A big rally in American 10-year T-note yields and the inability of the European Union to vaccinate its population have taken their toll on the common European currency, halting the slide in the dollar. Inflation-adjusted “real” yields of long-term US Treasuries are threatening to climb into positive territory but, at negative 0.69%, they are not there quite yet.

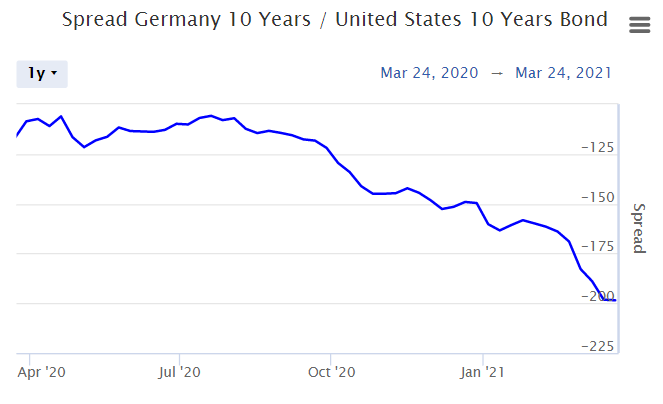

Source: www.worldgovernmentbonds.com

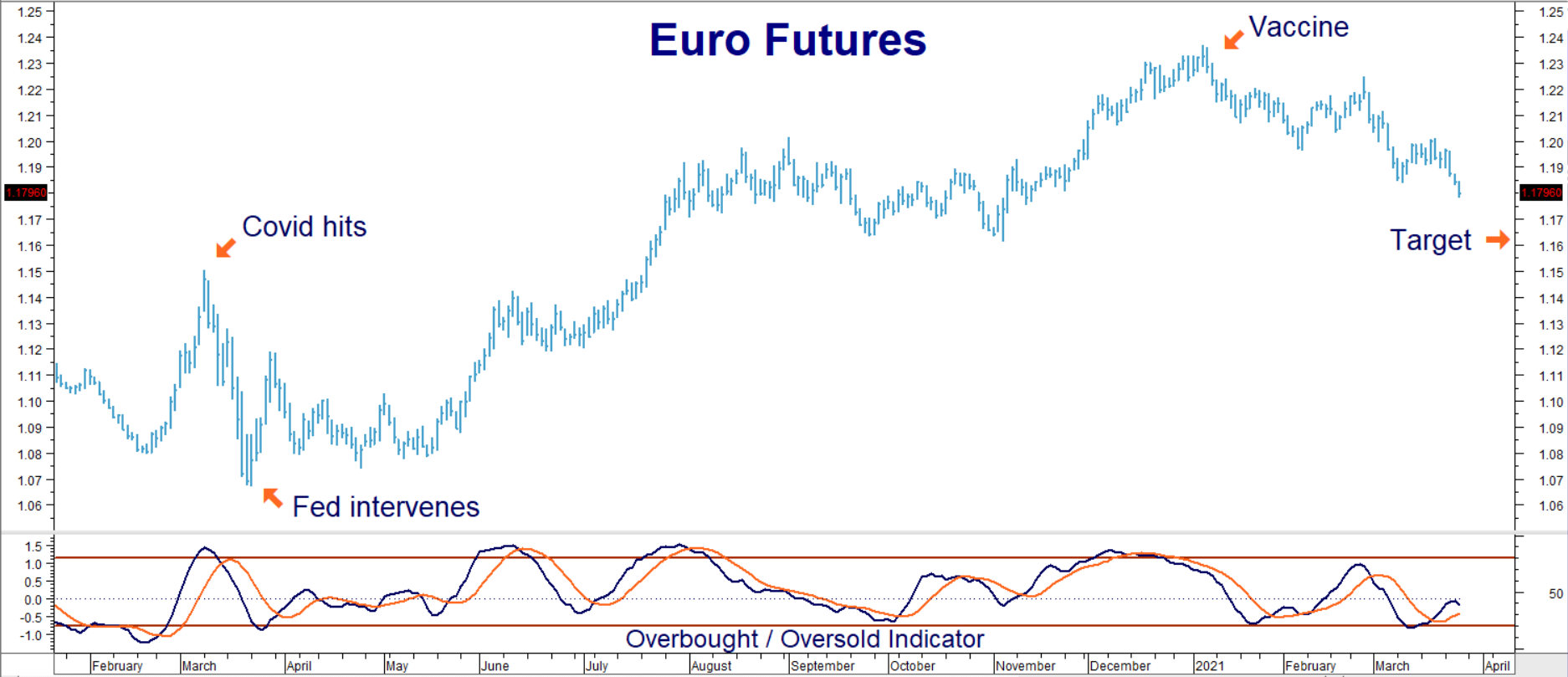

The biggest factor in the Euro’s recent collapse is the difference between European and American interest rates. German 10-year bund yields fell nearly 2 full percentage points below American 10-yr Treasuries on Tuesday. This yield differential incentivizes both the purchase of US Treasuries and the dollars needed to buy them, hurting the euro in the process. The dollar is also being supported by the progress the US is making against Covid, especially when compared with the EU. Not surprisingly, the Euro got hit on Wednesday and again on Thursday.

RMB Group trading customers who followed the recommendation in our February blog post to take a bearish position against the euro by purchasing the June $1.19 Eurocurrency puts traded on the Chicago Mercantile Exchange (CME) for $750 should consider exiting half of their positions at twice their initial entry level or higher, taking their initial risk “off the table” in the process. These puts settled for $2,350 on Thursday. Consider holding the other half for a move to our original downside objective of $1.16. Prices can and will change so contact your RMB group professional for the latest.

Data Source: Reuters/Datastream

Please be advised that you need a futures account to trade the markets in this post. The RMB Group has been helping our clientele trade futures and options since 1991. RMB Group brokers are familiar with the option strategies described in this report. Call us toll-free at 800-345-7026 or 312-373-4970 (direct) for more information and/or to open a trading account. Or visit our website at www.rmbgroup.com. Want to know more about trading futures and options? Download our FREE Report, the RMB Group “Short Course in Futures and Options.”

* * * * * * * *

The RMB Group

222 South Riverside Plaza, Suite 1200, Chicago, IL 60606

This material has been prepared by a sales or trading employee or agent of R.J. O’Brien & Associates (“RJO”)/RMB Group and is, or is in the nature of, a solicitation. This material is not a research report prepared by a Research Department. By accepting this communication, you agree that you are an experienced user of the futures markets, capable of making independent trading decisions, and agree that you are not, and will not, rely solely on this communication in making trading decisions.

DISTRIBUTION IN SOME JURISDICTIONS MAY BE PROHIBITED OR RESTRICTED BY LAW. PERSONS IN POSSESSION OF THIS COMMUNICATION INDIRECTLY SHOULD INFORM THEMSELVES ABOUT AND OBSERVE ANY SUCH PROHIBITION OR RESTRICTIONS. TO THE EXTENT THAT YOU HAVE RECEIVED THIS COMMUNICATION INDIRECTLY AND SOLICITATIONS ARE PROHIBITED IN YOUR JURISDICTION WITHOUT REGISTRATION, THE MARKET COMMENTARY IN THIS COMMUNICATION SHOULD NOT BE CONSIDERED A SOLICITATION.

The risk of loss in trading futures and/or options is substantial and each investor and/or trader must consider whether this is a suitable investment. Past performance, whether actual or indicated by simulated historical tests of strategies, is not indicative of future results. Trading advice is based on information taken from trades and statistical services and other sources that RJO/RMB believes are reliable. We do not guarantee that such information is accurate or complete and it should not be relied upon as such. Trading advice reflects our good faith judgment at a specific time and is subject to change without notice. There is no guarantee that the advice we give will result in profitable trades.