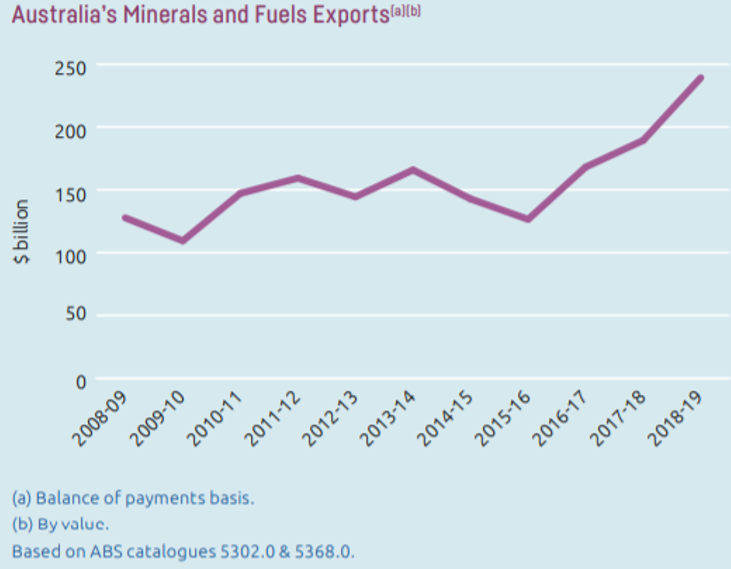

Traders call the Australian dollar a “commodity currency” because its economy is heavily dependent on natural resources. Australia is the number 1 exporter of iron ore, the 2nd largest exporter of aluminum ores (as well as lead and zinc ores) and the 3rd largest exporter of copper ores. It is also a critical supplier of coal and a major exporter of agricultural commodities: 2nd largest of beef, 4th largest of sugar, and a big player in wheat.

The top ten exporting industries in Australia are: 1) Iron Ore, 2) Oil and Gas Extraction, 3) Coal, 4) Liquid Natural Gas, 5) Gold and other non-ferrous metals, 6) Meat, 7) Grain, 8) Alumina, 9) Pharmaceutical manufacturing, and 10) Copper, Silver, Lead and Zinc smelting. Nine of these ten are commodities. Supply shortages and rising demand are causing the prices of all these critical commodities to soar.

Asia is the destination for one-third of Australian Exports, with most of these heading to China. China purchases 40% of Australian imports – despite trade tensions and Chinese tariffs. A big rally in iron ore prices following the 2008 financial crisis was enough to send the Australian dollar to parity with the Greenback. Iron ore prices recently hit 10-year highs, but the Aussie dollar is worth just a little more than 72 US cents as we write this. Commodity currencies, like the Aussie, tend to do well during periods of commodity inflation – but not this time. Why?

Is Aussie $ the “Baby in the Bathwater?”

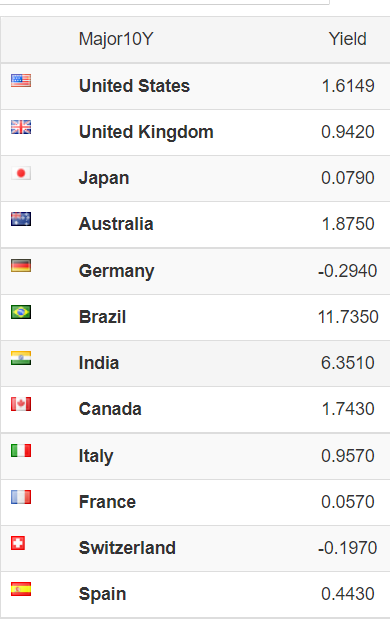

We believe it has to do with Covid and the market’s current obsession with yields. The pandemic shut down Australia for months, hamstringing its economy and penalizing its currency. At the same time, the rapid recovery in the US lit a fire under US Treasury yields – especially versus the developed nations of Europe. This made US Treasuries far more lucrative than the sovereign debt of nearly every major Eurozone nation.

Global 10-year Yields

Source: Trading Economics

US 10-year T-notes are currently yielding 1.6% following the re-nomination of Jerome Powell to head the Fed. This is far more than the equivalent sovereign debt of Germany, France, Switzerland and even profligate Italy. Swiss and German yields are still negative despite increasing inflation in the eurozone. Global investors looking for a higher “risk-free” rate of return are flocking to US Treasuries, converting their currencies into dollars and pushing up the Greenback.

The “Aussie” is caught up in this trend, despite yields on its Treasury debt that exceed those in the US. Currently yielding 1.85%, Australian 10-year treasuries are paying a quarter of a percent more than US 10-year notes. Yet the Aussie dollar is down versus the Greenback on Powell’s nomination as we write this.

The Australian dollar has the potential to benefit from both higher commodity prices and its yield advantage versus US Treasury debt. By dumping the Aussie in an out-all rush into the US dollar, Forex traders may have “thrown the baby out with the bathwater.” We expect inflation and high commodity prices to be with us far longer than Covid. This means the “shutdown discount” currently priced into the Aussie dollar due to strict Covid procedures could disappear soon.

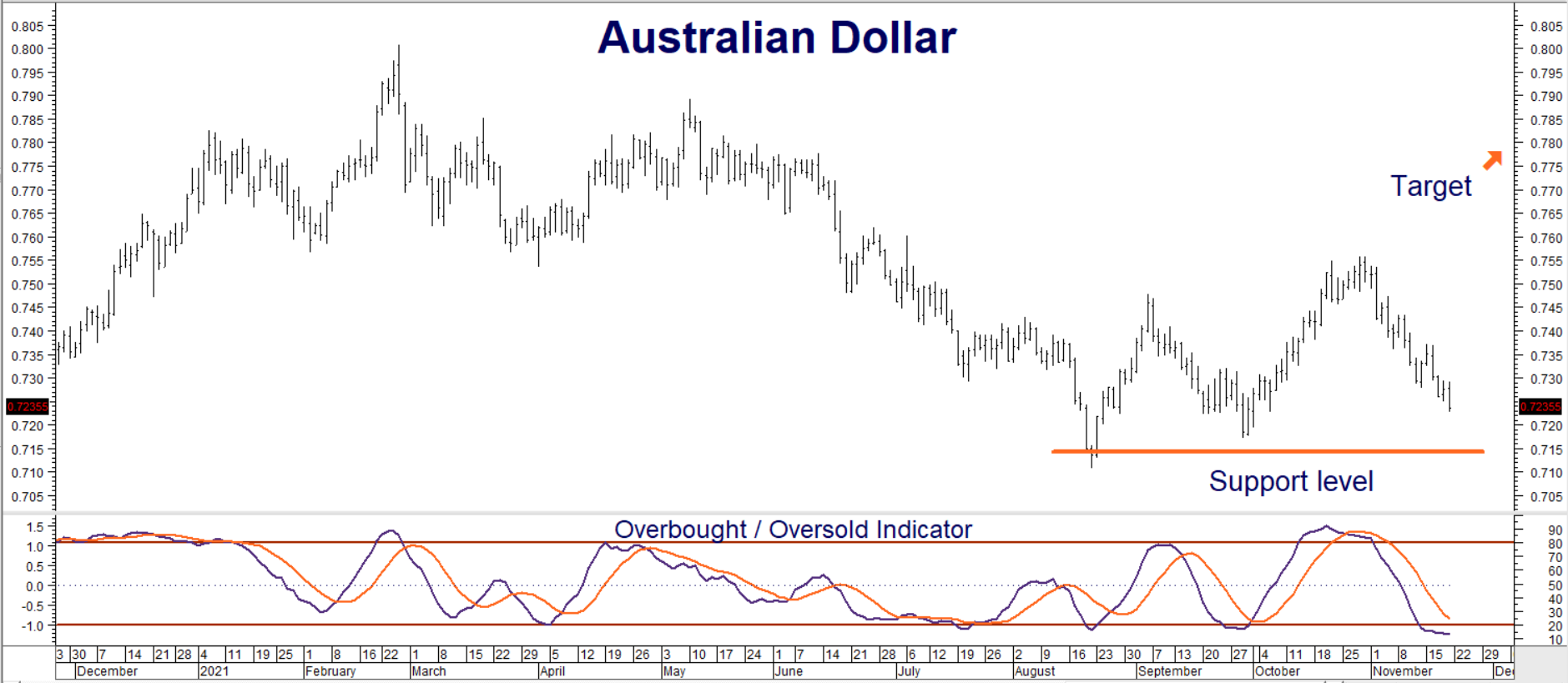

Aussie Dollar Is Oversold and Testing Support

RMB Group trading customers may want to consider using current weakness as an opportunity to take a low-cost, fixed-risk long position using the March Australian dollar call options traded on the CME. Let’s use the latest dip in the Aussie as an opportunity to establish a “stealth” inflation hedge. This hedge is currently much cheaper than traditional ones like gold, and definitely far safer than extremely volatile, non-traditional inflation hedges like Bitcoin.

Data Source: Reuters/Datastream

The August low of .7106 in the front-month Australian dollar futures contract is a key level to watch. Failure to close significantly below this level is good news for the bulls. Better news would be a significant close above the October high of .7557. This could set the Aussie up for a final push to our target price of .7800.

RMB Group trading customers may want to consider buying March 2022 .7450 call options for $600 or less. Look for the March 2022 futures contract to hit .7800 prior to option expiration on March 4, 2022. Your maximum risk is the amount you pay plus transaction costs. These calls will be worth at least $3,500 each should the March contract hit our target prior to option expiration. Prices can and will change, so contact your RMB Group trading professional for the latest.

Please be advised that you need a futures account to trade the markets in this post. The RMB Group has been helping our clientele trade futures and options since 1991. RMB Group brokers are familiar with the option strategies described in this report. Call us toll-free at 800-345-7026 or 312-373-4970 (direct) for more information and/or to open a trading account. Or visit our website at www.rmbgroup.com. Want to know more about trading futures and options? Download our FREE Report, the RMB Group “Short Course in Futures and Options.”

* * * * * * * *

The RMB Group

222 South Riverside Plaza, Suite 1200, Chicago, IL 60606

This material has been prepared by a sales or trading employee or agent of R.J. O’Brien & Associates (“RJO”)/RMB Group and is, or is in the nature of, a solicitation. This material is not a research report prepared by a Research Department. By accepting this communication, you agree that you are an experienced user of the futures markets, capable of making independent trading decisions, and agree that you are not, and will not, rely solely on this communication in making trading decisions.

DISTRIBUTION IN SOME JURISDICTIONS MAY BE PROHIBITED OR RESTRICTED BY LAW. PERSONS IN POSSESSION OF THIS COMMUNICATION INDIRECTLY SHOULD INFORM THEMSELVES ABOUT AND OBSERVE ANY SUCH PROHIBITION OR RESTRICTIONS. TO THE EXTENT THAT YOU HAVE RECEIVED THIS COMMUNICATION INDIRECTLY AND SOLICITATIONS ARE PROHIBITED IN YOUR JURISDICTION WITHOUT REGISTRATION, THE MARKET COMMENTARY IN THIS COMMUNICATION SHOULD NOT BE CONSIDERED A SOLICITATION.

The risk of loss in trading futures and/or options is substantial and each investor and/or trader must consider whether this is a suitable investment. Past performance, whether actual or indicated by simulated historical tests of strategies, is not indicative of future results. Trading advice is based on information taken from trades and statistical services and other sources that RJO/RMB believes are reliable. We do not guarantee that such information is accurate or complete and it should not be relied upon as such. Trading advice reflects our good faith judgment at a specific time and is subject to change without notice. There is no guarantee that the advice we give will result in profitable trades.