Soybeans hit our upside target of $10.60 per bushel last week, supported by Chinese demand and buying from large commodity funds. Corn and sugar have not hit our upside targets yet, but are doing well. Driven by ‘zero” interest rates, investors are flocking to anything that looks like it could perform during periods of inflation. What we’ve been predicting has finally arrived. Commodities are hot. They could get even hotter as new money flocks in.

Agricultural commodities have joined gold and silver and appear to be benefiting from capital looking for legitimate inflation hedges. Big rallies in gold and silver made them expensive in a hurry. Agricultural commodities were dirt cheap until very recently – and some still are. But that number is shrinking as more investors build inflation into their decisions.

This is what we wrote in our blog post recommending soybeans in mid-August:

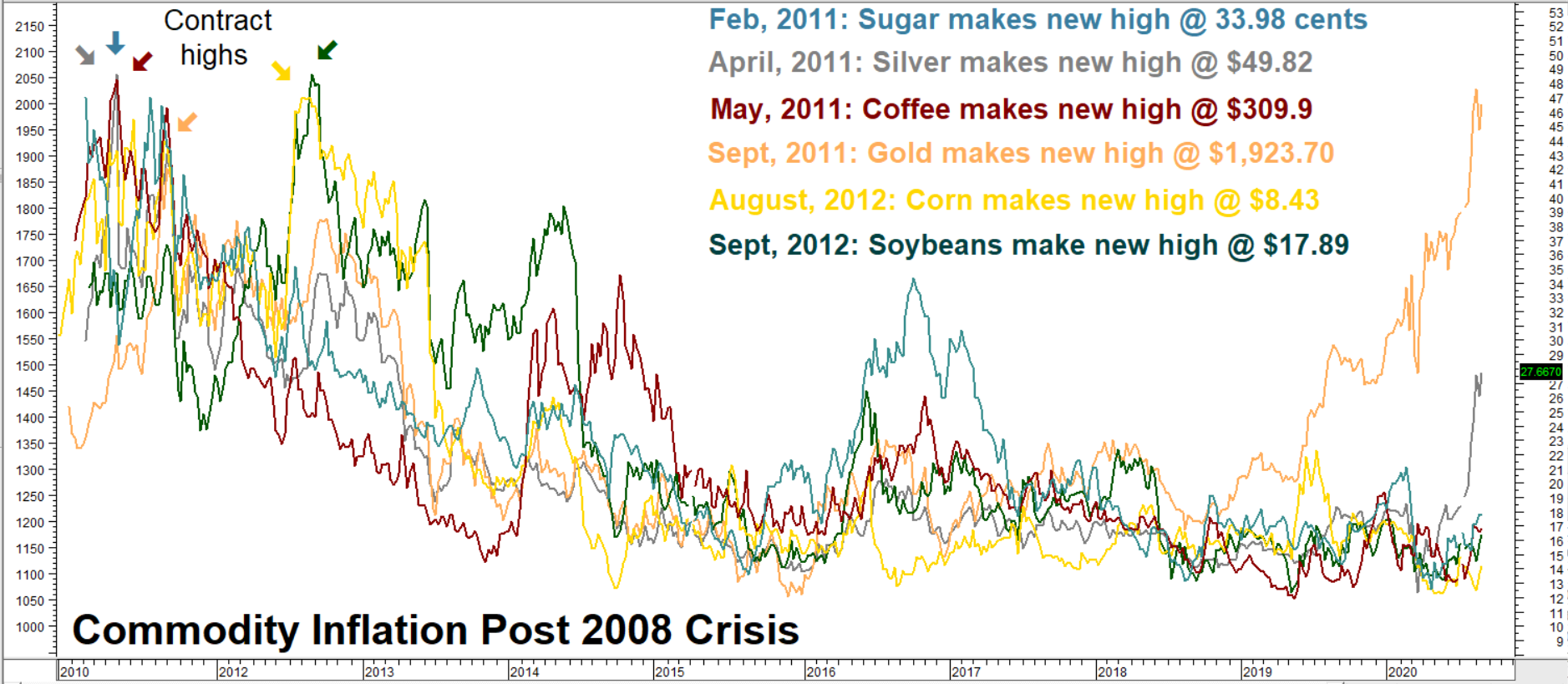

“… Fueled by a weak dollar borne of artificially-low interest rates and months of aggressive Quantitative Easing (QE), commodities soared in 2011 and 2012, with many markets posting all-time highs that still stand.

“While supply and demand played a role in the 2012 soybean bull, it was the Fed’s weak dollar policies which set the stage for their ultimate explosiveness. As the chart (below) illustrates, sugar, silver, coffee, gold, corn (as well as other key commodities not on the chart) joined soybeans in making new contract highs. Even more powerful weak dollar policies today could result in a similar scenario for many of the same commodities.

“Commodities are priced in dollars. It takes more dollars to purchase an equivalent amount of any commodity when the greenback is weak. This is a key reason why the contract highs in all of the commodities shown in the “Commodity Inflation Post 2008” chart above correspond to a particularly weak period for the US dollar. (See chart below.)”

Data Source: Reuters/Datastream

Commodities are surging, driven by some of the same factors that caused them to rally after the 2008/2009 recession. We had a feeling we would feature the chart above again…just not so soon. Virtually no one had an interest in the agricultural commodity sector as an inflation hedge three months ago – and yet here we are.

Corn and soybeans are in the midst of powerful, counter seasonal rallies. Sugar keeps rising despite major fundamental headwinds. The chart above may be telling us that we are in the early innings of a bull market in agricultural commodities which could rival the gains of 2011 and 2012. Add exploding global population and climate change into the mix, and who knows how high some key commodities could climb.

Let’s review some of our bullish recommendations:

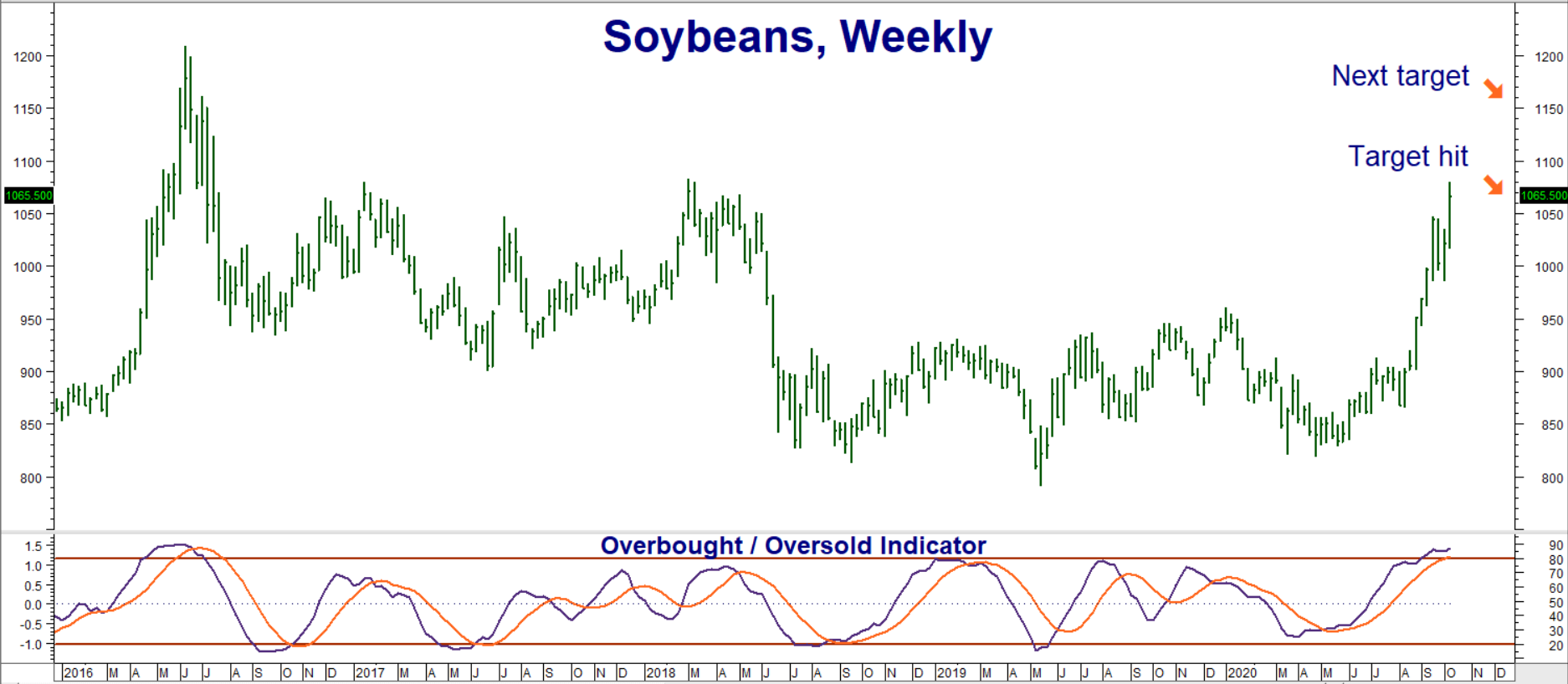

Soybeans: Exit Bull Spreads, Get Ready to Buy Pull-Backs

Soybeans hit our upside target of $10.60 per bushel last week. The front-month November futures contract settled at $10.65 on Friday. July 2021 futures finished the week at $10.45. Our target price was based on a rolling front month contract, so that’s the signal we are using. We expected “beans” to rally, but definitely not as quickly as they have. (We would have been better off in the November options, but will take the results, hindsight notwithstanding.)

The good news is soybeans soared on what would have normally been a mildly bullish USDA report on Friday. The July $9.80 / $10.60 bull call spreads we suggested buying for $675 or less back in mid-August finished the day at $1,768 each. Now that our target is hit, RMB Group trading customers should consider exiting all of your remaining bull spreads if you haven’t already.

As the chart below illustrates, soybeans are overbought and running into resistance. Get ready to re-enter bullish positions on a corrective pull-back. Our next upside target is $11.50 per bushel in the front futures contract.

Data Source: Reuters/Datastream

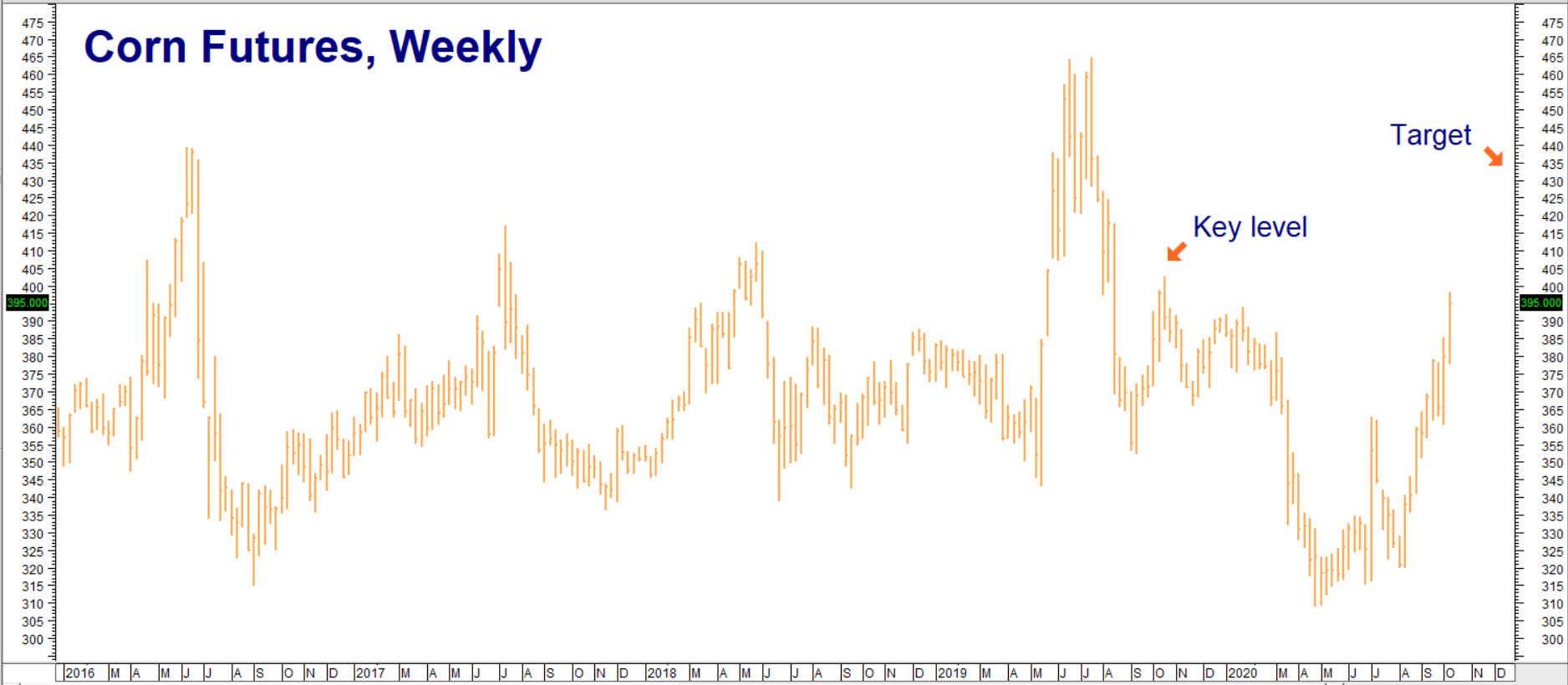

Corn: Exit Half Your Calls & Play With “House” Money

Like soybeans, corn rose sharply on Friday’s mildly bullish USDA crop report. And like soybeans, corn is rising in the midst of the harvest, which is typically the weakest seasonal period. This is extremely encouraging. Front month futures took out the old swing highs of $3.63 per bushel in early September. They are poised to do the same with the next key level of $4.03. A series of positive closes over this will set the stage for an assault on our upside target of $4.35.

However, we need to be aware that the $4.00 per bushel level marks the beginning of solid resistance that has stopped many rallies in the past. (See chart below.) RMB Group trading customers who took our suggestion in our late August blog post to buy December $3.60 corn calls for $650 or thereabouts may want to consider exiting half of their positions at twice their original entry price or higher. You will take your initial risk off the table in the process. Consider holding the other half to capitalize on a move to our $4.35 target. These calls settled for $1,843 on Friday.

Data Source: Reuters/Datastream

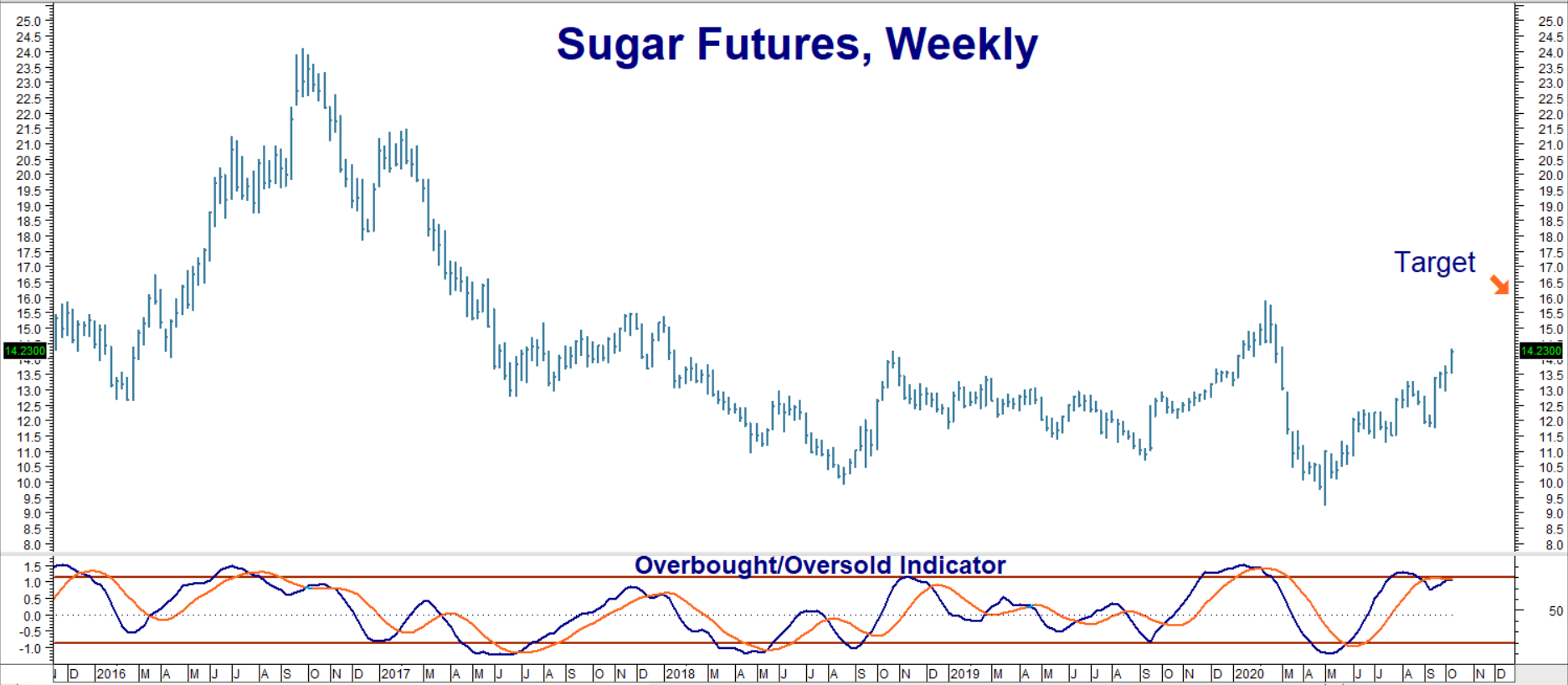

Take Initial Risk “Off the Table” in Sugar

Sugar was one of the first commodities to make new contract highs following the 2008/2009 recession, beating gold by nearly six months. And while it may be less jumpy this time, the sweet stuff is performing well despite typically bearish factors like a weak Brazilian real and low energy prices. Brazil is the world’s largest sugar producer. It also generates its ethanol from sugar rather than corn. High crude oil and gasoline prices tend to increase the demand for ethanol. Sugar is priced in dollars, so a weak real enables Brazilian sugar farmers to accept fewer of them to cover expenses denominated in reals.

Data Source: Reuters/Datastream

Like soybeans and corn, sugar is exhibiting strength in the absence of any real shortages and despite the drag of a weak home currency. We consider this to be extremely bullish over the longer-term. The stock market has been doing the same thing since the Fed unleased their “everything put” and promised to backstop virtually every financial asset class. The reverberations of this policy are now also being felt in commodities like sugar.

Last week’s rally in sugar boosted the price of May 13-cent calls we suggested purchasing for a little over $616 in our April 7th blog post. These settled for $1,444 each as of the close on Friday. Sugar is overbought, so RMB Group trading customers holding these calls may want to consider exiting half at current levels, taking initial risk off the table in the process. Hold the balance for a move higher.

Sugar topped out at nearly 34 cents per ounce following the last recession. And while we don’t expect a repeat this time, its ability to rally in the face of what would normally be a bearish environment could be a signal of even better days ahead. Our target remains 16 cents per pound for now. Prices can and will change, so contact your RMB Group broker for the latest.

Please be advised that you need a futures account to trade the markets in this post. The RMB Group has been helping our clientele trade futures and options since 1991. RMB Group brokers are familiar with the option strategies described in this report. Call us toll-free at 800-345-7026 or 312-373-4970 (direct) for more information and/or to open a trading account. Or visit our website at www.rmbgroup.com. Want to know more about trading futures and options? Download our FREE Report, the RMB Group “Short Course in Futures and Options.”

* * * * * * * *

The RMB Group

222 South Riverside Plaza, Suite 1200, Chicago, IL 60606

This material has been prepared by a sales or trading employee or agent of R.J. O’Brien & Associates (“RJO”)/RMB Group and is, or is in the nature of, a solicitation. This material is not a research report prepared by a Research Department. By accepting this communication, you agree that you are an experienced user of the futures markets, capable of making independent trading decisions, and agree that you are not, and will not, rely solely on this communication in making trading decisions.

DISTRIBUTION IN SOME JURISDICTIONS MAY BE PROHIBITED OR RESTRICTED BY LAW. PERSONS IN POSSESSION OF THIS COMMUNICATION INDIRECTLY SHOULD INFORM THEMSELVES ABOUT AND OBSERVE ANY SUCH PROHIBITION OR RESTRICTIONS. TO THE EXTENT THAT YOU HAVE RECEIVED THIS COMMUNICATION INDIRECTLY AND SOLICITATIONS ARE PROHIBITED IN YOUR JURISDICTION WITHOUT REGISTRATION, THE MARKET COMMENTARY IN THIS COMMUNICATION SHOULD NOT BE CONSIDERED A SOLICITATION.

The risk of loss in trading futures and/or options is substantial and each investor and/or trader must consider whether this is a suitable investment. Past performance, whether actual or indicated by simulated historical tests of strategies, is not indicative of future results. Trading advice is based on information taken from trades and statistical services and other sources that RJO/RMB believes are reliable. We do not guarantee that such information is accurate or complete and it should not be relied upon as such. Trading advice reflects our good faith judgment at a specific time and is subject to change without notice. There is no guarantee that the advice we give will result in profitable trades.