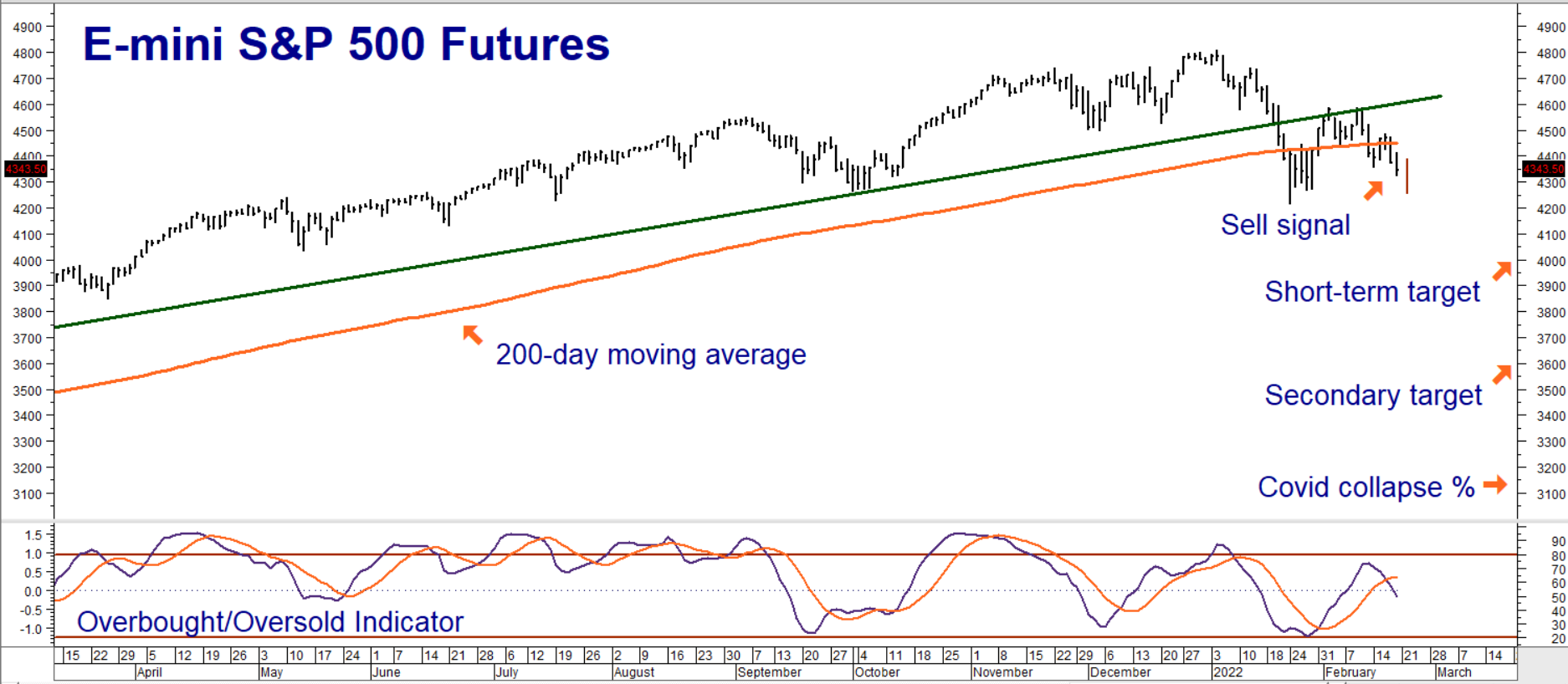

The rumblings of war in Europe grow louder. Vladimir Putin’s decision to recognize the two breakaway provinces of Donetsk and Luhansk as independent territories adds to growing evidence of his determination to attack Ukraine. The order could be given at any time. Not surprisingly, E-mini, S&P 500 futures are down sharply in the overnight session as we write this on Monday night. A sustained decline below January’s swing low of 4212.75 sets this market up for further declines.

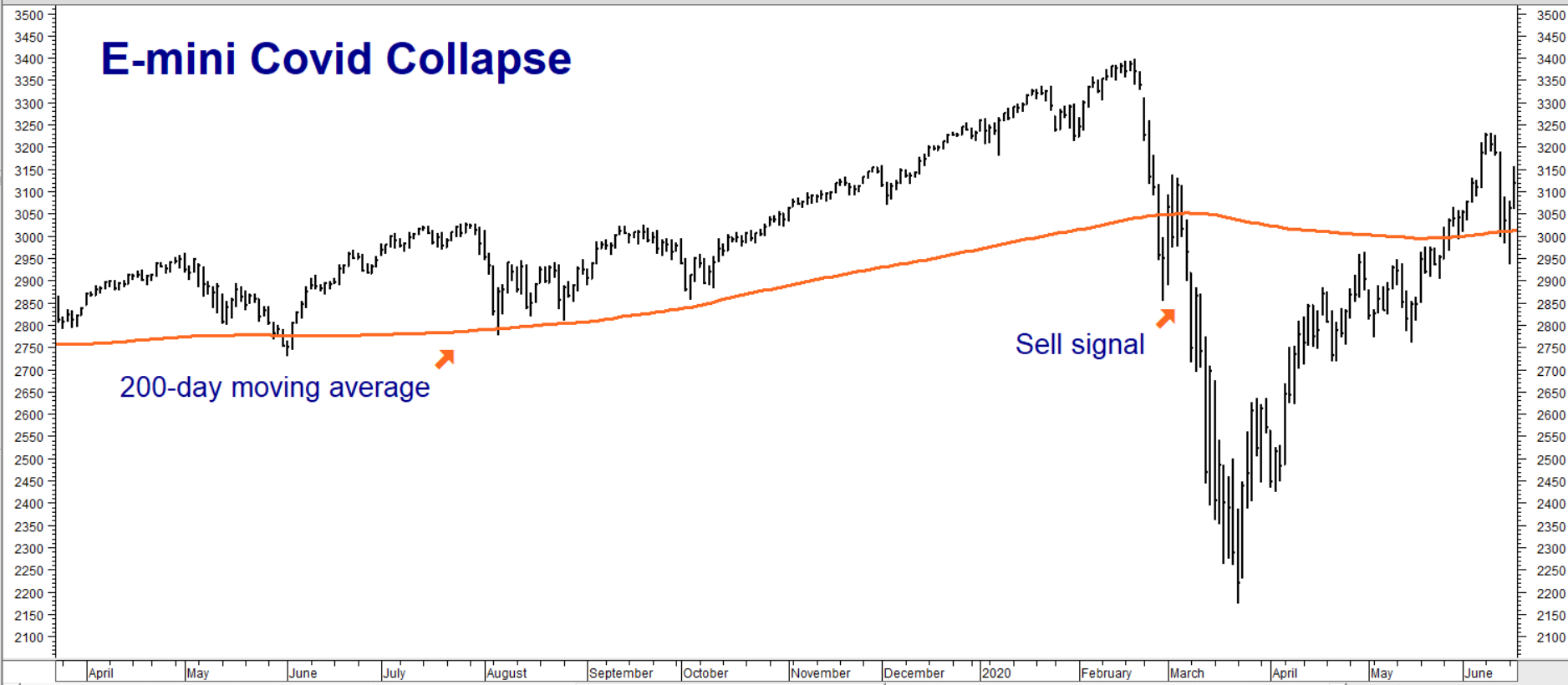

E-mini futures closed below the previous day’s low on Friday for a second consecutive day, flashing a big sell signal in the process. (See charts below.) The 2020 Covid collapse began the same way, with consecutive closes below both the previous day’s low and the 200-day moving average. An initial selloff accelerated soon after. A similar percentage collapse today would take E-mini futures as low as 3100.

Data Source: Reuters / Datastream

Covid was the “black swan” that flew over the 2020 bear market. War is the bird flexing its wings now. And while we are not expecting identical results, we’ve added a secondary, Fibonacci-derived target of 3600 to our technical outlook. This will come into play if and when our short-term target of 4000 in the March futures contract is hit. We’ll be looking to re-establish bearish positions using this new target on the bounce we believe will happen shortly after a Russian incursion.

Meanwhile, RMB Group trading customers should prepare to exit ALL their March 4100 / 3800 and March 4200 / 4000 bear put spreads once our 4000 target is hit. Like Putin’s order to attack, this could happen at any time, including the overnight session. Prices are changing rapidly with events, so contact your RMB Group trading professional for the latest.

Data Source: Reuters / Datastream

Please be advised that you need a futures account to trade the markets in this post. The RMB Group has been helping our clientele trade futures and options since 1991. RMB Group brokers are familiar with the option strategies described in this report. Call us toll-free at 800-345-7026 or 312-373-4970 (direct) for more information and/or to open a trading account. Or visit our website at www.rmbgroup.com. Want to know more about trading futures and options? Download our FREE Report, the RMB Group “Short Course in Futures and Options.”

* * * * * * * *

The RMB Group

222 South Riverside Plaza, Suite 1200, Chicago, IL 60606

This material has been prepared by a sales or trading employee or agent of R.J. O’Brien & Associates (“RJO”)/RMB Group and is, or is in the nature of, a solicitation. This material is not a research report prepared by a Research Department. By accepting this communication, you agree that you are an experienced user of the futures markets, capable of making independent trading decisions, and agree that you are not, and will not, rely solely on this communication in making trading decisions.

DISTRIBUTION IN SOME JURISDICTIONS MAY BE PROHIBITED OR RESTRICTED BY LAW. PERSONS IN POSSESSION OF THIS COMMUNICATION INDIRECTLY SHOULD INFORM THEMSELVES ABOUT AND OBSERVE ANY SUCH PROHIBITION OR RESTRICTIONS. TO THE EXTENT THAT YOU HAVE RECEIVED THIS COMMUNICATION INDIRECTLY AND SOLICITATIONS ARE PROHIBITED IN YOUR JURISDICTION WITHOUT REGISTRATION, THE MARKET COMMENTARY IN THIS COMMUNICATION SHOULD NOT BE CONSIDERED A SOLICITATION.

The risk of loss in trading futures and/or options is substantial and each investor and/or trader must consider whether this is a suitable investment. Past performance, whether actual or indicated by simulated historical tests of strategies, is not indicative of future results. Trading advice is based on information taken from trades and statistical services and other sources that RJO/RMB believes are reliable. We do not guarantee that such information is accurate or complete and it should not be relied upon as such. Trading advice reflects our good faith judgment at a specific time and is subject to change without notice. There is no guarantee that the advice we give will result in profitable trades.