Exploding Chinese demand, a disappointing North American harvest and drier-than-normal conditions across key soy-producing areas of Brazil and Argentina have provided the fuel for the ongoing bull market in soybeans. “Beans” closed at $12.64 per bushel on Christmas Eve – up 46% from their midsummer lows of $8.69. Soybeans could be the “gift that keeps on giving” should these factors continue to feed the bull in 2021.

China imported 45% more soybeans from America over the first 11 months of this year compared to 2019. Chinese soybean imports from the US jumped 136% in November 2020 alone versus last year. But demand from the globe’s most populous nation is only part of the story. The world has roughly 80.3 million more mouths to feed this year and will add millions more next year, providing a sustainable source of increased demand.

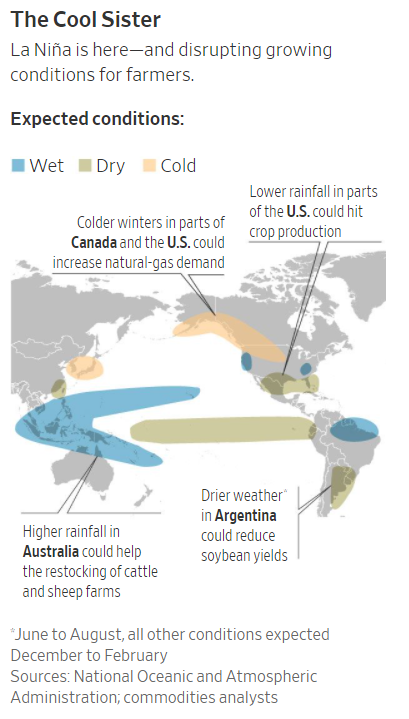

Ideal growing conditions the past few years have resulted in a streak of bumper crops critical to meeting this demand. But Mother Nature hasn’t been so cooperative this year. Brazil is the world’s largest soybean exporter. Argentina is also a big producer. Dry conditions have delayed the planting of the South American crop and begun to threaten its development. The peak growing months of January and February are when South American soy crops get “made.” Weather during this period determines yield. It needs to rain soon.

Some analysts are predicting prices as high as $18 per bushel should current La Niña dryness persist and stifle crop development. While we are not willing to stick our necks out this far, we won’t be surprised to see a continuation of the current rally in the first half of 2021. North America’s less-than-stellar 2019 carryout will not provide much of a backstop to supply should weather problems south of the Equator continue. This will make further gains to $14.00 per bushel not only possible, but probable.

Other Bullish Factors

Soybeans are rallying during a seasonally unfriendly time. Soybeans are typically weak during and directly following the North American harvest due to price pressure caused by farmer selling. Not this year. Farmers and commercial traders are not putting any pressure on the market as they wait to see what happens to the South American crop.

Mega-exporter Brazil’s decision to eliminate tariffs on imported beans in October signaled Brazil’s worry about its own domestic supplies. By removing the penalty for imported soybeans, Brazil indicated that it could no longer meet China’s expanding needs. This also meant market conditions were a lot tighter than USDA figures had been indicating at the time.

Russia’s recent announcement that it was imposing a tariff on soybean exports is a signal that it is worried about its domestic supply. Discouraging exports helps keep domestic grain bins full. This is also a bullish development, pointing again to tighter marker conditions than currently indicated by the USDA.

“Backwardation” Continues to Signal Higher Prices

We covered “backwardation” in our October 27th blog on soybeans. Here’s a shortened explanation from that post:

“In ‘backwarded’ markets, front month futures contracts are more expensive than back month contracts. This typically happens during supply shortages. End users, desperate for product, focus their buying on front month futures, intent on taking actual delivery. Prices rise as other users pile into the market, forcing short sellers to “cover” (buy-back) their positions as well. Backwardation is generally a very bullish signal.”

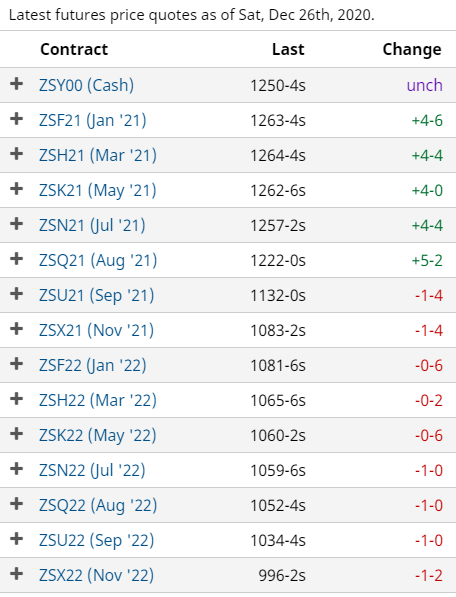

Note the difference between the price of soybeans for delivery in March 2021 ($12.6450 per bushel) and soybeans for delivery in March 2022 ($10.6575 per bushel) in the table below. If this were a normal “contango” market, March 2022 soybeans would be more expensive in order to price in the costs of storage, insurance and lost interest on the capital tied up in buying the beans and storing them until 2022. But not this year…

Fears of an impending shortage have driven the price of March 2021 beans to nearly a $2.00 per bushel (18.6%) premium over March 2022 beans. This premium is significantly higher than the $1.08 per bushel (11.2%) 12-month premium that we considered super friendly back in our late October blog post on soybeans. This current level of backwardation in soybeans is rare – and potentially even more bullish.

Backward Beans

Target Hit: Exit All Spread Positions & Wait for a Correction

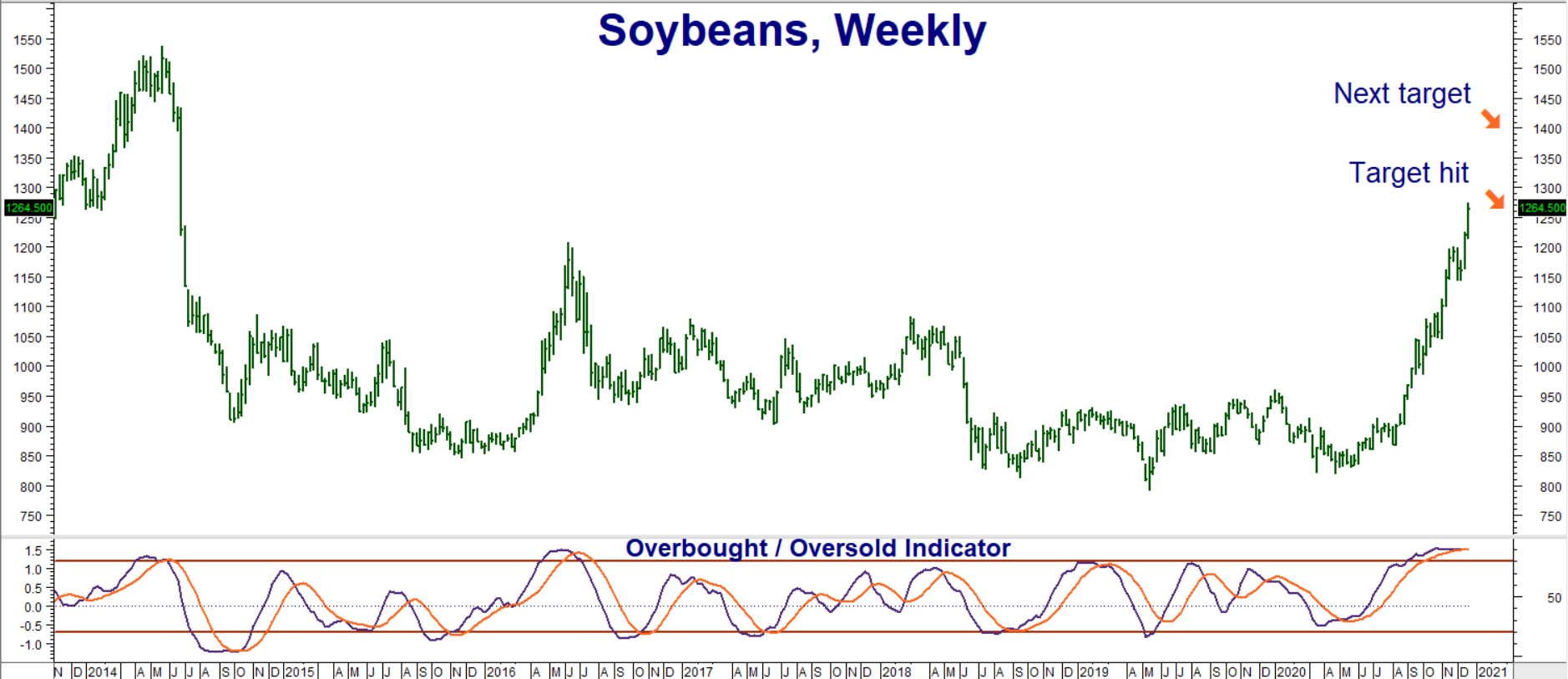

Our upside target of $12.60 per bushel was hit on Thursday, December 24th. This gave RMB Group trading customers who followed our suggestion to buy July 2021 $11.60 / $12.60 bull call spreads for $800 or less two months ago an early Christmas present. These spreads settled for $2,400 on Christmas Eve. Consider exiting all of your remaining spread positions now if you haven’t already. Prices can and will change so contact your RMB Group broker for the latest.

Soybeans are very overbought at these levels. (See chart below.) A market this extended could react violently to a wetter-than-expected forecast. Consider using any significant correction (rain-inspired or otherwise) as an opportunity to re-establish long positions. Our new upside objective is $14.00 per bushel. We’ll be monitoring this market closely for the next entry opportunity.

Data Source: Reuters/Datastream

Please be advised that you need a futures account to trade the markets in this post. The RMB Group has been helping our clientele trade futures and options since 1991. RMB Group brokers are familiar with the option strategies described in this report. Call us toll-free at 800-345-7026 or 312-373-4970 (direct) for more information and/or to open a trading account. Or visit our website at www.rmbgroup.com. Want to know more about trading futures and options? Download our FREE Report, the RMB Group “Short Course in Futures and Options.”

* * * * * * * *

The RMB Group

222 South Riverside Plaza, Suite 1200, Chicago, IL 60606

This material has been prepared by a sales or trading employee or agent of R.J. O’Brien & Associates (“RJO”)/RMB Group and is, or is in the nature of, a solicitation. This material is not a research report prepared by a Research Department. By accepting this communication, you agree that you are an experienced user of the futures markets, capable of making independent trading decisions, and agree that you are not, and will not, rely solely on this communication in making trading decisions.

DISTRIBUTION IN SOME JURISDICTIONS MAY BE PROHIBITED OR RESTRICTED BY LAW. PERSONS IN POSSESSION OF THIS COMMUNICATION INDIRECTLY SHOULD INFORM THEMSELVES ABOUT AND OBSERVE ANY SUCH PROHIBITION OR RESTRICTIONS. TO THE EXTENT THAT YOU HAVE RECEIVED THIS COMMUNICATION INDIRECTLY AND SOLICITATIONS ARE PROHIBITED IN YOUR JURISDICTION WITHOUT REGISTRATION, THE MARKET COMMENTARY IN THIS COMMUNICATION SHOULD NOT BE CONSIDERED A SOLICITATION.

The risk of loss in trading futures and/or options is substantial and each investor and/or trader must consider whether this is a suitable investment. Past performance, whether actual or indicated by simulated historical tests of strategies, is not indicative of future results. Trading advice is based on information taken from trades and statistical services and other sources that RJO/RMB believes are reliable. We do not guarantee that such information is accurate or complete and it should not be relied upon as such. Trading advice reflects our good faith judgment at a specific time and is subject to change without notice. There is no guarantee that the advice we give will result in profitable trades