We knew it was coming… The correction in the precious metals we talked about in our last blog post is now a reality. As we mentioned in our last post, we believe these corrections are healthy. Old resistance for silver at $17.50 per ounce is now support. Ditto for old resistance at $16.00 per ounce. Silver can decline as low as $16.00 without seriously damaging the current uptrend.

Data source: Reuters/Datastream

Data source: Reuters/Datastream

Silver is still overbought despite its recent corrective price action so it may take a few more weeks for the current correction to become more defined. We anticipate using further setbacks as an opportunities to re-establish full positions using 5,000 COMEX silver options. Until then, RMB Group trading customers that took our suggestion to pare back long positions and take some risk off the table should continue hold onto their remaining longs. We’ll be monitoring this market for new entry opportunities.

Gold Bull Is More Mature

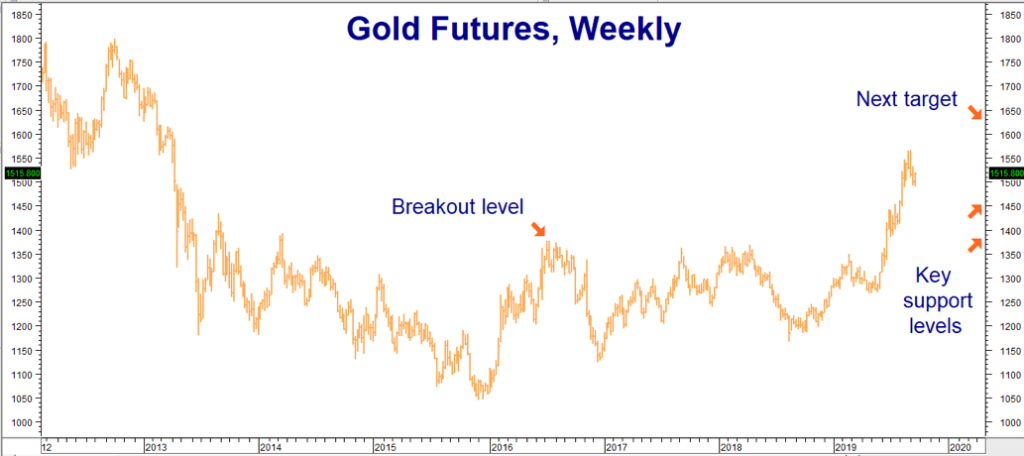

The first thing one notices when looking at a weekly gold chart is how much further along it is than its poorer cousin. Unlike silver which has yet to break out to the upside, gold has advanced far beyond its breakout level and hit every single one of our upside objectives except our last at $1,640 per ounce. While we believe gold could head as high as $2,000 over the long term, we haven’t seen enough technical (chart-based) evidence to make that call official yet.

Data source: Reuters/Datastream

Data source: Reuters/Datastream

Unlike silver which has a split personality – part precious metal, part industrial metal – gold is purely a monetary metal. There are three legitimate reserves currencies: the euro, the yen and the US dollar. The first two have been sinking against the dollar in a race to the bottom. This leaves gold as the only real alternative to those wishing to pare back their dollar exposure. That’s why we’ve been recommending long positions using 100-ounce COMEX gold options since the beginning of the year.

Like silver, old levels of resistance have now become support. The Midas metal could decline as low as $1,390 per ounce without severely damaging the long-term bull market. However, given the continuing global need for a dollar hedge, we do not expect gold to retreat that far. Consequently, RMB trading customers may want to consider using a setback to $1,450 per ounce as an opportunity to establish or add to long positions. We’ll be monitoring this market for entry opportunities.

Commodities Are Cheap, Cotton Particularly So

Gold and silver may be all the rage, but the bull has bypassed the rest of the commodity sector. Soft commodities in particular are cheap. Sugar, coffee and cotton are all within striking distance of ten-year lows. Much of this is due to the strong dollar, which makes commodities priced in dollars – which pretty much includes all commodities – cheaper. And while cheapness in and of itself should never be a reason to buy anything, there are situations when it makes sense to buy low from a risk-to-reward perspective – especially when a cheap price is combined with low volatility. We believe that such an opportunity is presenting itself in cotton right now.

The white, fluffy stuff has been one of the major victims of the trade war as climbing tariffs on Chinese-made clothing have forced global retailers to switch to manufacturing to other nations. Resourcing on this kind of scale takes time. Combine it with the climbing prices of garments resulting from China’s retaliatory tariffs and you get a big drop in demand for cotton.

Data source: Reuters/Datastream

Data source: Reuters/Datastream

We have been around long enough to remember the old commodity floor-trader days. One of their more familiar sayings was, “The best cure for low prices is low prices.” This is basically “Economics 101.” When prices drop low enough, producers stop producing. This leads to supply shortages and higher prices.

We can see this writ large in the weekly cotton chart above. Prices have spent the last eight years oscillating between lows right around 55 cents per pound to 95 cents per pound. The last time cotton declined to the bottom of this range was in early 2016. Six months later it was at 78 cents per pound. Surprisingly low implied volatility in cotton is providing us with an opportunity to position ourselves for a similar bounce-back to the middle of cotton’s long term trading range.

RMB Group trading customers may want to consider buying July 70-cent cotton calls while simultaneously selling an equal number of July 80-cent cotton calls for $650 or less. This, plus transaction costs, is your maximum risk. This “bull call spread” has the potential to be worth as much as $5,000 should cotton hit our 80 cents per pound target by option expiration on June 12, 2020.

As the chart above suggests, cotton also has a tendency to weaken during the fall and winter and to strengthen again in the spring and summer. And while there is no guarantee this seasonal tendency will happen again this year, the trade suggested above keeps us long through most of cotton’s friendly season.

Please be advised that you need a futures account to trade the markets in this post. The RMB Group has been helping its clientele trade futures and options since 1991 and are very familiar with all kinds of option strategies. Call us toll-free at 800-345-7026 or 312-373-4970 (direct) for more information and/or to open a trading account. Or visit our website at www.rmbgroup.com.

* * * * * * * *

The RMB Group

222 South Riverside Plaza, Suite 1200, Chicago, IL 60606

This material has been prepared by a sales or trading employee or agent of R.J. O’Brien & Associates (“RJO”)/RMB Group and is, or is in the nature of, a solicitation. This material is not a research report prepared by a Research Department. By accepting this communication, you agree that you are an experienced user of the futures markets, capable of making independent trading decisions, and agree that you are not, and will not, rely solely on this communication in making trading decisions.

DISTRIBUTION IN SOME JURISDICTIONS MAY BE PROHIBITED OR RESTRICTED BY LAW. PERSONS IN POSSESSION OF THIS COMMUNICATION INDIRECTLY SHOULD INFORM THEMSELVES ABOUT AND OBSERVE ANY SUCH PROHIBITION OR RESTRICTIONS. TO THE EXTENT THAT YOU HAVE RECEIVED THIS COMMUNICATION INDIRECTLY AND SOLICITATIONS ARE PROHIBITED IN YOUR JURISDICTION WITHOUT REGISTRATION, THE MARKET COMMENTARY IN THIS COMMUNICATION SHOULD NOT BE CONSIDERED A SOLICITATION.

The risk of loss in trading futures and/or options is substantial and each investor and/or trader must consider whether this is a suitable investment. Past performance, whether actual or indicated by simulated historical tests of strategies, is not indicative of future results. Trading advice is based on information taken from trades and statistical services and other sources that RJO/RMB believes are reliable. We do not guarantee that such information is accurate or complete and it should not be relied upon as such. Trading advice reflects our good faith judgment at a specific time and is subject to change without notice. There is no guarantee that the advice we give will result in profitable trades.