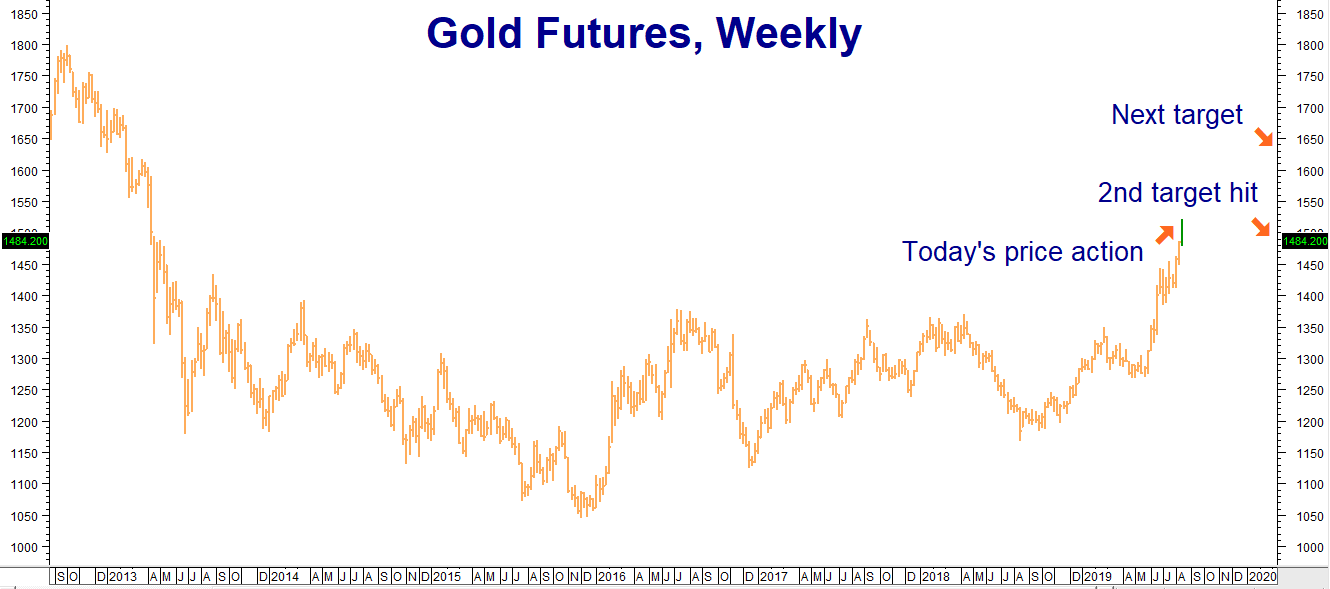

It’s a big day in metals. The desire for an alternative currency not enmeshed in the Sino-American trade war has pushed the price of gold well past our second long-term objective of $1,500 per ounce and well within striking distance of our third long-term objective at $1,640 per ounce. Today’s $30 per ounce rally is just the latest expression of global fear sparked by the Trump Administration’s escalation of the tariff war with China.

Gold has thousands of years of history as the preferred currency in a crisis. With Europe flat on its back and the euro weak, it and (finally!) silver appear to be the only reasonable alternatives left to those wishing to diversify out of the dollar. This is why we expect the rally in both metals to continue. But first we need to manage some of the bullish positions we already have on. Moves like these are rare and have a history of retracing quickly.

Data source: Thompson/Reuters

RMB Group trading customers who took our suggestion to buy June 2020 $1,450 / $1,500 bull call spreads for around $750 each using the COMEX gold options should consider exiting now. These spreads are currently trading for around $2,600 each. Consider replacing these positions with new call spreads designed to take advantage of a move to our third price objective of $1,640 per ounce.

We expected gold to rally, but not as fast as it has. That’s why we recommended June 2020 options rather than sticking with the December 2019 options with a shorter expiration window. But things have changed. The bull market in gold is running hot. Instead of using June 2020 options to establish new long, RMB trading customers may want to consider using December 2019 options instead.

We like the December $1,600 / $1,650 bull spreads which are currently going for around $850. Prices are changing rapidly so check with your RMB Group broker for the latest.

Silver Also Making a Move

Silver is matching gold nearly step for step today, up 65 cents per ounce as we write this. We figured it was just a matter of time before the poor man’s gold awoke from its long slumber. As the chart below illustrates, today’s rally to $17.26 put silver right in the middle of our first target range of between $17.00 and $17.50 per ounce that we established in our blog post of early July. Our second upside target of $20.00 per ounce is now in play.

Data source: Thompson/Reuters

RMB trading customers that took our suggestions to purchase December 2019 $16.00 / $17.00 and $16.50 / $17.50 bull call spreads using COMEX silver options for $965 and $675 respectively should consider exiting now. The $16.00 / $17.00 spreads are currently trading around $2,700. The $16.50 / $17.50 spreads are going for roughly $2,200.

Consider replacing these positions with similar spreads using higher strike prices. December COMEX silver $18.50 / $20.00 bull call spreads – currently going for roughly $1,200 – could be worth as much as $7,500 should silver rally as high as $20.00 per ounce by option expiration on November 25, 2019. December COMEX silver $19.00 / $20.00 bull spreads are going for roughly $700. These could be worth as much as $5,000 given the same scenario.

Like gold, silver prices are changing rapidly so contact your personal RMB Group broker for the latest.

Please be advised that you need a futures account to trade the markets in this post. The RMB Group has been helping its clientele trade futures and options since 1991 and are very familiar with all kinds of option strategies. Call us toll-free at 800-345-7026 or 312-373-4970 (direct) for more information and/or to open a trading account. Or visit our website at www.rmbgroup.com.

* * * * * * * *

The RMB Group

222 South Riverside Plaza, Suite 1200, Chicago, IL 60606

This material has been prepared by a sales or trading employee or agent of R.J. O’Brien & Associates (“RJO”)/RMB Group and is, or is in the nature of, a solicitation. This material is not a research report prepared by a Research Department. By accepting this communication, you agree that you are an experienced user of the futures markets, capable of making independent trading decisions, and agree that you are not, and will not, rely solely on this communication in making trading decisions.

DISTRIBUTION IN SOME JURISDICTIONS MAY BE PROHIBITED OR RESTRICTED BY LAW. PERSONS IN POSSESSION OF THIS COMMUNICATION INDIRECTLY SHOULD INFORM THEMSELVES ABOUT AND OBSERVE ANY SUCH PROHIBITION OR RESTRICTIONS. TO THE EXTENT THAT YOU HAVE RECEIVED THIS COMMUNICATION INDIRECTLY AND SOLICITATIONS ARE PROHIBITED IN YOUR JURISDICTION WITHOUT REGISTRATION, THE MARKET COMMENTARY IN THIS COMMUNICATION SHOULD NOT BE CONSIDERED A SOLICITATION.

The risk of loss in trading futures and/or options is substantial and each investor and/or trader must consider whether this is a suitable investment. Past performance, whether actual or indicated by simulated historical tests of strategies, is not indicative of future results. Trading advice is based on information taken from trades and statistical services and other sources that RJO/RMB believes are reliable. We do not guarantee that such information is accurate or complete and it should not be relied upon as such. Trading advice reflects our good faith judgment at a specific time and is subject to change without notice. There is no guarantee that the advice we give will result in profitable trades.