And the award for the weakest major currency on board goes to… the Japanese Yen. Exploding deficits, mind boggling quantitative easing and a negative GDP have been too much for the Japanese currency to handle. Add in a Prime Minister Shinzo Abe’s call for snap election and you have the perfect formula for a big decline.

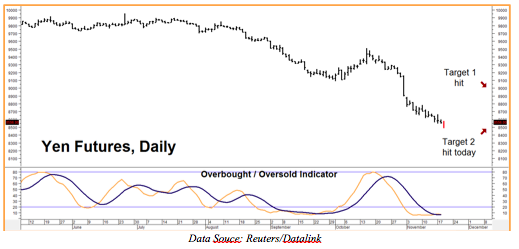

The yen is lower again today, trading below our the second downside target of 0.08500 we established in Alert #32 back in mid-October (Click here to read.) We believe the yen could go a lot lower over the long haul. A collapse to .00500 (200 yen to the dollar) is not out of the question. Nevertheless, the yen is extremely oversold on both a daily and weekly basis and is getting to be a very “crowded” trade.

While yen could drop as low as 0.008350 near term, we are going to stick with our original target and advise selling (exiting) all remaining December and March put options, looking for an upward correction to re-establish and perhaps even get more aggressive with new bearish positions.

Foreign currencies can move fast so check with your personal RMB Group broker for the latest. If you don’t have an RMB Group trading account and would like to know more about this or any other “Big Move” strategy, call 800-345-7026 toll free or 312-373-4970 direct. You can also email suerutsen@rmbgroup.com or visit us online at www.rmbgroup.com.