Seven years of near-perfect growing weather combined with the ability of new variants of genetically-engineered corn to withstand higher temperatures and wetter conditions have been enough to match increasing demand. How much longer will these price-depressing conditions last? Like it or hate it, GMO grain will probably be with us forever, but the real determinant of corn price is ever-capricious Mother Nature.

People need to eat. Global population is expanding at a rate of 60 to 80 million per year. More people means more grain is required to feed them and the growing number of meat-producing animals favored by the expanding middle class in population-heavy India and China. Increasing demand is already baked into the equation. So was the China / US trade war, that is, until Friday.

The yellow grain may have received a bit of help from the yellow-haired American President’s negotiating team. Friday’s announcement that a “Phase One” agreement was reached was good news for corn. While this agreement gave the US nothing in terms of its intellectual property theft, it did include a Chinese promise to purchase $32 billion in US agricultural products over the next two years.

This is down from the $40 to $50 billion China supposedly agreed to in October. But it is a substantial increase considering that China was purchasing roughly $24 billion in American agricultural products per year prior to the start of the 2017 trade war. Whether China follows through on its promise remains to be seen. Today’s markets are skeptical. Corn and soybeans are up 5 and 8 cents respectively as we write this – not exactly a ringing endorsement of Friday’s announcement.

Higher Prices Critical to Trump’s Re-election Chances…

Farmers have been and still are one of Donald Trump’s key blocks of support. With his impeachment almost certain, the president will need every single person who voted for him last time to do it again. The Chinese may have “won” Phase One by giving up virtually nothing for a reduction in tariffs, but we suspect the Trump administration will do everything they can to hold them to their promised grain purchases. Higher grain prices will virtually assure big turnouts in rural America.

…But Weather Still Trumps All

With the US crop in the bin and the South American crop just in the ground, all eyes now turn south. Your humble editor just returned from a trip to Antarctica and flew home over vast tracts of freshly-planted fields in Argentina and Brazil. And while this is just a casual observation, the corn-growing areas surrounding my connecting airport in Argentina looked extremely dry. Coincidently enough, this just flashed across our Dow Jones wire service:

WORLD CORN PROSPECTS

Some beneficial rain in the major soybean areas of central Argentina (Santa Fe and Cordoba). Little rain in the major corn areas (Buenos Aires). More rain is needed to support corn and soybean planting and development. The next chance of any beneficial showers will be on Friday. However amounts and coverage may be disappointing. This situation bears watching.

Watch we will.

Seasonal Factors Favor Spring / Early Summer Rallies

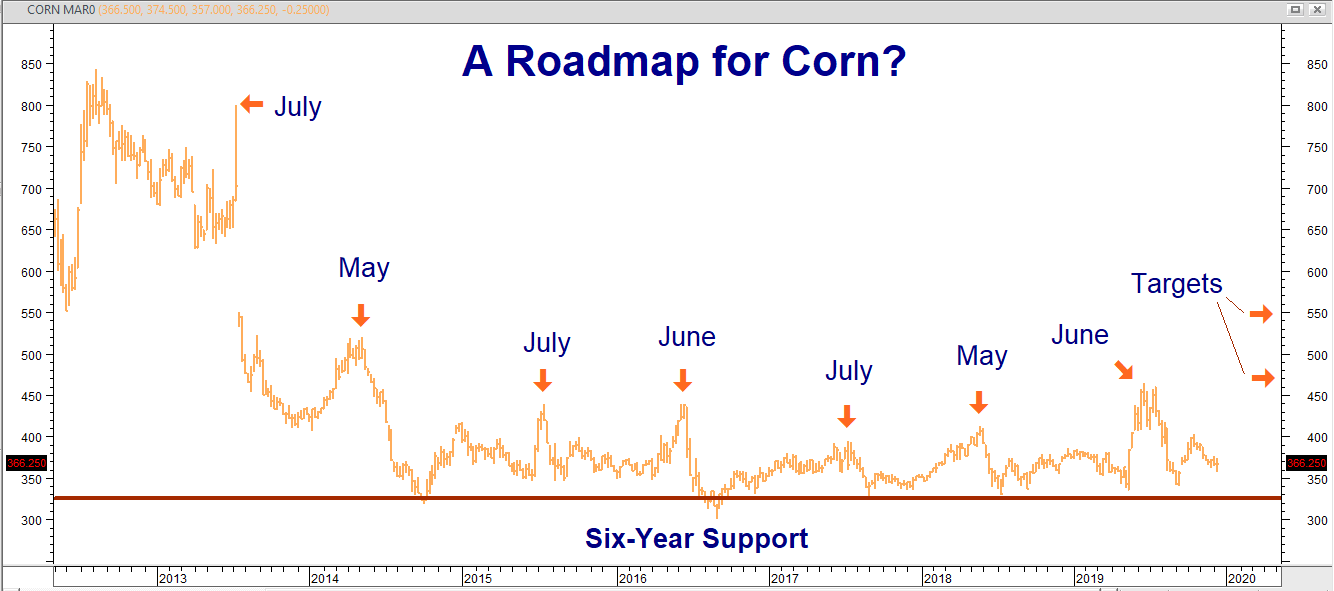

It is generally not a good idea to make trading decisions based on seasonal factors alone. However, studying seasonal tendencies along with other factors can help provide a trading edge. We examined some of these factors in our last blog on grains and the trade negotiations back in October. In it we included a slightly different version of the chart below.

Data Source: Reuters/Datastream

As we stated in that blog, “…corn has a pronounced tendency to make its highs in late spring and early summer when crop conditions are still unknown and then decline in the fall when the harvest is in. Six years of near-perfect growing conditions following the North American planting season have contributed to this easily-identifiable pattern.”

Call Options Are Surprisingly Inexpensive

Corn is cheaper now than it was then. So are the call options for July and December. And why this hasn’t been great news for the July $4.50 calls we suggested purchasing for $600 or less (currently trading for $350 each), current conditions are providing RMB trading clients who followed our suggestion with an opportunity to get a lot closer to the market for a negligible additional cost – and for those who do not own a bullish position in corn to establish one now.

Just how cheap are July corn options? July 2020 call futures are currently trading for $3.98 per bushel or roughly $4.00. You can buy both a $4.00 call and a $4.00 put for 40 cents or $2,000. Divide 40 cents by $4.00 and the market is telling you it expects a move of no more than 10% in either direction between now and the expiration of July 2020 corn options on June 26, 2020. Any major weather event prior to this could cause corn prices to soar much more than 10%.

RMB trading customers who followed our suggestion in October to buy July 2020 $4.50 calls may want to consider selling them and replacing them with July 2020 $4.20 calls. Pay no more than $350 for the entire swap. This will increase your risk by $350 plus transaction cost, but get you almost 7 percent closer to the market. Those without long positions in corn may want to consider buying July $4.20 calls outright. Pay no more than $650. This plus transaction cost is your maximum risk.

July $4.20 calls will be worth at least $2,500 should corn hit our $4.70 objective prior to option expiration in late June. They will be worth at least $6,500 at our second objective of $5.50 per bushel.

Soybeans Doing a Bit Better

China has traditionally purchased more soybeans than corn from the US (in terms of dollar value), so we are not surprised to see the bullish July $10.00 / $11.00 bull call spreads we suggested purchasing for $500 or less holding their value. These spreads are currently trading around $700. Let’s hold these for now. Soybeans follow roughly the same seasonal patterns as corn, but are not nearly as precise. Those without long positions in soybeans may want to consider establishing one on setbacks. Contact your RMB Group broker for pricing.

Please be advised that you need a futures account to trade the markets in this post. The RMB Group has been helping its clientele trade futures and options since 1991. RMB Group brokers are familiar with the option strategies described in this report. Call us toll-free at 800-345-7026 or 312-373-4970 (direct) for more information and/or to open a trading account. Or visit our website at www.rmbgroup.com. Want to know more about trading futures and options? Download our FREE Report, the RMB Group “Short Course in Futures and Options.”

* * * * * * * *

The RMB Group

222 South Riverside Plaza, Suite 1200, Chicago, IL 60606

This material has been prepared by a sales or trading employee or agent of R.J. O’Brien & Associates (“RJO”)/RMB Group and is, or is in the nature of, a solicitation. This material is not a research report prepared by a Research Department. By accepting this communication, you agree that you are an experienced user of the futures markets, capable of making independent trading decisions, and agree that you are not, and will not, rely solely on this communication in making trading decisions.

DISTRIBUTION IN SOME JURISDICTIONS MAY BE PROHIBITED OR RESTRICTED BY LAW. PERSONS IN POSSESSION OF THIS COMMUNICATION INDIRECTLY SHOULD INFORM THEMSELVES ABOUT AND OBSERVE ANY SUCH PROHIBITION OR RESTRICTIONS. TO THE EXTENT THAT YOU HAVE RECEIVED THIS COMMUNICATION INDIRECTLY AND SOLICITATIONS ARE PROHIBITED IN YOUR JURISDICTION WITHOUT REGISTRATION, THE MARKET COMMENTARY IN THIS COMMUNICATION SHOULD NOT BE CONSIDERED A SOLICITATION.

The risk of loss in trading futures and/or options is substantial and each investor and/or trader must consider whether this is a suitable investment. Past performance, whether actual or indicated by simulated historical tests of strategies, is not indicative of future results. Trading advice is based on information taken from trades and statistical services and other sources that RJO/RMB believes are reliable. We do not guarantee that such information is accurate or complete and it should not be relied upon as such. Trading advice reflects our good faith judgment at a specific time and is subject to change without notice. There is no guarantee that the advice we give will result in profitable trades.