The dollar is undergoing a huge correction this morning in collaboration with the huge decline in Europe and the continuation of the big selloff in US stocks. It may be a tough day for stock investors, but today’s turmoil is providing us with a nice opportunity to tip toe back into the short side of the Japanese yen.

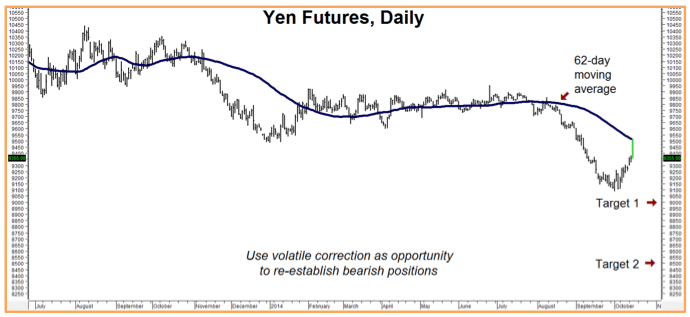

If you are a conservative trader and followed our suggestion to take some cash off the table a little less than a month ago (Alert #28), you’ve been on the sidelines waiting for the yen’s short term oversold condition to resolve itself. Today’s rally ran prices right up to the 62- day moving average and halted, providing us with a nice entry point for new bearish positions.

Our reasons for maintaining bearish positions in the yen remain the same. Here’s a quick excerpt from our soon to be released Special Report on the bubble in the Japanese debt market:

“At nearly 227% of Gross Domestic Product Japan’s (GDP), Japanese government debt is potentially more destabilizing than that of any other developed nation. Debt is so high that the International Monetary Fund (IMF) deemed it “unsustainable” and called upon Japan to bring it under control.

“But the Land of the Rising Sun is doing the opposite…

“Japan’s most recent budget calls for roughly 50% of new spending to be financed from taxes – 24% of which it will spend on interest for bonds already outstanding.

The other 50% will come from newly-issued bonds, adding even more debt to an already unsustainable load. The math doesn’t work unless Japan can either 1) conjure up the mother of all economic recoveries, or 2) devalue its currency enough to reduce the real value of outstanding debt to manageable levels. Japan’s shrinking population and centuries-old distaste for immigration mean the former is unlikely.

“Prime Minister Shinzo Abe is having a little more success with the latter. His weak yen policy has managed to slice 31% of the yen’s value versus the dollar in just three years. The yen will need to fall much further in order to make a significant dent in Japan’s real debt load. Two hundred yen to the dollar – $0.005000 or 1.2 cent per yen if you trade futures – is not an unreasonable long-term target.

“If you’ve been following our “Big Move Trade Alerts” and “Special Reports” you know that we’ve been bearish on the yen for a long time – and remain so for numerous reasons. Our intermediate term target of .009200 has already been hit. Our next intermediate downside objectives are.009000 and .008500.

Put options in the yen are surprisingly inexpensive considering today’s huge spike in volatility. If you are an RMB Group trading customer you make want to consider purchasing March yen puts.

The put we are recommending is currently going for $1,125. This, plus transaction cost, is your total risk. It will be worth at least $2,500 should the yen drop to our .009000 objective prior to option expiration on March 16, 2015 and at least $8,750 on a decline to our second target of .008500.

Prices can and do change, so customers should check with their personal RMB Group broker for the latest. If you don’t have an RMB Group trading account and would like to know more about this or any other “Big Move” strategy we are currently recommending, give us a call at 800-345-7026 toll free or 312-373-4970 direct. You can also email suerutsen@rmbgroup.com or visit us online at www.rmbgroup.com.

Important Corn Update: Don’t look now, but the drought in Brazil could be helping to put a bottom in the “new gold.” Harvest time here is planting time in South America. Both corn and soybeans could be heavily impacted if it doesn’t rain soon.

Corn is starting to improve from a technical perspective as well. Recent price action has negated it 5-month downtrend (see chart below) and yesterday’s close above the 62-day moving average – an indicator that has been stellar in defining both bull and bear markets in corn – is positive.

If you didn’t take our recommendation to buy long term call options outlined in our Special Report, Investing in the New Gold: Protein , it’s still not too late to do so. Call your personal broker or use the contact info above for our latest recommendations.