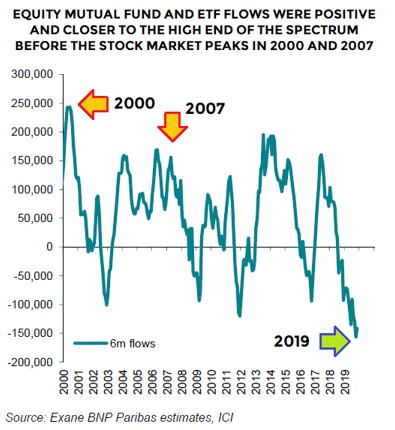

Impeachment? Stocks don’t care. All major indexes greeted Wednesday’s historic news with a giant yawn and then promptly rallied, focusing on low interest rates and slow but steady economic growth. Stocks show little of the euphoria typical of major market tops. Stocks may be expensive, but they are not tulip bulbs – at least not yet. Stock investors remain sanguine but cautious. This is evident gauged by the amount of money they been removing from the market in 2019.

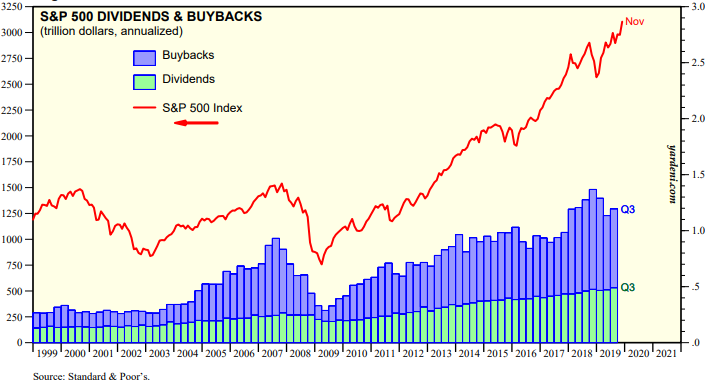

Stocks are where they are mainly due to two factors: low interest rates and corporate buy-backs largely facilitated by low interest rates. As we outlined in our November blog, “Fractional Reserve Banking and Potential Trouble in the Bond Market”, corporate America has all the cash it needs, and then some.

Fed Incentivizing Stock Buy-Backs with 2019 Rate Cuts

Companies are buying back their own shares because cheap money is making it profitable. Corporate America believes the most productive use of the excess cash thrust upon them by the Federal Reserve (and the rest of the world’s central banks) is to invest in their own shares. Excess cash is being returned to investors rather than spent on projects without the prospect of a better return. We believe the lack of better prospects should be seen as a warning. Money can’t keep chasing its tail forever.

The Fed’s decision to lower rates three times during the longest stock bull market in history has reinforced this potentially dangerous behavior. Apple alone is buying back $75 billion in stock. As the chart below illustrates, the S&P 500 rallies when buybacks increase and declines when they decrease.

Anything which threatens buybacks could have an outsized impact – especially with the retail stock investor on the sideline. Three things that have the potential to curtail stock buybacks are: 1) higher interest rates, 2) excessive corporate leverage, and 3) tax increases on capital gains. Higher interest rates make lending to buy back stock more expensive. Excessive debt puts free cash at risk as more funds are needed for debt service. Higher taxes on capital gains lower the utility of holding stocks.

We covered exploding global debt in our blog “Fractional Reserve Banking and Potential Trouble in the Bond Market” but corporate debt is also soaring. Depending upon who wins the Democratic primary, sharply higher taxes on gains and/or stock market transactions could be part of a new Democratic administration in January.

Short-term interest rates have stopped going down. The Federal Reserve has basically told the market not to expect any more rate cuts in 2020. The Fed is always reluctant to act during an election year to avoid the perception of influencing it. However, long term interest rates have been heading higher as more European central banks abandon the failed experiment known as “negative interest rates.” One of the first adopters of negative rates was Sweden. It just raised its key rate to “0.”

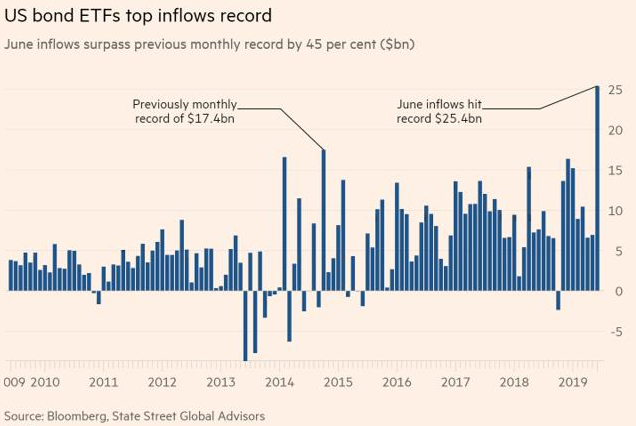

Bond Euphoria Under the Radar

We believe the real “tell” for trouble in 2020 will come from the bond market. Bonds have been the beneficiaries of “risk off” spasms in stocks the entire way up. As bonds become more expensive, their yields fall. The bond market has been the beneficiary of retail investor caution in stocks. Most of the money not going into stocks is flowing into bonds.

Retail traders may be reticent about investing in stocks, but they are practically giddy about throwing money at bonds. This happens as bond prices are higher and bond yields are lower than nearly any time in history. The financial press is obsessed with the stock market, but no one is talking about the big bubble inflating in the bond market. As we indicated in our November blog, the bursting of this bubble could do far more damage than a similar setback in stocks.

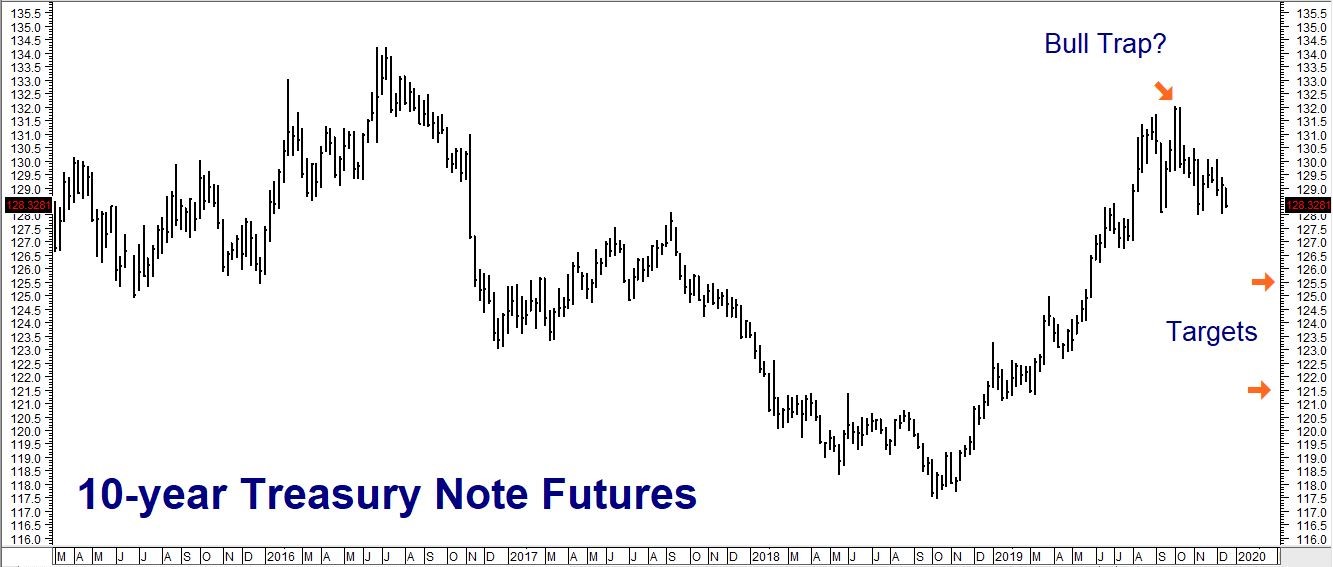

Trouble for Treasuries?

We posted this chart in a previous blog. It illustrates a market which is losing momentum. Ten-year futures are making low highs and if they decline below 128-01 will be making lower lows. A Friday close below this level will break support, putting our downside targets of 125-32 and 121-32 into play.

RMB trading customers who followed our suggestion to purchase March 127-00 T-note puts for $500 or less should continue to hold their positions. We believe this is a reasonably priced downside hedge for anyone who holds a substantial amount of bonds, bond funds or bond ETFs.

Lack of liquidity in the more distant contracts means we need to stick to the March options for now. We will be looking at new hedges as the New Year progresses. Check with your RMB Group broker for the latest pricing.

Data Source: Reuters/Datastream

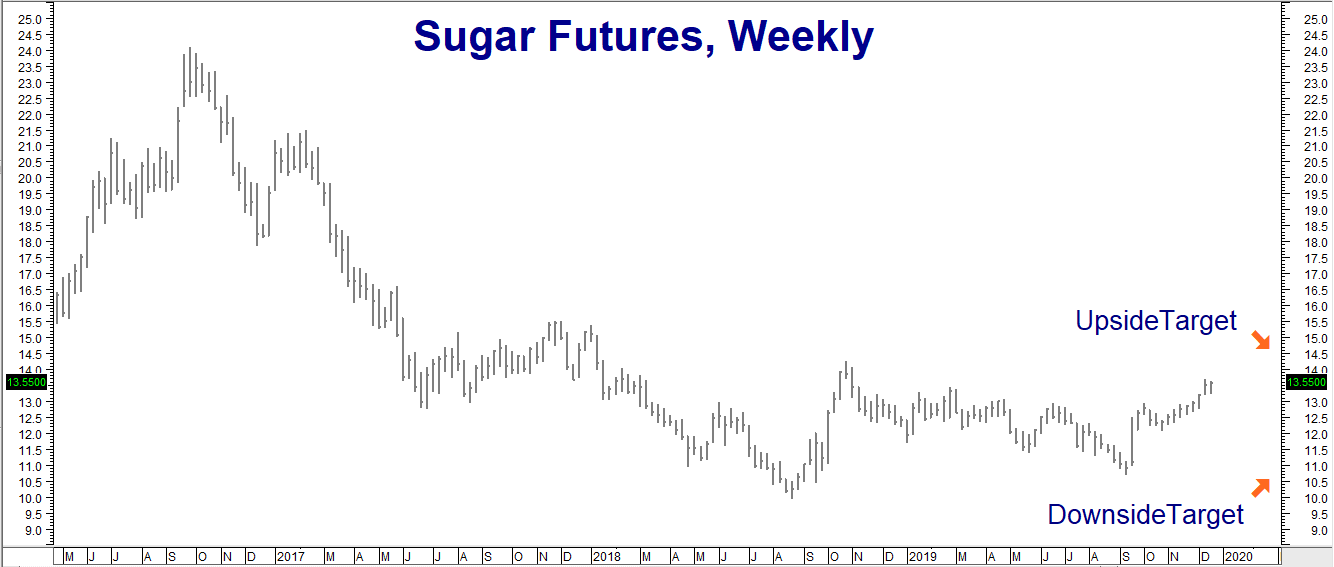

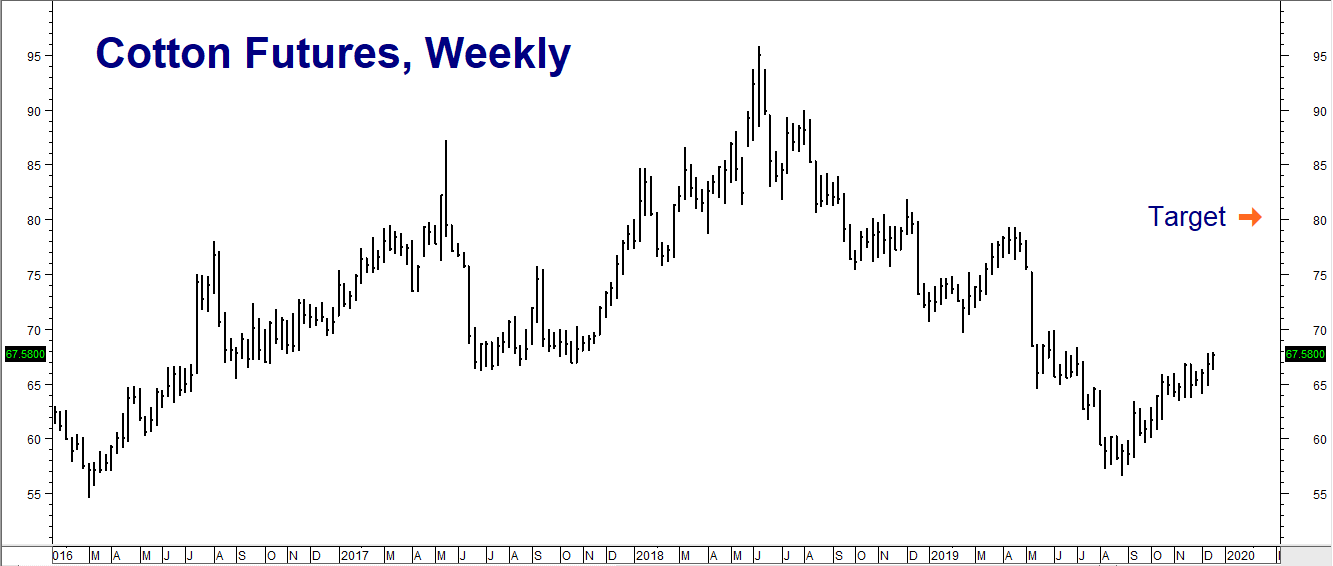

Sugar and Cotton Looking Good

The approaching holidays mean the next ten days could see reduced liquidity in all the markets. Big moves often happen in illiquid markets, so we want to be ready. The sugar and cotton positions we suggested purchasing in recent blogs are looking good. Both are very close to double the initial price we recommended paying.

RMB trading customers who purchased more than one position in either market may want to consider entering open orders to exit half at double your initial entry level. A fill essentially takes your initial risk “off-the-table” and allows you to hold the balance of your positions with “house” money.

Here are the updated charts of these two markets:

Data Source: Reuters/Datastream

Data Source: Reuters/Datastream

Please be advised that you need a futures account to trade the markets in this post. The RMB Group has been helping its clientele trade futures and options since 1991. RMB Group brokers are familiar with the option strategies described in this report. Call us toll-free at 800-345-7026 or 312-373-4970 (direct) for more information and/or to open a trading account. Or visit our website at www.rmbgroup.com. Want to know more about trading futures and options? Download our FREE Report, the RMB Group “Short Course in Futures and Options.”

* * * * * * * *

The RMB Group

222 South Riverside Plaza, Suite 1200, Chicago, IL 60606

This material has been prepared by a sales or trading employee or agent of R.J. O’Brien & Associates (“RJO”)/RMB Group and is, or is in the nature of, a solicitation. This material is not a research report prepared by a Research Department. By accepting this communication, you agree that you are an experienced user of the futures markets, capable of making independent trading decisions, and agree that you are not, and will not, rely solely on this communication in making trading decisions.

DISTRIBUTION IN SOME JURISDICTIONS MAY BE PROHIBITED OR RESTRICTED BY LAW. PERSONS IN POSSESSION OF THIS COMMUNICATION INDIRECTLY SHOULD INFORM THEMSELVES ABOUT AND OBSERVE ANY SUCH PROHIBITION OR RESTRICTIONS. TO THE EXTENT THAT YOU HAVE RECEIVED THIS COMMUNICATION INDIRECTLY AND SOLICITATIONS ARE PROHIBITED IN YOUR JURISDICTION WITHOUT REGISTRATION, THE MARKET COMMENTARY IN THIS COMMUNICATION SHOULD NOT BE CONSIDERED A SOLICITATION.

The risk of loss in trading futures and/or options is substantial and each investor and/or trader must consider whether this is a suitable investment. Past performance, whether actual or indicated by simulated historical tests of strategies, is not indicative of future results. Trading advice is based on information taken from trades and statistical services and other sources that RJO/RMB believes are reliable. We do not guarantee that such information is accurate or complete and it should not be relied upon as such. Trading advice reflects our good faith judgment at a specific time and is subject to change without notice. There is no guarantee that the advice we give will result in profitable trades.