Buoyed by “rock star” shares like Tesla, Amazon and Apple, big stock market averages have been getting nearly all of the end-of-the-year press. But the best performing asset class of 2020 wasn’t stocks; it was commodities – especially agricultural commodities. Dirt-cheap money and the Federal Reserve’s promise to backstop nearly everything following the March 2020 COVID crisis was the rocket fuel that powered both bull markets. We’ve been calling it the Fed’s “Everything Put.”

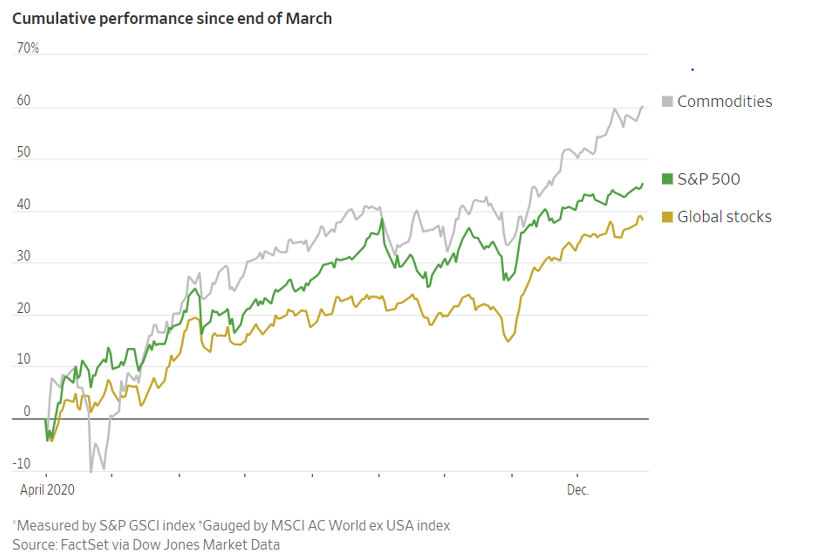

The chart below – from an article in yesterday’s Wall Street Journal titled “From Stocks to Bitcoin, Investors Bet the “Everything Rally” Will Continue” – illustrates commodities’ outperformance. But the text itself says very little about commodities. At RMB Group, we’re used to commodities being the Roger Dangerfield of investments. It is an asset class that tends to get little respect. Perhaps that will change in 2021.

The “Everything Rally” referenced in the WSJ headline was the most foreseeable consequence of the Fed’s “Everything Put”. Commodities soared after the Fed lowered interest rates following the housing collapse of 2008. The amount of stimulus being funneled into both the markets and pockets of consumers is at least three times more now. And more is coming, no matter who wins the critical Senate election in Georgia. We suspect the inflationary effects of the current stimulus will be at least as great this time.

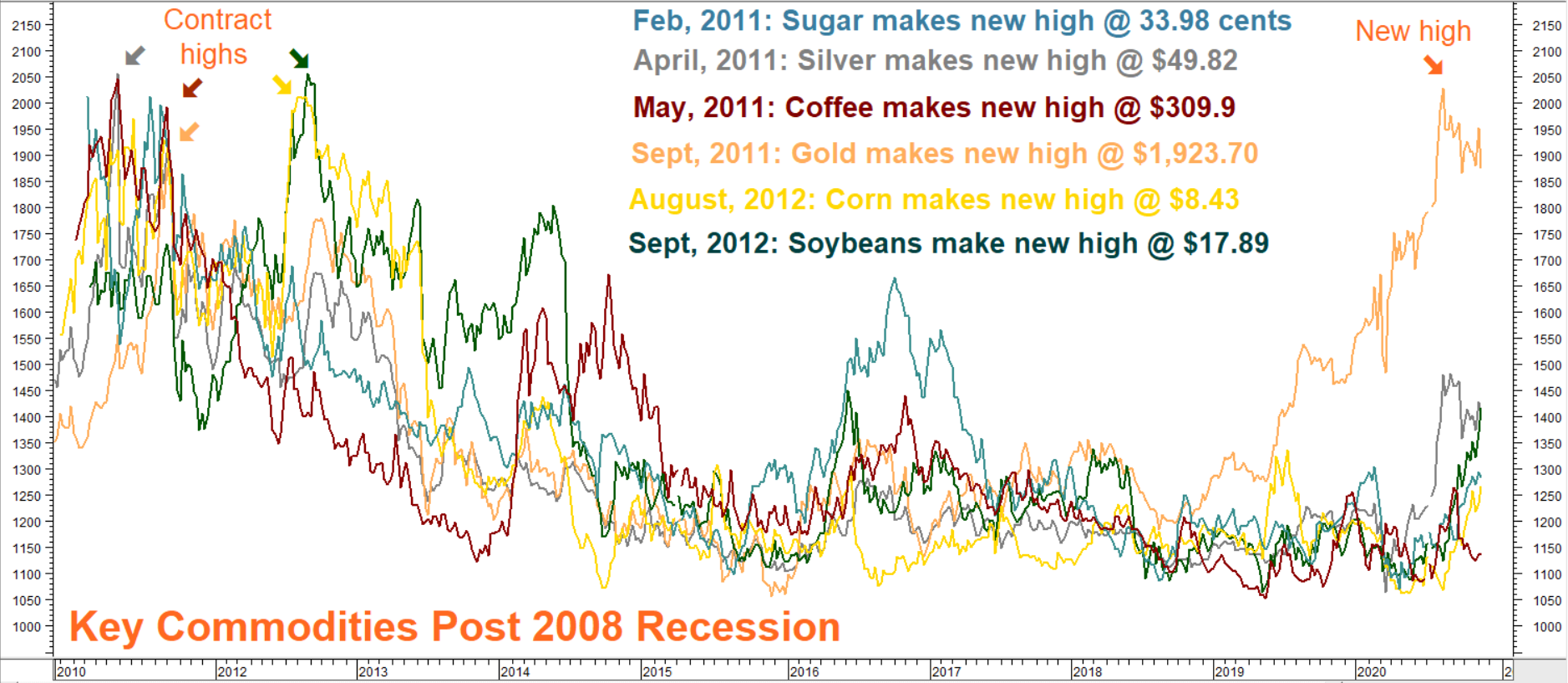

History does not always repeat, but it is a good teacher. That’s why we’ve featured the chart below in our blogs since the Fed created their “Everything Put” in late March. Commodities didn’t really get rolling until 2011 – roughly 2 ½ years after the peak of the housing crisis – so we would not be surprised to see the current rally continue for some time. Gold is the only commodity that has been able to take out its historical high so far. We do not believe it will be the last.

Data Source: Reuters/Datastream

People need commodities to eat, build shelter and stay warm. There are 80 million more people on the planet this January than in January 2020. There will probably be at least 80 million more next year. Global population should continue to drive demand for commodities. Weather will be a wild card when it comes to supply.

Volatile Commodities Will Offer New Opportunities

Markets like corn and soybeans soared from abnormally low levels to surprisingly high levels of volatility virtually overnight in mid-summer 2020 due to drier-than-expected weather. Dry conditions continue to threaten South American crops. We expect volatility in commodities to remain elevated, but we also believe we’ll see more two-way movement. The nearly straight-line 2020 rallies in commodities like corn, soybeans and wheat will not continue forever.

We welcome rain-inspired corrections in the grains and intend to use them to add to some of our open bullish positions as well as re-enter some markets that have hit our upside targets. Soybeans is a market we will be watching closely to get back into. So are silver and gold.

Unleaded gasoline could be a big beneficiary of the COVID recovery in early spring. Americans will hit the road by the millions as more are vaccinated. The pent-up demand to travel will find an outlet and when it does, watch out. The wholesale price of unleaded gasoline dropped briefly below 50 cents a gallon during the March 2020 panic phase of the pandemic. We don’t expect it to be as inexpensive this time. However, anything south of $1.20 per gallon will fuel our interest in a hurry.

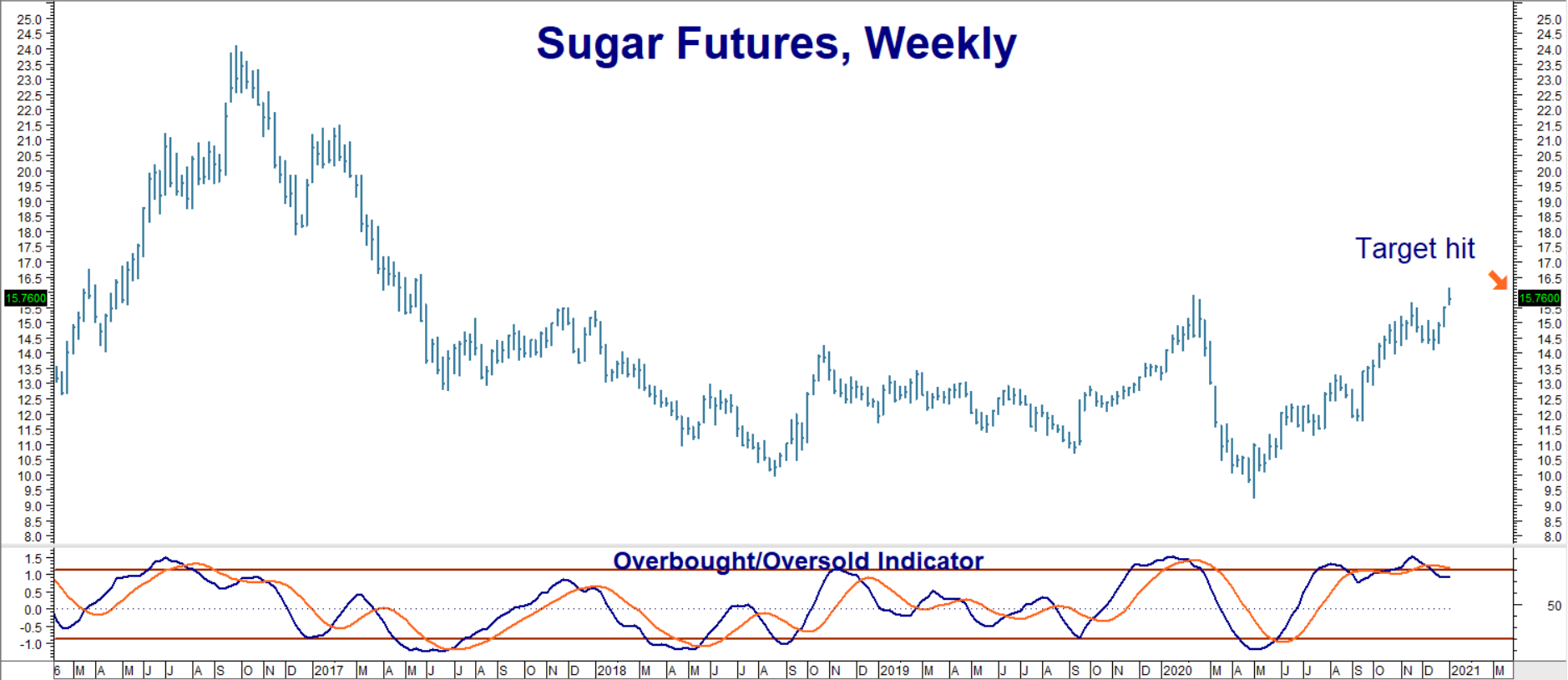

Target Hit in Sugar

With apologies to Jackie Gleason, “how sweet it is!” It didn’t last long, but sugar hit our target of 16 cents per pound in Monday’s trading. RMB Group trading customers who followed our suggestion in April to buy May 13-cent sugar calls for a little over $616 each should consider exiting all of their remaining calls now, looking to re-enter following a correction. These calls settled for $2,362.20 yesterday. Prices can and will change so check with your RMB Group broker for the latest.

Data Source: Reuters/Datastream

Please be advised that you need a futures account to trade the markets in this post. The RMB Group has been helping our clientele trade futures and options since 1991. RMB Group brokers are familiar with the option strategies described in this report. Call us toll-free at 800-345-7026 or 312-373-4970 (direct) for more information and/or to open a trading account. Or visit our website at www.rmbgroup.com. Want to know more about trading futures and options? Download our FREE Report, the RMB Group “Short Course in Futures and Options.”

* * * * * * * *

The RMB Group

222 South Riverside Plaza, Suite 1200, Chicago, IL 60606

This material has been prepared by a sales or trading employee or agent of R.J. O’Brien & Associates (“RJO”)/RMB Group and is, or is in the nature of, a solicitation. This material is not a research report prepared by a Research Department. By accepting this communication, you agree that you are an experienced user of the futures markets, capable of making independent trading decisions, and agree that you are not, and will not, rely solely on this communication in making trading decisions.

DISTRIBUTION IN SOME JURISDICTIONS MAY BE PROHIBITED OR RESTRICTED BY LAW. PERSONS IN POSSESSION OF THIS COMMUNICATION INDIRECTLY SHOULD INFORM THEMSELVES ABOUT AND OBSERVE ANY SUCH PROHIBITION OR RESTRICTIONS. TO THE EXTENT THAT YOU HAVE RECEIVED THIS COMMUNICATION INDIRECTLY AND SOLICITATIONS ARE PROHIBITED IN YOUR JURISDICTION WITHOUT REGISTRATION, THE MARKET COMMENTARY IN THIS COMMUNICATION SHOULD NOT BE CONSIDERED A SOLICITATION.

The risk of loss in trading futures and/or options is substantial and each investor and/or trader must consider whether this is a suitable investment. Past performance, whether actual or indicated by simulated historical tests of strategies, is not indicative of future results. Trading advice is based on information taken from trades and statistical services and other sources that RJO/RMB believes are reliable. We do not guarantee that such information is accurate or complete and it should not be relied upon as such. Trading advice reflects our good faith judgment at a specific time and is subject to change without notice. There is no guarantee that the advice we give will result in profitable trades.