“Bulls make money. Bears make money. Pigs get slaughtered.” You have undoubtedly heard this phrase before. Pigs do get slaughtered, but in pork-loving China and other parts of Asia there are not enough to go around. African Swine Flu (ASF) is ravaging the Chinese pig population. Some analysts estimate a reduction in domestic supply of over 50%.

ASF is almost 100% fatal. Sick pigs don’t recover. This is a problem – especially in a nation of 1.4 billion pork lovers. Chinese inflation clocked in at 4.5% in November, mostly due to a 97% increase in pork prices. African Swine Flu has also spread to Indonesia, Vietnam and 9 other Asian nations. Recent estimates peg 25% of the globe’s pig population being lost to what some are calling “Pig Ebola.”

Both bulls and bears in the Lean Hog futures trading on the CME have had to work hard to make money. Hogs have been trading sideways despite the global shortage. The biggest reason for this is the trade war. China is not buying the pigs it needs from the US due to the 72% retaliatory tariffs it imposed on imports. It chose to source pork from Brazil and other South American nations instead.

Both bulls and bears in the Lean Hog futures trading on the CME have had to work hard to make money. Hogs have been trading sideways despite the global shortage. The biggest reason for this is the trade war. China is not buying the pigs it needs from the US due to the 72% retaliatory tariffs it imposed on imports. It chose to source pork from Brazil and other South American nations instead.

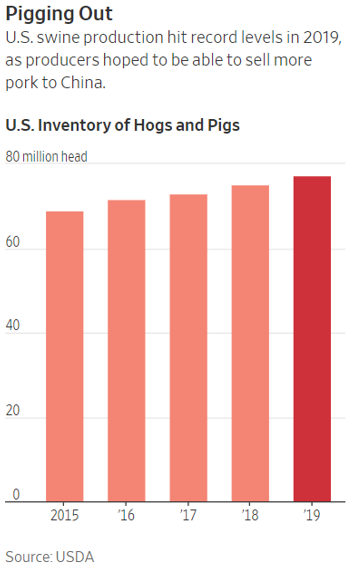

At the same time, US producers have been increasing production in anticipation of a trade deal that has yet to be signed. The push and pull of bullish expectations of a negotiated reduction in Chinese tariffs versus the lack of Chinese buying is reflected in the sideways market in the chart of June hogs below. We chose the June chart because it corresponds to grilling season in the US. This is typically the period of highest demand. The August futures contract covers the summer as well and, like June, tends to trade at a premium to other contract months.

Data Source: Reuters/Datastream

Lean hog futures made an all-time high of 1.3360 cents per pound in 2014 due to the outbreak of another hog-killing virus, PED. This virus killed 7.7 million head of hogs in the US. African Swine flu has killed 400 million pigs in China alone, and many more in other parts of Asia. How much longer will the trade issue keep a lid on US hog prices? It depends on the Trump Administration’s ability to actually implement a trade deal. The US has the pigs. China needs them. It should be simple – but it hasn’t been so far.

With the price of June (and August) hog futures close to the bottom of their 1-year trading ranges, now might be a time to consider long positions. African Swine Flu has made options expensive. This favors bull put spreads and long futures positions protected by “collars.” Our upside target is just above the top of the current trading range at 98 cents per pound. RMB trading customers should check with their RMB Group broker for the latest recommendations.

Sugar Hits Our Upside Target – Sweet!

Sugar hit our upside target of 14.5 cents per pound in today’s session. RMB Group trading customers who haven’t exited the long March 13-cent call leg of the strangles we suggested purchasing for $650 or less in our November blog post should consider doing so tomorrow. These calls traded as high as $1,724.80 earlier today. Continue to hold your “now fully paid” for 12-cent puts. Who knows what could happen between now and March option expiration on February 18th.

Please be advised that you need a futures account to trade the markets in this post. The RMB Group has been helping its clientele trade futures and options since 1991. RMB Group brokers are familiar with the option strategies described in this report. Call us toll-free at 800-345-7026 or 312-373-4970 (direct) for more information and/or to open a trading account. Or visit our website at www.rmbgroup.com. Want to know more about trading futures and options? Download our FREE Report, the RMB Group “Short Course in Futures and Options.”

* * * * * * * *

The RMB Group

222 South Riverside Plaza, Suite 1200, Chicago, IL 60606

This material has been prepared by a sales or trading employee or agent of R.J. O’Brien & Associates (“RJO”)/RMB Group and is, or is in the nature of, a solicitation. This material is not a research report prepared by a Research Department. By accepting this communication, you agree that you are an experienced user of the futures markets, capable of making independent trading decisions, and agree that you are not, and will not, rely solely on this communication in making trading decisions.

DISTRIBUTION IN SOME JURISDICTIONS MAY BE PROHIBITED OR RESTRICTED BY LAW. PERSONS IN POSSESSION OF THIS COMMUNICATION INDIRECTLY SHOULD INFORM THEMSELVES ABOUT AND OBSERVE ANY SUCH PROHIBITION OR RESTRICTIONS. TO THE EXTENT THAT YOU HAVE RECEIVED THIS COMMUNICATION INDIRECTLY AND SOLICITATIONS ARE PROHIBITED IN YOUR JURISDICTION WITHOUT REGISTRATION, THE MARKET COMMENTARY IN THIS COMMUNICATION SHOULD NOT BE CONSIDERED A SOLICITATION.

The risk of loss in trading futures and/or options is substantial and each investor and/or trader must consider whether this is a suitable investment. Past performance, whether actual or indicated by simulated historical tests of strategies, is not indicative of future results. Trading advice is based on information taken from trades and statistical services and other sources that RJO/RMB believes are reliable. We do not guarantee that such information is accurate or complete and it should not be relied upon as such. Trading advice reflects our good faith judgment at a specific time and is subject to change without notice. There is no guarantee that the advice we give will result in profitable trades.