Speed defines modern markets. Changes in sentiment manifest themselves instantly and get discounted by price movements almost as fast. 10-year Treasury Notes yielded 1.73% three months ago, confident that the trillions being pumped into the economy by the US Government and the Fed would result in sustained inflation. Today they pay just 1.36%, or 21% less. This could have big ramifications for the value of the dollar.

Three notable things contributed to last quarter’s big drop in bond yields. The first is the lack of progress on new Fiscal stimulus. The odds of a $6 trillion infrastructure bill making its way through Congress have diminished substantially, tempering inflation expectations. The second is the Delta variant of Covid which could slow economic recovery. The third (and one we want to focus on) is the relative value of US Treasury debt versus that of other sovereign nations.

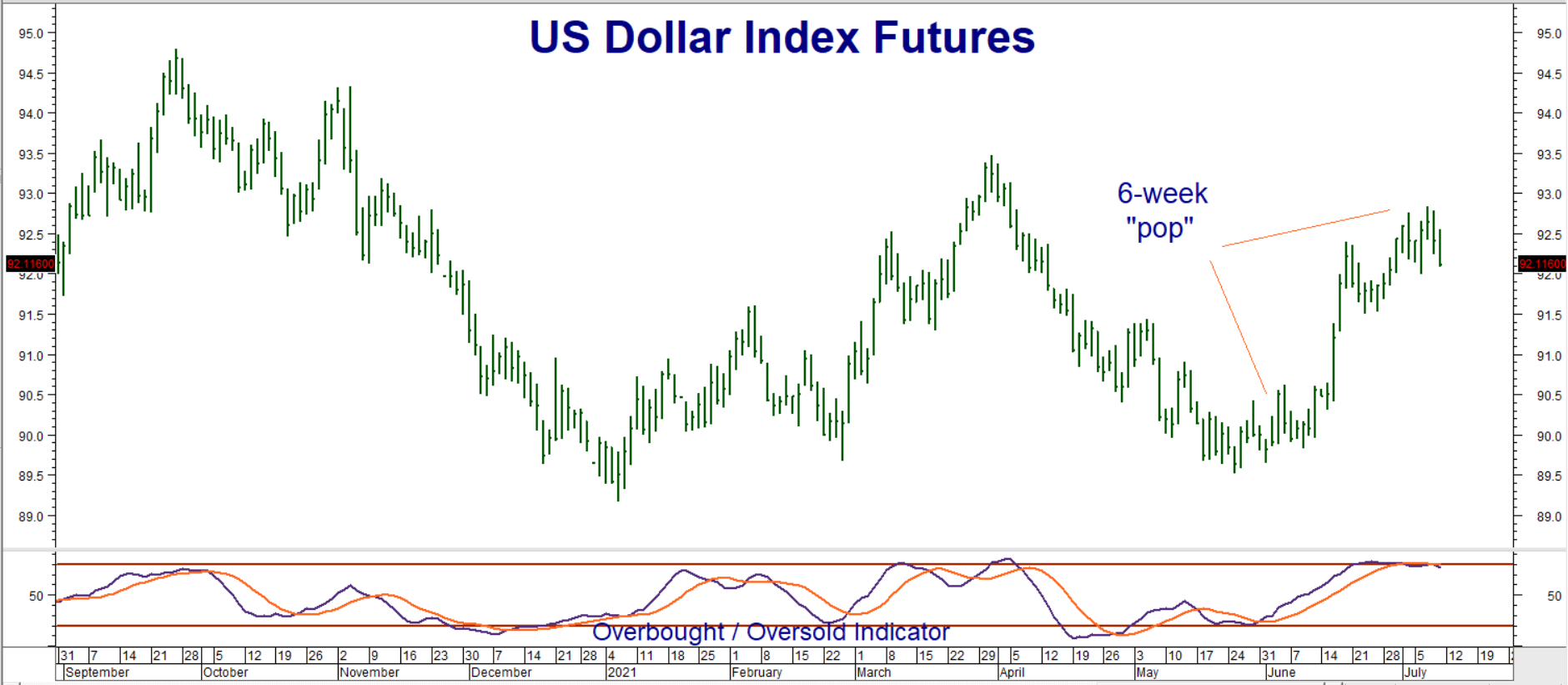

The treasury debt of most other industrialized nations yields far less than the US. At 1.73%, US 10-year yields were so much higher than those of Europe or Japan that it made sense to borrow money in those currencies while paying virtually nothing to do so, convert it into US dollars and invest it in US T-bonds and Notes. The demand for dollars to make this trade is one of the reasons behind the greenback’s 6-week recovery.

Data Source: Reuters/Datastream

Foreign buyers are some of the biggest purchasers of US T-bonds and notes. We expect overseas’ interest to subside as the spread between US and European bonds continues to narrow, making the euro “carry trade” less profitable. We also believe more stimulus is coming despite the current hang-ups in Washington. Most of Congress will be running again in 2022 and want to be seen as “doing something.” We are not sure how much will be forthcoming, but expect it to be in the trillions.

The Delta variant will continue to be a concern, but the election calendar argues against a return of the lockdowns of 2020. Voters simply won’t stand for it. The Fed will continue to pump and print. Congress will continue to spend. Inflation will stay around for a while. The dollar’s status as the world’s most important reserve currency may protect it from many of these excesses, but even it has a breaking point.

Euro Calls Are a Proxy for a Short Dollar Play

We are not calling for an all-out collapse in the dollar, but we do expect it to retest the lows it made to start the year. Dollar Index Options are illiquid, making it hard to establish a bearish position without taking on the risk of shorting the futures. The Euro makes up the largest portion of the Dollar Index and moves opposite the greenback. Euro options are generally much more liquid than Dollar Index options.

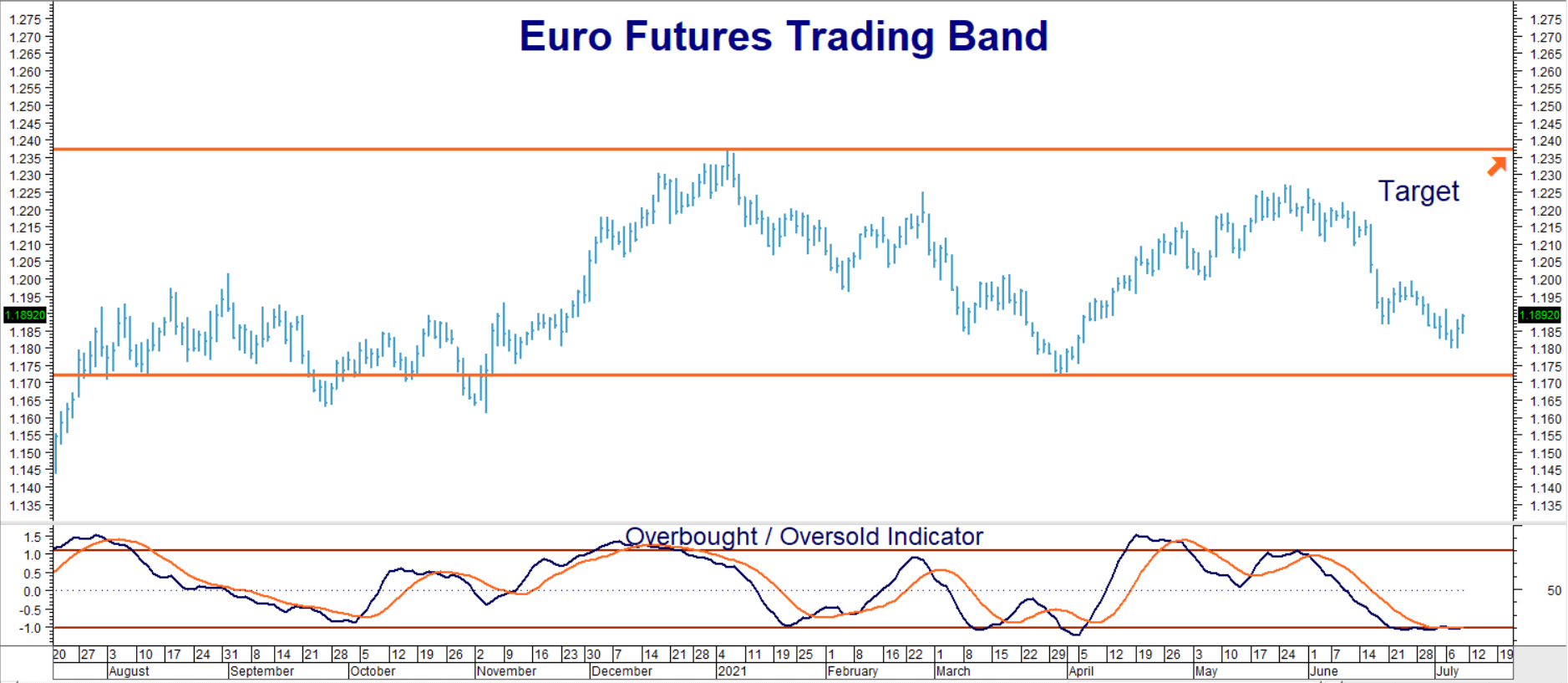

Data Source: Reuters/Datastream

A weaker dollar almost always corresponds with a stronger Euro, making the Euro chart above the opposite of the dollar chart. Our target is a retest of the highs made at the start of this year. We expect Europe to be one of the biggest beneficiaries of the surging recovery in the US as the former emerges from Covid. We expect Europe’s lagged response to give the Euro an extra boost over other major currencies.

RMB Group trading customers may want to consider buying December 2021 $1.205 Euro calls while simultaneously selling an equal number of December 2021 $1.235 Euro calls for a net cost of $800 or less. Look for the Euro to hit our upside target of $1.2350 prior to option expiration on December 3, 2021. Your maximum risk is the net cost of this “bull call spread” plus transaction costs.

This spread has the potential to worth as much as $3,750. Exit if and when our $1.2350 target it hit. Prices can and will change so contact your RMB Group professional for the latest.

Please be advised that you need a futures account to trade the markets in this post. The RMB Group has been helping our clientele trade futures and options since 1991. RMB Group brokers are familiar with the option strategies described in this report. Call us toll-free at 800-345-7026 or 312-373-4970 (direct) for more information and/or to open a trading account. Or visit our website at www.rmbgroup.com. Want to know more about trading futures and options? Download our FREE Report, the RMB Group “Short Course in Futures and Options.”

* * * * * * * *

The RMB Group

222 South Riverside Plaza, Suite 1200, Chicago, IL 60606

This material has been prepared by a sales or trading employee or agent of R.J. O’Brien & Associates (“RJO”)/RMB Group and is, or is in the nature of, a solicitation. This material is not a research report prepared by a Research Department. By accepting this communication, you agree that you are an experienced user of the futures markets, capable of making independent trading decisions, and agree that you are not, and will not, rely solely on this communication in making trading decisions.

DISTRIBUTION IN SOME JURISDICTIONS MAY BE PROHIBITED OR RESTRICTED BY LAW. PERSONS IN POSSESSION OF THIS COMMUNICATION INDIRECTLY SHOULD INFORM THEMSELVES ABOUT AND OBSERVE ANY SUCH PROHIBITION OR RESTRICTIONS. TO THE EXTENT THAT YOU HAVE RECEIVED THIS COMMUNICATION INDIRECTLY AND SOLICITATIONS ARE PROHIBITED IN YOUR JURISDICTION WITHOUT REGISTRATION, THE MARKET COMMENTARY IN THIS COMMUNICATION SHOULD NOT BE CONSIDERED A SOLICITATION.

The risk of loss in trading futures and/or options is substantial and each investor and/or trader must consider whether this is a suitable investment. Past performance, whether actual or indicated by simulated historical tests of strategies, is not indicative of future results. Trading advice is based on information taken from trades and statistical services and other sources that RJO/RMB believes are reliable. We do not guarantee that such information is accurate or complete and it should not be relied upon as such. Trading advice reflects our good faith judgment at a specific time and is subject to change without notice. There is no guarantee that the advice we give will result in profitable trades.