Current mark-ups (known as “premiums”) mean gold needs to rally $200 per ounce and silver $11.52 per ounce from current levels before coin investors see a dime of profit. Precious metal investors are being asked to make an investment that requires a gain of 11.5% in gold and 38% in silver just to break even. Options could be a better bet – especially if gold re-establishes its uptrend within the next six months.

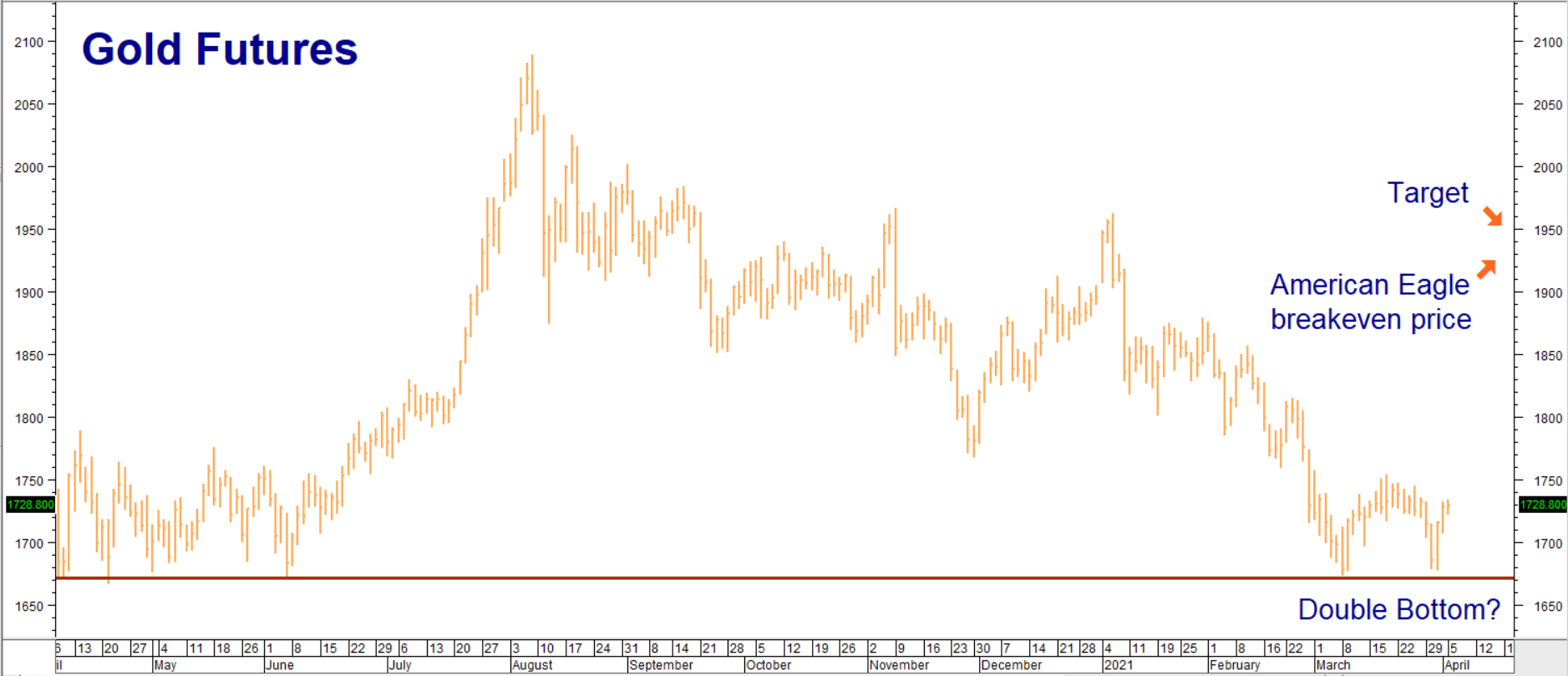

Gold is the most technically sound of the two metals right now. It bounced smartly from long-term support at $1,670 per ounce over the past few trading sessions and appears to be establishing a classic “double bottom.” Spot gold is trading for $1,730 per ounce as we write this, but the best price we could find online for a gold American Eagle was $1,930. This means gold would need to rally $200 per ounce just for the coin buyer to break even – and doesn’t include shipping and insurance costs.

Data Source: Reuters/Datastream

Sky-high premiums on gold coins make them similar in some ways to call options. Call options buyers pay a “premium” for the right but not the obligation to buy gold at a specific price (known as the “strike” or “striking” price) for a fixed period of time. The key here is “…but not the obligation.” If gold doesn’t rally, call buyers will not exercise their right to buy, limiting their loss to the ‘premium” paid for the call plus any transaction costs.

Gold Eagle buyers are paying a premium, but are also buying gold itself. A buyer of 5 ounces worth of Gold Eagles would wind up paying $8,650 for the gold portion of their coins and $1,000 in dealer premium. What if the $1,000 in coin dealer premium could be used to better effect by using options instead?

Bull Spread Alternative to Gold Coins

Instead of buying coins, gold bulls may want to consider creating a “bull call spread” using COMEX gold options. COMEX gold call options cover 100 ounces of gold. Our upside target is $1,950 per ounce – just $14 per ounce higher than the current breakeven price of gold American Eagles.

RMB Group trading clients seeking an alternative to expensive gold coins may want to consider buying December 2021 $1,900 gold calls while simultaneously selling an equal number of December 2021 $1,950 gold calls for a net cost of $900 or less. These “bull call spreads” settled for $830 on Monday, April 5. Prices can and will change, so contact RMB Group for the latest.

This strategy pairs the right to be long 100 ounces of gold at $1,900 per ounce with the obligation to be short 100 ounces of gold at $1,950 per ounce. This means we can capture the $50 per ounce difference, but no more. $50 times 100-ounce contract size means the most this spread can be worth is $5,000. Our maximum risk is the net amount we pay for this spread plus any transaction cost.

Gold would need to climb above $2,900 per ounce to be worth the same amount for an investor holding 5 one-ounce American Eagles. December 2021 gold futures need to rally above $1909 per ounce by December option expiration on November 23, 2021 for our bull spread alternative to pay off. (Note: this is $21 less than the American Eagle $1,930 breakeven price.) Failure to do so will result in the loss of the entire amount paid for the trade. Gold coin holders will still have their gold coins after this date. However, they will have spent and risked more upfront.

Bull Spread Alternative to Silver Coins

Silver is far more volatile than gold. This partially explains the absolutely crazy coin premiums in this market. Spot silver is trading for $24.83 per ounce as we write this, but the best price that we could find online for a one-ounce silver American Eagle was $34.25. This means silver would need to rally $9.42 per ounce just for the coin buyer to break even. A buyer of 100 Silver Eagles would wind up paying $2,483 for the silver portion of their coins and $942 in dealer premiums.

Data Source: Reuters/Datastream

Silver bulls may want to consider creating a “bull call spread” using COMEX silver options instead of buying ridiculously expensive silver coins. COMEX silver call options cover 5,000 ounces of silver. Our upside target is the top of the current trading range at $30 per ounce – a whopping 4 dollar per ounce lower than the current breakeven price of silver American Eagles.

RMB Group trading clients looking for an alternative to expensive silver coins may want to consider buying an equal number of December 2021 $29.00 silver calls while simultaneously selling an equal number of December 2021 $30.00 silver calls for a net cost of $900 or less. These spreads settled for $855 on Monday April 5. Prices can and will change, so contact RMB Group for the latest.

This strategy pairs the right to be long 5,000 ounces of silver at $29.00 per ounce with the obligation to be short 5,000 ounces of silver at $30.00 per ounce. This means we can capture the $1 per ounce difference, but no more. $1 times the 5,000-ounce contract size means the most this spread can be worth is $5,000. Your maximum risk is the net amount you pay for this spread plus any transaction cost. Silver would need to climb above $84.00 per ounce to be worth the same amount for an investor holding 100 American Eagle coins.

Silver needs to rally above $30 per ounce by November 23, 2021 for our spread alternative to pay off. (Note: our target is $4 per ounce less than the American Eagle breakeven price). Failure to rally before then will result in the loss for the entire amount paid for the trade. Silver coin holders will still have their silver after this date, but will have spent and risked more upfront.

Inflationary Forces Gathering Strength

Gold has been trending sideways since making a new contract high of $1,289 per ounce last August. Many of the same forces that supported that move are still intact, and some have even grown stronger. Silver has not been able to make a new high, but has soundly beaten gold in terms of percentage return. It is trading sideways as well.

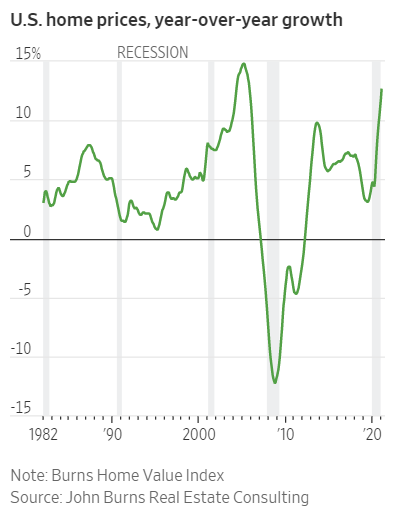

The trillions of new dollars injected into the American economy last year have already been followed by 2021’s $1.9 trillion Covid Relief Bill. Now that the Senate Parliamentarian has ruled it’s possible to amend this bill to include further infrastructure spending, we would not be surprised to see an additional $4 trillion pumped into the system before the year is out. Inflation will likely accelerate and, if history is any guide, so will gold and silver.

Asset inflation is already well-established. The S&P 500 has soared a whopping 80% since its March 2020 Covid lows. Housing prices are climbing. Covid relief checks are going right into the pockets of consumers. This increases the odds that it will be spent on goods and services. Soaring job numbers (900,000 in just the last month) will put even more money into people’s pockets. Infrastructure dollars could add trillions to the pile.

The big negative holding back gold and silver now is rising bond yields. Higher interest rates increase the opportunity cost of holding physical gold and silver. We believe rates will continue to rise, but will lag the pace of inflation as the Fed delays action. This will cause inflation to grow strong enough to catch the eye of the precious metals once again.

Please be advised that you need a futures account to trade the markets in this post. The RMB Group has been helping our clientele trade futures and options since 1991. RMB Group brokers are familiar with the option strategies described in this report. Call us toll-free at 800-345-7026 or 312-373-4970 (direct) for more information and/or to open a trading account. Or visit our website at www.rmbgroup.com. Want to know more about trading futures and options? Download our FREE Report, the RMB Group “Short Course in Futures and Options.”

* * * * * * * *

The RMB Group

222 South Riverside Plaza, Suite 1200, Chicago, IL 60606

This material has been prepared by a sales or trading employee or agent of R.J. O’Brien & Associates (“RJO”)/RMB Group and is, or is in the nature of, a solicitation. This material is not a research report prepared by a Research Department. By accepting this communication, you agree that you are an experienced user of the futures markets, capable of making independent trading decisions, and agree that you are not, and will not, rely solely on this communication in making trading decisions.

DISTRIBUTION IN SOME JURISDICTIONS MAY BE PROHIBITED OR RESTRICTED BY LAW. PERSONS IN POSSESSION OF THIS COMMUNICATION INDIRECTLY SHOULD INFORM THEMSELVES ABOUT AND OBSERVE ANY SUCH PROHIBITION OR RESTRICTIONS. TO THE EXTENT THAT YOU HAVE RECEIVED THIS COMMUNICATION INDIRECTLY AND SOLICITATIONS ARE PROHIBITED IN YOUR JURISDICTION WITHOUT REGISTRATION, THE MARKET COMMENTARY IN THIS COMMUNICATION SHOULD NOT BE CONSIDERED A SOLICITATION.

The risk of loss in trading futures and/or options is substantial and each investor and/or trader must consider whether this is a suitable investment. Past performance, whether actual or indicated by simulated historical tests of strategies, is not indicative of future results. Trading advice is based on information taken from trades and statistical services and other sources that RJO/RMB believes are reliable. We do not guarantee that such information is accurate or complete and it should not be relied upon as such. Trading advice reflects our good faith judgment at a specific time and is subject to change without notice. There is no guarantee that the advice we give will result in profitable trades.