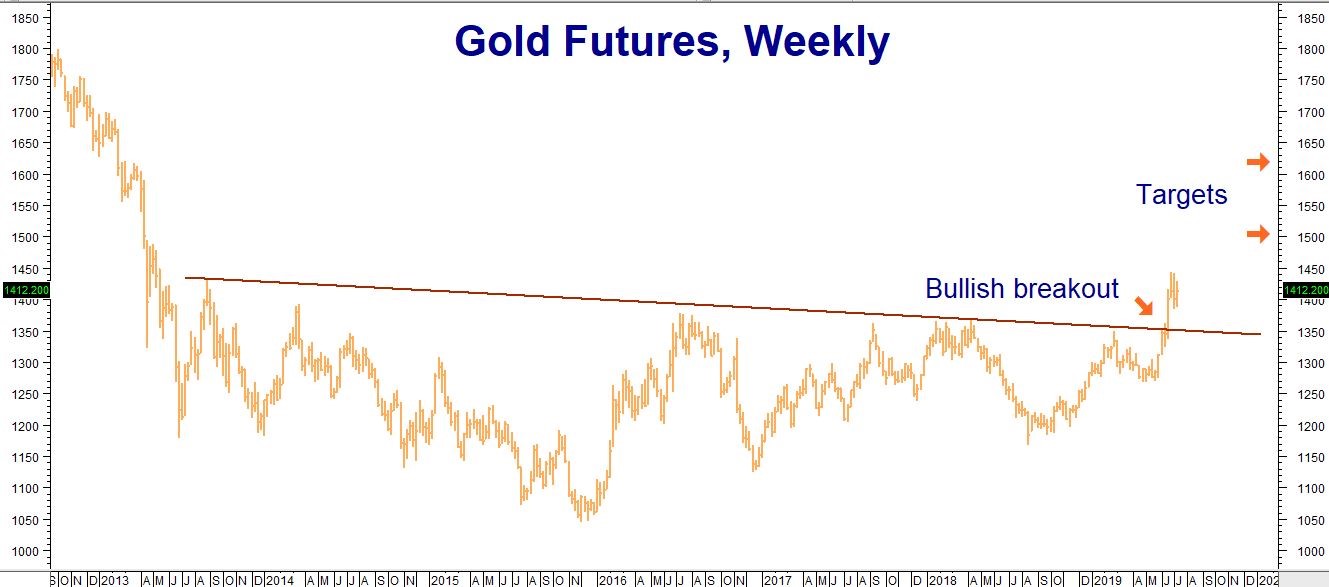

Gold continues to impress. After breaking out by slicing through both key resistance at $1,377 per ounce and a 6-year high of $1,399 per ounce, the Midas metal has hardly backed off at all. Instead, it appears to be consolidating for a move higher by chopping sideways as it works off the severely-overbought conditions caused by its powerful, late-June rally. Key resistance at $1,377 is now key support, although gold could decline as low as $1,350 per ounce without severely damaging its bullish outlook. Our second upside objective of $1,500 per ounce is now definitely in play.

Data source: Reuters

Inflation Is Supposedly Dead, So Why Is Gold Rallying?

Gold typically does well during periods of inflation, so why is it in bull mode now that inflation is considered dead by nearly everyone, including the US Federal Reserve? Why else would the Fed all but guarantee a late July rate cut with the US unemployment rate at historical lows and the stock market at historical highs? The Fed must believe it has finally solved the inflation problem and that the real problem with inflation is there isn’t enough of it. Fed Chairman Powell should be careful what he wishes for.

Analysts say a rate cut is needed to counter the potential threat of a slowdown which hasn’t materialized yet. Is the Fed so afraid of the knock-on deflationary consequences of the Trump trade wars that it feels the need to hit the accelerator now – while stocks are hitting new highs? Or is the Fed concerned that Europe’s never-ending economic malaise will spread to the US? We don’t know. What we do know is the Fed’s well-telegraphed intentions have been bullish for gold.

There are three reasons for this: 1) lower interest rates reduce the opportunity costs of holding gold; 2) gold has a thousand-year history of acting as an alternative currency; and 3) gold has historically been a hedge of last resort against global calamity. We covered the first and third reasons in our June 4th blog. The world hasn’t gotten any safer since then. The tensions with Iran in the Persian Gulf and with China in the South China Sea are higher now. Any mistake could lead to armed conflict.

Trade & Political Tensions Stoke Alternative Currency Demand

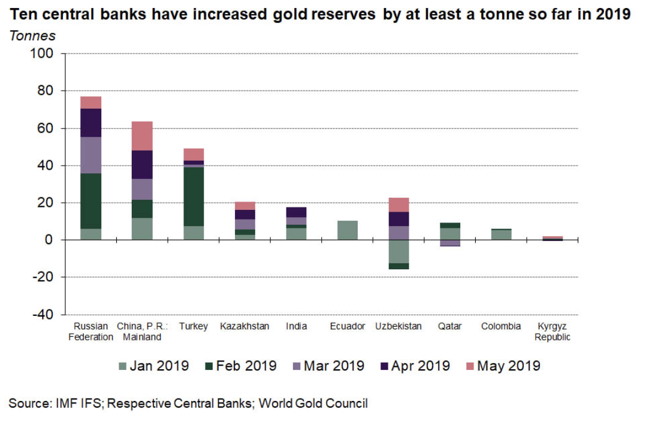

Central Bank buying is one of the biggest fundamental reasons behind gold’s latest run. According to the International Monetary Fund (IMF), central banks have purchased 247 metric tons of gold in 2019 – nearly a 73% increase from 2018. Which central banks are doing most of the buying? Russia and China. Both have been the targets of either economic sanctions (in the case of Russia) or tariffs.

One way to reduce the impact of sanctions or tariffs is to manipulate your currency. Since it is the world’s preferred reserve currency, most global business is done in dollars. Sanctions limit access to the global banking system which is dominated by dollar-based trade. One way to get around this is to trade with something besides dollars. Gold has been an alternative form of payment for millennia. Bitcoin and its crypto-cousins are the new kids on the block. Could dollar avoidance be part of what has fueled Bitcoin’s 230 percent gain (from low to high) in 2019 as well? It is certainly possible.

Source: Coindesk

Nations can also manipulate their currencies to reduce the effect of tariffs. A cheaper currency means cheaper prices for exported goods. Tariffs of 25% could be offset by reducing the value of the exporter’s home currency by an equivalent 25%. The problem with this is the buying power of the exporting nation would also be reduced by 25%.

While this is an extreme example, a country like China, for example, could mitigate the negative effects of a weaker currency engineered to offset some of the effects of the Trump tariffs by holding gold. As the yuan sinks, the value of the Bank of China’s gold holdings rises, helping to neutralize negative effects on BOC reserves and maintain overall purchasing power.

If our analysis is right, then trade and political tensions between the US and the rest of the world will continue to be good for gold, with or without inflation or a significantly weaker US dollar. Since we don’t see these tensions relaxing any time soon, we expect the Midas metal to remain in bull mode.

Platinum and Silver Remain Big Relative Bargains

History tell us that when gold rallies for an extended period, both platinum and silver eventually follow suit, often outperforming their yellow cousin over the long run. We’ve written about how cheap both platinum and silver are vis-à-vis gold before. As the Gold / Silver Ratio and Platinum – Gold Spread charts below illustrate, they both remain extremely undervalued versus the yellow metal.

Data source: FutureSource

It now takes nearly 93 ounces of silver to buy one ounce of gold. The last time silver was this cheap in relation to gold was in 1990. As the chart above illustrates, periods of extreme relative valuation tend not to last very long. When relative values are this overextended, silver has the potential to make gains, even if gold does nothing.

Let’s assume gold stays unchanged from Monday’s gold settlement price of $1,413.50 per ounce and that the gold / silver ratio declines to old swing highs of 82 ounces of silver to one ounce of gold. This would make each ounce of silver worth $17.24 cents – $1.87 per ounce higher than Monday’s close – even if gold does nothing.

Since we don’t expect gold to back off much given current tensions between the US and most of the rest of the world – and given silver’s history of catching up to and eventually surpassing gold (percentagewise) during past bull markets – we believe long positions in the poor man’s gold could be one of the most promising trades on the board right now. Factor in silver’s recent lack of volatility (which has rendered COMEX silver options surprisingly inexpensive) and you get nearly all the ingredients for a good speculation.

Things look good for RMB Group trading customers who took our suggestion in our last blog to consider purchasing December $16.00 / $17.00 or December $16.50 / $17.50 bull call spreads in COMEX silver. Today’s 36-cent rally – which has occurred while gold remained essentially flat – is certainly a move in the right direction.

Data source: Reuters

Gold has already broken out to the upside. As the chart above illustrates, silver still has a bit of work to do. A sustained move above old swing highs at $16.20 per ounce in the front futures contract could ignite an even bigger move. Our first price target remains $17.50 per ounce which we believe is achievable this year. Given today’s price action, which puts the market close to the key $16.20 level, we’re adding two more long-term upside targets at $20.00 per ounce and $23.00 per ounce.

Platinum Also Potentially Explosive

Data source: FutureSource

Prior to the 2008 recession, an ounce of platinum commanded nearly $1,200 more than an ounce of gold. Automakers shifted from using platinum in catalytic converters to using a combination of palladium and rhodium because of platinum’s high cost. Now gold costs $583 per ounce more than platinum.

Data source: FutureSource

The traditional platinum premium over gold began to reverse when automakers decided to retool and use a combination of palladium and rhodium in place of platinum. Catalytic converter demand means palladium now costs $706 per ounce more than platinum – even though platinum is a much more efficient catalyst. Currently going for roughly $3,555 per ounce, rhodium isn’t cheap either.

Data source: FutureSource

Why haven’t automakers retooled and switched back to platinum? We have no idea. However, we think it is reasonable to expect that they will be forced to if the relative valuations between the two keep diverging.

RMB Group trading customers who took our suggestion in February to buy platinum futures at $825 per ounce or lower should continue to hold. We still like long positions in the futures as long as they are backed with at least 50% margin. Platinum options are thinly traded and more difficult to trade – but not impossible. Monitor this space for potential platinum option recommendations.

Please be advised that you need a futures account to trade the markets in this post. The RMB Group has been helping its clientele trade futures and options since 1991 and are very familiar with all kinds of option strategies. Call us toll-free at 800-345-7026 or 312-373-4970 (direct) for more information and/or to open a trading account. Or visit our website at www.rmbgroup.com.

* * * * * * * *

The RMB Group

222 South Riverside Plaza, Suite 1200, Chicago, IL 60606

This material has been prepared by a sales or trading employee or agent of R.J. O’Brien & Associates (“RJO”)/RMB Group and is, or is in the nature of, a solicitation. This material is not a research report prepared by a Research Department. By accepting this communication, you agree that you are an experienced user of the futures markets, capable of making independent trading decisions, and agree that you are not, and will not, rely solely on this communication in making trading decisions.

DISTRIBUTION IN SOME JURISDICTIONS MAY BE PROHIBITED OR RESTRICTED BY LAW. PERSONS IN POSSESSION OF THIS COMMUNICATION INDIRECTLY SHOULD INFORM THEMSELVES ABOUT AND OBSERVE ANY SUCH PROHIBITION OR RESTRICTIONS. TO THE EXTENT THAT YOU HAVE RECEIVED THIS COMMUNICATION INDIRECTLY AND SOLICITATIONS ARE PROHIBITED IN YOUR JURISDICTION WITHOUT REGISTRATION, THE MARKET COMMENTARY IN THIS COMMUNICATION SHOULD NOT BE CONSIDERED A SOLICITATION.

The risk of loss in trading futures and/or options is substantial and each investor and/or trader must consider whether this is a suitable investment. Past performance, whether actual or indicated by simulated historical tests of strategies, is not indicative of future results. Trading advice is based on information taken from trades and statistical services and other sources that RJO/RMB believes are reliable. We do not guarantee that such information is accurate or complete and it should not be relied upon as such. Trading advice reflects our good faith judgment at a specific time and is subject to change without notice. There is no guarantee that the advice we give will result in profitable trades.