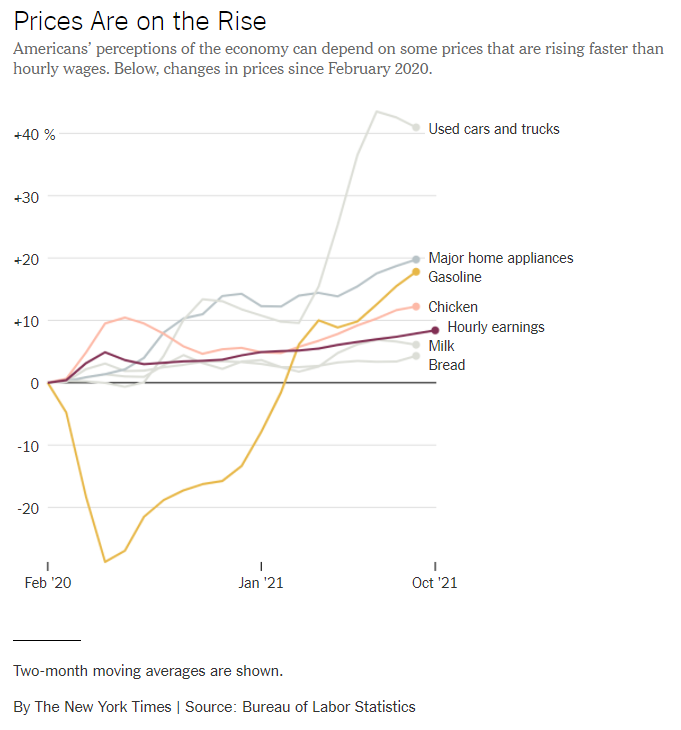

The Consumer Price Index is soaring, pushing prices up over 5% on an annualized basis. This is a 13-yr high. Wages in hospitality industries, like hotels and restaurants, are up 7.6% over the past year, outpacing overall gains of 4.2%. Wages tend to be “sticky”; they rarely go down. Neither will your tab. It now costs 6.8% more to eat out.

At the same time, shortages of goods and services are driving up prices beyond the hospitality sector. The lack of computer chips means there are fewer new cars, causing the price of used cars to skyrocket. (A good one will cost 40% more than 20 months ago.) The cost of fueling that car has risen too, as gasoline jumped nearly 20% in the same timeframe. Believe it or not, consumer prices are rising at the fastest pace in 30 years.

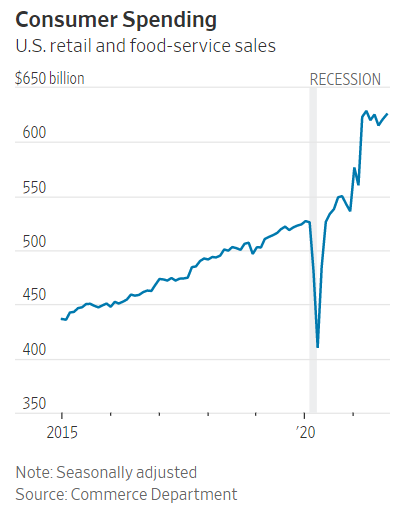

Flush with cash from fat Covid stimulus checks – one issued during the Trump Administration and one by the Biden Administration – Americans conducted a massive spend-a-thon. And who could blame them? After months of being cooped up in lockdown, they were bound to bust out. Their fervor, plus copious amounts of free money from the Federal Reserve, is responsible for the chart above, and the one below.

Add in Christmas, the recent passage of the Infrastructure Bill ($1 trillion), and the probable passage of the “Build Back Better Bill” ($1.75 trillion), and we don’t see demand fading any time soon. Prices will need to rise much further to curtail the demand behind much of today’s inflation.

Will The Fed Be Forced to Act Faster?

The New York Federal Reserve Bank’s near-term inflation expectation survey hit a record in October, with one-year inflation expectations at 5.7%. This is the highest since the survey began in 2013. Even more concerning is the three-year survey which showed inflation expectations at 4.2% — more than double the Fed’s 2% target. Three years doesn’t sound “transitory” to us.

Inflation expectations nearly always lead to more inflation. If you believe the price of that flat-screen TV you’re eyeing is going up, you won’t wait. You’ll buy it now and maybe borrow (at today’s ridiculously low rates) to do so. So will a whole bunch of other folks.

This behavior will increase demand and forces prices even higher, increasing demand even more to create a self-sustaining “feedback loop.” This is what the Fed dreads, because the expectations that drive inflation are extremely difficult to stop once they take hold. The Fed likes to use the term “anchored.” One thing is fairly certain: the deflationary expectations that have defined the 21st century now seem to be “unanchored.”

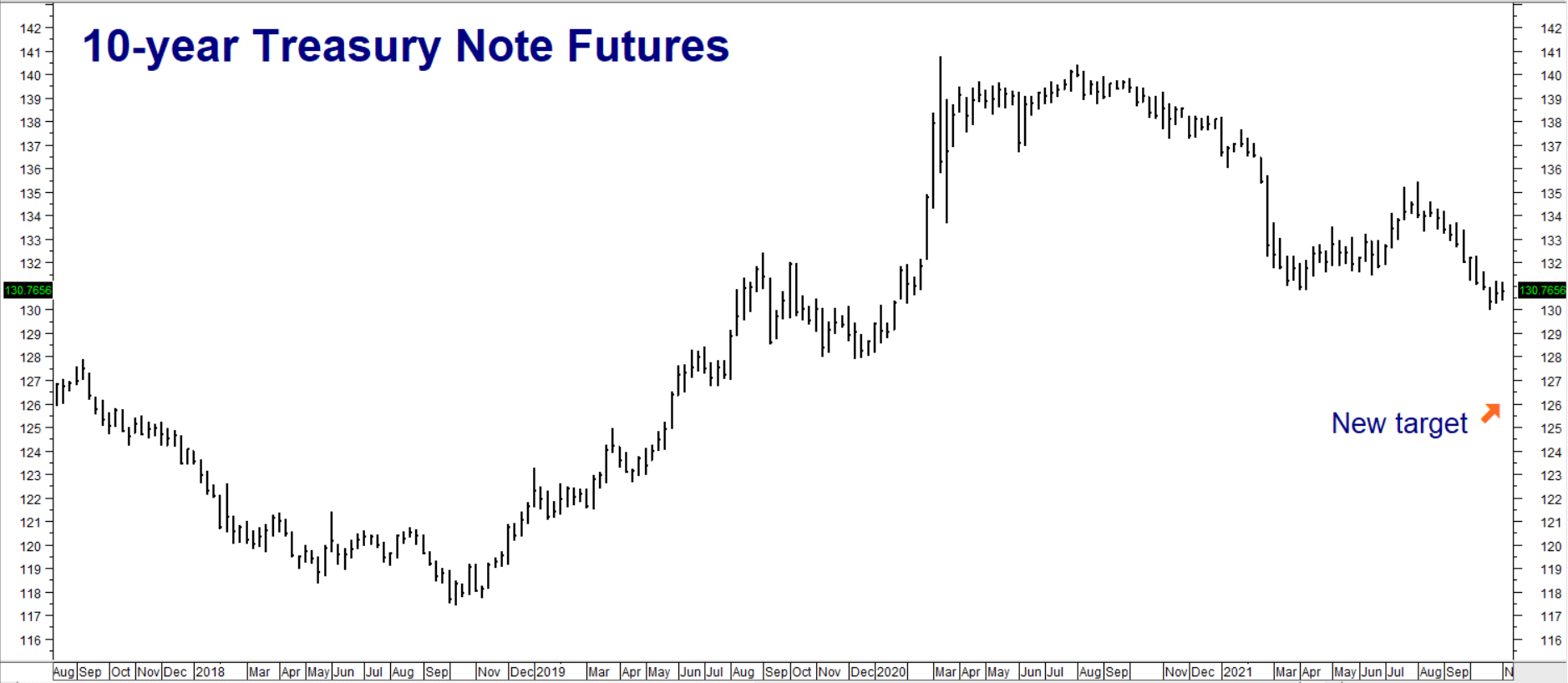

This why we believe the Fed will act sooner than it indicates, and why we expect a faster than-expected “taper”. Fed Chairman Jerome Powell has made it clear that Treasury purchases will decline well in advance of increases in the Fed Funds Rate. The New York Fed’s survey is not good news. We expect Powell to announce another reduction in Treasury and Mortgage-backed security purchases soon. This could be extremely bearish for bonds, notes, and other long-term debt securities.

“Roll” Your Remaining December 10-Year Treasury Puts into March and Establish New Bearish Positions

After months of ignoring inflationary signals flashing everywhere, the Treasury market is starting to react. Yields are on the rise. Because the price of bonds and notes fall when yields rise, prices are falling. (See chart below.) We’ve been fortunate enough to catch some of the move down, but our remaining December 132-00 T-note puts expire in just 17 days. We need to “roll” them into March.

Data Source: Reuters/Datastream

We originally suggested buying December 132-00 T-note puts in our early September post when they were trading for a little over $500. RMG Group trading customers who followed our suggestion to exit half of these puts (when they were trading for a little over $1,400) should consider exiting the rest of their positions immediately.

December 132-00 T-note puts are trading for roughly $843 as we write this. Consider selling them and using the proceeds to buy March 130-00 puts. (March 130-00 puts are currently trading for roughly $891 each.) Those without an outstanding bearish position in T-notes should also consider establishing one using March 130-00 T-note puts. Ditto for those looking to hedge the bonds, notes and mortgage-backed securities in their portfolios.

Our new downside target is 126-00 in the March 10-year T-note futures contract. March 130-00 puts will be worth at least $4,000 each should the March futures contract decline to our target price prior to expiration on February 18, 2022. Your maximum risk is the amount you pay for your options plus transaction costs. Prices can and will change, so contact your RMB Group trading professional for the latest.

Please be advised that you need a futures account to trade the markets in this post. The RMB Group has been helping our clientele trade futures and options since 1991. RMB Group brokers are familiar with the option strategies described in this report. Call us toll-free at 800-345-7026 or 312-373-4970 (direct) for more information and/or to open a trading account. Or visit our website at www.rmbgroup.com. Want to know more about trading futures and options? Download our FREE Report, the RMB Group “Short Course in Futures and Options.”

* * * * * * * *

The RMB Group

222 South Riverside Plaza, Suite 1200, Chicago, IL 60606

This material has been prepared by a sales or trading employee or agent of R.J. O’Brien & Associates (“RJO”)/RMB Group and is, or is in the nature of, a solicitation. This material is not a research report prepared by a Research Department. By accepting this communication, you agree that you are an experienced user of the futures markets, capable of making independent trading decisions, and agree that you are not, and will not, rely solely on this communication in making trading decisions.

DISTRIBUTION IN SOME JURISDICTIONS MAY BE PROHIBITED OR RESTRICTED BY LAW. PERSONS IN POSSESSION OF THIS COMMUNICATION INDIRECTLY SHOULD INFORM THEMSELVES ABOUT AND OBSERVE ANY SUCH PROHIBITION OR RESTRICTIONS. TO THE EXTENT THAT YOU HAVE RECEIVED THIS COMMUNICATION INDIRECTLY AND SOLICITATIONS ARE PROHIBITED IN YOUR JURISDICTION WITHOUT REGISTRATION, THE MARKET COMMENTARY IN THIS COMMUNICATION SHOULD NOT BE CONSIDERED A SOLICITATION.

The risk of loss in trading futures and/or options is substantial and each investor and/or trader must consider whether this is a suitable investment. Past performance, whether actual or indicated by simulated historical tests of strategies, is not indicative of future results. Trading advice is based on information taken from trades and statistical services and other sources that RJO/RMB believes are reliable. We do not guarantee that such information is accurate or complete and it should not be relied upon as such. Trading advice reflects our good faith judgment at a specific time and is subject to change without notice. There is no guarantee that the advice we give will result in profitable trades.