Summer is right around the corner, and with it a “make-or-break” time for corn and soybeans. Prices tend to rise in spring planting season as traders and end users attempt to account for variables like weather. Prices fall as summer planting progresses and traders become more confident that sufficient supplies will be produced. This summer’s North American crop is critical.

Exploding global demand – particularly from China as it rebuilds its virus-decimated pig crop — and supply constraints from a South American harvest decimated by extremely dry weather are causing prices to soar. Corn and soybeans rallied within striking distance of their 2012 all-time contract highs before backing off last week. North American supplies will be needed to deal with what has become very real and potentially-dangerous shortages.

Planting Intentions Report Powers April Rallies

The USDA’s March planting intentions showed a small increase in soybean acres and virtually no increase in corn acres. This caused prices of both commodities to take off in April. Front contract “old crop” soybeans were trading at $13.64 per bushel prior to the March report. Soybeans traded as high as $16.67 per bushel ten days ago – an increase of $22.2% in just one month.

Front contract corn prices rose even more on a percentage basis. They rallied from a low of $5.33 per bushel prior to the release of the report to an intra-day high of $7.35 two weeks ago – a gain of 38%. Historically-high prices like this should incentivize farmers to plant “fencepost to fencepost”, using every acre of available land. Will the smoking hot rallies in both markets be enough to increase planted acres and reduce demand? That’s the billion-dollar question.

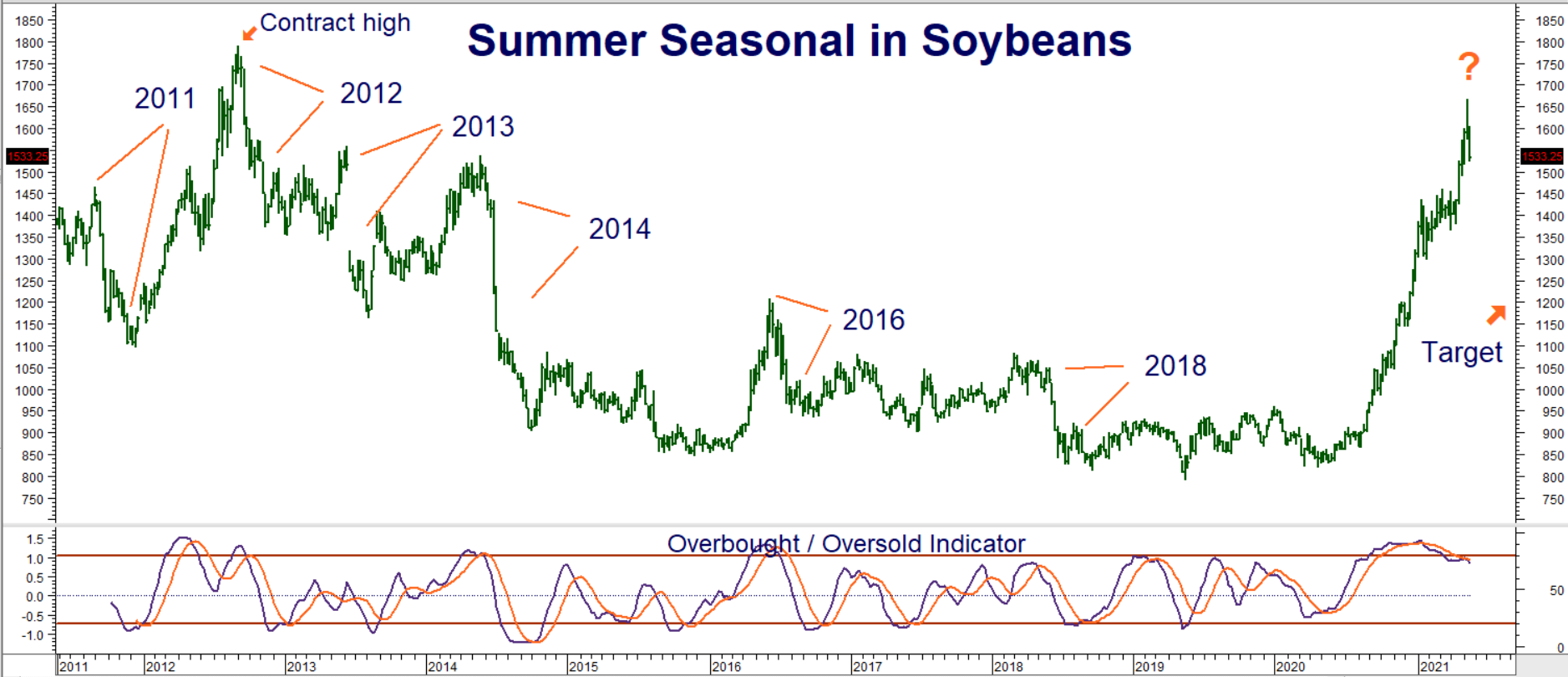

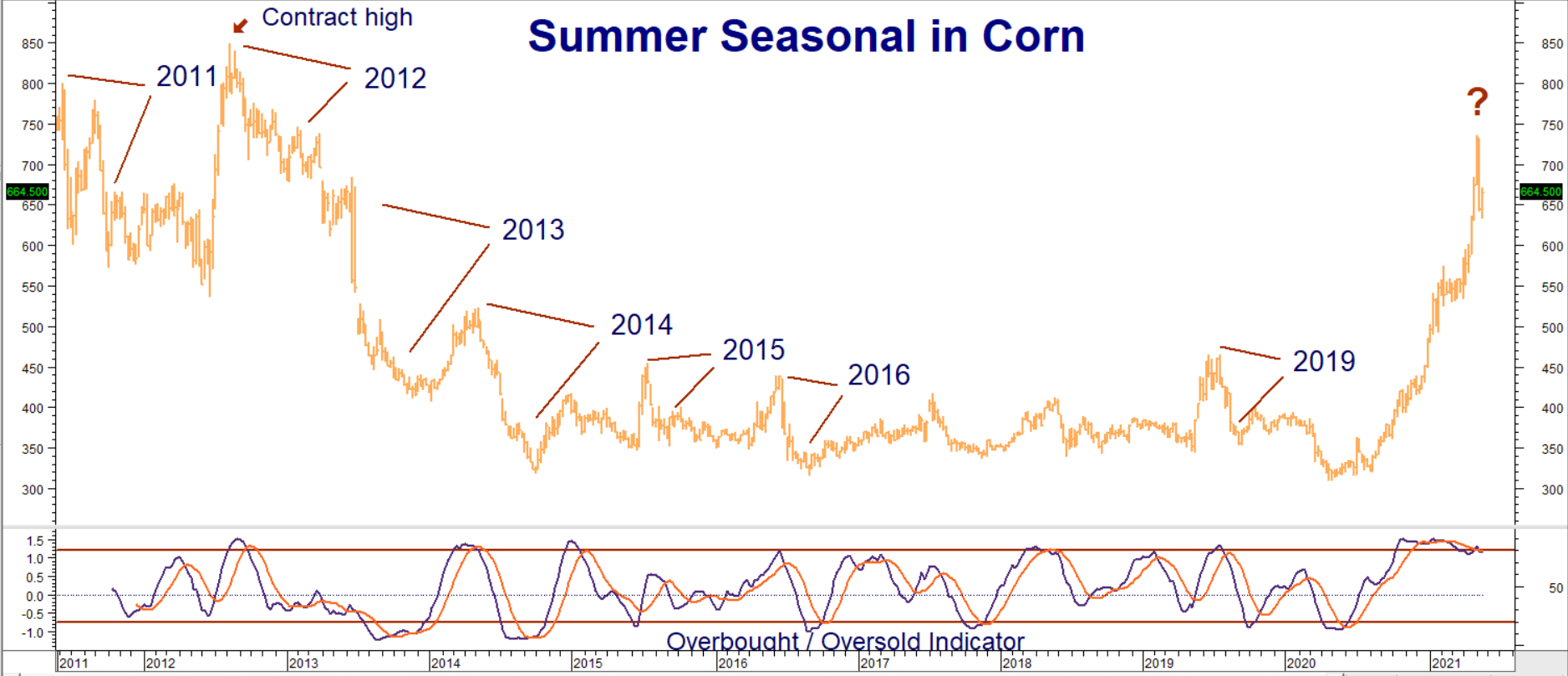

The two charts below illustrate the seasonal tendency of soybeans and corn to decline in summer and early fall over the past 10 ½ years. While this doesn’t happen every year – there was virtually no decline in 2020 – we believe current price levels, combined with an extremely overbought market, make soybeans and corn especially vulnerable to these types of seasonal declines this year. Barring adverse North American weather, we expect significant downside corrections in soybeans and corn before Labor Day.

Data Source: Reuters/Datastream

Data Source: Reuters/Datastream

Potential Downside Pressure from Farmer “Marketing”

High prices can affect farmer “marketing” which involves hedging/pre-selling of expected production in the futures or forward markets. Favorable prices can incentivize producers to sell forward their expected harvest in order to lock in profits early in the growing session. Declines are reinforced or reversed later in the summer growing season as farmers get a better idea of how many bushels they are going to produce, and either close out or add to their hedges.

Corn and soybean prices have risen in almost a straight line. It’s human nature to hold out for more. We believe this is happening now. Home sellers are doing the same thing in the hot housing market. In both cases, prices will eventually rise high enough to squelch demand and lead to a reversal. It’s too early to know whether the market has reached that level, but we suspect we are getting close in both corn and soybeans.

Farmers who haven’t locked in gains yet, may rush to do so once they believe the current rally has run its course. This could add to the speed of any correction – and cause prices to fall further.

Soy Options: A Reasonable Way to Play Summer Correction

September at-the-money put options in corn are indicating an implied volatility north of 40%. In our opinion, this is too rich for a reasonable fixed-risk short position. The situation is better for soybeans. September at-the-money put options indicate a high, but far more reasonable, valuation with an implied volatility of 20.4%.

RMB Group trading customers may want to consider using September soybean puts to create a fixed-risk short position. Consider buying September 2021 $13.00 puts while simultaneously selling an equal number of September 2021 $12.00 puts for a net cost of $700 or less. Look for September soybean futures to hit our downside target of $12.00 per bushel prior to option expiration on August 27th.

Your maximum risk is the amount you paid for your spread(s) plus transaction cost. This trade has the potential to be worth as much as $5,000. Prices can and will change, so contact your RMB Group trading professional for the latest.

Please be advised that you need a futures account to trade the markets in this post. The RMB Group has been helping our clientele trade futures and options since 1991. RMB Group brokers are familiar with the option strategies described in this report. Call us toll-free at 800-345-7026 or 312-373-4970 (direct) for more information and/or to open a trading account. Or visit our website at www.rmbgroup.com. Want to know more about trading futures and options? Download our FREE Report, the RMB Group “Short Course in Futures and Options.”

* * * * * * * *

The RMB Group

222 South Riverside Plaza, Suite 1200, Chicago, IL 60606

This material has been prepared by a sales or trading employee or agent of R.J. O’Brien & Associates (“RJO”)/RMB Group and is, or is in the nature of, a solicitation. This material is not a research report prepared by a Research Department. By accepting this communication, you agree that you are an experienced user of the futures markets, capable of making independent trading decisions, and agree that you are not, and will not, rely solely on this communication in making trading decisions.

DISTRIBUTION IN SOME JURISDICTIONS MAY BE PROHIBITED OR RESTRICTED BY LAW. PERSONS IN POSSESSION OF THIS COMMUNICATION INDIRECTLY SHOULD INFORM THEMSELVES ABOUT AND OBSERVE ANY SUCH PROHIBITION OR RESTRICTIONS. TO THE EXTENT THAT YOU HAVE RECEIVED THIS COMMUNICATION INDIRECTLY AND SOLICITATIONS ARE PROHIBITED IN YOUR JURISDICTION WITHOUT REGISTRATION, THE MARKET COMMENTARY IN THIS COMMUNICATION SHOULD NOT BE CONSIDERED A SOLICITATION.

The risk of loss in trading futures and/or options is substantial and each investor and/or trader must consider whether this is a suitable investment. Past performance, whether actual or indicated by simulated historical tests of strategies, is not indicative of future results. Trading advice is based on information taken from trades and statistical services and other sources that RJO/RMB believes are reliable. We do not guarantee that such information is accurate or complete and it should not be relied upon as such. Trading advice reflects our good faith judgment at a specific time and is subject to change without notice. There is no guarantee that the advice we give will result in profitable trades.