Perhaps the most interesting thing about Monday’s big sell-off in silver and gold is the lack of any fundamental reason behind it. The wire services blame a stronger dollar. Yet yesterday’s settlement of 99.02 in the dollar index futures was not much higher than its 98.39 settlement on September 4th – the same day that gold and silver settled at their highs for the year.

One of the main reasons gold and silver have rallied is low interest rates. Low rates make gold and silver more attractive because they reduce the opportunity cost of holding metals. Metals do not generate interest. This means that gold and silver coin and bullion holders must consider the loss of potential risk-free interest income as part of the cost of owning metals. Like the dollar, interest rates have hardly moved since precious metals made their most recent highs. So it’s obviously not interest rates.

Could the sell-off in gold and silver be caused by problems in the repo market? It’s possible, but highly unlikely. Demand for overnight money has recently swamped supply, causing banks to pay usurious amounts of interest to meet their reserve requirements. Is this demand for cash causing banks to sell metals holdings? It’s highly doubtful. The amount of cash needed far exceeds any proceeds banks would receive for their metals holdings.

Are central banks dumping their gold – particularly the central banks of US adversaries Russia and China? We have no confirmation of any central bank dumping. The biggest purchasers of gold are the central banks of countries either subject to US sanctions involving dollar-based banking or those needing to hedge their dollar holdings in a non-bank setting. Gold takes care of both of those problems. Why would the Russian and Chinese central banks lift one of the only true dollar hedges they have?

Just Normal Volatility?

Could the latest decline in gold in silver be a result of normal volatility? Precious metals traders know how volatile these shiny commodities can be. Monday’s price action is a testament to this tendency. Gold tumbled $30 per ounce, settling down over 2%. Silver kept pace, plummeting 66 cents or nearly 3.5% at the time of settlement. As we mentioned in our last blog post, we are not surprised by this volatility. It is part and parcel of what precious metals are.

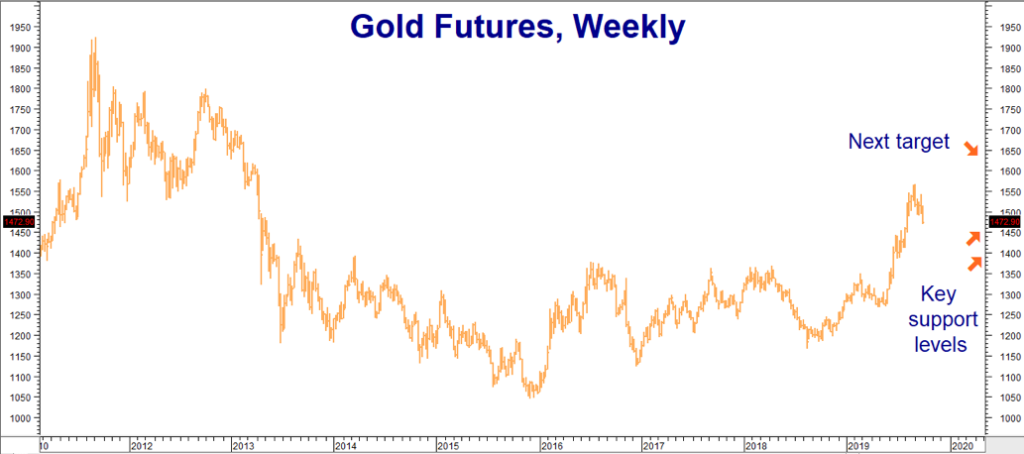

This is why we like to establish multiple targets and take some of our risk off-the-table when these targets are achieved. Doing so enables RMB Group trading customers to squirrel away cash that (hopefully) can be used to re-establish bigger positions on setbacks. Monday’s big declines in both gold and silver have pushed prices close to a key support level in gold and into a key support band in silver. So is it time to buy?

Data Source: Reuters/Datastream

Data Source: Reuters/Datastream

Gold’s settlement on Monday of $1.472.90 per ounce is still a good $23 per ounce above our first long-term support level at $1,450. RMB trading customers who wish to establish new long positions or add to existing positions should consider waiting until either: 1) gold declines into the $1,450 to $1,400 support band, or 2) gold closes twice consecutively above Monday’s high of $1,515 per ounce.

Consider purchasing June 2020 $1,550 / $1,650 bull call spreads in the 100-ounce COMEX gold options should the first scenario play out over the next couple of weeks. Pay no more than $1,500. If filled at this price, your maximum risk is $1,500 plus transaction costs. This spread has the potential to be worth as much as $10,000 should silver rally to or beyond $1,650 per ounce prior to option expiration on May 26, 2020.

Silver Is Testing Key Support

Monday’s price action pulled silver down into the middle of its support band between $17.50 and $16.50 per ounce. Silver’s technical posture is weaker than that of gold, the latter of which has yet to even test the top of its support zone. If you’ve been following our blogs, you know that we believe silver’s weaker position now belies much higher upside potential later.

As the chart below illustrates, silver has now retraced 50% of this summer’s bull move. 50% retracements are common in bull and bear markets and are often used to add to or establish new positions.

Data Source: Reuters/Datastream

Data Source: Reuters/Datastream

Silver could decline as low as $16.40 per ounce without seriously damaging the bullish trend. Its tendency to run stops means it could dip even lower before reversing. As we’ve mentioned in previous blogs, silver’s fate rests largely on gold’s. Gold is still technically strong despite Monday’s big decline. Consequently, it may be a good idea to consider establishing (or adding to) long-term bullish positions in silver at these levels.

In early April we posted one of our longest blogs, “Silver for Pennies on the Dollar,” which details how to take a longer-term, bullish position in silver for a surprisingly low cost. We also showed readers how to “earn interest” on that position by creating a synthetic “silver-backed” CD. We’ve recently updated this post to account for silver’s rally, along with a new trading suggestion.

Please be advised that you need a futures account to trade the markets in this post. The RMB Group has been helping its clientele trade futures and options since 1991 and are very familiar with all kinds of option strategies. Call us toll-free at 800-345-7026 or 312-373-4970 (direct) for more information and/or to open a trading account. Or visit our website at www.rmbgroup.com.

* * * * * * * *

The RMB Group

222 South Riverside Plaza, Suite 1200, Chicago, IL 60606

This material has been prepared by a sales or trading employee or agent of R.J. O’Brien & Associates (“RJO”)/RMB Group and is, or is in the nature of, a solicitation. This material is not a research report prepared by a Research Department. By accepting this communication, you agree that you are an experienced user of the futures markets, capable of making independent trading decisions, and agree that you are not, and will not, rely solely on this communication in making trading decisions.

DISTRIBUTION IN SOME JURISDICTIONS MAY BE PROHIBITED OR RESTRICTED BY LAW. PERSONS IN POSSESSION OF THIS COMMUNICATION INDIRECTLY SHOULD INFORM THEMSELVES ABOUT AND OBSERVE ANY SUCH PROHIBITION OR RESTRICTIONS. TO THE EXTENT THAT YOU HAVE RECEIVED THIS COMMUNICATION INDIRECTLY AND SOLICITATIONS ARE PROHIBITED IN YOUR JURISDICTION WITHOUT REGISTRATION, THE MARKET COMMENTARY IN THIS COMMUNICATION SHOULD NOT BE CONSIDERED A SOLICITATION.

The risk of loss in trading futures and/or options is substantial and each investor and/or trader must consider whether this is a suitable investment. Past performance, whether actual or indicated by simulated historical tests of strategies, is not indicative of future results. Trading advice is based on information taken from trades and statistical services and other sources that RJO/RMB believes are reliable. We do not guarantee that such information is accurate or complete and it should not be relied upon as such. Trading advice reflects our good faith judgment at a specific time an