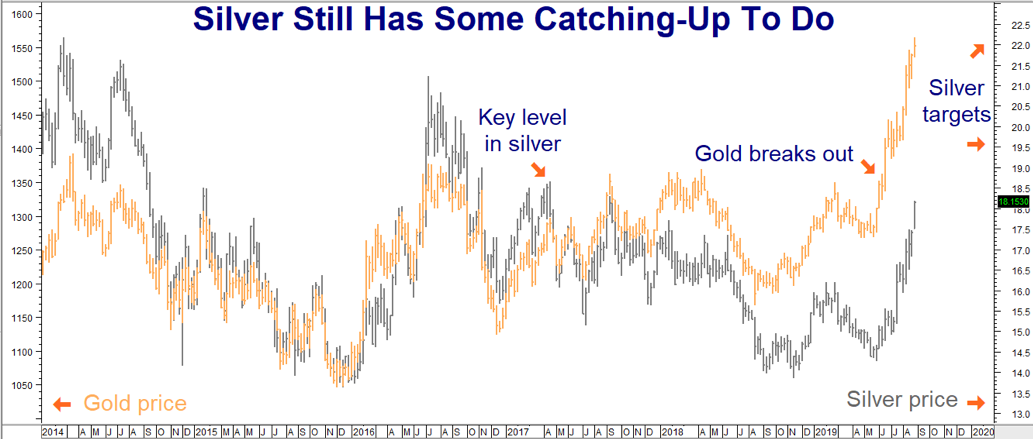

Silver’s big “catch-up” rally appears to have begun. The poor man’s gold sprinted out of the gate this morning and hasn’t looked back, soaring as much as 52 cents as we write this. Gold is up as well but silver is beating it soundly on a percentage basis. We’ve been bullish on precious metals in general and silver in particular for nearly all of 2019 but gold has been the superstar up until today.

Data Source: Reuters/Datastream

Data Source: Reuters/Datastream

Silver made up a lot of ground earlier but as the chart above suggests, it still has some catching-up to do. Gold’s poorer cousin has yet to break out to the upside like gold, but today’s price action certainly gets it closer.

Silver hit our $17.50 per ounce target yesterday and appears poised to make a run at our next objective of $19.50 per ounce. However it needs to clear multiple bands of resistance first. A few solid closes above $18.66 would set the stage for a nice move higher. That said, silver does have an annoying habit of reversing just when it looks the most promising.

We certainly do not want RMB Group trading customers who followed suggestions to buy December 2019, July 2020 and December 2020 bull call spreads we’ve been recommending to exit the market entirely. However, it may be the time to take a little cash off the table if you own more than one bullish position in silver. Most of the spreads we’ve recommended have either risen to twice our original entry levels or are close to it. Exiting a few here would reduce and in even eliminate your original risk. You may be able to lock-in in a small gain as well.

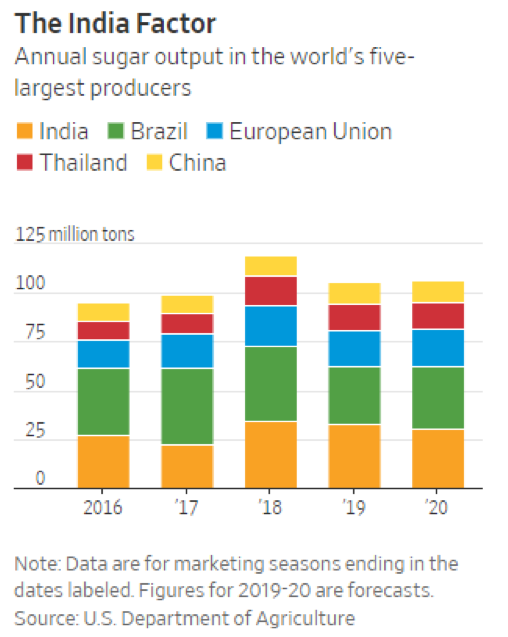

Sugar Flirting With Downside Breakout

A glut in India and the crashing Real in Brazil are weighing heavily in the sugar market. These two nations are the number 2 and number 1 exporters of the sweet stuff respectively, so what happens in both can have big impact on price. RMB trading customers who followed our suggestion back in April to take advantage of historically low volatility in the sweet stuff by purchasing both puts and calls have benefited from sugar’s decline by virtue of the October 12-cent puts they own. However, with only 19 days left until expiration, these puts are nearing the end of their lives.

A glut in India and the crashing Real in Brazil are weighing heavily in the sugar market. These two nations are the number 2 and number 1 exporters of the sweet stuff respectively, so what happens in both can have big impact on price. RMB trading customers who followed our suggestion back in April to take advantage of historically low volatility in the sweet stuff by purchasing both puts and calls have benefited from sugar’s decline by virtue of the October 12-cent puts they own. However, with only 19 days left until expiration, these puts are nearing the end of their lives.

The technical (chart-based) picture for sugar look extremely bearish. Sugar has been making series of lower lows and lower highs since June. It is certainly possible that the sweet stuff could hit our original objective by the expiration of our in-the-money October 12-cent puts on 9/16/2019. However it also possible that sugar could rally in the same timeframe, threatening the relatively modest paper gains this position has accumulated in the past couple of days.

Data Source: Reuters/Datastream

Data Source: Reuters/Datastream

Should you swing for the fences and count on a continuation of this move lower? Or should you let discretion prove the better part of valor and exit with our capital intact? The answer is easy for those who own more than one of these soon-to-expire puts; consider exiting half or more and let the other half (or fewer) ride.

It’s trader’s choice for those who own only one. Are you conservative or more of a risk-taker? Choose the option best suited to your personality. There is no wrong answer here.

Please be advised that you need a futures account to trade the markets in this post. The RMB Group has been helping its clientele trade futures and options since 1991 and are very familiar with all kinds of option strategies. Call us toll-free at 800-345-7026 or 312-373-4970 (direct) for more information and/or to open a trading account. Or visit our website at www.rmbgroup.com.

* * * * * * * *

The RMB Group

222 South Riverside Plaza, Suite 1200, Chicago, IL 60606

This material has been prepared by a sales or trading employee or agent of R.J. O’Brien & Associates (“RJO”)/RMB Group and is, or is in the nature of, a solicitation. This material is not a research report prepared by a Research Department. By accepting this communication, you agree that you are an experienced user of the futures markets, capable of making independent trading decisions, and agree that you are not, and will not, rely solely on this communication in making trading decisions.

DISTRIBUTION IN SOME JURISDICTIONS MAY BE PROHIBITED OR RESTRICTED BY LAW. PERSONS IN POSSESSION OF THIS COMMUNICATION INDIRECTLY SHOULD INFORM THEMSELVES ABOUT AND OBSERVE ANY SUCH PROHIBITION OR RESTRICTIONS. TO THE EXTENT THAT YOU HAVE RECEIVED THIS COMMUNICATION INDIRECTLY AND SOLICITATIONS ARE PROHIBITED IN YOUR JURISDICTION WITHOUT REGISTRATION, THE MARKET COMMENTARY IN THIS COMMUNICATION SHOULD NOT BE CONSIDERED A SOLICITATION.

The risk of loss in trading futures and/or options is substantial and each investor and/or trader must consider whether this is a suitable investment. Past performance, whether actual or indicated by simulated historical tests of strategies, is not indicative of future results. Trading advice is based on information taken from trades and statistical services and other sources that RJO/RMB believes are reliable. We do not guarantee that such information is accurate or complete and it should not be relied upon as such. Trading advice reflects our good faith judgment at a specific time and is subject to change without notice. There is no guarantee that the advice we give will result in profitable trades.