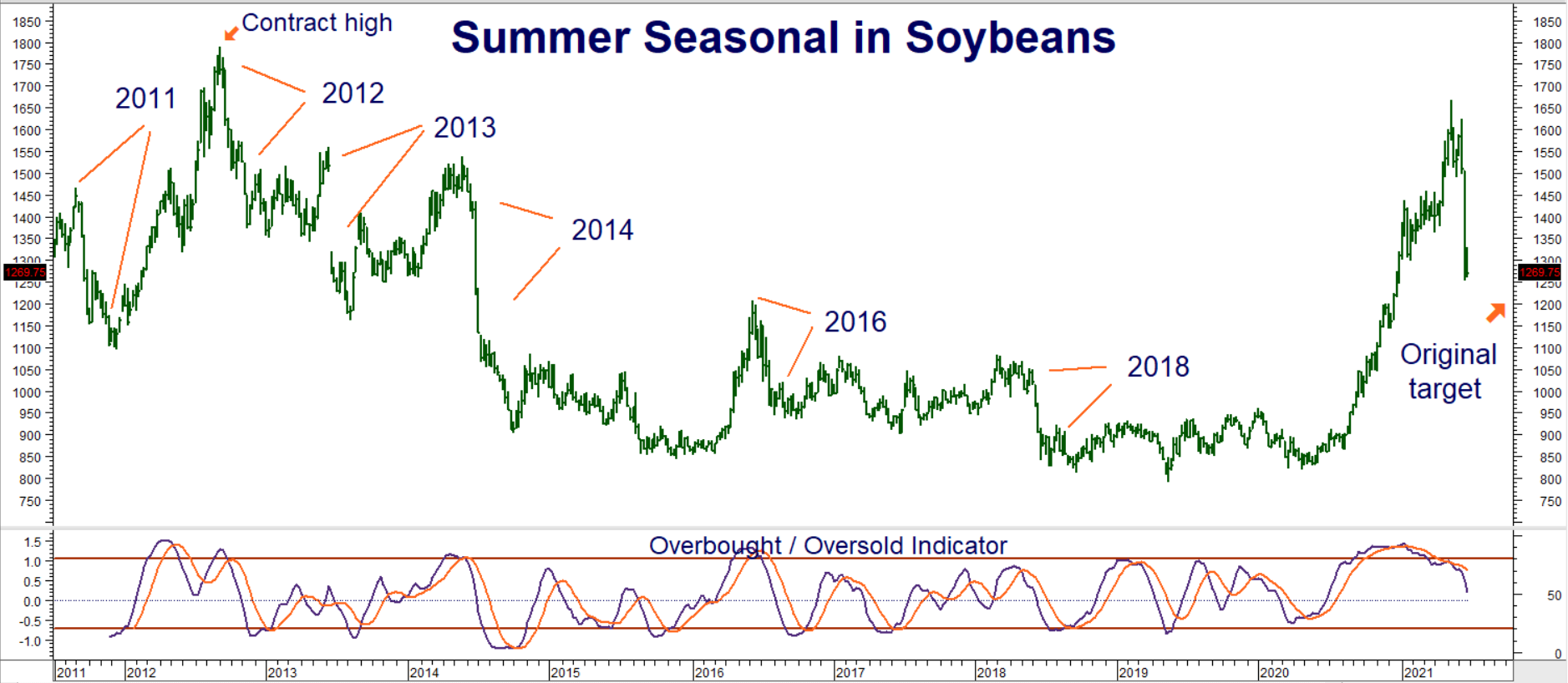

Much needed moisture across portions of the American grain belt weighed on soybean futures last week. Prices plummeted, bashing soybean bulls in the process. Front month futures finished the week 23.8% lower than the $16.675 per bushel highs they set in mid-May, fulfilling our prediction our prediction of a classic summer correction. Will prices fall even further? Only Mother Nature knows for sure.

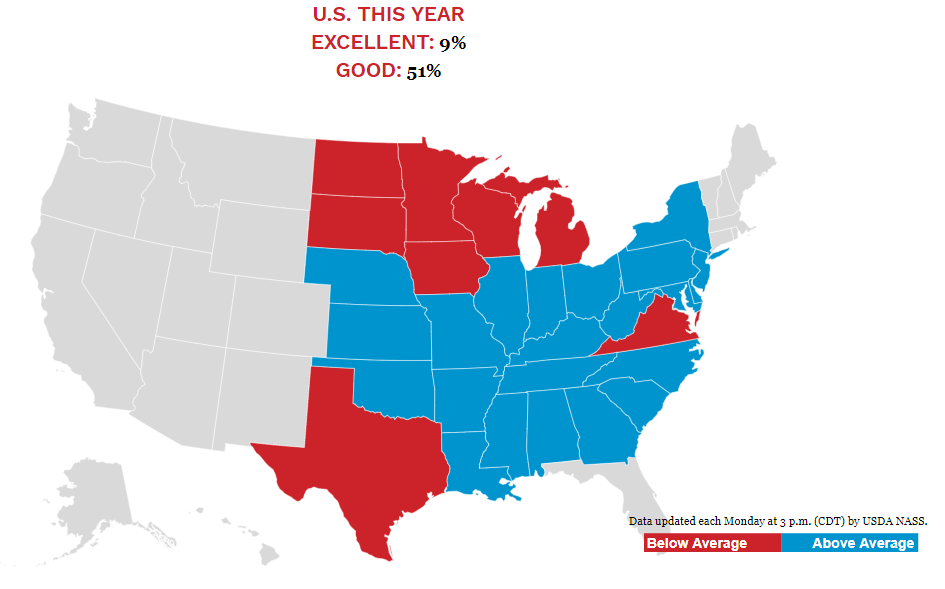

Last week’s rain was helpful, but the American soybean crop is still far from being “made.” As the map of last Monday’s crop conditions (below) illustrates, crop condition depends on location. Parts of the North American growing region are not doing well at all and could continue to suffer unless the rain that fell on LaSalle Street in Chicago extends over a larger area. A new map is due out today.

Source: Successful Farming

The volatility that has been so beneficial to our bear spreads could become equally as detrimental should more red appear on today’s updated crop conditions map. Prices settled above our original $12.00 per bushel downside objective on Friday, but we are inclined to recommend closing out the September $13.00 / $12.00 bear put spreads we suggested purchasing for $700.00 or less in late May anyway. These spreads settled for $2,462.50 on Friday.

Data Source: Reuters/Datastream

Two Exit Options

RMB Group trading customers who followed our suggestion to purchase September bear spreads may want to consider one of two choices: 1) place an order to exit half of your remaining positions at twice your initial entry level or higher, then exit the other half if our original $12.00 per bushel target is hit or 2) exit all remaining positions immediately.

A fill on option 1 will enable you take your initial off the table and perhaps lock in some gains depending on your fill price. Consider option 1 should beans open higher on Monday. Consider option 2 if soybeans open lower on Monday. Strong export sales combined with drier-than-normal conditions could change sentiment in a hurry. Rising volatility has the potential to slow the pace of gain in our bear spread so we are comfortable exiting here..

Prices can and will change. Contact your RMB Group broker for the latest.

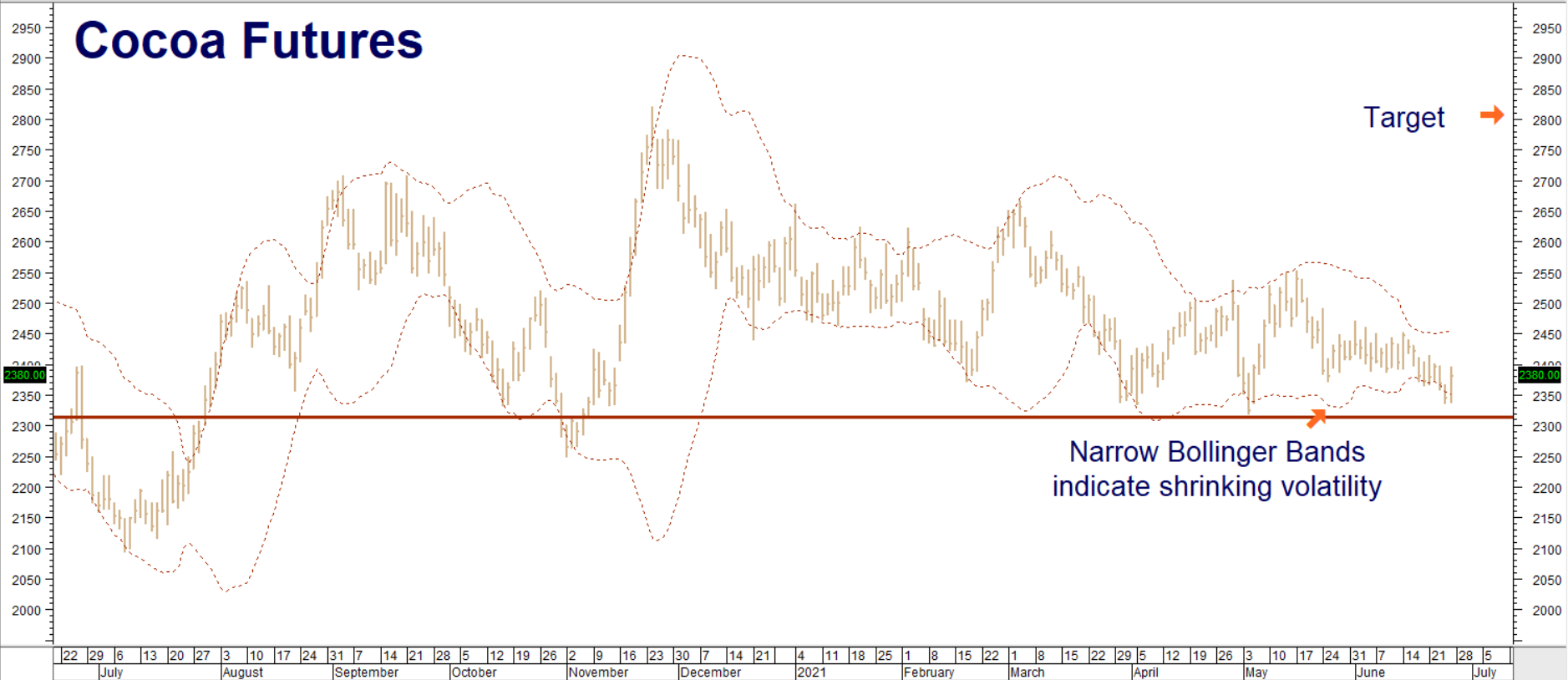

Cocoa Setting Up for a Run to the Top of Its Trading Range

Cocoa is one of the only commodity markets not participating in the inflation trade. Four months of listless, sideways price action have stripped much of the volatility out of this market, making its options relatively inexpensive – especially when compared the “through-the-roof” valuations of other commodities tied more firmly to the inflation trade.

The return of inflation following the 2008 / 2009 financial crisis corresponded with new contact highs in cocoa. Burdensome supplies are weighing on price now but we would not be surprised to see some bargain hunting from inflation trade participants before the end of the year. New contract highs are probably not in the cards but another run to the top of cocoa’s multi-month trading range may be.

Data Source: Reuters/Datastream

Friday’s price action was encouraging. Cocoa tested long-term support just above $2,300 per ton and then bounced smartly, finishing the session $35 higher. We believe the next stop will be a run to the top of the current trading range. Our target is $2,800 per ton.

RMB Group trading customers may want to consider buying December 2021 $2,500 cocoa calls while simultaneously selling an equal number of December 2021 $2,800 cocoa calls for a net cost of $600 or less, looking for the chocolatey stuff to test the top of its trading range prior to option expiration on November 5, 2021. Your maximum risk is the net cost of your “bull call spread” plus transaction costs. This trade has the potential to be worth as much as $3,000.

Please be advised that you need a futures account to trade the markets in this post. The RMB Group has been helping our clientele trade futures and options since 1991. RMB Group brokers are familiar with the option strategies described in this report. Call us toll-free at 800-345-7026 or 312-373-4970 (direct) for more information and/or to open a trading account. Or visit our website at www.rmbgroup.com. Want to know more about trading futures and options? Download our FREE Report, the RMB Group “Short Course in Futures and Options.”

* * * * * * * *

The RMB Group

222 South Riverside Plaza, Suite 1200, Chicago, IL 60606

This material has been prepared by a sales or trading employee or agent of R.J. O’Brien & Associates (“RJO”)/RMB Group and is, or is in the nature of, a solicitation. This material is not a research report prepared by a Research Department. By accepting this communication, you agree that you are an experienced user of the futures markets, capable of making independent trading decisions, and agree that you are not, and will not, rely solely on this communication in making trading decisions.

DISTRIBUTION IN SOME JURISDICTIONS MAY BE PROHIBITED OR RESTRICTED BY LAW. PERSONS IN POSSESSION OF THIS COMMUNICATION INDIRECTLY SHOULD INFORM THEMSELVES ABOUT AND OBSERVE ANY SUCH PROHIBITION OR RESTRICTIONS. TO THE EXTENT THAT YOU HAVE RECEIVED THIS COMMUNICATION INDIRECTLY AND SOLICITATIONS ARE PROHIBITED IN YOUR JURISDICTION WITHOUT REGISTRATION, THE MARKET COMMENTARY IN THIS COMMUNICATION SHOULD NOT BE CONSIDERED A SOLICITATION.

The risk of loss in trading futures and/or options is substantial and each investor and/or trader must consider whether this is a suitable investment. Past performance, whether actual or indicated by simulated historical tests of strategies, is not indicative of future results. Trading advice is based on information taken from trades and statistical services and other sources that RJO/RMB believes are reliable. We do not guarantee that such information is accurate or complete and it should not be relied upon as such. Trading advice reflects our good faith judgment at a specific time and is subject to change without notice. There is no guarantee that the advice we give will result in profitable trades.