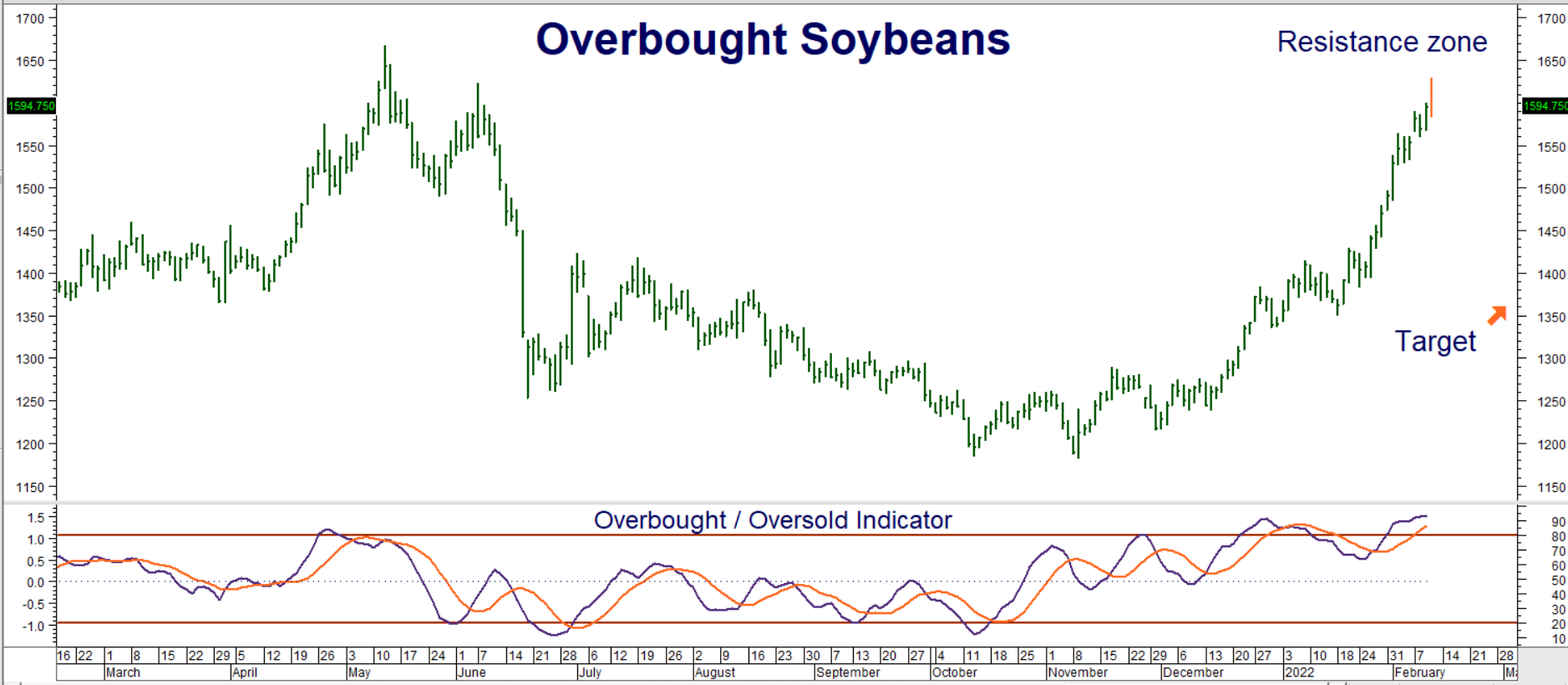

Soybeans started today’s session strong. Follow-through buying from yesterday’s bullish World Supply & Demand Estimate (WASDE) release sent prices right through last May’s $16.23 per bushel high with ease. The USDA reduced estimates for both the soon-to-arrive Brazilian crop and for overall global stockpiles. But this upside momentum did not last long. Front contract soybean futures finished sharply lower. Is this the beginning of a classic “blow-off” in beans?

Soybeans soared 34% — from a low of $12.17 per bushel in late November to this morning’s high of $16.33 – in just 10 weeks. We believe beans have now fully priced in bad South American weather and are overdue for a significant correction, starting as soon as today. Beans were unable to penetrate the big resistance zone between last spring’s two highs and appear poised to test support down at the $13.60 level. This anticipates a classic 61.8% retracement of the current bull move.

Data Source: Reuters/Datastream

A lot depends on Mother Nature. It’s make-or-break time for the Argentine crop in particular. Big exports to China have also kept a floor under soybeans. However, the South American harvest will soon become yesterday’s news and the focus will shift to this year’s North American crop. The market is providing an excellent opportunity for North American growers to lock in high prices. We expect them to plant fencepost-to-fencepost this spring.

Falling Financials Can Drag Commodities Down

Correlations can revert to “1” in bear markets. A collapse in traditional investments like stocks and bonds forces investors to reassess their risk tolerance. Fear is a much more powerful emotion than greed. This can lead to bouts of selling in virtually everything. Overextended markets like soybeans are particularly vulnerable. Stocks and bonds are getting hammered hard today. Soybeans and most other commodities are following.

RMB Group trading customers may want to consider buying July $14.20 soybean puts while simultaneously selling an equal number of July $13.60 puts for a net premium of $600 or less. Look for prices to hit our target prior to option expiration on June 24, 2022.

Your maximum risk is the net amount paid for these “bear put spreads” plus transaction cost. Each spread has the potential to be worth as much as $3,000. Exit all positions if and when our downside target is hit. Prices can and will change, so contact your RMB Group trading professional for the latest.

Please be advised that you need a futures account to trade the markets in this post. The RMB Group has been helping our clientele trade futures and options since 1991. RMB Group brokers are familiar with the option strategies described in this report. Call us toll-free at 800-345-7026 or 312-373-4970 (direct) for more information and/or to open a trading account. Or visit our website at www.rmbgroup.com. Want to know more about trading futures and options? Download our FREE Report, the RMB Group “Short Course in Futures and Options.”

* * * * * * * *

The RMB Group

222 South Riverside Plaza, Suite 1200, Chicago, IL 60606

This material has been prepared by a sales or trading employee or agent of R.J. O’Brien & Associates (“RJO”)/RMB Group and is, or is in the nature of, a solicitation. This material is not a research report prepared by a Research Department. By accepting this communication, you agree that you are an experienced user of the futures markets, capable of making independent trading decisions, and agree that you are not, and will not, rely solely on this communication in making trading decisions.

DISTRIBUTION IN SOME JURISDICTIONS MAY BE PROHIBITED OR RESTRICTED BY LAW. PERSONS IN POSSESSION OF THIS COMMUNICATION INDIRECTLY SHOULD INFORM THEMSELVES ABOUT AND OBSERVE ANY SUCH PROHIBITION OR RESTRICTIONS. TO THE EXTENT THAT YOU HAVE RECEIVED THIS COMMUNICATION INDIRECTLY AND SOLICITATIONS ARE PROHIBITED IN YOUR JURISDICTION WITHOUT REGISTRATION, THE MARKET COMMENTARY IN THIS COMMUNICATION SHOULD NOT BE CONSIDERED A SOLICITATION.

The risk of loss in trading futures and/or options is substantial and each investor and/or trader must consider whether this is a suitable investment. Past performance, whether actual or indicated by simulated historical tests of strategies, is not indicative of future results. Trading advice is based on information taken from trades and statistical services and other sources that RJO/RMB believes are reliable. We do not guarantee that such information is accurate or complete and it should not be relied upon as such. Trading advice reflects our good faith judgment at a specific time and is subject to change without notice. There is no guarantee that the advice we give will result in profitable trades.