The overnight assassination of Iranian Quds Force Commander General Qassam Soleimani in a drone strike ordered by Donald Trump has changed the game in the Mid-East. History is replete with examples of assassinations that provide springboards to all-out war. World War I is a modern-day example. The ultimate result of this strike remains to be seen. Crude oil is understandably higher, stocks are sharply lower, and volatility has spiked across the board.

Gold is popping on this news, rising within striking distance of old swing highs at $1,567 per ounce. Two or more consecutively higher closes above this level will set the stage for an assault on our next upside objective of $1,650 per ounce – with the possibility of heading as high as $1,775 per ounce before the year ends.

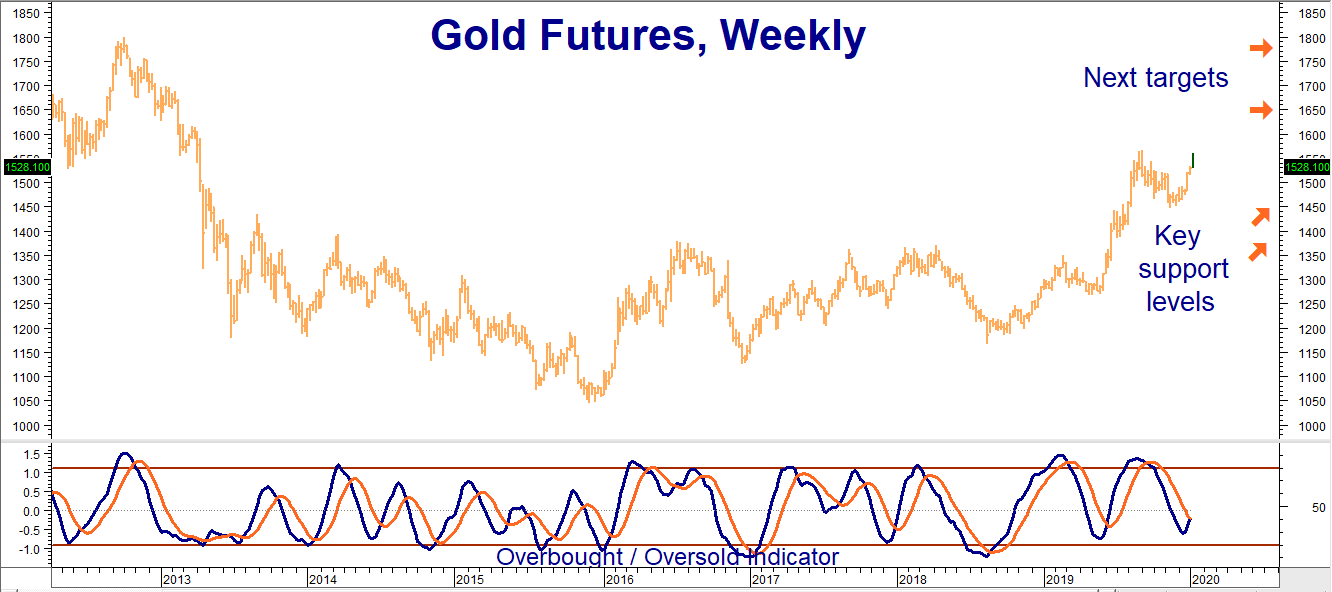

Data Source: Reuters/Datastream

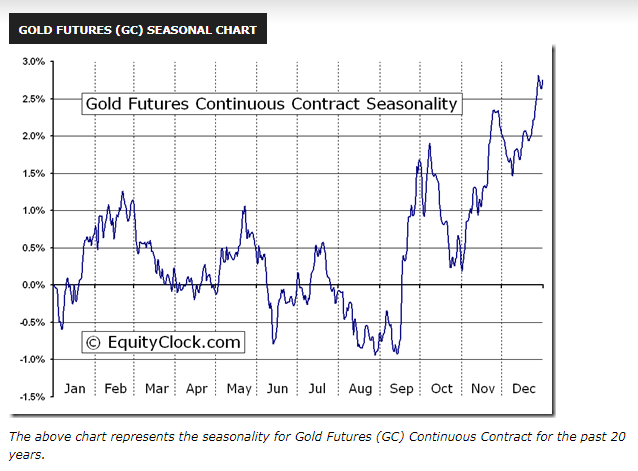

As the chart above suggests, gold is oversold on a weekly basis. Higher lows in our “Overbought / Oversold Indicator” suggest the possibility of higher gold prices ahead. Especially as we approach the seasonally friendly months of January and February. And while it’s never a good idea to base a trade strictly on seasonal tendencies, they can be useful with timing a trade. That they line up with this morning’s increase in geopolitical volatility is a plus.

RMB Group trading customers who follow our blog posts know we dedicated most of our “big move” recommendations in 2019 to the precious metals sector. The assassination of Qassam Soleimani adds a whole new layer of uncertainty to an already dangerous situation in the Mid-East. It increases the odds of geopolitical chaos in one of the more volatile regions of the globe.

We believe an escalation of the tit-for-tat violence between the US and Iran is not only possible, but likely. Gold has a long history of being an effective hedge against the kind of chaos an escalation could spawn. This is why we believe it is only fitting to cover it in our first blog of the New Year. 2020 will feature many potentially chaotic events – including perhaps the most divisive presidential election in US history – but what we’ve been watching the most (prior to this morning) is price action of the US dollar.

Break in Buck Could Pop the Lid Off Gold

The dollar price of gold is a function of two factors: 1) investor sentiment and 2) the value of the US dollar itself. Investor sentiment was the driving force behind gold’s impressive 19% gain in 2019 – “impressive” because it achieved the gain without any help from a weaker dollar. US Dollar Index futures finished 2019 at 96.06, slightly higher than their 2018 close of 95.74.

The value of the US dollar is important to the price of gold because it is the unit of measure. Simple math tells us that it will take more weak dollars to purchase an equivalent amount of gold. This means all of 2019’s gains in the dollar price of gold were due to central bank and investment demand, not to changes in the buck. The need for a hedge against chaos, caused by big social, cultural and political disruption across the globe, more than compensated for a stronger dollar.

President Trump’s “hit” on Soleimani just ratcheted-up the possibility of war to a whole new level. We expect disruption to remain the theme for 2020. Add a weaker dollar to the mix, and the demand for gold could skyrocket.

Dollar Should Be Much Higher

The current Fed Funds rate is 1.75%. The equivalent European Central Bank (ECB) rate is negative 0.5%. That means investors receive a return for holding dollars and have to pay to hold Euros. The Greenback’s 2.25% yield advantage means the dollar should be soaring, but it is not. It is weakening instead. Why? One of the reasons may be President Trump’s stated desire for a weaker dollar. Another could be the perception of the US as a less-stable nation. Whatever the reason, the dollar is not doing what it “should” given its interest-rate advantage.

Data Source: Reuters/Datastream

As the chart above illustrates, the once-mighty dollar has been making lower highs and lower lows since September. Recent price action in the Greenback just negated a 15-month uptrend. A continuation of this decline could mean big days ahead for gold. We will have more on this, and other precious metals, in the coming days.

Hold Existing Long Positions

The June 2020 $1,550 / $1,650 bull call spreads we suggested purchasing for $1,500 or less back in October are currently trading for around $2,700. Continue to hold these positions in anticipation of a run to our $1,650 objective prior to option expiration on May 26. RMB Group trading customers without long positions in gold may want to consider establishing half-positions using a similar strategy. Gold is moving fast, so check with your RMB broker for the latest pricing.

Please be advised that you need a futures account to trade the markets in this post. The RMB Group has been helping its clientele trade futures and options since 1991. RMB Group brokers are familiar with the option strategies described in this report. Call us toll-free at 800-345-7026 or 312-373-4970 (direct) for more information and/or to open a trading account. Or visit our website at www.rmbgroup.com. Want to know more about trading futures and options? Download our FREE Report, the RMB Group “Short Course in Futures and Options.”

* * * * * * * *

The RMB Group

222 South Riverside Plaza, Suite 1200, Chicago, IL 60606

This material has been prepared by a sales or trading employee or agent of R.J. O’Brien & Associates (“RJO”)/RMB Group and is, or is in the nature of, a solicitation. This material is not a research report prepared by a Research Department. By accepting this communication, you agree that you are an experienced user of the futures markets, capable of making independent trading decisions, and agree that you are not, and will not, rely solely on this communication in making trading decisions.

DISTRIBUTION IN SOME JURISDICTIONS MAY BE PROHIBITED OR RESTRICTED BY LAW. PERSONS IN POSSESSION OF THIS COMMUNICATION INDIRECTLY SHOULD INFORM THEMSELVES ABOUT AND OBSERVE ANY SUCH PROHIBITION OR RESTRICTIONS. TO THE EXTENT THAT YOU HAVE RECEIVED THIS COMMUNICATION INDIRECTLY AND SOLICITATIONS ARE PROHIBITED IN YOUR JURISDICTION WITHOUT REGISTRATION, THE MARKET COMMENTARY IN THIS COMMUNICATION SHOULD NOT BE CONSIDERED A SOLICITATION.

The risk of loss in trading futures and/or options is substantial and each investor and/or trader must consider whether this is a suitable investment. Past performance, whether actual or indicated by simulated historical tests of strategies, is not indicative of future results. Trading advice is based on information taken from trades and statistical services and other sources that RJO/RMB believes are reliable. We do not guarantee that such information is accurate or complete and it should not be relied upon as such. Trading advice reflects our good faith judgment at a specific time and is subject to change without notice. There is no guarantee that the advice we give will result in profitable trades.