Micro Bitcoin futures (symbol MBT), which cover 1/10th of a bitcoin, give traders and speculators a way to manage bitcoin exposure in smaller, more manageable chucks. Because it is just as easy to sell futures contracts as it is to buy them, MBT futures are also one of the easiest ways to take a short position in bitcoin.

Launched in May, MBT futures now sport trading volumes in excess of 10,000 contracts per day. This makes them a very viable, liquid market in a surprisingly short period of time. The small size of this contract makes it more attractive to individual investors who would normally avoid trading traditional, larger and more commercially-oriented futures contracts.

The standard CME Bitcoin futures contract (symbol BTC) is 5 bitcoins. The current price of 1 bitcoin is $46,670, which makes each standard contract worth $233,350. The CME Micro Bitcoin contract is worth $4,667. This makes a 10% swing in the latter just $467, as opposed to $23,335 in the standard CME contract.

Extremely Volatile, But Potentially Lucrative

Bitcoin was originally conceived as an alternative currency but its neck-snapping volatility has made that nearly impossible. With movements of 10 to 20 percent or more over the course of a single trading day still possible, bitcoin is still unsuitable for basic commerce. Would you spend bitcoin to buy a good or service if there was a reasonable chance that the dollar value of bitcoin would spike 20% the next day? Probably not.

Would you accept bitcoin in exchange for a good or service, knowing it might be worth 20% less by nightfall? The answer is probably “no.” And while there are plenty of services that do accept bitcoin, most of them likely have procedures to offset the bitcoin they receive by selling it for fiat currency immediately. Most vendors are not set up to do this. Individuals are certainly not.

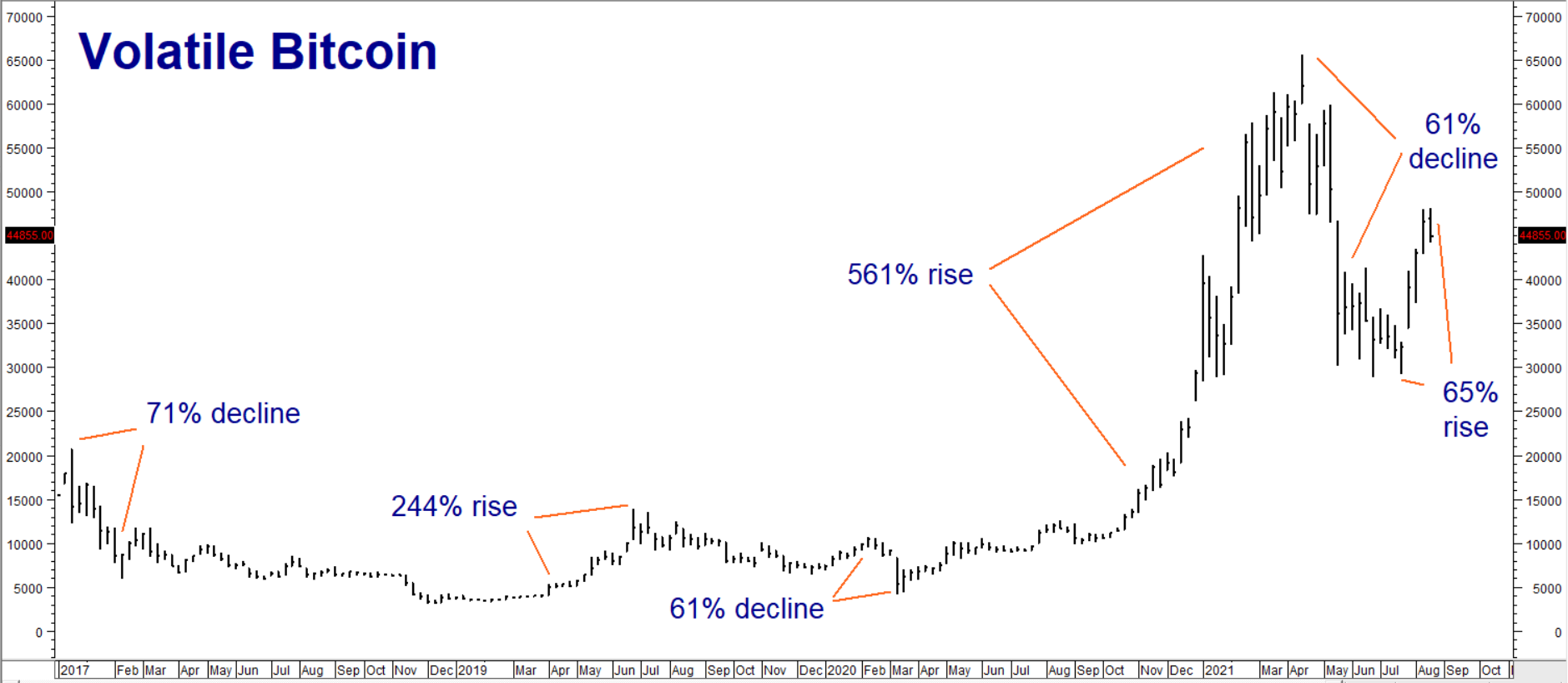

Active traders love volatility. The volatility that makes Bitcoin difficult to use as a currency also makes it potentially lucrative (or destructive). Bitcoin has soared $561%, declined 61% and rose 65% in just the past 12 months. (See chart below.) The small size of the CME’s micro contract enables traders to fine-tune the amount of speculative capital they put on the line at any time, making it easier to execute a flexible trading plan.

Data Source: Reuters/Datastream

Micro Bitcoin Futures are Transparent, Regulated

and Have Tax Advantages

CME Micro Bitcoin futures contacts begin trading at 6pm ET on Sunday and stop trading at 5pm ET on Friday with a daily 1-hour break extending from 5pm to 6pm each trading day. Prices are transparent and easily available. You can type “Micro Bitcoin Futures” into the Yahoo Finance quote box and get a quote.

Since they trade on a regulated futures exchange, MBT futures are considered section 1256 contracts. This means they have special tax provisions. All gains and losses are divided into 60% long-term and 40% short-term, no matter what the holding period. This 60% / 40% treatment can be a big advantage for active traders.

MBT futures are “marked to the market” which means gains or losses in any year are considered realized as of the final yearly close. Unlike stocks and cryptos traded on platforms like Robinhood or Coinbase, there is no need to keep detailed trading records. Our clearing firm (RJ O’Brien) will send RMB Group trading customers a 1099 form with everything needed to complete their taxes.

The minimum price fluctuation for MBT futures is $5 per bitcoin or 50 cents per contract. You do not need a digital wallet to trade Micro Bitcoin futures contracts, just a futures account. The current margin requirement to trade 1 MBT futures contract is $1,600. We recommend committing at least half the contract value to avoid getting into margin call trouble.

Why Now?

Bitcoin has been chock-full of big moves. We have been reluctant to track Bitcoin for three reasons: 1) Very few of our trading customers understood it; 2) Because of its volatile nature, our clearing firm had a high financial bar for customers who wanted to trade it, and 3) BTC options were, and still are, ridiculously expensive.

Bitcoin awareness and knowledge have expanded substantially. Lots of individual investors are now trading it on different platforms. The small size of MBT futures makes them more palatable for individual traders and an alternative to high-priced options. We’ll have more specific trading advice on MBT going forward.

Want to know more ? We wrote a report on Bitcoin in 2018 (updated in 2019) explaining it in simple terms. It’s a little dated, but the basics remain unchanged. Contact your RMB Group professional for our latest recommendations.

Please be advised that you need a futures account to trade the markets in this post. The RMB Group has been helping our clientele trade futures and options since 1991. RMB Group brokers are familiar with the option strategies described in this report. Call us toll-free at 800-345-7026 or 312-373-4970 (direct) for more information and/or to open a trading account. Or visit our website at www.rmbgroup.com. Want to know more about trading futures and options? Download our FREE Report, the RMB Group “Short Course in Futures and Options.”

* * * * * * * *

The RMB Group

222 South Riverside Plaza, Suite 1200, Chicago, IL 60606

This material has been prepared by a sales or trading employee or agent of R.J. O’Brien & Associates (“RJO”)/RMB Group and is, or is in the nature of, a solicitation. This material is not a research report prepared by a Research Department. By accepting this communication, you agree that you are an experienced user of the futures markets, capable of making independent trading decisions, and agree that you are not, and will not, rely solely on this communication in making trading decisions.

DISTRIBUTION IN SOME JURISDICTIONS MAY BE PROHIBITED OR RESTRICTED BY LAW. PERSONS IN POSSESSION OF THIS COMMUNICATION INDIRECTLY SHOULD INFORM THEMSELVES ABOUT AND OBSERVE ANY SUCH PROHIBITION OR RESTRICTIONS. TO THE EXTENT THAT YOU HAVE RECEIVED THIS COMMUNICATION INDIRECTLY AND SOLICITATIONS ARE PROHIBITED IN YOUR JURISDICTION WITHOUT REGISTRATION, THE MARKET COMMENTARY IN THIS COMMUNICATION SHOULD NOT BE CONSIDERED A SOLICITATION.

The risk of loss in trading futures and/or options is substantial and each investor and/or trader must consider whether this is a suitable investment. Past performance, whether actual or indicated by simulated historical tests of strategies, is not indicative of future results. Trading advice is based on information taken from trades and statistical services and other sources that RJO/RMB believes are reliable. We do not guarantee that such information is accurate or complete and it should not be relied upon as such. Trading advice reflects our good faith judgment at a specific time and is subject to change without notice. There is no guarantee that the advice we give will result in profitable trades.