What happened to volatility? We’ve been in the commodity business a long time and can’t remember seeing so many markets trading sideways at the same time. Has the 3rd impeachment of a US President sucked up all the energy in the room or is today’s sideways market environment a symptom of something else? We believe the answer is a resounding “yes.”

The impeachment hearings may have trumped other news, leaving many key markets short of their usual diet of information. But we also sense a powerful inertia born of fear of the unknown. As we pointed out in our last blog post, the global economy is slowing despite years of dangerously low, and even negative, interest rates. This is dragging the US economy down as well. Jobs may be plentiful, but pay is barely keeping pace with inflation.

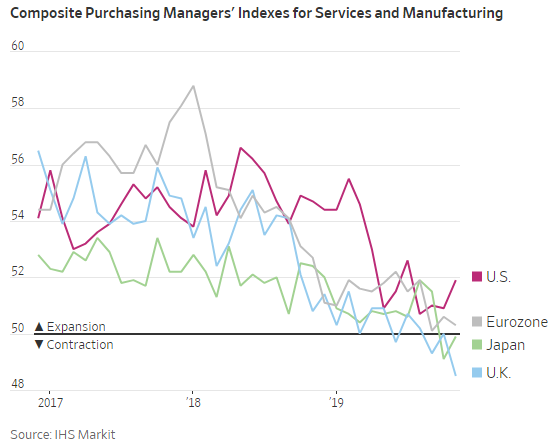

The last three Fed rate cuts have helped cushion the decline but, as illustrated in the chart above, they have not changed the overall downward trend. Instead of leading the way up, the US appears to be following Europe and Japan down. Chairman Powell’s recent announcement of a halt in further cuts means an end to the stimulus likely responsible for the upward blip for the US in the chart above.

We expect US growth will continue to slow and wages will continue to lag unless capital is pumped directly into the working man’s economy, not “trickled down” from the financial system. One way to do this is a coordinated infrastructure rebuild. This is something that requires a willingness to compromise on the part of American politicians –virtually impossible given the current political environment.

Brexit and the rise of nationalism in industrial Europe – especially in Europe’s largest economy, Germany – threaten the whole Eurozone experiment. Much European discord stems from slower growth. The US / Chinese trade war is a major drag on Europe. Many Chinese products use German components.

Potential disruptions to the huge German auto sector from the electric car revolution could also prove to be a huge drag on European growth. Electric automobiles require fewer parts and fewer workers to assemble them. Automotive supply chains extend throughout Europe. A slowdown in the German auto industry has the potential to affect the whole continent.

The European Central Bank (ECB) has been trying to fight slow growth with negative interest rates for the past 5 years. As the chart above illustrates, it is not working.

2020 Could Be Most Disruptive US Election Since the Civil War

The impeachment hearings which riveted the nation over the past two weeks are just “Act I” of what could be the most potentially disruptive US election since the Civil War. Red America and Blue America have grown so far apart, there is no putting them back together short of an economic catastrophe or a war. The center is fast disappearing.

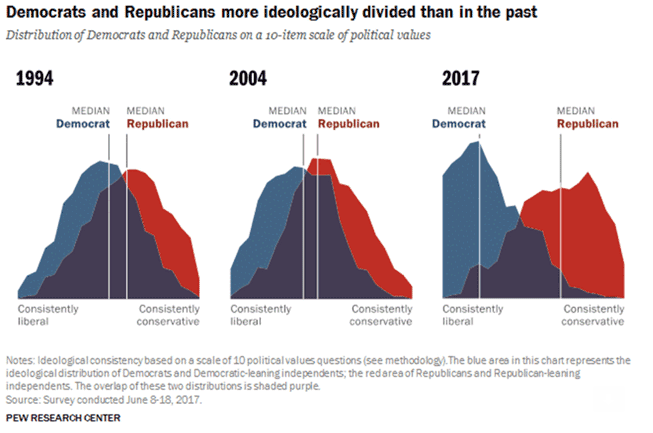

The chart below shows just how far the two tribes have drifted from one another. Note the huge chasm between the views of Democrats and Republicans in 2017 versus 2004. The parties had a lot more in common 13 years ago. Rational people used to be able to discuss their political differences and meet in the middle. Now this is rare. Members of the other tribe are not viewed as fellow Americans, but as enemies.

The economic problems currently facing the US cannot be solved without compromise, but animosity between the two American tribes makes compromise impossible – even for things the majority of voters agree on, like infrastructure. The inability to get anything done politically makes interest rate cuts by the Federal Reserve the only tool to incentivize economic growth.

Like Europe, lower interest rates aren’t working in America either. This probably means a continuation of the slow-growth, lagging-wage environment at the core of the discontent in the American electorate. People on both sides are angry. Angry people vote. They also tend to make bad, fear-based decisions. Fear is the enemy of any economy.

We don’t know which tribe will gain the upper hand in the coming election, or if the whole process will end up in a stalemate. Large investors whose capital ultimately moves markets don’t know either. This is why nearly everything is trending sideways. The one thing on which both sides seem to agree is the 2020 election will have far-reaching and potentially catastrophic consequences. Neither side has the upper hand, so uncertainty rules.

Markets may not be moving much now, but we believe they will as we get closer to next November. Some of these moves could be huge as big traders, ETFs and mutual funds struggle to get out (or in) the same door at the same time. Historically expensive stock and bond markets could exaggerate downside moves in either.

Volatility helps determine the price of options; the more volatile a given market, the more expensive its options will be, and vice versa. Low volatility now means options in many key markets are relatively cheap. This is currently providing us with opportunities that may not be around a whole lot longer once 2020 is upon us.

We still like the long silver, gold, cotton and grain positions we currently have. We also like the short 10-year T-note hedge we suggested in our last blog. Options in all these markets remain relatively cheap. Check with your RMB Group Broker for the latest.

Manage Market Chaos with Professionally-Managed Futures

Another way to play the coming chaos is to leave it to the professionals. What we suggested in a blog post in late August is just as valid now:

This could also be the perfect time to consider adding professionally managed futures accounts to one’s asset mix. Futures money managers (known as Commodity Trading Advisors or “CTAs”) can go both long and short, giving them the ability to capitalize on bull and bear moves in any market. Managed futures accounts have a multi-year tendency to “zig” when stocks and bonds “zag”, making them an excellent diversification tool.

Many CTAs specialize in certain asset classes like agriculture, precious metals, currencies, interest rates and energies. Others trade a broad portfolio of different markets. They all must supply “Disclosure Documents” – which include audited track records – to prospective customers. Download our Free Report, “Opportunities Outside the Stock Market” to learn more about how professionally managed futures can help you survive the coming storm. Track the performance of select CTAs here.

Please be advised that you need a futures account to trade the markets in this post. The RMB Group has been helping its clientele trade futures and options since 1991. RMB Group brokers are familiar with the option strategies described in this report. Call us toll-free at 800-345-7026 or 312-373-4970 (direct) for more information and/or to open a trading account. Or visit our website at www.rmbgroup.com. Want to know more about trading futures and options? Download our FREE Report, the RMB Group “Short Course in Futures and Options.”

* * * * * * * *

The RMB Group

222 South Riverside Plaza, Suite 1200, Chicago, IL 60606

This material has been prepared by a sales or trading employee or agent of R.J. O’Brien & Associates (“RJO”)/RMB Group and is, or is in the nature of, a solicitation. This material is not a research report prepared by a Research Department. By accepting this communication, you agree that you are an experienced user of the futures markets, capable of making independent trading decisions, and agree that you are not, and will not, rely solely on this communication in making trading decisions.

DISTRIBUTION IN SOME JURISDICTIONS MAY BE PROHIBITED OR RESTRICTED BY LAW. PERSONS IN POSSESSION OF THIS COMMUNICATION INDIRECTLY SHOULD INFORM THEMSELVES ABOUT AND OBSERVE ANY SUCH PROHIBITION OR RESTRICTIONS. TO THE EXTENT THAT YOU HAVE RECEIVED THIS COMMUNICATION INDIRECTLY AND SOLICITATIONS ARE PROHIBITED IN YOUR JURISDICTION WITHOUT REGISTRATION, THE MARKET COMMENTARY IN THIS COMMUNICATION SHOULD NOT BE CONSIDERED A SOLICITATION.

The risk of loss in trading futures and/or options is substantial and each investor and/or trader must consider whether this is a suitable investment. Past performance, whether actual or indicated by simulated historical tests of strategies, is not indicative of future results. Trading advice is based on information taken from trades and statistical services and other sources that RJO/RMB believes are reliable. We do not guarantee that such information is accurate or complete and it should not be relied upon as such. Trading advice reflects our good faith judgment at a specific time and is subject to change without notice. There is no guarantee that the advice we give will result in profitable trades.