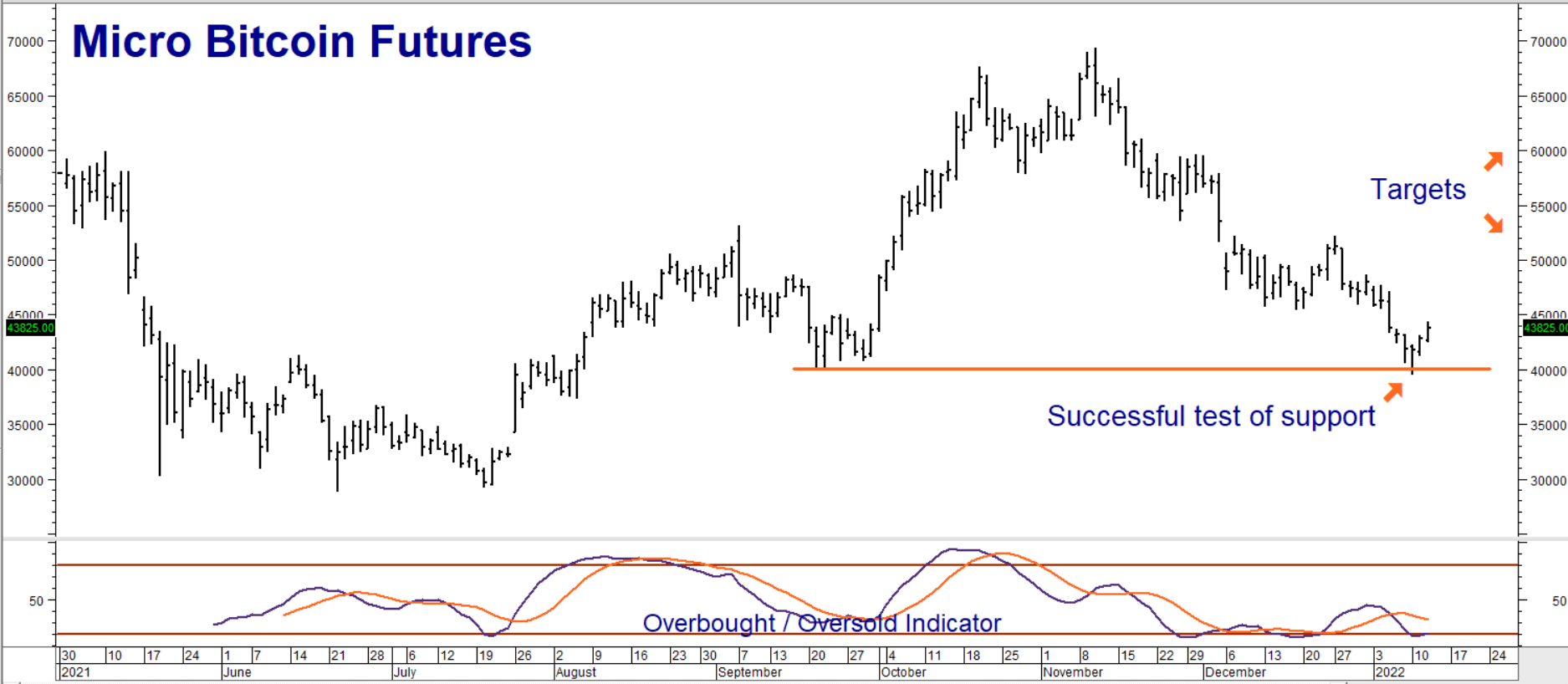

Bitcoin tested and bounced from previous support levels at $40,000 on Friday. It followed through to the upside on Monday, closing above Friday’s high, and rallied again on Tuesday, closing above Monday’s high. This is positive price action. It could also be signal that that selloff that began in early November that took the king of cryptos down 43% in just two months is over.

Volatility is what makes Bitcoin a very compelling trading vehicle. With a contract size of 1/10th of a Bitcoin, CME “micro” bitcoin futures contracts are small enough to allow RMB Group trading customers to take strategic long positions with reasonable downside risks. We introduced micro bitcoin futures in an August blog post (you can review it here) and indicated that we would be monitoring the market. We believe a buying opportunity is at hand.

Bitcoin Based on Belief

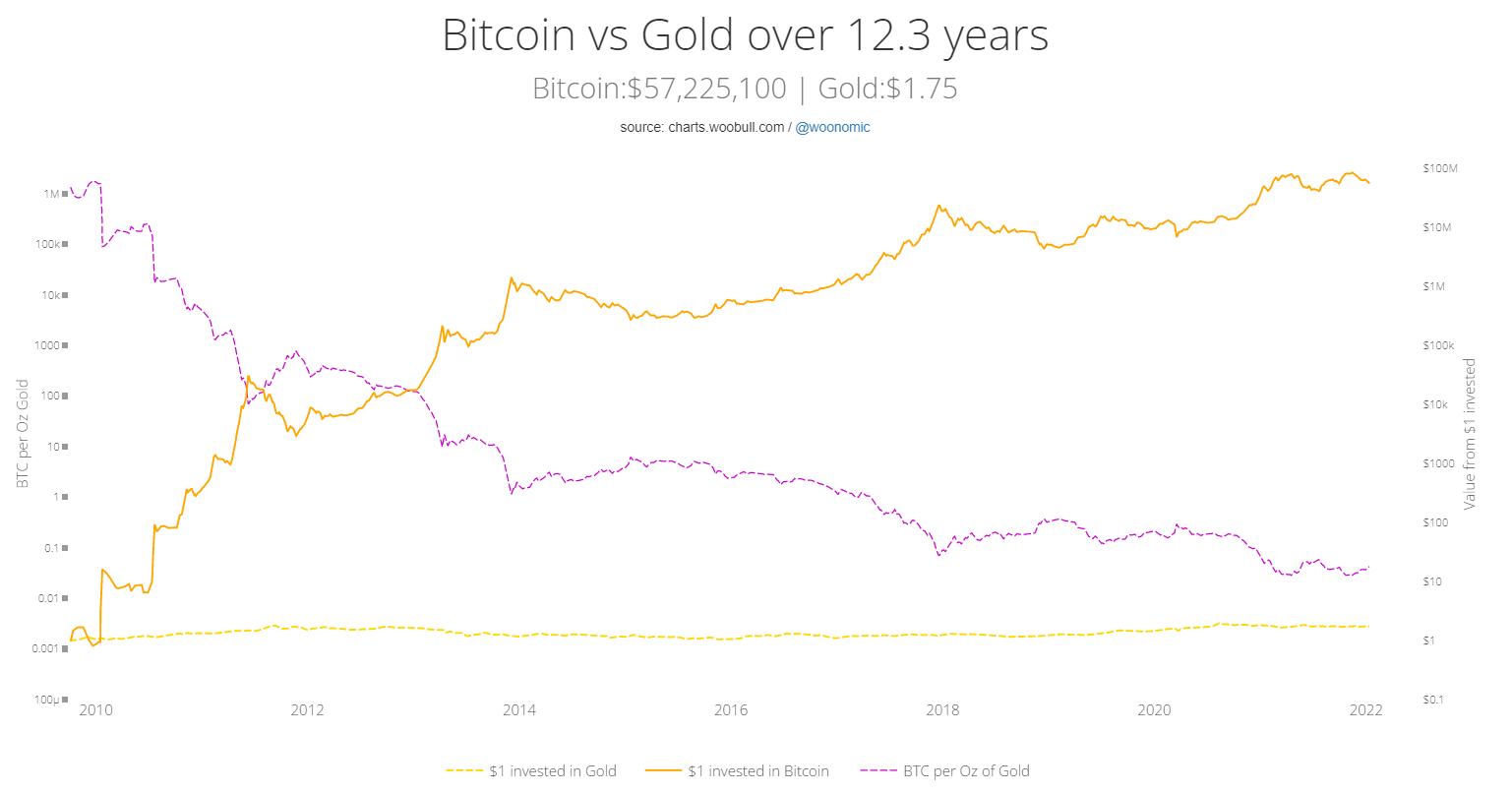

Some investors view Bitcoin as an alternative currency. We believe it is still way too volatile for that. Would you rely on a currency that could lose 43% in just 2 months? Others see it merely as a store of value like gold. This viewpoint is more realistic. Bitcoin has beaten the pants of gold (see chart above), silver and every single fiat currency on the planet. Its track record is short (12 years) but nothing short of impressive. What gives bitcoin its value? Belief. Things are ultimately worth what people believe they are worth. It doesn’t matter if they are stocks, fiat currencies or the pieces of computer code we call “bitcoin.”

Think about any cash transaction. It can only take place if both parties agree that the paper notes being exchanged are worth the amount printed on them. Modern currency is not backed by gold, silver or any other fixed asset beyond the “good faith and credit” of the government issuing it. The only thing that makes a $100 bill worth $100 is the shared belief that $100 is what it is worth. Enough people believe in bitcoin right now to make each Bitcoin worth almost $44,000 as we write this.

El Salvador replaced its national currency with Bitcoin in September, opting for volatility over debasement. Yesterday’s Wall Street Journal featured an article that begins with the following line “The Turkish lira has become so volatile that Turks have ditched the local currency for assets with an even riskier reputation: cryptocurrencies.” Changes in belief lead to changes in price.

Bitcoin Trades on Fear and Greed

Unlike other “hard” commodities like soybeans, gold or crude oil, the supply of Bitcoin is fixed by its algorithm. No more than 21 million bitcoins will be mined. The algorithm makes the mining of each new coin more difficult. With supply fixed and demand based purely on belief (for now at least), our analysis of this market will be purely “technical.” This is just a fancy way of saying chart-based. Price charts illustrate the history of the powerful human emotions that underlie all markets: fear and greed.

Data Source: Reuters / Datastream

Front month micro bitcoin futures settled Wednesday for $43,825 per bitcoin. Since its contract size is 1/10th of a bitcoin, its closing contract value was $4,382.50. The chart above shows the big down move that began in November halting at roughly $40,000 — the same support level as the prior down move in September. $30,000 was the level supplying support to the market in May and June. That level held as well.

Does that mean $40,000 will do the same? Not necessarily. What the chart above is telling us is the level of fear responsible for the latest decline is lower. Lower fear levels may be providing an opening for the re-emergence of greed or even fear of a bullish nature like FOMO (fear of missing out). Bitcoin is also extremely oversold and vulnerable to corrective rallies.

What to Do Now

RMB Group trading customers may want to consider buying February CME micro bitcoin futures for no more than $45,000, looking for bitcoin to hit our upside targets of $52,000 and $60,000 in the front-month futures contract. We do not plan to use stop loss orders, so we recommend putting up 100% of the contract value — $4,500 per contract if filled at $45,000 — to avoid the possibility of a margin call. Price action at $52,000 will determine whether we exit there or hold out for $60,000. Both of these targets are Fibonacci-based. Prices can and will change so contact your RMB Group trading professional for the latest.

Please be advised that you need a futures account to trade the markets in this post. The RMB Group has been helping our clientele trade futures and options since 1991. RMB Group brokers are familiar with the option strategies described in this report. Call us toll-free at 800-345-7026 or 312-373-4970 (direct) for more information and/or to open a trading account. Or visit our website at www.rmbgroup.com. Want to know more about trading futures and options? Download our FREE Report, the RMB Group “Short Course in Futures and Options.”