If you’ve been wondering what has happened to volatility, you are not alone. One of the lead articles in today’s Wall Street Journal begins with:

“An unusual period of calm has blanketed trading of stocks and commodities in recent days, befuddling some analysts who had expected activity in riskier assets to pick up at the start of first-quarter earnings season.”

One of the little-known secrets of quiet markets is the “both sides from the middle” speculative opportunities they create. Because option prices are largely determined by volatility, extended quiet periods in markets tend to drive the cost of options down. While cheapness is not necessarily a sufficient reason to buy, it certainly makes mistakes far less costly.

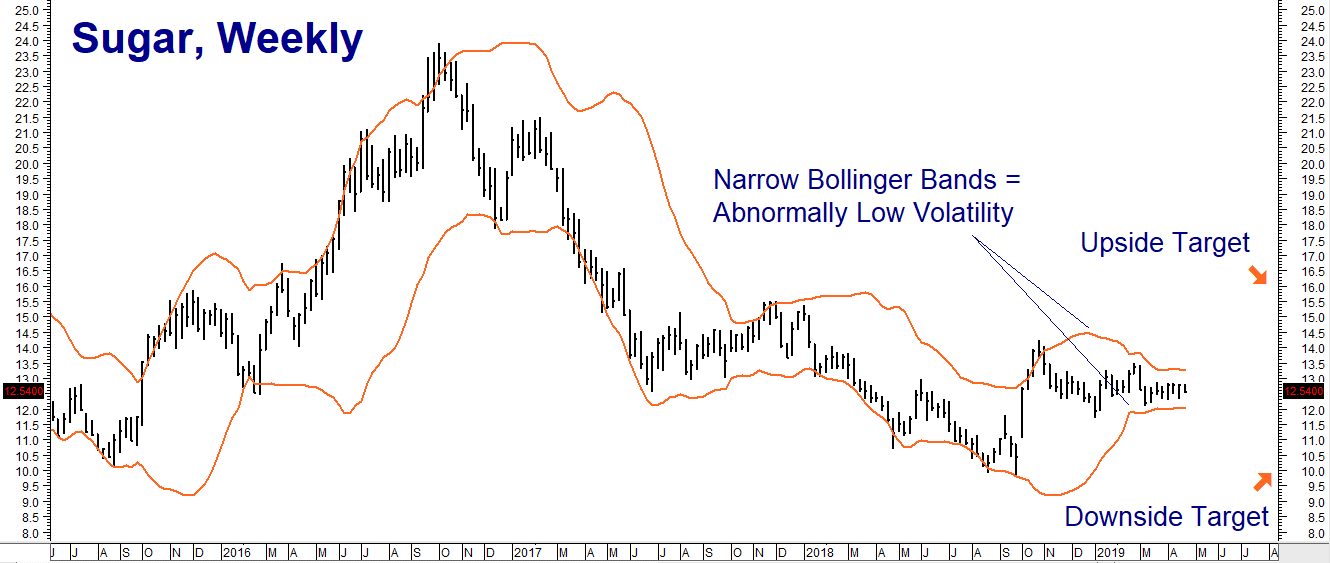

In rare instances, options get cheap enough to justify buying both puts and calls at the same time, setting the buyer up to capitalize on a breakout move in either direction. We believe sugar is one of these opportunities. Bollinger Bands measure market volatility by tracing out a range 2 standard deviations above and below a given market. Wide bands indicate high volatility. Narrow bands illustrate low volatility. Weekly Bollinger Bands in sugar are the narrowest they’ve been in over 10 years.

Given the typically volatile nature of the sugar market, we do not expect the current sideways market conditions to last very long. RMB Group trading customers may want to consider positioning themselves to capitalize on a sugar breakout in either direction by simultaneously buying October 14-cent sugar calls and October 12-cent sugar puts. Pay no more than today’s combined closing price of 60 points ($672).

If filled, your maximum risk is $672 plus transaction costs. This trade will be worth at least $2,240 should the sweet stuff hit either our upside target of 16 cents per pound or our downside objective of 10 cents per pound prior to option expiration on September 16, 2019.

Please be advised that you need a futures account to trade the markets in this post. The RMB Group has been helping its clientele trade futures and options since 1991 and are very familiar with all kinds of option strategies. Call us toll-free at 800-345-7026 or 312-373-4970 (direct) for more information and/or to open a trading account. Or visit our website at www.rmbgroup.com.

* * * * * * * *

The RMB Group

222 South Riverside Plaza, Suite 1200, Chicago, IL 60606

This material has been prepared by a sales or trading employee or agent of R.J. O’Brien & Associates (“RJO”)/RMB Group and is, or is in the nature of, a solicitation. This material is not a research report prepared by a Research Department. By accepting this communication, you agree that you are an experienced user of the futures markets, capable of making independent trading decisions, and agree that you are not, and will not, rely solely on this communication in making trading decisions.

DISTRIBUTION IN SOME JURISDICTIONS MAY BE PROHIBITED OR RESTRICTED BY LAW. PERSONS IN POSSESSION OF THIS COMMUNICATION INDIRECTLY SHOULD INFORM THEMSELVES ABOUT AND OBSERVE ANY SUCH PROHIBITION OR RESTRICTIONS. TO THE EXTENT THAT YOU HAVE RECEIVED THIS COMMUNICATION INDIRECTLY AND SOLICITATIONS ARE PROHIBITED IN YOUR JURISDICTION WITHOUT REGISTRATION, THE MARKET COMMENTARY IN THIS COMMUNICATION SHOULD NOT BE CONSIDERED A SOLICITATION.

The risk of loss in trading futures and/or options is substantial and each investor and/or trader must consider whether this is a suitable investment. Past performance, whether actual or indicated by simulated historical tests of strategies, is not indicative of future results. Trading advice is based on information taken from trades and statistical services and other sources that RJO/RMB believes are reliable. We do not guarantee that such information is accurate or complete and it should not be relied upon as such. Trading advice reflects our good faith judgment at a specific time and is subject to change without notice. There is no guarantee that the advice we give will result in profitable trades.