Last week was big for platinum group metals (PGMs). Stricter emissions standards in China proved to be the catalyst for a huge move in palladium. Palladium and platinum are critical components of catalytic converters. Catalytic converters are the main emission control devices for virtually all internal combustion engine (ICE) modes of transportation. New Chinese air quality regulations require 30% more palladium in catalytic converters, substantially increasing demand for this rare metal.

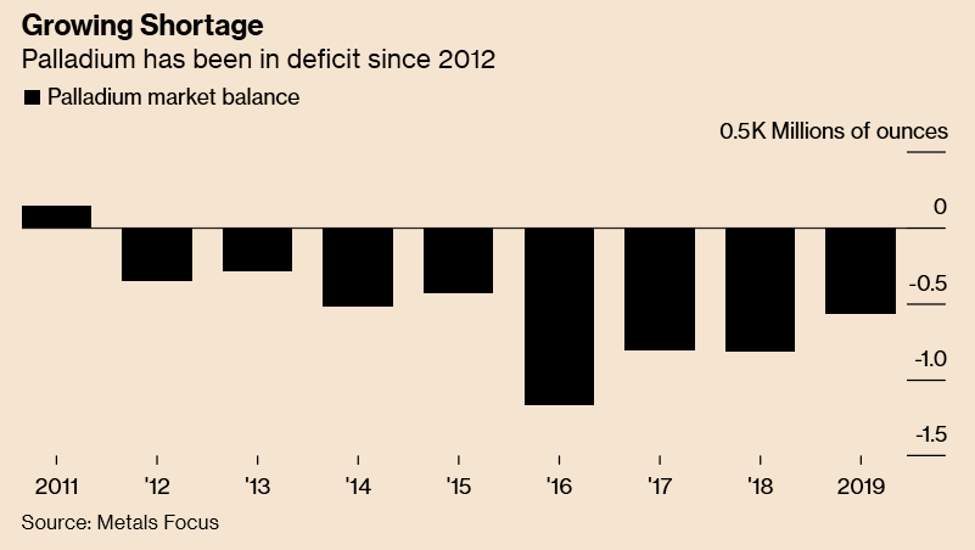

Increased demand for palladium is coming at a time when supplies are tight. Nearly all palladium is mined in Russia or South Africa, and much of it is a byproduct of mining for other metals like nickel and platinum. Nearly 85% of all palladium mined is used in catalytic converters. As the chart below illustrates, the palladium market has been in a deficit since 2012.

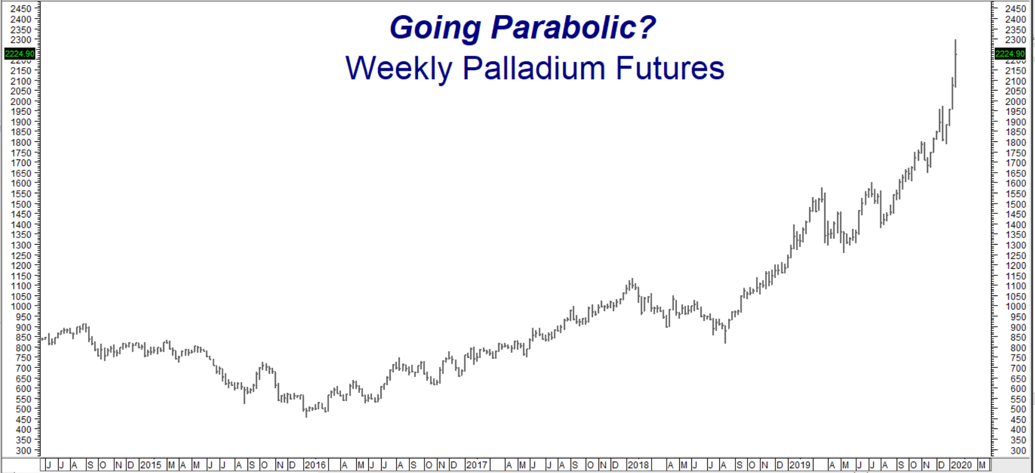

New Chinese requirements could cause this deficit to widen substantially this year. Analysts expect roughly 9 million ounces of palladium to be mined in 2020. Demand is expected to increase to roughly 10 million ounces, leaving an estimated deficit of 1 million ounces. Palladium prices have skyrocketed, briefly threatening $2,300 per ounce before backing off to current levels of $2,240 per ounce – a gain of 17.3% in the first three weeks of the year.

Data Source: Reuters/Datastream

Platinum Is Much Cheaper Than Palladium

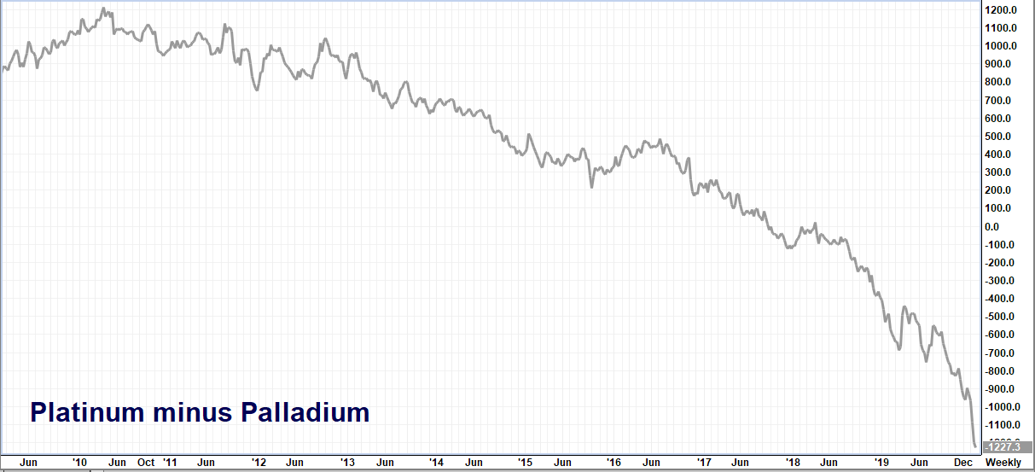

Platinum is a more efficient alternative to palladium when it comes to catalyzing ICE exhaust. It can withstand higher heat and less of it is required to catalyze to the same reaction. Platinum is also getting cheaper on an absolute basis than its expensive cousin. As illustrated in the chart below, an ounce of platinum was over $1,100 more costly than an ounce of palladium in 2010. It is now $1,227 cheaper and appears to be getting more so by the day.

Data Source: FutureSource

Platinum’s $1,100 premium to palladium caused automakers to switch to palladium for their catalytic converters during the past last decade. Why haven’t they switched back? There are two reasons we can discern: electrification and certification. The first involves the belief that ICE-powered cars are going the way of the horse and buggy as electric cars drive the future. Since the amount of metal required for a catalytic converter is small, why spend a ton of money to retool when the demand for your product is bound to decline?

Changes in manufacturing processes also require environmental certifications across numerous political jurisdictions. This means a lot more testing, and a bunch of new paperwork, all of which cost money.

Fair enough…

However, the world isn’t going all-electric overnight. Populous nations like India could join China and demand reduced emissions in their ICE vehicles. And, of course, there is price. Should the trend in the chart above continue, the gap between platinum and palladium will come a point where it will make more economic sense to bite the bullet and switch back to platinum – electrification or not. We believe the market is getting close to this turning point. Platinum could explode, if and when this occurs.

Data Source: Reuters/Datastream

This is why we expect the near-parabolic rally in palladium to help platinum. Platinum sliced through our first upside objective of $1,000 per ounce largely due to the price action of its manic cousin. Platinum then immediately tested long-term resistance at $1,048 per ounce before backing off. This is good news for RMB Group trading customers who followed our suggestion to buy platinum futures a year ago, and for those who added to or established new positions suggested in our blog earlier this month.

Platinum continues to make higher highs and higher lows. It took out its old swing high of $1,001 per ounce last week and then closed above that level multiple times. This positive price action means we can move our risk point up to $880 per ounce. It also dictates new upside targets which replace the $1,000 per ounce and $1,200 per ounce targets we originally established. Our new targets are $1,080 and $1,230 per ounce respectively.

We continue to like platinum – especially on setbacks. Key levels to watch are $1,048 (the resistance level the market just tested) and 2016 highs of $1,199 per ounce. A series of closes above $1,200 per ounce would signal an upside breakout. This could set the stage for sharply higher prices down the road.

Please be advised that you need a futures account to trade the markets in this post. The RMB Group has been helping its clientele trade futures and options since 1991. RMB Group brokers are familiar with the option strategies described in this report. Call us toll-free at 800-345-7026 or 312-373-4970 (direct) for more information and/or to open a trading account. Or visit our website at www.rmbgroup.com. Want to know more about trading futures and options? Download our FREE Report, the RMB Group “Short Course in Futures and Options.”

* * * * * * * *

The RMB Group

222 South Riverside Plaza, Suite 1200, Chicago, IL 60606

This material has been prepared by a sales or trading employee or agent of R.J. O’Brien & Associates (“RJO”)/RMB Group and is, or is in the nature of, a solicitation. This material is not a research report prepared by a Research Department. By accepting this communication, you agree that you are an experienced user of the futures markets, capable of making independent trading decisions, and agree that you are not, and will not, rely solely on this communication in making trading decisions.

DISTRIBUTION IN SOME JURISDICTIONS MAY BE PROHIBITED OR RESTRICTED BY LAW. PERSONS IN POSSESSION OF THIS COMMUNICATION INDIRECTLY SHOULD INFORM THEMSELVES ABOUT AND OBSERVE ANY SUCH PROHIBITION OR RESTRICTIONS. TO THE EXTENT THAT YOU HAVE RECEIVED THIS COMMUNICATION INDIRECTLY AND SOLICITATIONS ARE PROHIBITED IN YOUR JURISDICTION WITHOUT REGISTRATION, THE MARKET COMMENTARY IN THIS COMMUNICATION SHOULD NOT BE CONSIDERED A SOLICITATION.

The risk of loss in trading futures and/or options is substantial and each investor and/or trader must consider whether this is a suitable investment. Past performance, whether actual or indicated by simulated historical tests of strategies, is not indicative of future results. Trading advice is based on information taken from trades and statistical services and other sources that RJO/RMB believes are reliable. We do not guarantee that such information is accurate or complete and it should not be relied upon as such. Trading advice reflects our good faith judgment at a specific time and is subject to change without notice. There is no guarantee that the advice we give will result in profitable trades.