Volatility is not always bad, especially when it comes to options, and particularly when markets are volatile in the direction expected. The Fed announced it was tightening policy at its meeting next week, causing a lot of downside volatility in the bond markets. Brazil released an updated harvest forecast, showing much lower expected yields. This fueled big upside volatility in soybeans. Both events provide us with an opportunity to take some cash “off the table” while maintaining a core position in both markets.

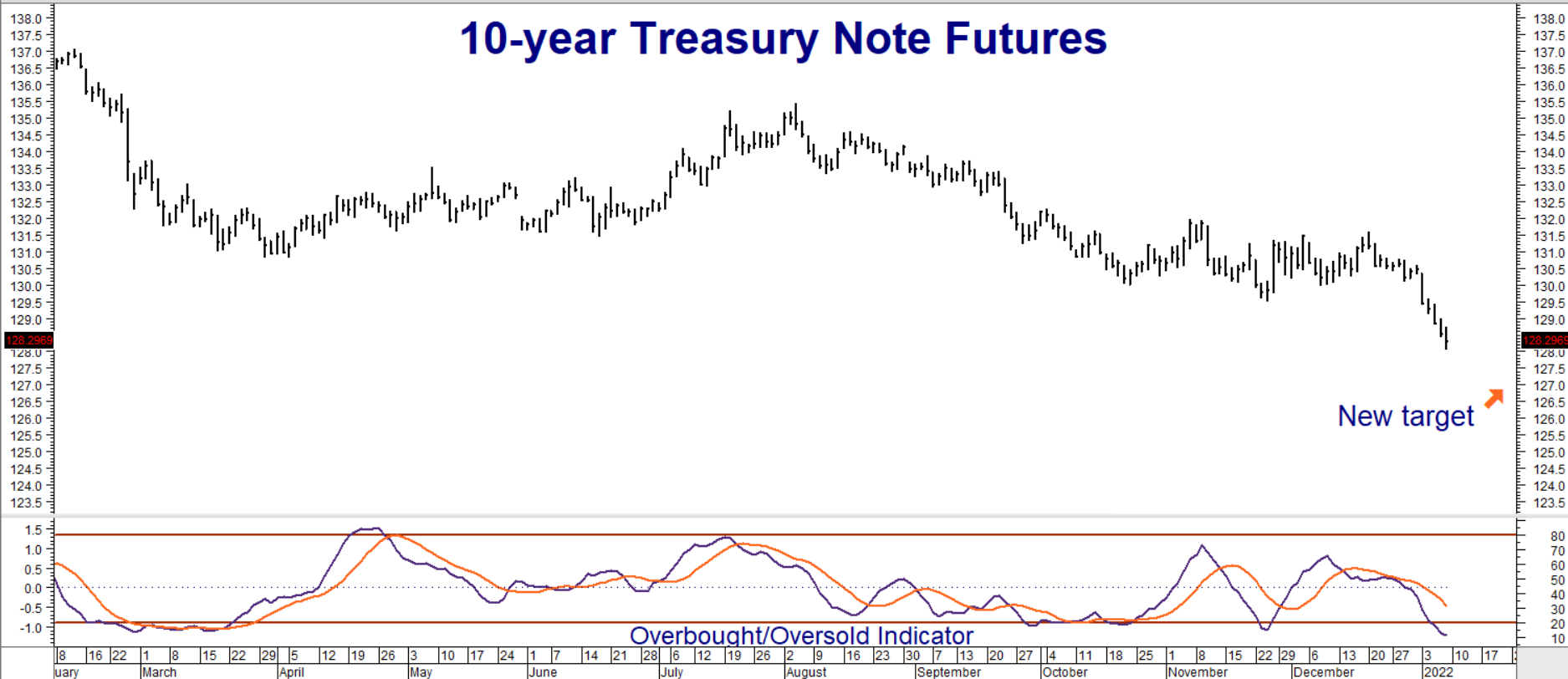

Let’s start with T-notes. Inflation pressures led RMB Group to take a bearish stance on bonds and notes since May of last year. Treasuries ignored these inflationary pressures at first, focusing instead on the Fed’s assurance that inflation would be “transitory.” The market didn’t really to begin to break down until September and then did so grudgingly, grinding lower rather than collapsing as we anticipated.

Data Source: Reuters/Datastream

We still believe T-note prices are higher and yields lower than they should be given an inflation rate of 6.8% and a core rate (minus food and energy) of 4.7%, but would not be surprised to see another bounce on the way to lower prices. The Treasury market seems to have convinced itself that yields will rise and prices will fall, but will do so slowly and in a measured way. It appears confident that Jerome Powell and Company have the situation under control and that the measures announced last week – ending QE and perhaps raising short-term interest rates by the end of March – will put a brake on inflation. We shall see.

Oversold Market & Stock Trouble Could Cause Brief Bounce in Bonds

10-year T-notes are oversold following last week’s Fed-inspired sell-off, making them vulnerable to a corrective rally. We also expect the stock market to run into trouble once it comes to terms with the Fed’s plan to take the free-money punchbowl away. That reckoning could occur sooner than many think. A significant correction in equities should cause a brief flight-to-quality bounce in Treasuries as money fleeing stocks rushes to find a home. We see any significant pop in bonds and notes as an opportunity add to our short position. Let’s use the recent decline to take some money off the table and reduce our risk until this bounce materializes.

RMB Group trading customers who followed our suggestion in November and bought more than one March 130-00 T-note puts we recommended should consider placing an order to exit half of their position at twice their initial entry level or higher. A fill takes your initial risk off the table and allows you to hold the balance of your position with house money. March 130-00 T-note puts settled for $1,906.25 on Friday.

We’ve raised our near-term downside target from 126-00 to 127-00 in the March 2022 futures contract due to market action following our original recommendation. Consider exiting all remaining positions once our new 127-00 target is hit. Get ready to reestablish a full short position on any major bounce, looking for a resumption of the downtrend longer term.

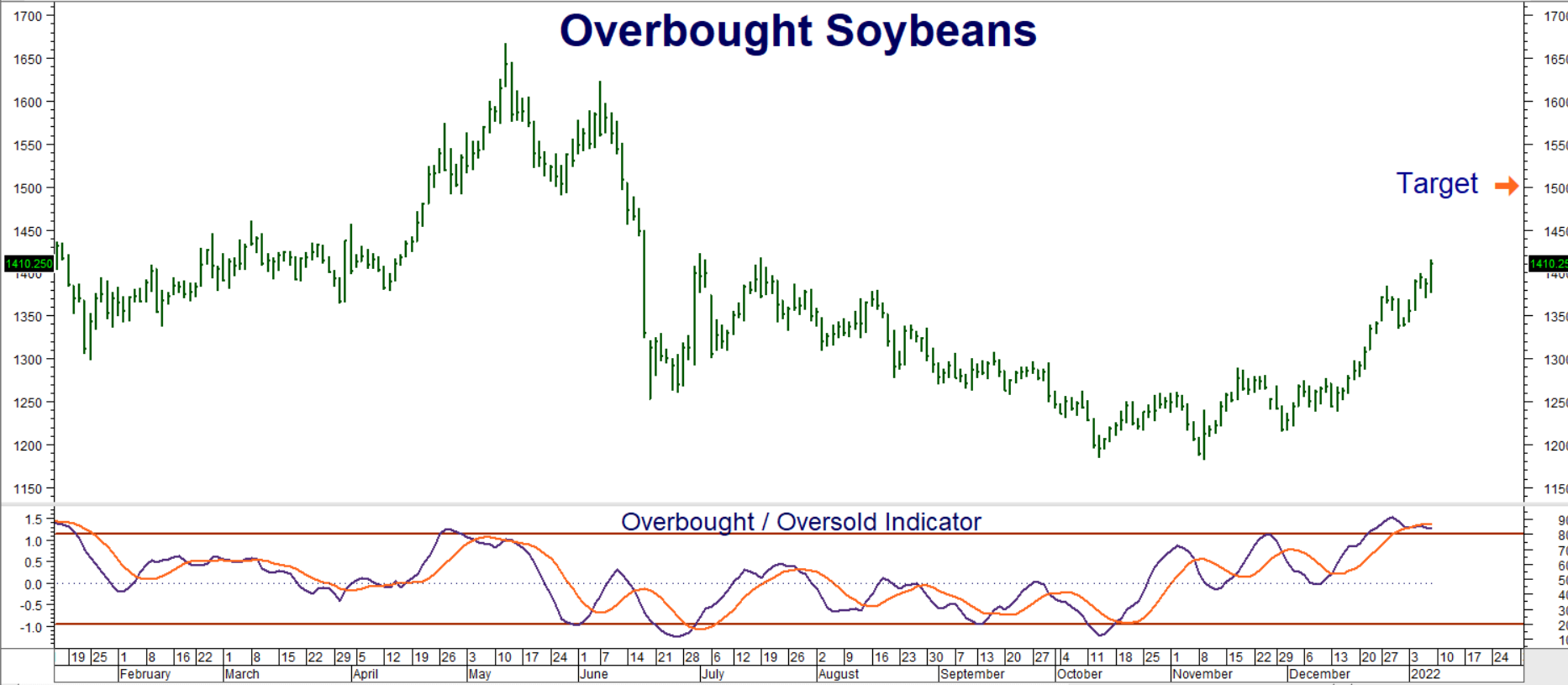

Soybeans Are Strong, But Overbought

La Niña-driven dryness in Southern Brazil is powering the current jump in soybeans. Commodities have a tendency to fall with stocks so last week’s rally in soybeans, despite Fed-inspired weakness in equities, was impressive. Soybeans are strong but overbought and will eventually need something more than weather to keep the rally going long term. Mother Nature can be capricious.

While our upside target in the May futures contract remains $15.00 per bushel, we believe the next big move in soybeans will be to the downside once the South American harvest is complete and weather ceases to be a big near-term factor. Today’s high prices could cause North American farmers to plant fencepost to fencepost this spring to make up for the current shortfall in Argentina and Southern Brazil. Commercial farmers will use futures and put options to lock in high prices before a single seed is in the ground. This hedging activity could signal a change in trend.

Data Source: Reuters/Datastream

Covid and China’s new anti-growth policies are not auspicious for Chinese demand for soybeans going forward. The expiration of the Trump trade agreement doesn’t help either. With the market focused on South American weather, these are concerns for later. In the meantime, let’s use this weather volatility as an opportunity to take some cash off the table and reduce the risk of our existing long positions.

Take Some Money Off the Table

RMB Group trading customers who purchased more than one May 2020 $1,400 / $1,500 bull call spreads we suggested buying for $750 or less in our October post should consider placing an order to exit half of their position for twice their initial entry price or higher. A fill reduces the overall risk of your remaining positions to zero. Our bull spreads settled for $1,825 on Friday.

Continue to hold the balance of your position for a move to our $15.00 per bushel target. Consider exiting all of your remaining spreads if and when this target is hit. Prices can and will change so contact your RMB Group trading professional for the latest.

Please be advised that you need a futures account to trade the markets in this post. The RMB Group has been helping our clientele trade futures and options since 1991. RMB Group brokers are familiar with the option strategies described in this report. Call us toll-free at 800-345-7026 or 312-373-4970 (direct) for more information and/or to open a trading account. Or visit our website at www.rmbgroup.com. Want to know more about trading futures and options? Download our FREE Report, the RMB Group “Short Course in Futures and Options.”

* * * * * * * *

The RMB Group

222 South Riverside Plaza, Suite 1200, Chicago, IL 60606

This material has been prepared by a sales or trading employee or agent of R.J. O’Brien & Associates (“RJO”)/RMB Group and is, or is in the nature of, a solicitation. This material is not a research report prepared by a Research Department. By accepting this communication, you agree that you are an experienced user of the futures markets, capable of making independent trading decisions, and agree that you are not, and will not, rely solely on this communication in making trading decisions.

DISTRIBUTION IN SOME JURISDICTIONS MAY BE PROHIBITED OR RESTRICTED BY LAW. PERSONS IN POSSESSION OF THIS COMMUNICATION INDIRECTLY SHOULD INFORM THEMSELVES ABOUT AND OBSERVE ANY SUCH PROHIBITION OR RESTRICTIONS. TO THE EXTENT THAT YOU HAVE RECEIVED THIS COMMUNICATION INDIRECTLY AND SOLICITATIONS ARE PROHIBITED IN YOUR JURISDICTION WITHOUT REGISTRATION, THE MARKET COMMENTARY IN THIS COMMUNICATION SHOULD NOT BE CONSIDERED A SOLICITATION.

The risk of loss in trading futures and/or options is substantial and each investor and/or trader must consider whether this is a suitable investment. Past performance, whether actual or indicated by simulated historical tests of strategies, is not indicative of future results. Trading advice is based on information taken from trades and statistical services and other sources that RJO/RMB believes are reliable. We do not guarantee that such information is accurate or complete and it should not be relied upon as such. Trading advice reflects our good faith judgment at a specific time and is subject to change without notice. There is no guarantee that the advice we give will result in profitable trades.