The worst drought in decades continues to crimp sugar supply in South America. Prices were sent skyward Tuesday following a retest of contract lows (see chart below) by the announcement by a Brazilian trade group that production fell sharply. Sugar producers in Brazil — the world’s numero uno producer – announced they produced 17% less of the sweet stuff than a year ago. Heavily short commodity funds were forced to cover, beginning what could be a significant technical turnaround in this market.

The bulls were given another boost yesterday when the International Sugar Organization (ICO) announced a big reduction in surpluses for the coming crop year. Production is expected to exceed demand by 473K metric tons – down 64% from the previous estimate.

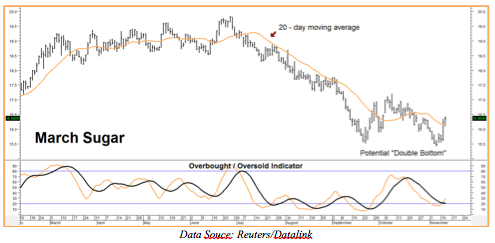

The chart is starting to show some stability as well. Sugar appears to be forming a classic “double bottom” which would be confirmed by a series of closes over 17.20 cents in the March futures contract. Higher closes above the 20 day moving average both Tuesday and Wednesday are supportive as well.

If you took our suggestion in Alert #30 to buy calls, things are definitely getting brighter. If not, now may be a good time to dip your fingers into the sugar bowl.

We are looking at May call options currently costing a little less than $700. These options will be worth at least $5,600 should the sweet stuff reach our 22.00 cents per pound objective prior to option expiration on April 15, 2014. Our risk point is two consecutively lower closes below old contract lows.

Check with your personal RMB Group broker for the latest. If you don’t have an RMB Group trading account and would like to know more about this or any other “Big Move” strategy, call 800-345-7026 toll free or 312-373-4970 direct. You can also email suerutsen@rmbgroup.com or visit us online at www.rmbgroup.com.