Big production cutbacks by mega-producers Russia and Saudi Arabia lit a fire under the oil market to start 2021. Now that these cuts have achieved their objective and prices have risen to $65 per barrel, both nations are discussing relaxing them. This would return over 1 million barrels per day (bpd) to the market in short order – and do so at the beginning of what is typically a seasonally unfriendly time for the black, sticky stuff.

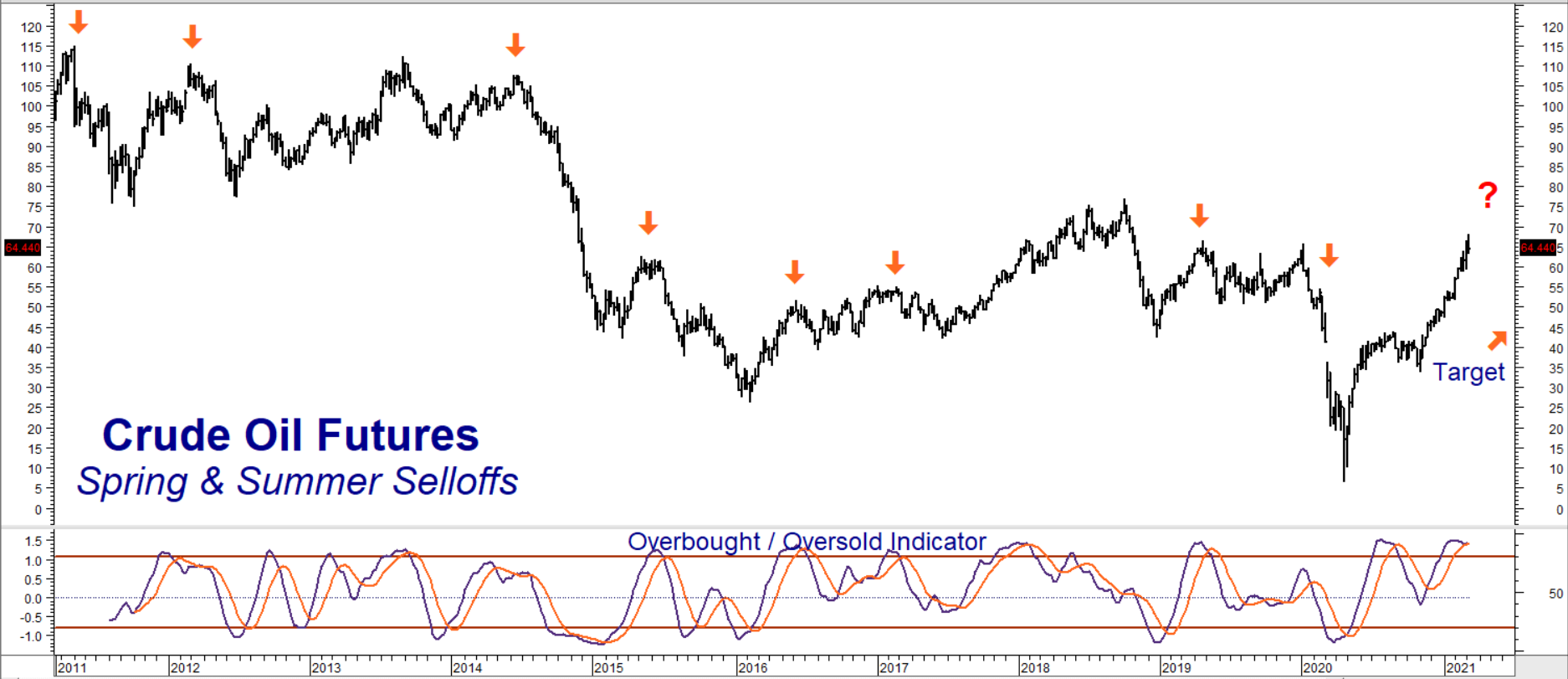

The chart below illustrates this seasonal tendency. Like all tendencies, it is not bulletproof. Crude oil can rally during the spring and summer due to supply concerns and has done so in the past. But with two of the globe’s biggest producers chomping at the bit to move more product, we do not believe it will be an issue.

Data Source: Reuters/Datastream

Crude is currently overbought and overdue for a correction. Crude oil also seems to be stalling against chart resistance at $65 per barrel – a level which has capped all rallies since 2015. Our downside target of $45 per barrel is just above previous resistance at $44 per barrel. A classic Fibonacci retracement of 61.8% from current levels would send the price of black gold to right around this level as well.

The Rise of Renewables

With the passage of the Covid Relief Bill, we expect the Biden Administration to shift the focus to infrastructure and climate change. Fossil fuels will be de-emphasized and discouraged and renewable fuels will be rewarded. We expect new US targets for emission reductions to be announced during next month’s climate summit, possibly doubling those proposed in the Obama Administration.

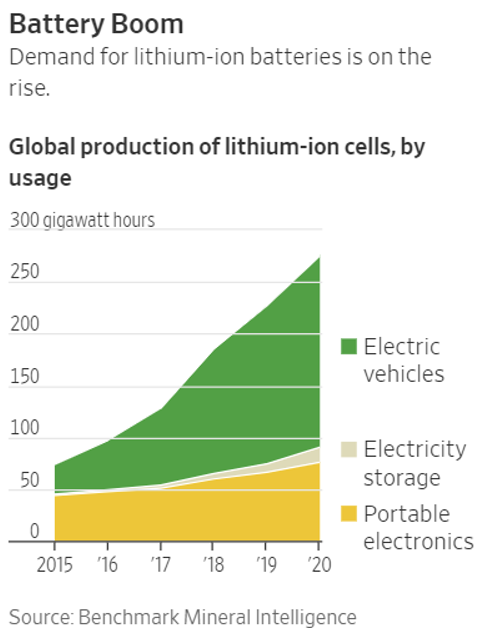

While we don’t expect these to directly alter the supply and demand picture for crude oil – especially in the next few months – we do expect them to impact the overall psychology of the market. Power plants produce 25% of US emissions. Light duty cars and trucks produce another 17%. Batteries have the potential to be highly disruptive to both industries, reducing the overall demand for fossil fuels, including gasoline refined from crude oil. Could an increase in the Federal portion of the gasoline tax be included in a future bill as an incentive for consumers to switch to EVs (electric vehicles)? It’s too early to tell, but not outside the realm of possibility.

High Implied Volatility in Crude Oil Options Favors Bear Spreads

Crude oil is a volatile market. That volatility is imbedded in the cost of its options, which are currently implying a potential move of roughly 34% in either direction. This makes the simple purchase of a call or put option expensive. We can reduce the cost of a fixed risk play in crude oil by combining the purchase of a put option close to the market with the sale of another put option further away from the market. This reduces much of the volatility premium in the process.

RMB trading customers may want to consider buying September 2021 $50.00 crude oil puts (which settled Wednesday for $1,670) while simultaneously selling an equal number of September 2021 $45.00 puts (which settled yesterday for $970) for a total cost of $700 or less. Buying the $50 pays for the right but not the obligation to be short crude oil futures at $50.00 per barrel. Selling the $45 crude oil put obligates us to buy crude oil futures for $45.00.

Our maximum risk is $700 we pay for the spread plus transaction costs. We can make the $5 per barrel difference ($5,000 on a 1,000-barrel futures contract), but no more. Expect to exit this trade if crude oil hits our $45.00 per barrel target prior to option expiration on August 17, 2021.

Please be advised that you need a futures account to trade the markets in this post. The RMB Group has been helping our clientele trade futures and options since 1991. RMB Group brokers are familiar with the option strategies described in this report. Call us toll-free at 800-345-7026 or 312-373-4970 (direct) for more information and/or to open a trading account. Or visit our website at www.rmbgroup.com. Want to know more about trading futures and options? Download our FREE Report, the RMB Group “Short Course in Futures and Options.”

* * * * * * * *

The RMB Group

222 South Riverside Plaza, Suite 1200, Chicago, IL 60606

This material has been prepared by a sales or trading employee or agent of R.J. O’Brien & Associates (“RJO”)/RMB Group and is, or is in the nature of, a solicitation. This material is not a research report prepared by a Research Department. By accepting this communication, you agree that you are an experienced user of the futures markets, capable of making independent trading decisions, and agree that you are not, and will not, rely solely on this communication in making trading decisions.

DISTRIBUTION IN SOME JURISDICTIONS MAY BE PROHIBITED OR RESTRICTED BY LAW. PERSONS IN POSSESSION OF THIS COMMUNICATION INDIRECTLY SHOULD INFORM THEMSELVES ABOUT AND OBSERVE ANY SUCH PROHIBITION OR RESTRICTIONS. TO THE EXTENT THAT YOU HAVE RECEIVED THIS COMMUNICATION INDIRECTLY AND SOLICITATIONS ARE PROHIBITED IN YOUR JURISDICTION WITHOUT REGISTRATION, THE MARKET COMMENTARY IN THIS COMMUNICATION SHOULD NOT BE CONSIDERED A SOLICITATION.

The risk of loss in trading futures and/or options is substantial and each investor and/or trader must consider whether this is a suitable investment. Past performance, whether actual or indicated by simulated historical tests of strategies, is not indicative of future results. Trading advice is based on information taken from trades and statistical services and other sources that RJO/RMB believes are reliable. We do not guarantee that such information is accurate or complete and it should not be relied upon as such. Trading advice reflects our good faith judgment at a specific time and is subject to change without notice. There is no guarantee that the advice we give will result in profitable trades.