“Don’t fight the Fed,” has been a winning mantra since the Financial Crisis of 2008 / 2009. The Fed made stocks the only game in town when it lowered short-term interest rates to zero and forced investors into a “risk on,” TINA (there is no alternative) mindset. The stock market stumbled along the way, but Federal Reserve policy kept interest rates low enough to prevent real damage to the bull market. Then Covid hit and stocks collapsed, falling 36% in just 5 weeks.

The Fed responded the same way as during the 2008 / 2009 Financial Crisis. It slashed short-term interest rates to zero and promised to buy boatloads of bonds and mortgage-backed securities. The stock market responded immediately, making one new high after another, rewarding traders who “bought the dip.” E-mini S&P 500 futures made a new high on Thursday, December 16th, posting an incredible 21-month gain of 118% from March 2020 Covid lows. That move was short-lived.

The rapid spread of the uber-contagious Omicron variant is being blamed for the two-day sell-off that followed. (The S&P 500 was down 4% from its high as of Monday’s close.) We believe it has more to do with the Fed’s announcement to switch into tightening mode to combat inflation. Doing so will remove the “Fed Put” that has made buying the dip in stocks a no-brainer until now. Jerome Powell and Company just told us what they intend to do. It will not be friendly for stocks. We shouldn’t fight it.

“Anchoring” Can Drag Down Returns

Nothing the Fed announced at its meeting last week was bullish, but that didn’t stop stocks from making new highs the very next day. Bulls have become so accustomed to new highs that they salivate whenever the market sells off more than a couple percentage points. Bulls bought the decline leading up to the Fed meeting and continued buying the day after, despite the bearish result. We believe this is part of a psychological phenomenon known as “anchoring.” This occurs when people become anchored to a belief that things will always continue to be the way they have been, blinding them to change.

The Fed is heading into a tightening mode and telegraphed that change clearly. It is going to “taper” its bond and mortgage security purchases twice as fast as originally planned and start raising short-term interest rates shortly thereafter. Don’t be surprised by three (and possibly more) rate increases in 2022. That’s up from zero just a few months ago. The Fed told us that its foot is now off the accelerator and will soon be firmly on the brake. Yet investors keep buying the dip as if nothing has changed.

The Stock Market is Dangerously Expensive

Because Fed actions must be executed through the banking system, they affect financial assets more than the prices of goods and services. Double-digit inflation in the stock and bond markets has been with us a decade. Stocks are up an average of 16% annually over the past 10 years. This corresponds with one of the easiest periods in the Federal Reserve’s history. Like Fed policy, these returns are far from normal.

Bottom Line: Stocks were the biggest beneficiaries of the Fed’s easy money policy, so it makes sense to assume they could wind up among the largest victims of its opposite.

Artificially-low interest rates drove real yields in debt securities like bonds, notes and CDs into negative territory a long time ago. If inflation is at the Fed’s target of 2% and your CD is only yielding .5%, you are losing 1.5% in purchasing power. Negative yields in supposedly safe investments are what forced investors into stocks and powered the TINA trade.

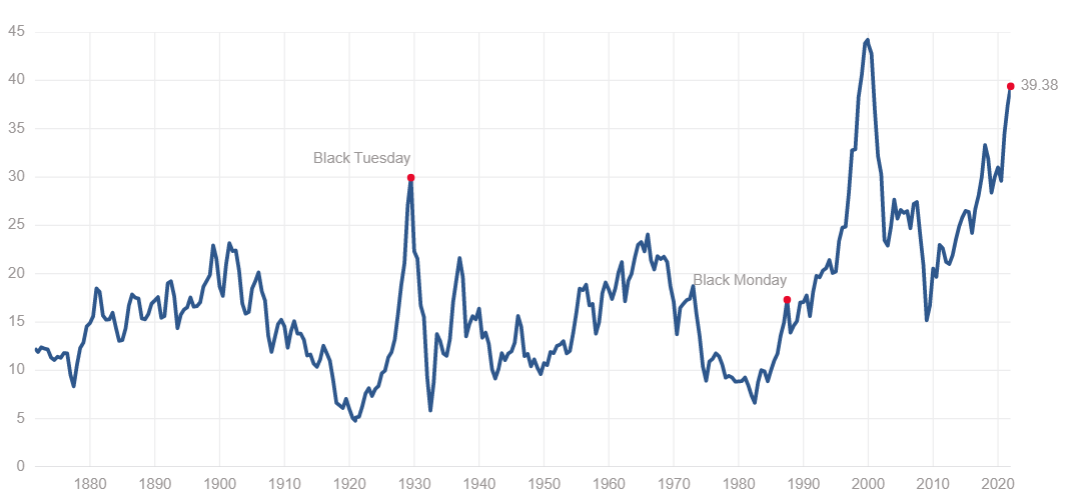

But at 6.8%, inflation is now much higher than the Fed target. It is higher than at any time since 1990, making the real yield of the S&P 500 negative. At -3%, it is at its lowest since 1947. The last time the S&P had a real yield approaching these levels was in 2000 when the Shiller PE ratio (see chart below) topped 40 right before the dot.com crash.

Source: multpl.com

A negative yield is not the only reason to be cautious here. Stocks are expensive by nearly every measure. Currently 39.38, the Shiller PE is within striking distance of all-time highs.

Other Signs of a Top

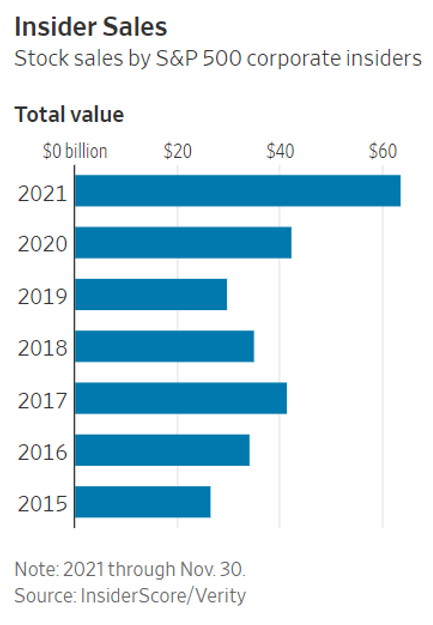

Just five stocks are responsible for 51% of the S&P 500’s return since April and 33% of its gains for this calendar year. Overall stock market returns would be much lower without Alphabet, Apple, Microsoft, Nvidia and Tesla. Bull markets this narrow tend to be fragile and susceptible to big reversals, especially when big corporate insiders like Tesla’s Elon Musk are selling.

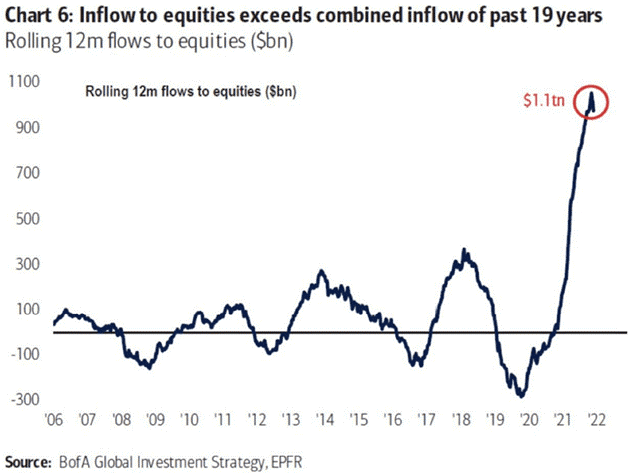

Commission-free trading, trillions in stimulus money, TINA (there is no alternative) and FOMO (fear of missing out) incentivized investors to pour over a trillion dollars into stocks since the Fed implemented its cheap-money Covid crisis policy in March of 2020. Commissions will most likely remain free (at least to the untrained eye). However, more stimulus cash will likely not be forthcoming, especially after Joe Manchin’s “no” vote on Build Back Better. TINA and FOMO probably won’t last long once the Fed pulls the punch bowl away.

Much of the new money chasing stocks is from new investors who’ve never experienced a serious correction, never mind a roaring bear market. Expect the bulk of this cash to head for the door the first time the way-too-popular “buy the dip” strategy fails. Corporate profits are also a source of fuel for bull markets. These have held up well until now, but like dividend yields, are also beginning to fall behind inflation.

It’s Time to Purchase Some “Crash Insurance”

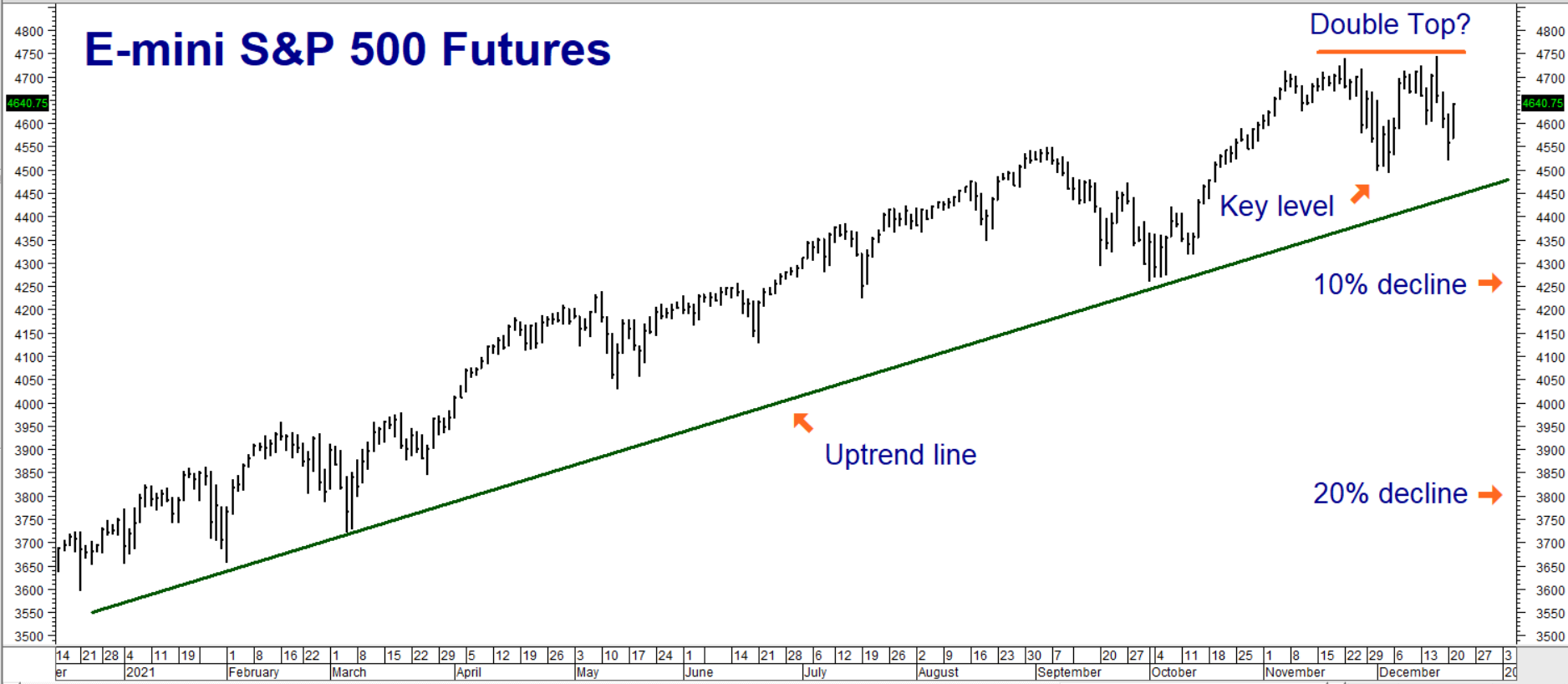

Are we calling a top? Not necessarily. But we won’t be surprised to see a significant correction soon. The dip buyers came back in droves yesterday – so anchoring behavior is still with us. The chart below illustrates a potential “double top” at 4750 in the E-mini, S&P 500 futures. Let’s use a continuation of this bounce as an opportunity to purchase some low cost, high deductible crash insurance. Our downside target is 3800.00 in the front month futures contract – a 20% correction from last Thursday’s high.

Data Source: Reuters/Datastream

RMB Group trading customers may want to consider buying March CME 4100 E-mini, S&P 500 puts and simultaneously selling an equal number of March CME 3800 E-mini, S&P 500 puts for a net cost of $950 of less. Our maximum risk on this trade is the price we pay plus transaction costs. Our “bear put spreads” have the potential to be worth as much as $15,000 each should the E-mini futures correct to 3800 prior to option expiration on March 18, 2022. A series of closes below the established uptrend line may be all that’s needed. Prices can and will change, so contact your RMB Group trading professional for the latest.

Please be advised that you need a futures account to trade the markets in this post. The RMB Group has been helping our clientele trade futures and options since 1991. RMB Group brokers are familiar with the option strategies described in this report. Call us toll-free at 800-345-7026 or 312-373-4970 (direct) for more information and/or to open a trading account. Or visit our website at www.rmbgroup.com. Want to know more about trading futures and options? Download our FREE Report, the RMB Group “Short Course in Futures and Options.”

* * * * * * * *

The RMB Group

222 South Riverside Plaza, Suite 1200, Chicago, IL 60606

This material has been prepared by a sales or trading employee or agent of R.J. O’Brien & Associates (“RJO”)/RMB Group and is, or is in the nature of, a solicitation. This material is not a research report prepared by a Research Department. By accepting this communication, you agree that you are an experienced user of the futures markets, capable of making independent trading decisions, and agree that you are not, and will not, rely solely on this communication in making trading decisions.

DISTRIBUTION IN SOME JURISDICTIONS MAY BE PROHIBITED OR RESTRICTED BY LAW. PERSONS IN POSSESSION OF THIS COMMUNICATION INDIRECTLY SHOULD INFORM THEMSELVES ABOUT AND OBSERVE ANY SUCH PROHIBITION OR RESTRICTIONS. TO THE EXTENT THAT YOU HAVE RECEIVED THIS COMMUNICATION INDIRECTLY AND SOLICITATIONS ARE PROHIBITED IN YOUR JURISDICTION WITHOUT REGISTRATION, THE MARKET COMMENTARY IN THIS COMMUNICATION SHOULD NOT BE CONSIDERED A SOLICITATION.

The risk of loss in trading futures and/or options is substantial and each investor and/or trader must consider whether this is a suitable investment. Past performance, whether actual or indicated by simulated historical tests of strategies, is not indicative of future results. Trading advice is based on information taken from trades and statistical services and other sources that RJO/RMB believes are reliable. We do not guarantee that such information is accurate or complete and it should not be relied upon as such. Trading advice reflects our good faith judgment at a specific time and is subject to change without notice. There is no guarantee that the advice we give will result in profitable trades.