The announcement of a potential trade deal sent the grain markets soaring on Friday (corn rallied a scorching 4.7%) as traders anticipated additional Chinese buying. China is expected to agree to purchase $40 to $50 billion in American agricultural products in exchange halt on tariff increase scheduled for later. We call Friday’s announcement a “phantom” trade deal because nothing has been signed yet. The deal is not expected to be finalized until November.

The “deal” is not comprehensive. It does not address real sticking points like Chinese theft of American intellectual property or unfairly restrictive access to the Chinese market. Even Donald Trump refers to it as “Phase 1.” With the American Presidential election approaching, it seems likely that any progress on these issues will become more difficult and political. Plenty could happen between now and the expected signing of the trade deal in mid-November 2019 that could derail it.

At RMB Group, we believe fundamental bullish forces – not a looming trade agreement — are the real reasons behind this year’s big, fall rallies in corn and soybeans. Consequently we think both of these markets have the potential to climb much higher, deal or no deal.

Let’s start with global population which is growing by leaps and bounds every year. More mouths to feed requires more food. The demand for more meat in the world’s most populous nations, in particular China, means greater demand for grain to feed cows, pigs and chickens. Global demand for agricultural products will rise with the population. It’s simple math.

Can South America Cover Chinese Grain Needs?

China sharply curtailed its purchases of American agricultural products in response to Trump’s tariff wars and then re-sourced most its food import requirements to South America. But can Brazil and Argentina pick up ALL of the slack? The South American planting season is just beginning. China spent $945 million on American soybeans in August as a gesture of good faith ahead of the negotiations that were supposedly wrapped up on Friday. It didn’t matter. Soybean prices declined in August.

The current leg up in beans didn’t begin until September 9. This date is more aligned with the beginning of both the North American harvest season and the start South American planting season. Recent reports show Brazil is off to its slowest planting start in 6 years. Brazilian corn production is expected to be down 1.7% as a result. While there is still plenty of time for planting to pick up, there is also plenty of time for things to go wrong as well. As we’ve mentioned in this space before, Mother Nature always has the last word when it comes to agricultural commodities.

There is a very real possibility that South America will not be able to provide for all of China’s growing food needs – especially considering the latter’s growing pork crisis. We wrote about the potential effects of African Swine Flu (ASF) over a year ago. ASF has decimated the Chinese pig crop, causing prices to soar in pork-loving China. The US would be the logical back-up supplier without the trade war – especially since Chinese companies own a huge chunk of the American pork industry. China may be relying on South America now, but its leaders are strategic and know the long-term pitfalls of relying on supplies from a single source.

China needs US pigs to stabilize pork prices and maintain social harmony. By negotiating a “truce” to the trade war by promising to buy American agricultural products, China is serving its own self-interest while placating the needs of Trump’s rural voter base, making it a “win-win” for both. Whether an agreement now will be too little, too late to help struggling American farmers remains to be seen.

Nevertheless, we believe a deal is in the interest of both sides and that some kind of accommodation will be made. If not now, than certainly by the end of the year. This could provide a fairly solid floor beneath meats and grains as we move closer the 2020 election season.

US Harvest Could Be Disrupted By Cold

A hard freeze essentially ends the growing season in the American Midwest. Abnormally cold weather in key growing areas of the American high plains could impact harvest efforts. According to last week’s USDA World Agricultural Supply Demand Estimates (WASDE) US corn is 58% mature compared with 92% last year because of lingering spring rains which delayed, and in some cases prevented, planting.

Soybeans were impacted as well. The October WASDE showed 14% of soybeans harvested as compared with 31% at the same time last year. The longer it takes to get these crops in the bin, the more susceptible they become to freeze damage.

While there is still time for the US harvest to turn out just fine, we suspect that mistakes by the USDA, mostly due to the loss of many of its seasoned employees unhappy with its planned move to Kansas, have had the effect of making its earlier estimates less accurate – especially as it relates to corn. As a result, we believe the damage to the corn crop resulting from late 2019’s late spring rains could be vastly underestimated. The next few months will tell the tale.

What Happens If the Trade War “Truce” Becomes Official?

Let’s assume that the trade deal announced Friday gets done. China purchased $24 billion in American agricultural products prior to the start of the trade war in 2017. This makes the $40 to $50 billion purchase of American agricultural supposedly agreed to in the current negotiation a huge number. If finalized, it should have a marked bullish effect on the entire agricultural sector.

The faster the money is spent, the more bullish it will be. Stretching purchases out over a number of years would still be positive but more nuanced. With November 2020 a little more than a year away, we suspect a push will be made to move any agreed-upon Chinese purchases forward far enough to raise crop prices noticeably.

Data Source: Reuters/Datastream

As we mentioned earlier, soybeans didn’t begin their latest upward impulse until early September, climbing smartly from a low of $8.51 per bushel to Friday’s high of $9.39 – a gain of 10.3% in one month. Friday’s rally also breached July highs of $9.365 per bushel which we identified as a “key level” of resistance earlier this year. The failure of prices to move much beyond the $9.365 level could be an indications that beans may be due for more “backing and filling” before the next break to the upside.

RMB group trading customers who followed our suggestion in our May 14 blog post to purchase July $10.00 / $11.00 bull call spreads for $600 or less (these bull spreads are currently trading for roughly $1,250) may want to consider using the latest rally as an opportunity to exit half of their positions now, taking their original risk off-the-table. Continue to hold the other half of your position for a potential move to our upside targets of $10.70 and $12.00. $10.70 is the next key level of resistance in the soybean market.

Those without bullish positions in beans may want to consider using downside retracements in this market as opportunities to get long. We like the July 2020 $11.00 / $12.00 bull spreads in the CBOT call options for $500 or less. If filled your maximum risk is $500 plus transaction cost. This position has the potential to be worth as much as $5,000 should beans hit our $12.00 per bushel objective at or prior to option expiration on June 26, 2020. Prices can and will change, so contact your RMB Group broker for the latest.

A Roadmap for Corn?

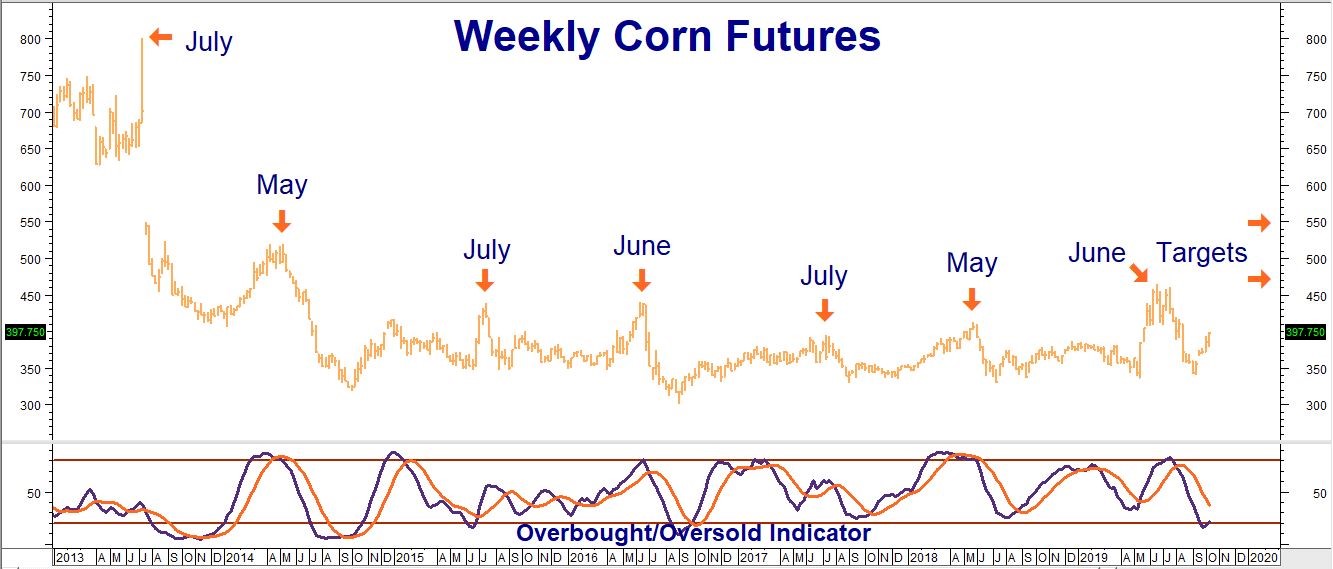

While seasonal tendencies should never be the sole determinant of a trade, knowing how they manifest themselves can help when constructing a trading plan. As illustrated in the chart below, corn has a pronounced tendency to make its highs in late spring and early summer when crop conditions are still unknown and then decline in the fall when the harvest is in. Six years of near-perfect growing conditions following the North American planting season have contributed to this easily-identifiable pattern.

We used this pattern on the bearish side earlier this year when we recommended holders of the December $4.20 calls we recommended in October 2018, to take the bulk of their risk off the table despite the bullish weather news flooding the airways at the time. Given 2019’s historically wet spring, we certainly did not expect corn to come close to retesting its lows like it did. But our respect for corn’s seasonal tendencies saved the trade.

And while there is absolutely no guarantee corn will follow its 2019 pattern again in 2020, flakey harvest weather in the US combined with unsure planting weather in South America have the potential to create more uncertainty premium in the yellow grain. Add in the possibility of dubious numbers coming out of a stripped-down USDA along with the political pressure to satisfy American farmers prior to November 2020 and you get the ingredients for a potentially explosive mix. It’s also October again. We believe corn is a buy at these levels.

Our upside targets are $4.70 and $5.50 per bushel. RMB group trading customers may want to consider purchasing July 2020 $4.50 corn calls for $600 or less, looking for the yellow grain to rally as high as $5.50 per bushel prior to option expiration on June 26, 2020. Your maximum risk is $600 plus transaction cost. July $4.50 calls will be worth at least $5,000 each should corn hit our $5.50 target prior to option expiration.

Please be advised that you need a futures account to trade the markets in this post. The RMB Group has been helping its clientele trade futures and options since 1991 and are very familiar with all kinds of option strategies. Call us toll-free at 800-345-7026 or 312-373-4970 (direct) for more information and/or to open a trading account. Or visit our website at www.rmbgroup.com. Want to know more about trading futures and options? Download our FREE Report, the RMB Group “Short Course in Futures and Options.”

* * * * * * * *

The RMB Group

222 South Riverside Plaza, Suite 1200, Chicago, IL 60606

This material has been prepared by a sales or trading employee or agent of R.J. O’Brien & Associates (“RJO”)/RMB Group and is, or is in the nature of, a solicitation. This material is not a research report prepared by a Research Department. By accepting this communication, you agree that you are an experienced user of the futures markets, capable of making independent trading decisions, and agree that you are not, and will not, rely solely on this communication in making trading decisions.

DISTRIBUTION IN SOME JURISDICTIONS MAY BE PROHIBITED OR RESTRICTED BY LAW. PERSONS IN POSSESSION OF THIS COMMUNICATION INDIRECTLY SHOULD INFORM THEMSELVES ABOUT AND OBSERVE ANY SUCH PROHIBITION OR RESTRICTIONS. TO THE EXTENT THAT YOU HAVE RECEIVED THIS COMMUNICATION INDIRECTLY AND SOLICITATIONS ARE PROHIBITED IN YOUR JURISDICTION WITHOUT REGISTRATION, THE MARKET COMMENTARY IN THIS COMMUNICATION SHOULD NOT BE CONSIDERED A SOLICITATION.

The risk of loss in trading futures and/or options is substantial and each investor and/or trader must consider whether this is a suitable investment. Past performance, whether actual or indicated by simulated historical tests of strategies, is not indicative of future results. Trading advice is based on information taken from trades and statistical services and other sources that RJO/RMB believes are reliable. We do not guarantee that such information is accurate or complete and it should not be relied upon as such. Trading advice reflects our good faith judgment at a specific time and is subject to change without notice. There is no guarantee that the advice we give will result in profitable trades.