Mix free money with a global pandemic, and you have the ingredients for a major market meltdown. It may not happen today, or tomorrow, or even this year. But if history is any guide, it will occur. Stocks looked fantastic in the 1920s until they didn’t. “Dot com” technology was the place to be at the turn of this century, until it wasn’t. Real estate and housing were sure things in 2008, until they weren’t. We believe we are close to a similar inflection point now.

We’ve discussed the destabilizing effects of “free money” in numerous blog posts. The Federal Reserve’s willingness to keep short term interest rates at or near “zero” was a major factor in our predictions (over a year ago) of a big rally in commodities, a return of inflation and sharply higher yields (and correspondingly lower prices) for long-term debt instruments like 10-year Treasury notes and 30-year Treasury bonds.

Money – at least short-term money – is still free. Chairman Jerome Powell and the Fed have publicly chosen to ignore an exploding stock market (up 87% from last March’s Covid lows), rapidly rising inflation, and forecasts of GDP north of 6% for 2021. They have vowed to keep the accelerator pressed to the floor to at least 2023. Meanwhile, this “free money” appears to be getting more disruptive with each passing day.

“Free Money” Encourages Speculative Behavior

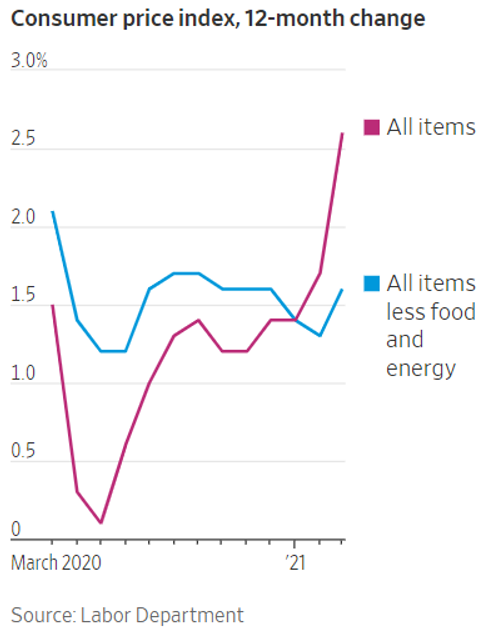

By keeping short-term interest rates at zero, the Fed has virtually eliminated the possibility of getting ahead by investing in safe instruments like bank CDs or Treasury Bills. The current inflation rate for the past 12 months (ending in March) is 2.62%. And while this number is a bit exaggerated because it is calculated using last March’s Covid-depressed statistics, it is still sobering.

The best yield we could find for a FDIC-insured, one-year CD on bankrate.com was 0.67%. The best rate for a two-year CD was 0.70%. This means an investor, looking for safety, would have to pay a very large price for it. The best two-year CD investment alternative available now would lose 1.92% in real terms given today’s inflation rate – something the Fed would be happy to nudge even higher in the next few months.

By keeping short-term interest rates at “zero”, the Fed is not only punishing savers, it is encouraging risky behavior by a crop of new investors. Many of them are poorly equipped to take on more risk.

Modern-day “Tulip Bulb” manias are popping up as investors jump at the chance to invest in whatever is going up in order to stay ahead of the rising inflation caused by the same free money policies that make it impossible for them to invest safely. Along with fear of missing out (FOMO) in the age of social media, this is threatening to turn the entire investment marketplace into a one giant casino. It is being helped by zero commissions (the perfect complement to “free money”) and trading apps with casino-like sounds and graphics.

The “GameStop” (GME) mania that saw the stock skyrocket 2,429% in January is being repeated in market after market. This includes new cyber-only markets like NFTs (non-fungible tokens) as cash-laden investors, guaranteed to lose by sitting on their dollars, chase after anything that offers the chance of a big return.

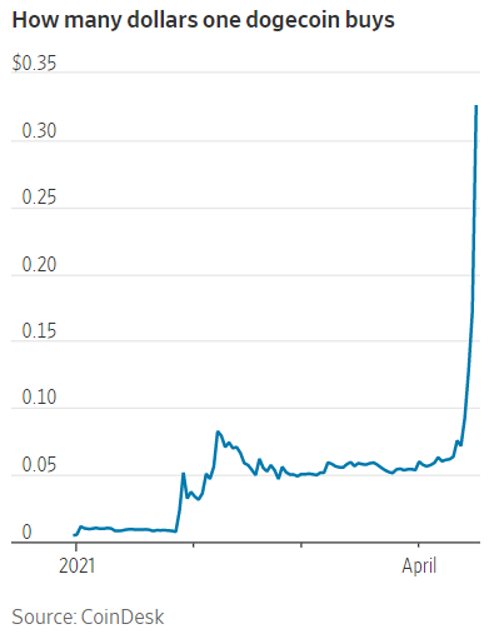

Buoyed by rampant speculation, Bitcoin has rallied nearly 300% from mid-November lows. Perhaps the biggest sign of the free-for-all defining today’s market is dogecoin. This crypto-currency was launched by Elon Musk as a literal joke just three months ago, partially in response to the GameStop episode. It has skyrocketed 3,200% since. There is now so much free money sloshing around from the Federal Reserve and Federal Government that Elon’s joke is one of the best performing assets.

Speculative Fever in Broader Market Is No Joke

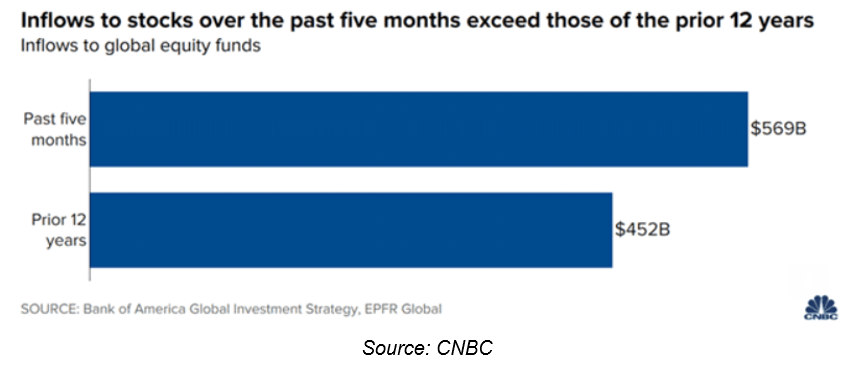

The multiple mini-manias peppering the investing landscape since January may be interesting and perhaps even profitable, but the chart that scares us the most is the one below. Inflows into stocks in just the past five months have exceeded all previous inflows over the past twelve years by a whopping $117 billion, or 25.9%.

This is what happens when money is free: too much money winds up chasing too few legitimately-priced investment opportunities, creating the potential for huge dislocations. Asset inflation is alive and well and having its moment in the spotlight. What is even more frightening is the chart below applies only to mutual funds. Inflows into individual stocks are not included.

Perfection is priced in. Everything needs to go exactly right, in our opinion, for the S&P 500 to remain at current levels. Things will probably need to go much better than expected for the rally to continue. For example, we are writing this less than an hour after the close on Tuesday, April 20th. Netflix just announced better-than-expected earnings. However, Netflix stock is down 11% in early aftermarket trading. We expect to see more of this as summer approaches.

What Could Go Wrong?

Plenty. Supply shortages due to Covid and the Texas Power grid failure are gumming up the works of key industries. A number of American auto plants remain shut down due to a shortage of microchips. Construction projects all across America are being held up or proving to be more expensive than originally planned due to the soaring cost of lumber and appliances. The Texas shutdown created a shortage of Oriented Strand Board (OSB) due to a lack of glue produced there. Ditto for other industries reliant on petroleum-based resins. Grains and other commodities are soaring due to weather and global demand, making every trip to the supermarket more expensive.

Shortages are inflationary. They also disrupt the efficient operation of the global economy. By interfering with the rapid movement of both people and goods across borders, Covid has caused a massive restructuring of supply chains. “Just in time” inventory management has been made more difficult, if not impossible. Many companies are sourcing products closer to home, undoing prior efficiencies in labor costs in the process. These efficiencies were one of the things that helped keep a lid on inflation throughout the globalization boom.

Where is New Buying Going to Come From?

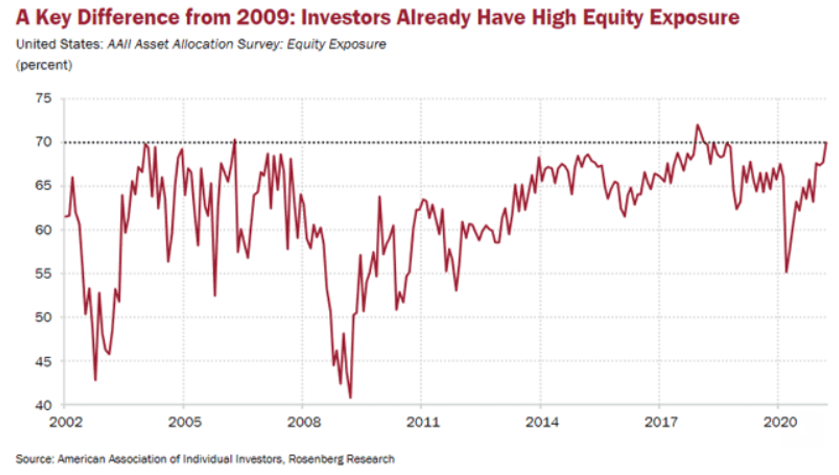

This spring’s big rally is being fueled, in part, by coronavirus stimulus cash. Unlike 2009, investors are already heavily invested in stocks. The market has likely seen the last of this. Attention and political capital have shifted to infrastructure, which will not put money directly into potential investors’ pockets.

90 million Covid stimulus checks were mailed in March. We believe stocks will become extremely vulnerable once the flood of new money slows to a trickle. The vaccine should also stop the cash not spent on vacations and travel because of the pandemic from flowing into the stock market because it is being used in the real economy again.

Tax Increases Not Priced into Stocks

The current focus on infrastructure will also shift the spotlight to taxes. President Biden has pledged not to raise taxes on families making less than $400,000 per year. This means corporate taxes are shaping up to be a major source of new revenue for the Administration’s infrastructure plan. Corporate taxes as a share of American GDP have been dropping for years; they are lower than they have ever been. It is not surprising to see them being targeted for new revenue.

Higher corporate taxes could throw a wet blanket over today’s hot bull market as money reserved for dividends and stock buy-backs gets redirected. Joe Biden has suggested eliminating favorable treatment for long-term capital gains in past campaign appearances. This could cause a raft of selling by investors looking to take profits before such a provision becomes law.

None of this is currently being discounted by the market. Any indication that any new taxes could be passed by filibuster-proof Budget Reconciliation in the US Senate could be the straw that breaks the back of the increasingly unstable bull market in stocks. We believe the resulting sell-off will be hard, fast and unavoidable by those who haven’t taken precautions beforehand.

Old clichés like “The trend is your friend” and “Don’t fight the Fed” have worked extremely well since the March 2020 Covid collapse. We believe “Sell in May and go away” may be the adage to remember this year – especially if Joe Manchin signs off on the revenue enhancements needed to fund infrastructure.

Don’t “Fight the Fed,” But Be Prepared for Nasty Surprises

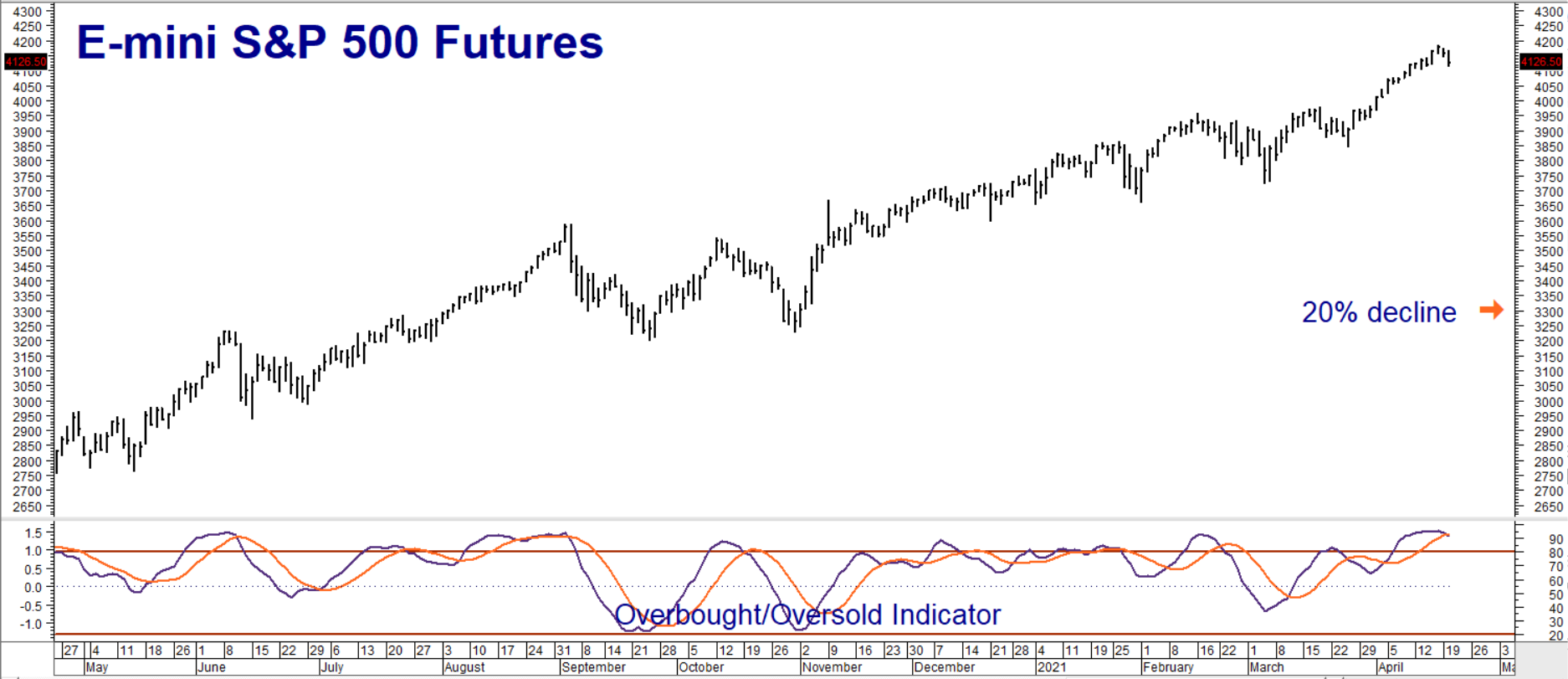

The trend is still up and the Fed is still uber-easy, so taking an all or nothing approach to the current vulnerable condition of the stock market is probably not a good idea. It may be prudent to consider purchasing some downside insurance against losses in the stock portion of your portfolio by using E-mini, S&P 500 futures options traded on the CME.

Why futures options? 1) They are extremely liquid. 2) They trade overnight. 3) They cover a smaller amount than the classic SPX cash index options. The contract size of the CME E-mini is 50 times the underlying index. This makes the contract worth 50 times Tuesday’s settlement price of 4,126.50 or $206,325.

Data source: Reuters/DataStream

RMB trading customers looking for a relatively cheap hedge against an unexpected decline may want to consider buying June 2021 June E-mini, S&P 500 3700 puts while simultaneously selling an equal number of June E-mini 3300 puts for a net cost of $900 or less. Prices can and will change, so contact your RMB Group investment professional for the latest.

This trade has the potential to be worth as much as $20,000 should E-mini futures settle at or below 3300 at option expiration on June 18, 2021. It gives us some protection against a market hiccup for the next 59 days without having to dump stocks. Maximum risk is the price paid for our bear spreads, plus transaction cost. Consider this the “premium” we are paying for our insurance.

Please be advised that you need a futures account to trade the markets in this post. The RMB Group has been helping our clientele trade futures and options since 1991. RMB Group brokers are familiar with the option strategies described in this report. Call us toll-free at 800-345-7026 or 312-373-4970 (direct) for more information and/or to open a trading account. Or visit our website at www.rmbgroup.com. Want to know more about trading futures and options? Download our FREE Report, the RMB Group “Short Course in Futures and Options.”

* * * * * * * *

The RMB Group

222 South Riverside Plaza, Suite 1200, Chicago, IL 60606

This material has been prepared by a sales or trading employee or agent of R.J. O’Brien & Associates (“RJO”)/RMB Group and is, or is in the nature of, a solicitation. This material is not a research report prepared by a Research Department. By accepting this communication, you agree that you are an experienced user of the futures markets, capable of making independent trading decisions, and agree that you are not, and will not, rely solely on this communication in making trading decisions.

DISTRIBUTION IN SOME JURISDICTIONS MAY BE PROHIBITED OR RESTRICTED BY LAW. PERSONS IN POSSESSION OF THIS COMMUNICATION INDIRECTLY SHOULD INFORM THEMSELVES ABOUT AND OBSERVE ANY SUCH PROHIBITION OR RESTRICTIONS. TO THE EXTENT THAT YOU HAVE RECEIVED THIS COMMUNICATION INDIRECTLY AND SOLICITATIONS ARE PROHIBITED IN YOUR JURISDICTION WITHOUT REGISTRATION, THE MARKET COMMENTARY IN THIS COMMUNICATION SHOULD NOT BE CONSIDERED A SOLICITATION.

The risk of loss in trading futures and/or options is substantial and each investor and/or trader must consider whether this is a suitable investment. Past performance, whether actual or indicated by simulated historical tests of strategies, is not indicative of future results. Trading advice is based on information taken from trades and statistical services and other sources that RJO/RMB believes are reliable. We do not guarantee that such information is accurate or complete and it should not be relied upon as such. Trading advice reflects our good faith judgment at a specific time and is subject to change without notice. There is no guarantee that the advice we give will result in profitable trades.