Gold broke out to the upside on Monday, slicing through old swing highs of $1,565 per ounce, but silver and platinum are lagging. We do not believe this will last much longer. Gold is rallying because of its dual role as an alternate currency and a hedge against global chaos. We examined the remarkable ability of gold to gain smartly in 2019 without any help from a weaker dollar in last Friday’s blog post. We also speculated on what would happen when the dollar does decline. The dollar index chart in that post deserves a second look.

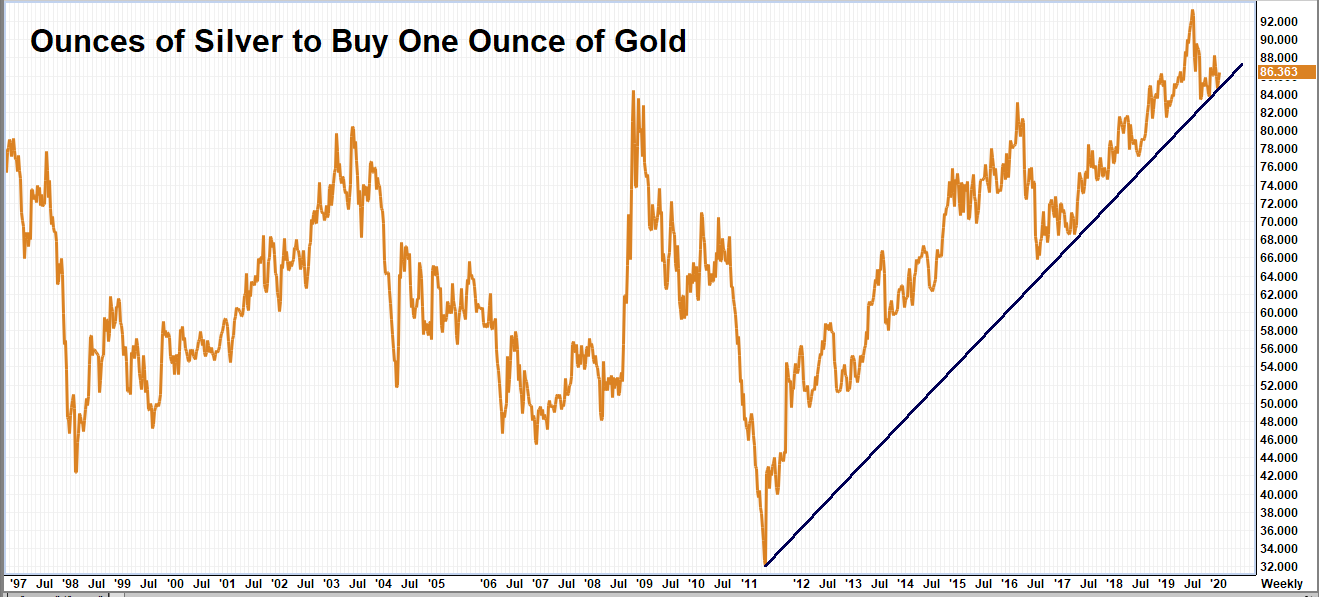

A 2020 decline in the US dollar would pop the lid off gold. It could have an even bigger bullish effect on silver and platinum, both of which are trading at huge discounts to their yellow cousin. The chart below illustrates how much silver has lagged gold since the top of the precious metal bull market in 2011. Back then it took 32 ounces of silver to buy one ounce of gold. Now it takes 88 ounces of silver to buy one ounce of gold.

Data Source: FutureSource

Silver is more volatile than gold. It tends to perform better in bull markets and worse in bear markets. Nearly every precious metal bull market has been accompanied by a low gold/silver ratio as investors, priced out of soaring gold prices, turn to silver. But not this one – at least not yet. Has the introduction of cheap, gold-backed ETFs like GLD and its knockoffs reduced the need for silver as a substitute? Maybe.

Gold is essentially a financial metal. It is more than anti-dollar. It is anti-currency. Central banks have been trying to weaken global currencies, so it is not surprising to see gold rally against all currencies since 2016. Silver and platinum have big industrial components, which makes them act more like commodities much of the time, tying them closely to the dollar. Both did well in 2019 because gold did well – but the strong dollar has held them back for a long time. Both have a lot of catching up to do. A weaker dollar in 2020 could be the catalyst for big moves in silver and platinum.

Stay Long Silver & Consider Adding

Unlike gold, which has posted one new swing high after another, silver has been unable to take out its 2016 high of $21.23 per ounce. But holding key support at $16.00 per is a positive sign. Failure to close above early September highs of $19.75 per ounce caused us to lower our near-term price targets slightly to $20 and $22 per ounce respectively. Our 18-month long-term target remains $25 per ounce. A series of higher closes above silver’s 2016 high would put this target in play. Silver is oversold on a weekly basis. This makes it a buy at current levels – especially for those without existing positions.

Data Source: Reuters/Datastream

RMB Group trading customers who followed our suggestions in our special report “Silver for Pennies on the Dollar” to buy December 2020 $19.00 / $22.00 or December $20.00 / $23 bull call spreads for $2,500 or less (depending on which version of the report you received) should continue to hold your positions. Silver is looking good. A couple of closes above $19.75 per ounce in the front-month futures contract will re-establish the bull trend. December $19.00 / $22.00 bull spreads settled for $3,450 yesterday. December $20.00 / $23.00 bull spreads finished at $2,600. Each of these silver trades has the potential to be worth as much as $15,000.

As we outlined in Friday’s blog, the death of Soleimani has changed the game, making the world more dangerous. Last night’s Iranian attack on US troops in Iraq has escalated the situation. Silver will eventually follow gold, and gold is going up. Aggressive traders may want to consider adding to bullish positions in silver. Those without bullish positions may want to consider establishing them now. Prices are changing rapidly, so check with your RMB Group broker for our latest recommendations and pricing.

Platinum Even Cheaper Than Silver Relative to Gold

Once known as the “rich man’s gold,” platinum has suffered under the domination of its yellow cousin since 2008. This is when automakers switched their manufacturing process to reduce the amount of platinum in catalytic converters and replace it with a cheaper palladium/rhodium combination. Platinum was trading for over $1,200 more per ounce than gold before the switch. It is now trading at a discount of $605. This is a net loss (in relation to gold) of over $1,800 per ounce. Platinum has lost nearly as much vis-a-vis gold than the combined cost of both metals.

Data Source: FutureSource

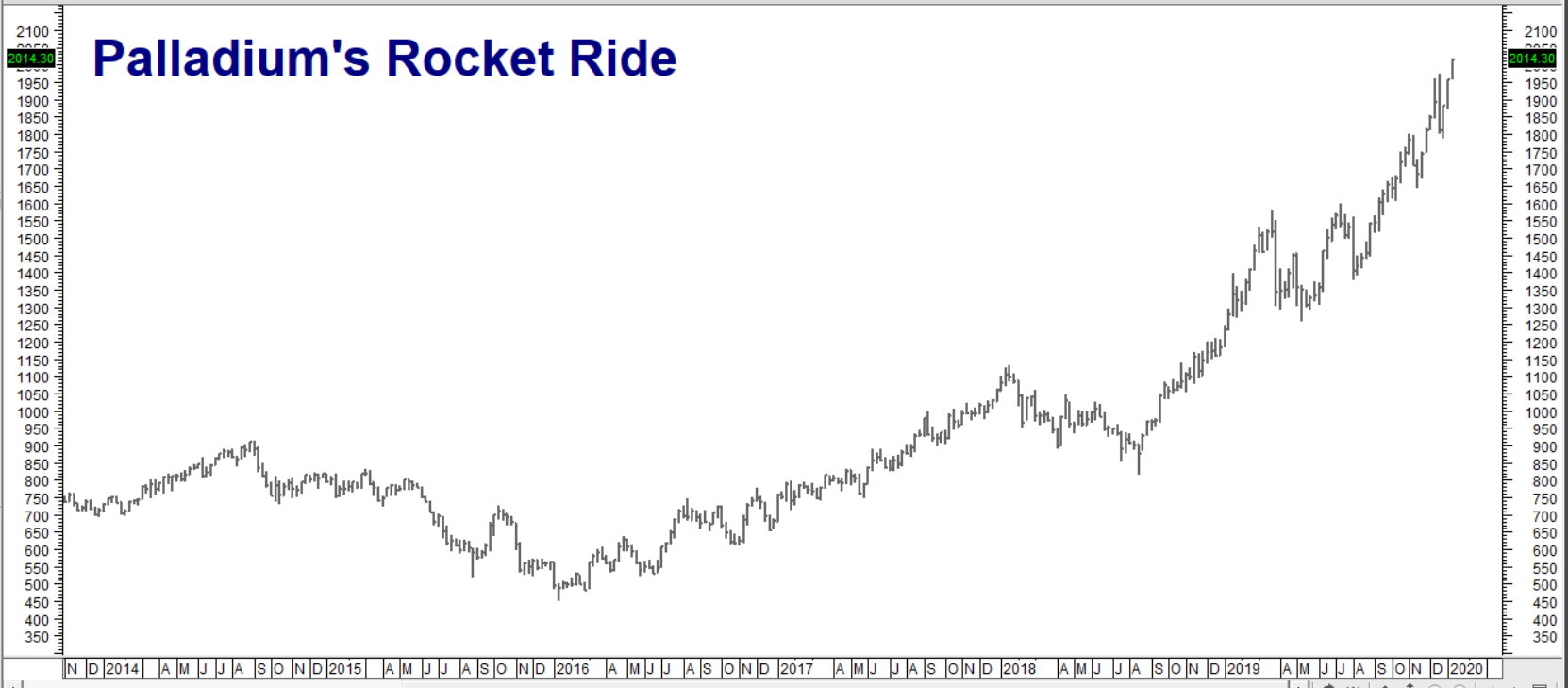

How did this happen? Industrial demand for platinum dried up and overpowered its investment component. Palladium, the beneficiary of the auto-catalyst shift in 2008, has soared. So has the price of rhodium, making the most popular formula for catalytic converters the most expensive. Platinum can tolerate much higher heat and has better catalytic properties than palladium, so less of it is required.

Why haven’t automakers switched back? We don’t know. What we do know is overall demand for platinum rose sharply in 2019 while supplies lagged, leading to a big deficit. But the supply deficit for palladium was even bigger, causing its price to rocket far ahead of platinum. Palladium now costs $1,032 more per ounce than platinum. It was $550 per ounce less in 2016. Platinum could soar if (and when) global automakers switch back.

Data Source: Reuters/Datastream

Data Source: FutureSource

RMB trading customers who took our suggestion to buy platinum futures at $825 per ounce should now raise their mental stop loss orders up to $850 per ounce. Those without positions in the futures market may want to consider futures or platinum call options. Platinum futures are 50-ounce contracts with a value of $48,580 as of last night’s settlement. Be prepared to margin your futures contract at least 50%. Call options are also available.

Data Source: Reuters/Datastream

Please be advised that you need a futures account to trade the markets in this post. The RMB Group has been helping its clientele trade futures and options since 1991. RMB Group brokers are familiar with the option strategies described in this report. Call us toll-free at 800-345-7026 or 312-373-4970 (direct) for more information and/or to open a trading account. Or visit our website at www.rmbgroup.com. Want to know more about trading futures and options? Download our FREE Report, the RMB Group “Short Course in Futures and Options.”

* * * * * * * *

The RMB Group

222 South Riverside Plaza, Suite 1200, Chicago, IL 60606

This material has been prepared by a sales or trading employee or agent of R.J. O’Brien & Associates (“RJO”)/RMB Group and is, or is in the nature of, a solicitation. This material is not a research report prepared by a Research Department. By accepting this communication, you agree that you are an experienced user of the futures markets, capable of making independent trading decisions, and agree that you are not, and will not, rely solely on this communication in making trading decisions.

DISTRIBUTION IN SOME JURISDICTIONS MAY BE PROHIBITED OR RESTRICTED BY LAW. PERSONS IN POSSESSION OF THIS COMMUNICATION INDIRECTLY SHOULD INFORM THEMSELVES ABOUT AND OBSERVE ANY SUCH PROHIBITION OR RESTRICTIONS. TO THE EXTENT THAT YOU HAVE RECEIVED THIS COMMUNICATION INDIRECTLY AND SOLICITATIONS ARE PROHIBITED IN YOUR JURISDICTION WITHOUT REGISTRATION, THE MARKET COMMENTARY IN THIS COMMUNICATION SHOULD NOT BE CONSIDERED A SOLICITATION.

The risk of loss in trading futures and/or options is substantial and each investor and/or trader must consider whether this is a suitable investment. Past performance, whether actual or indicated by simulated historical tests of strategies, is not indicative of future results. Trading advice is based on information taken from trades and statistical services and other sources that RJO/RMB believes are reliable. We do not guarantee that such information is accurate or complete and it should not be relied upon as such. Trading advice reflects our good faith judgment at a specific time and is subject to change without notice. There is no guarantee that the advice we give will result in profitable trades.