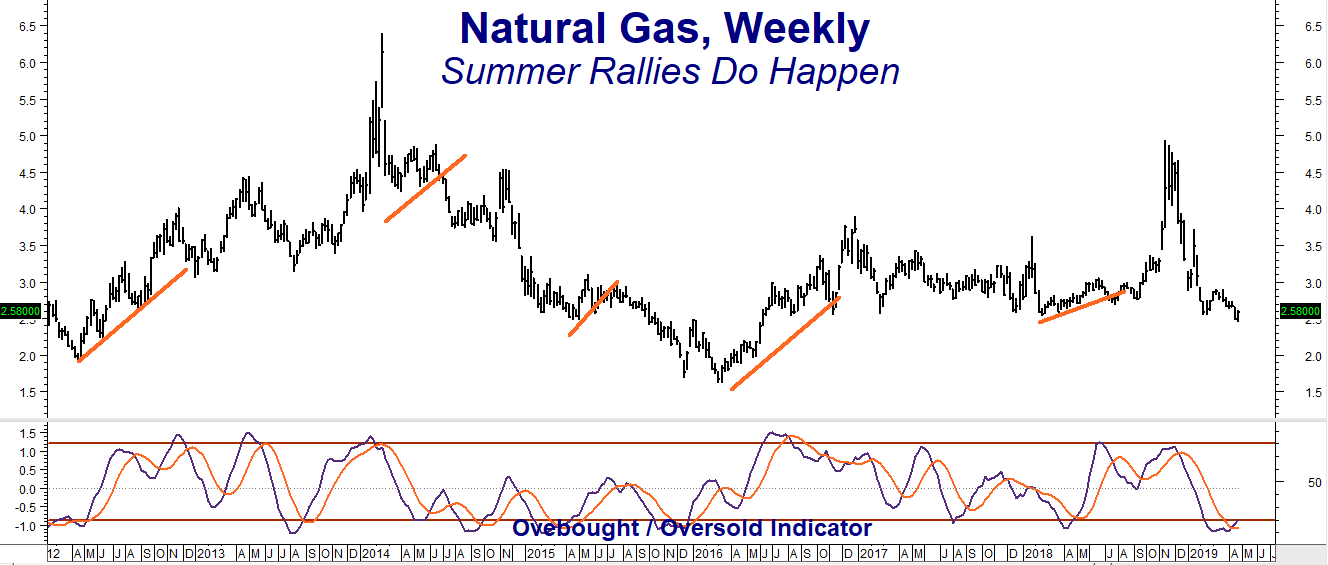

While natural gas is not necessarily known for summer rallies, they can and do occur. (See chart below.) Natural gas is notoriously volatile. Prices can explode or implode at any time for any reason. Recent sideways price action has lowered the temperature of the market – and the prices of call options have followed.

RMB Group trading customers may want to consider positioning themselves for a bullish surprise by taking a look at the October $2.90 or $3.00 calls traded on the NYMEX division of the CME Group.

October $2.90 calls closed Friday at $710. A move to our $3.25 objective prior to October option expiration on September 25, 2019 would make them worth at least $3,500. October $3.00 calls closed Friday at $480. They would be worth at least $2,500 should October natural gas futures reach our $3.25 objective prior to option expiration.

Please be advised that you need a futures account to trade the markets in this post. The RMB Group has been helping its clientele trade futures and options since 1991 and are very familiar with all kinds of option strategies. Call us toll-free at 800-345-7026 or 312-373-4970 (direct) for more information and/or to open a trading account. Or visit our website at www.rmbgroup.com.

* * * * * * * *

The RMB Group

222 South Riverside Plaza, Suite 1200, Chicago, IL 60606

This material has been prepared by a sales or trading employee or agent of R.J. O’Brien & Associates (“RJO”)/RMB Group and is, or is in the nature of, a solicitation. This material is not a research report prepared by a Research Department. By accepting this communication, you agree that you are an experienced user of the futures markets, capable of making independent trading decisions, and agree that you are not, and will not, rely solely on this communication in making trading decisions.

DISTRIBUTION IN SOME JURISDICTIONS MAY BE PROHIBITED OR RESTRICTED BY LAW. PERSONS IN POSSESSION OF THIS COMMUNICATION INDIRECTLY SHOULD INFORM THEMSELVES ABOUT AND OBSERVE ANY SUCH PROHIBITION OR RESTRICTIONS. TO THE EXTENT THAT YOU HAVE RECEIVED THIS COMMUNICATION INDIRECTLY AND SOLICITATIONS ARE PROHIBITED IN YOUR JURISDICTION WITHOUT REGISTRATION, THE MARKET COMMENTARY IN THIS COMMUNICATION SHOULD NOT BE CONSIDERED A SOLICITATION.

The risk of loss in trading futures and/or options is substantial and each investor and/or trader must consider whether this is a suitable investment. Past performance, whether actual or indicated by simulated historical tests of strategies, is not indicative of future results. Trading advice is based on information taken from trades and statistical services and other sources that RJO/RMB believes are reliable. We do not guarantee that such information is accurate or complete and it should not be relied upon as such. Trading advice reflects our good faith judgment at a specific time and is subject to change without notice. There is no guarantee that the advice we give will result in profitable trades.