OPEC and its big-producing ally, Russia, have masterfully managed the price of crude oil throughout the entire Covid crisis. Coordinated supply cuts fueled an incredible 1,084% gain in front-month WTI crude oil futures, which soared from a $6.50 per barrel low in April, 2020 to a July 2021 high of $76.98. We believe this rally, as incredible as it may have been, may be in the process of reversing.

OPEC supply cuts were born of necessity. The virus shut down the global economy and caused oil demand to collapse. Price followed. OPEC’s and other big producers like Russia joined forces. Their supply reductions stopped prices from collapsing and ignited of the biggest bull moves in crude oil that we’ve ever seen.

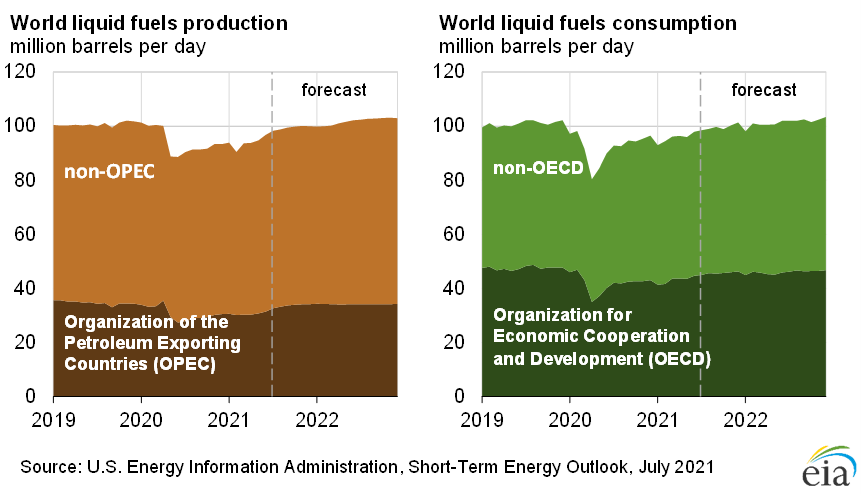

The introduction of effective vaccines at the beginning of this year released pent up demand for travel and fueled a big increase in economic activity. The US Energy Information Administration (EIA) is forecasting demand for crude oil to reach and perhaps slightly exceed 2019 levels as soon as next year. The harmony that defined OPEC during the height of the Covid crisis could be in jeopardy now that cooperation and big supply cuts are no longer necessary.

OPEC’s recent July meeting was more contentious than others in the Covid timeline. Producers jockeyed with each other, attempting to cash in on today’s high prices by increasing production. OPEC ended their July meeting with the goal of ending all production cuts by September 2022, gradually increasing output by 400,000 barrels per day on a monthly basis, starting with this month.

OPEC supply cuts powered the current bull market. Their July decision to reverse these cuts could end it.

Oil Demand Expected to Return to “Normal” in 2022

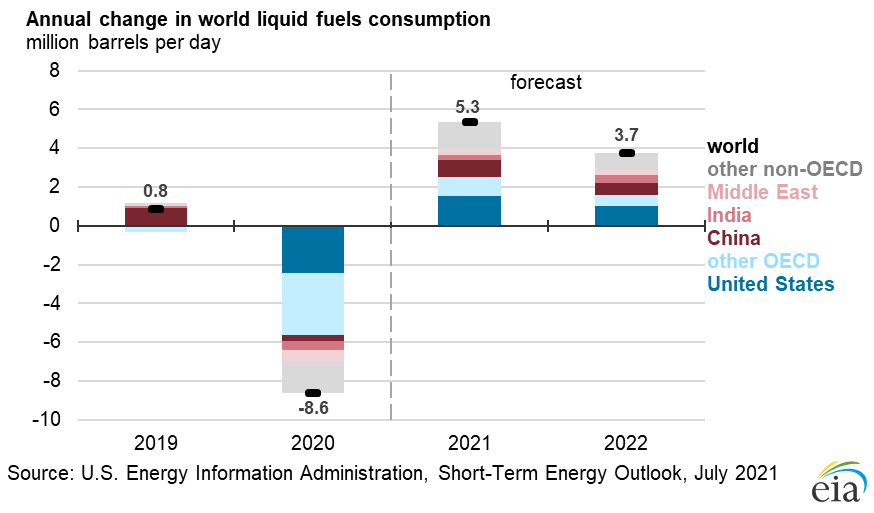

The EIA expects oil consumption to return to pre-Covid levels in 2022, virtually eliminating the 2020 drop and adding an additional 400,000 barrels per day to the total. Add the 5.3 million barrels per day (MBD) increase forecast for 2021 to the 3.7 MBD forecast for 2022 and you get 9.0 MBD or 400,000 barrels per day more than the 8.6 MBD drop in 2020. This is short of the 800,000 barrels per day increase in 2019 by 400,000 bpd, but it is close enough to call it even.

Perhaps more intriguing than the raw numbers is where the increase in consumption is forecast to come from. As the chart above illustrates, nearly all of the 2019 increase came from China while the bulk of the forecasted 2021 and 2022 increases are expected to come from non-OECD countries. One wonders whether these increases will actually occur given especially virulent Delta strain and its potential damping effect of the economies of the under-vaccinated, developing world.

Pre-Covid Crude as a Guide to Post-Vaccine Prices

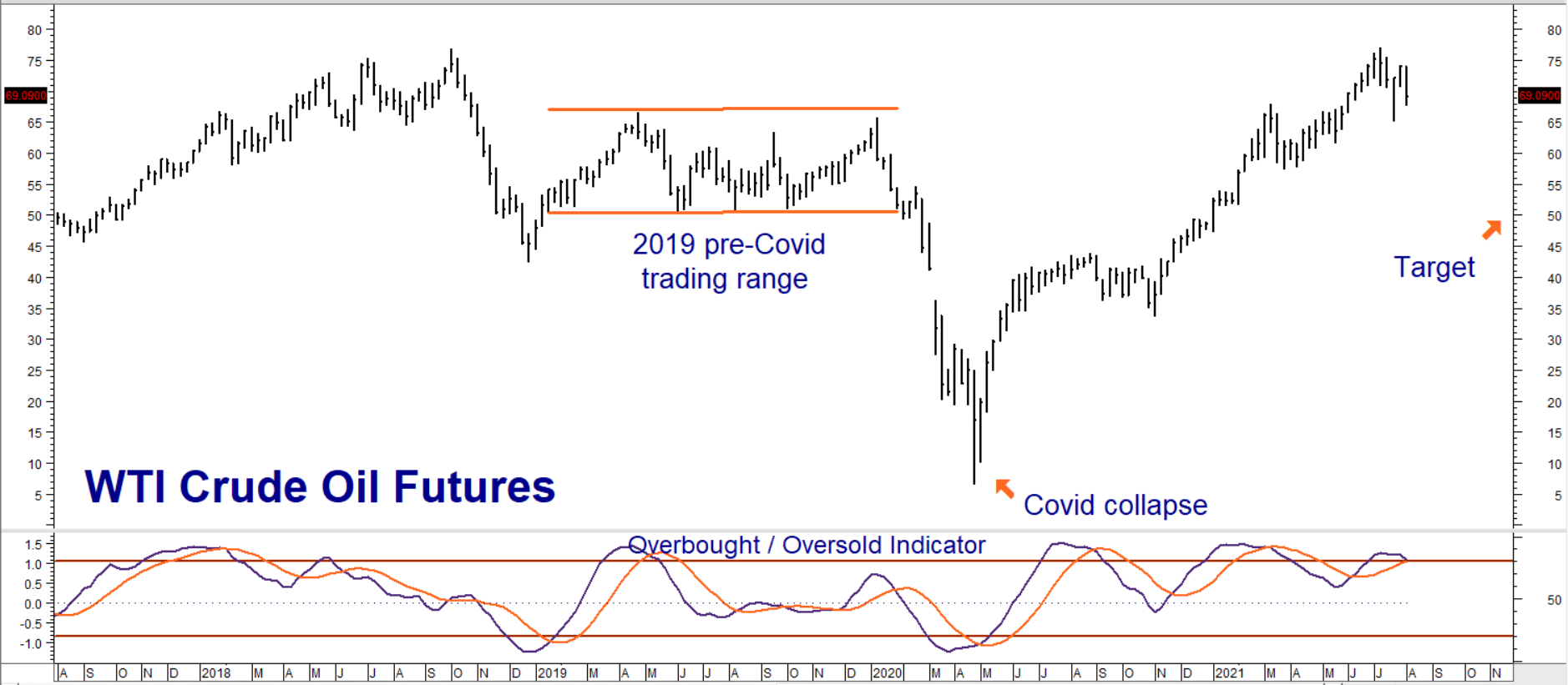

But let’s assume the EIA forecasts are correct and crude oil supply and demand returns “normal,” pre-Covid 2019 levels by 2022. To get an idea of what the crude market could look like minus the heavy OPEC intervention that defined 2020 and the first half of 2021, one could take a look at what prices did in 2019.

Data Source: Reuters/Datastream

They didn’t do much, as the chart above illustrates. WTI crude oil futures spent all of 2019 trapped in a trading range that oscillated between resistance at $65 per barrel and support at $50 per barrel. Consequently, we would not be surprised to see $50 support tested again now that OPEC is in the process of reversing its cuts in the post-vaccine era.

Use WTI Crude Options to Create Fixed Risk Short Position

RMB group trading customers may want to consider buying December 2021 $55.00 crude oil put options while simultaneously selling an equal number of December 2021 $50.00 crude oil put options, looking for the December 2020 futures contract to fall to our target of $50 per barrel prior to December option expiration on November 16, 2021. Crude oil is currently overbought and vulnerable to corrective declines.

This “bear put spread” settled for a price of $560 on Thursday. Your maximum risk is the net price you pay for your spread(s) plus transaction costs. This trade has the potential to be worth as much as $5,000. Exit all positions if and when our $50 per barrel downside price target is hit Prices can and will change. Contact your RMB Group trading professional for the latest.

Please be advised that you need a futures account to trade the markets in this post. The RMB Group has been helping our clientele trade futures and options since 1991. RMB Group brokers are familiar with the option strategies described in this report. Call us toll-free at 800-345-7026 or 312-373-4970 (direct) for more information and/or to open a trading account. Or visit our website at www.rmbgroup.com. Want to know more about trading futures and options? Download our FREE Report, the RMB Group “Short Course in Futures and Options.”

* * * * * * * *

The RMB Group

222 South Riverside Plaza, Suite 1200, Chicago, IL 60606

This material has been prepared by a sales or trading employee or agent of R.J. O’Brien & Associates (“RJO”)/RMB Group and is, or is in the nature of, a solicitation. This material is not a research report prepared by a Research Department. By accepting this communication, you agree that you are an experienced user of the futures markets, capable of making independent trading decisions, and agree that you are not, and will not, rely solely on this communication in making trading decisions.

DISTRIBUTION IN SOME JURISDICTIONS MAY BE PROHIBITED OR RESTRICTED BY LAW. PERSONS IN POSSESSION OF THIS COMMUNICATION INDIRECTLY SHOULD INFORM THEMSELVES ABOUT AND OBSERVE ANY SUCH PROHIBITION OR RESTRICTIONS. TO THE EXTENT THAT YOU HAVE RECEIVED THIS COMMUNICATION INDIRECTLY AND SOLICITATIONS ARE PROHIBITED IN YOUR JURISDICTION WITHOUT REGISTRATION, THE MARKET COMMENTARY IN THIS COMMUNICATION SHOULD NOT BE CONSIDERED A SOLICITATION.

The risk of loss in trading futures and/or options is substantial and each investor and/or trader must consider whether this is a suitable investment. Past performance, whether actual or indicated by simulated historical tests of strategies, is not indicative of future results. Trading advice is based on information taken from trades and statistical services and other sources that RJO/RMB believes are reliable. We do not guarantee that such information is accurate or complete and it should not be relied upon as such. Trading advice reflects our good faith judgment at a specific time and is subject to change without notice. There is no guarantee that the advice we give will result in profitable trades.