Get ready for Season 3 of “Covid Catastrophe,” the dystopian series that everyone is being forced to watch. Season 1 saw the virus invade the world, disrupt the global economy and kill millions. Science counterattacked in Season 2, using vaccines that slowed, but couldn’t stop the advance of “Delta” variant. Season 3 begins with Omicron, a new, far more contagious strain. It may pose biggest plot twist yet – especially for the once red-hot energy market.

Demand for oil rose for most of 2021 as millions of newly vaccinated drivers hit the road, confident that “normal” was just around the corner. This demand, plus OPEC’s ability to hold together as a group to hold back supplies of crude from the market, caused the prices of both crude oil and gasoline to skyrocket.

Confidence in the vaccines is waning as more and more “breakthrough” cases hit the media. Uber-contagious Omicron is not helping matters any. It is probably the biggest threat to the current bull market in crude oil. But it is not the only one. Bad poll numbers resulting from high prices at the pump forced President Biden to become personally involved in a coordinated effort to lower prices. He has been surprisingly successful so far.

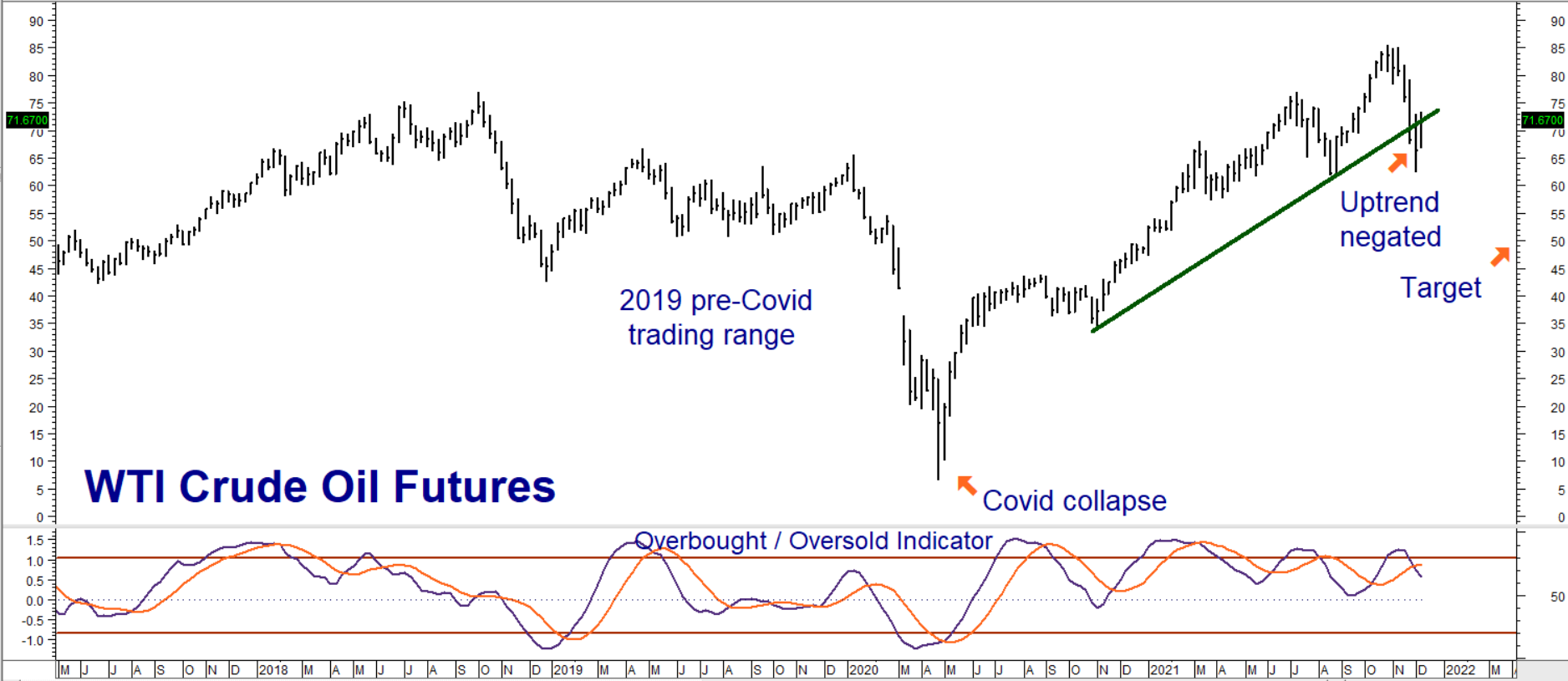

Data Source: Reuters/Datastream

West Texas Intermediate (WTI) crude oil futures topped out within days of Biden’s decision to release supplies from the strategic reserve. Front-month futures declined rapidly, falling from a high of $84.97 per barrel to a low of $62.43 – a drop of 27 percent — in just four weeks. We believe there is more downside left. Omicron, slowing demand, and the potential for discord in OPEC should help keep a lid on prices as we approach the late winter / early spring period of seasonal weakness for crude. Our target is $50.00 per barrel.

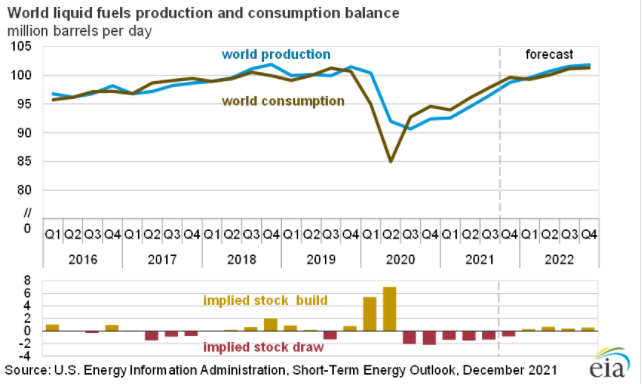

Crude Oil Demand Not Expected to Grow Much in 2022

The US Energy Information Administration (EIA) estimates global crude oil consumption in 2021 at 97 million barrels per day. This is less than pre-pandemic levels. It expects consumption to increase just slightly in 2022 to 100.5 mbd and forecasts global production in 2022 to be 100.93 mbd or slightly more than expected demand. As the chart below illustrates, the oil market is now in balance following months in the immediate aftermath of the pandemic when demand exceeded supply.

Our target of $50 per barrel represents the bottom of the trading range that formed pre-Covid when the market was in balance. (See chart above.) It is also a price that allows many US producers to keep pumping profitably.

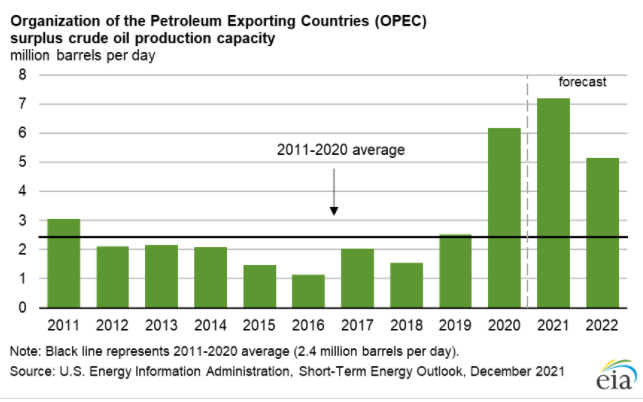

Key to Crude in OPEC’s Hands

OPEC unity is mostly responsible the 18-month long, monster rally in crude oil. But how much longer will this last? Flush with oil money, Russia is building up forces on the Ukrainian border in preparation for a possible invasion. At the same time, Saudi Arabia is a long time US ally that is trying to mend its relationship with the US following the murder of journalist Jamal Khashoggi.

Ongoing diplomacy between Saudi Arabia and the US may be happening right now. It would not surprise us to see the release of more of the Kingdom’s surplus capacity in exchange for enhanced arms sales some other favor. The release of more oil by the Saudis would help lower American gas prices. It would also hurt the Russian treasury at a critical time, giving Vladimir Putin a reason to reconsider an attack on Ukraine.

The EIA expects OPEC to hold fewer barrels off the market in 2022. This removes much of the fuel that powered the 2021 crude oil bull market.

Consider Using Bear Put Spreads to Make Bear Play Cheaper

Crude oil is notoriously volatile. This volatility is currently reflected in its options, making them expensive. One way to lower the cost and risk of a bearish option position is to match the purchase of a put with the sale of another put with a lower strike price. Doing so sharply reduces the embedded volatility cost of the position because the sale of the put with the lower strike price helps to offset much of the volatility premium embedded in the put with the higher strike price.

RMB Group trading customers may want to consider placing an order to buy April 2022 $55.00 WTI crude oil puts while simultaneously selling an equal number of April 2022 WTI $50.00 puts for a net cost of $690 or less, looking for crude oil to hit our $50 target prior to April option expiration on March 17, 2022. Your maximum risk is the net amount paid for your “bear put spread” plus transaction costs. This spread has the potential to be worth as much as $5,000. Exit all positions if and when our $50 per barrel target is hit.

Prices can and will change so contact your RMB Group trading professional for the latest.

Please be advised that you need a futures account to trade the markets in this post. The RMB Group has been helping our clientele trade futures and options since 1991. RMB Group brokers are familiar with the option strategies described in this report. Call us toll-free at 800-345-7026 or 312-373-4970 (direct) for more information and/or to open a trading account. Or visit our website at www.rmbgroup.com. Want to know more about trading futures and options? Download our FREE Report, the RMB Group “Short Course in Futures and Options.”

* * * * * * * *

The RMB Group

222 South Riverside Plaza, Suite 1200, Chicago, IL 60606

This material has been prepared by a sales or trading employee or agent of R.J. O’Brien & Associates (“RJO”)/RMB Group and is, or is in the nature of, a solicitation. This material is not a research report prepared by a Research Department. By accepting this communication, you agree that you are an experienced user of the futures markets, capable of making independent trading decisions, and agree that you are not, and will not, rely solely on this communication in making trading decisions.

DISTRIBUTION IN SOME JURISDICTIONS MAY BE PROHIBITED OR RESTRICTED BY LAW. PERSONS IN POSSESSION OF THIS COMMUNICATION INDIRECTLY SHOULD INFORM THEMSELVES ABOUT AND OBSERVE ANY SUCH PROHIBITION OR RESTRICTIONS. TO THE EXTENT THAT YOU HAVE RECEIVED THIS COMMUNICATION INDIRECTLY AND SOLICITATIONS ARE PROHIBITED IN YOUR JURISDICTION WITHOUT REGISTRATION, THE MARKET COMMENTARY IN THIS COMMUNICATION SHOULD NOT BE CONSIDERED A SOLICITATION.

The risk of loss in trading futures and/or options is substantial and each investor and/or trader must consider whether this is a suitable investment. Past performance, whether actual or indicated by simulated historical tests of strategies, is not indicative of future results. Trading advice is based on information taken from trades and statistical services and other sources that RJO/RMB believes are reliable. We do not guarantee that such information is accurate or complete and it should not be relied upon as such. Trading advice reflects our good faith judgment at a specific time and is subject to change without notice. There is no guarantee that the advice we give will result in profitable trades.