Poor platinum. It is one of the rarest of metals, hidden deep within the earth, making it far harder to mine than gold or silver. Platinum also boasts superior industrial properties, such as very high resistance to heat and a remarkable ability to act as a catalyst for chemical reactions.

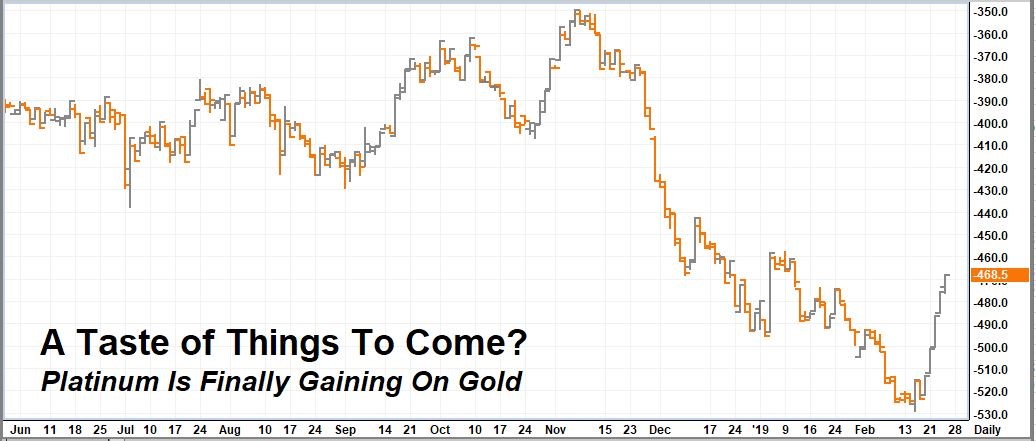

Once known as the “Rich Man’s Gold”, platinum has fallen on hard times. The former king of precious metals, once fetching $1,200 per ounce more than gold, is now a pauper. Yesterday it was trading for $468 less than its yellow cousin. We covered some of the reasons why platinum has underperformed so miserably in our blog post earlier this month. We are going to dig a little deeper in this Alert.

Data Source: FutureSource

Catalytic Converter Demand Is Critical To the Price of Platinum and Palladium

Both platinum and palladium can be used as the main catalyzing agent in vehicle catalytic converters. Platinum’s higher boiling point, superior heat, and more efficient catalytic properties means it takes less platinum to achieve the same reaction as palladium. Platinum’s higher temperature tolerance also enables it to be used where palladium cannot, like some diesel catalytic converters.

Two big events caused automakers to use a lot more palladium and much less platinum:

- Shortages caused the price of platinum to soar in 2008, exploding to a premium of nearly $1,600 per ounce over the price of palladium. (See chart below.) This made platinum much more expensive to use in the manufacture of catalytic converters than palladium, so auto manufacturers came up with an alternative. Automakers were able to combine less-efficient palladium with rhodium and achieve results slightly superior to platinum. They have stuck to that formula despite sharply rising prices for both metals.

- The Volkswagen cheating scandal of 2015 impacted platinum negatively. Engineers at VW found a way to game the way emissions on diesel-powered vehicles were recorded, resulting in emission measurements far lower than engines actually produced. Diesel cars were popular in Europe and catching on in America, but the market virtually collapsed once the details of the scandal become public.

Platinum went from costing almost $1,600 per ounce more than palladium to costing $657 less. Palladium is now so expensive that catalytic converter thefts are becoming a problem. A looming supply shortage could drive up prices further. Rhodium currently costs $2,705 per ounce – a $1,844 premium over the price of platinum. How much more expensive do palladium and rhodium need to get before carmakers decide to change back to platinum for their gasoline-powered cars? This is the million-dollar question.

Platinum’s higher heat resistance means it was still being used in diesel-powered vehicles. The effect of reduced demand for diesels caused by the VW scandal is easily visible in the chart below. Platinum has gone from a premium of $450 over palladium in 2015 to a discount of $657 under palladium now. The same type of price action is evident in the long-term gold-palladium spread chart as well.

Data Source: FutureSource

Relative Valuations Are Stretched

Relative valuations between platinum and gold, platinum and palladium, and platinum and rhodium are so stretched that a sharp reversal could occur at any time. As we noted in our February blog post, trying to play any of these spreads in the futures markets is a non-starter. They are all potential “widow-makers” capable of bankrupting an undercapitalized trader in the blink of an eye. We believe a far less volatile way to play a reversal in these ridiculously stretched relationships is to keep it simple and buy the metal that is the most undervalued: platinum. A reversal of these stretched relationships could be extremely positive for platinum as traders unwind their positions in relatively illiquid markets.

Three Things That Could Ultimately Help Platinum

- Stricter emission standards in Europe are forcing automakers to use more palladium in their catalytic converters to meet increasingly onerous testing protocols. This is helping to inflate the price of palladium – a market already plagued by huge shortages – making the switch back to platinum look better each day. Stricter emission standards for trucks in Europe should help platinum directly.

- Stricter emission standards in China are coming. China’s huge population and growing economy mean these new standards could impact the platinum / palladium relationship far more than in Europe.

- Palladium is harder and harder to get. A severe shortage of the metal is causing automakers to lease the metal from the palladium ETF, increasing the potential for a switch back to platinum.

What We Are Doing Now

RMB Group Trading Customers who took our suggestion in early February to get long platinum, either by buying the futures directly or using the platinum call options we suggested, should consider holding your positions. As the chart below indicates, platinum is trying to establish a bottom. It is oversold on an intermediate-term basis.

Last Friday’s close negated the short-term downtrend that has been in force since late January, and this week’s bullish follow-through is very encouraging. It will take a series of closes above old swing highs at $881.50 per ounce to convince us that the low is in. A breach of that level should put our other targets into play. We believe a run to $930 per ounce is possible. Take out that level and the next stop could be $1,010.

Data Source: Reuters

Another potentially bullish development is platinum’s relationship with gold. The long-term relationship displayed by the monthly chart at the beginning of this Alert looks grim, but the shorter-term view is much better.

The daily spread chart below shows platinum actually outperformed gold for the past 8 days, gaining $61.50 per ounce on its once-cheaper cousin. Could this be a signal of game-changing investment demand? Only time will tell. Platinum is much rarer than gold and has historically been more valuable – at times, far more valuable. We believe it could be the biggest bargain on the board right now. Visit www.rmbgroup.com to learn more.

Data Source: FutureSource

Please be advised that you need a futures account to trade the markets in this post. The RMB Group has been helping its clientele trade futures and options since 1991 and are very familiar with all kinds of option strategies. Call us toll-free at 800-345-7026 or 312-373-4970 (direct) for more information and/or to open a trading account. Or visit our website at www.rmbgroup.com.

* * * * * * * *

The RMB Group

222 South Riverside Plaza, Suite 1200, Chicago, IL 60606

This material has been prepared by a sales or trading employee or agent of R.J. O’Brien & Associates (“RJO”)/RMB Group and is, or is in the nature of, a solicitation. This material is not a research report prepared by a Research Department. By accepting this communication, you agree that you are an experienced user of the futures markets, capable of making independent trading decisions, and agree that you are not, and will not, rely solely on this communication in making trading decisions.

DISTRIBUTION IN SOME JURISDICTIONS MAY BE PROHIBITED OR RESTRICTED BY LAW. PERSONS IN POSSESSION OF THIS COMMUNICATION INDIRECTLY SHOULD INFORM THEMSELVES ABOUT AND OBSERVE ANY SUCH PROHIBITION OR RESTRICTIONS. TO THE EXTENT THAT YOU HAVE RECEIVED THIS COMMUNICATION INDIRECTLY AND SOLICITATIONS ARE PROHIBITED IN YOUR JURISDICTION WITHOUT REGISTRATION, THE MARKET COMMENTARY IN THIS COMMUNICATION SHOULD NOT BE CONSIDERED A SOLICITATION.

The risk of loss in trading futures and/or options is substantial and each investor and/or trader must consider whether this is a suitable investment. Past performance, whether actual or indicated by simulated historical tests of strategies, is not indicative of future results. Trading advice is based on information taken from trades and statistical services and other sources that RJO/RMB believes are reliable. We do not guarantee that such information is accurate or complete and it should not be relied upon as such. Trading advice reflects our good faith judgment at a specific time and is subject to change without notice. There is no guarantee that the advice we give will result in profitable trades.