“Don’t fight the Fed,” should be the operative rule in the S&P 500. Jerome Powell and Company signaled they were going to take the free-money punch bowl away. The told us they were going to raise interest rates, stop buying treasuries and trim their balance sheet. But as we pointed out in our late December blog post, stock market investors weren’t listening. They still aren’t.

Stock players viewed last Monday’s 4% decline as just another opportunity to buy, oblivious to the absence of the punchbowl and also the “Fed Put.” The Fed is telling us – in plain English this time – that its concern is not protecting financial assets like stocks and bonds, but the real economy. The Fed’s goal now is to tame inflation – the beast that supply chain issues, fiscal stimulus cash, and its own easy money policies have unleased on real people who need to buy food, gas their cars, and keep a roof over their heads.

Expected rate increases for 2022 went from virtually zero three months ago to potentially five now. Some are predicting increases greater than the Fed’s standard 25 basis points a pop. Yet the market soldiers on. Old habits remain. Buying the dip worked well when the Fed was the stock investor’s friend and near-zero yields in safe money instruments (like CDs) meant there really wasn’t any alternative. Things will be very different as soon as next month.

Current Rally is Opportunity to Re-establish Hedges

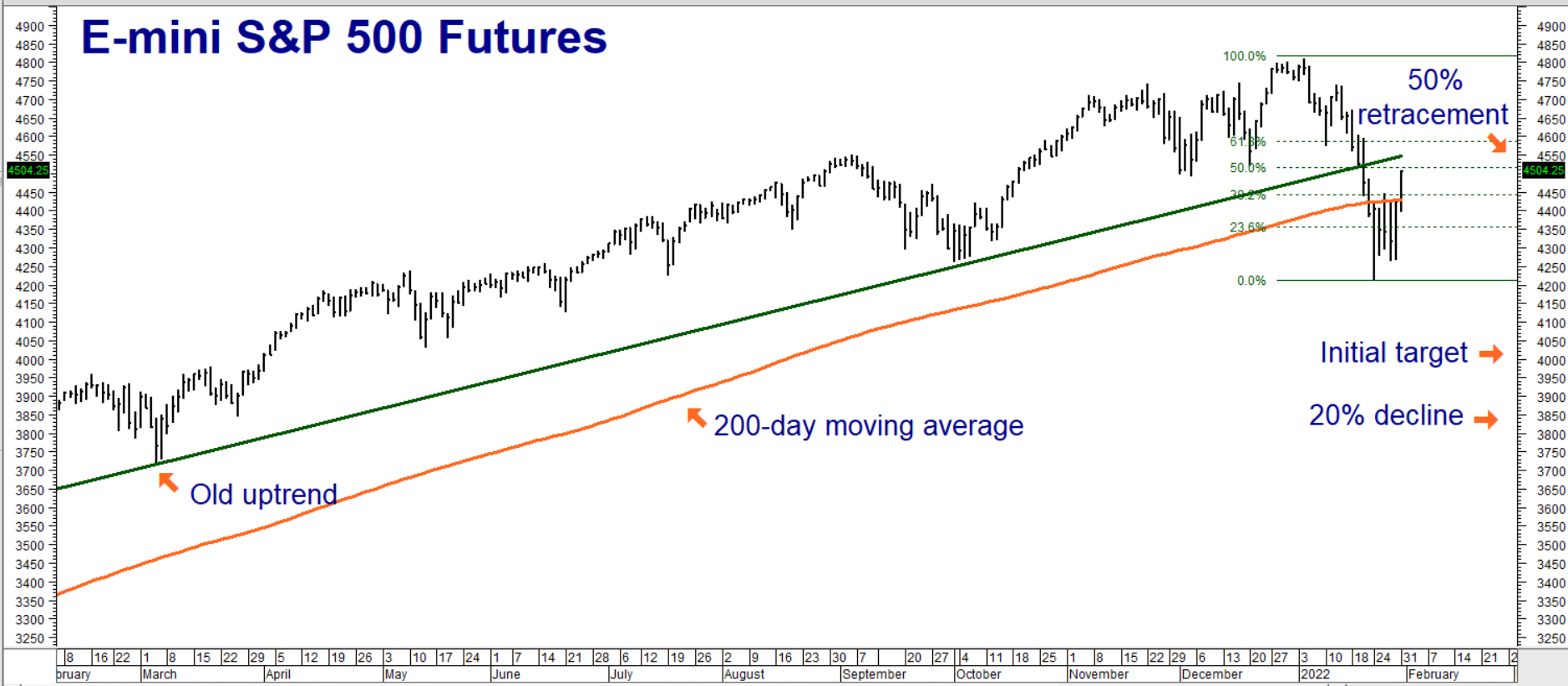

E-mini, S&P 500 futures bounced as high as 4507 yesterday – or roughly 6.5% higher than the 4212 low on January 24th. In our blog post that same day, we suggested exiting half of our bearish March 4100 / 3800 bear put spread hedges in the E-mini, S&P 500 futures for $2,500 or more. The market gave us plenty of opportunities to do so the next day. The current rally is providing us with another opportunity.

As we noted in our last post, “Capitulations are often followed by huge “up” days that fool folks looking for hope.” The bounce from last week’s decline has now retraced 50% of the corrective decline that started the new year. E-mini futures closed above the 200-day moving average yesterday, giving the bulls plenty of hope. It also gives us a fighting chance to re-establish the bearish positions we exited last week. We’ll use slightly different strike prices this time.

Data Source: Reuters/Datastream

RMB Group trading customers may want to consider buying March 4200 E-mini, S&P 500 puts while simultaneously selling an equal number of March 4000 E-mini puts for $950 or less. Look for the market to hit our revised short-term objective of 4000 in the March futures contract prior to March option expiration on March 18, 2022. Our maximum risk is the price we pay for our spreads plus transaction cost. Each has the potential to be worth as much as $10,000. Prices can change, so contact your RMB Group trading professional for the latest.

$15.00 Target Hit in Soybeans; Exit All Bullish Positions

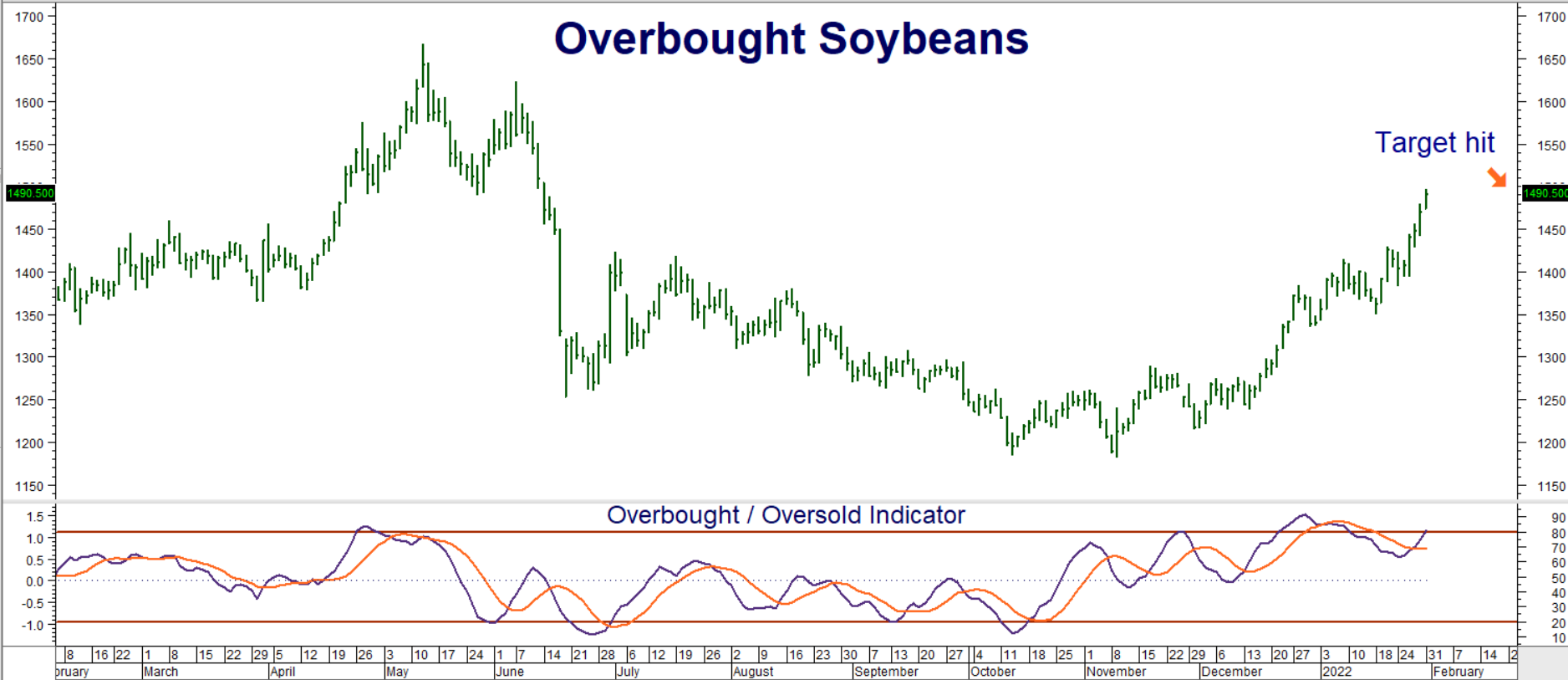

May soybean futures hit our $15.00 per bushel target in Sunday’s overnight session and again during Monday’s regular session. RMB Group trading customers who followed our suggestion to buy purchase May $14.00 / $15.00 bull call spreads in soybeans for $750 or less should consider exiting all of your positions now. These spreads settled yesterday at $2,750 each.

Dry weather in Southern Brazil and Argentina did what we expected and lowered yields. The focus will shift back to the Northern Hemisphere and the American crop as soon as the South American harvest is complete. We believe American farmers will plant “fencepost to fencepost” given today’s high prices. Chinese consumption could also suffer due to Covid and other factors. The IMF expects China’s GDP to slow from 5.7% to 4.8% in the coming year. Our next move in this market will probably be on the short side. Soybeans are very overbought, so stay tuned.

Data Source: Reuters/Datastream

Please be advised that you need a futures account to trade the markets in this post. The RMB Group has been helping our clientele trade futures and options since 1991. RMB Group brokers are familiar with the option strategies described in this report. Call us toll-free at 800-345-7026 or 312-373-4970 (direct) for more information and/or to open a trading account. Or visit our website at www.rmbgroup.com. Want to know more about trading futures and options? Download our FREE Report, the RMB Group “Short Course in Futures and Options.”

* * * * * * * *

The RMB Group

222 South Riverside Plaza, Suite 1200, Chicago, IL 60606

This material has been prepared by a sales or trading employee or agent of R.J. O’Brien & Associates (“RJO”)/RMB Group and is, or is in the nature of, a solicitation. This material is not a research report prepared by a Research Department. By accepting this communication, you agree that you are an experienced user of the futures markets, capable of making independent trading decisions, and agree that you are not, and will not, rely solely on this communication in making trading decisions.

DISTRIBUTION IN SOME JURISDICTIONS MAY BE PROHIBITED OR RESTRICTED BY LAW. PERSONS IN POSSESSION OF THIS COMMUNICATION INDIRECTLY SHOULD INFORM THEMSELVES ABOUT AND OBSERVE ANY SUCH PROHIBITION OR RESTRICTIONS. TO THE EXTENT THAT YOU HAVE RECEIVED THIS COMMUNICATION INDIRECTLY AND SOLICITATIONS ARE PROHIBITED IN YOUR JURISDICTION WITHOUT REGISTRATION, THE MARKET COMMENTARY IN THIS COMMUNICATION SHOULD NOT BE CONSIDERED A SOLICITATION.

The risk of loss in trading futures and/or options is substantial and each investor and/or trader must consider whether this is a suitable investment. Past performance, whether actual or indicated by simulated historical tests of strategies, is not indicative of future results. Trading advice is based on information taken from trades and statistical services and other sources that RJO/RMB believes are reliable. We do not guarantee that such information is accurate or complete and it should not be relied upon as such. Trading advice reflects our good faith judgment at a specific time and is subject to change without notice. There is no guarantee that the advice we give will result in profitable trades.