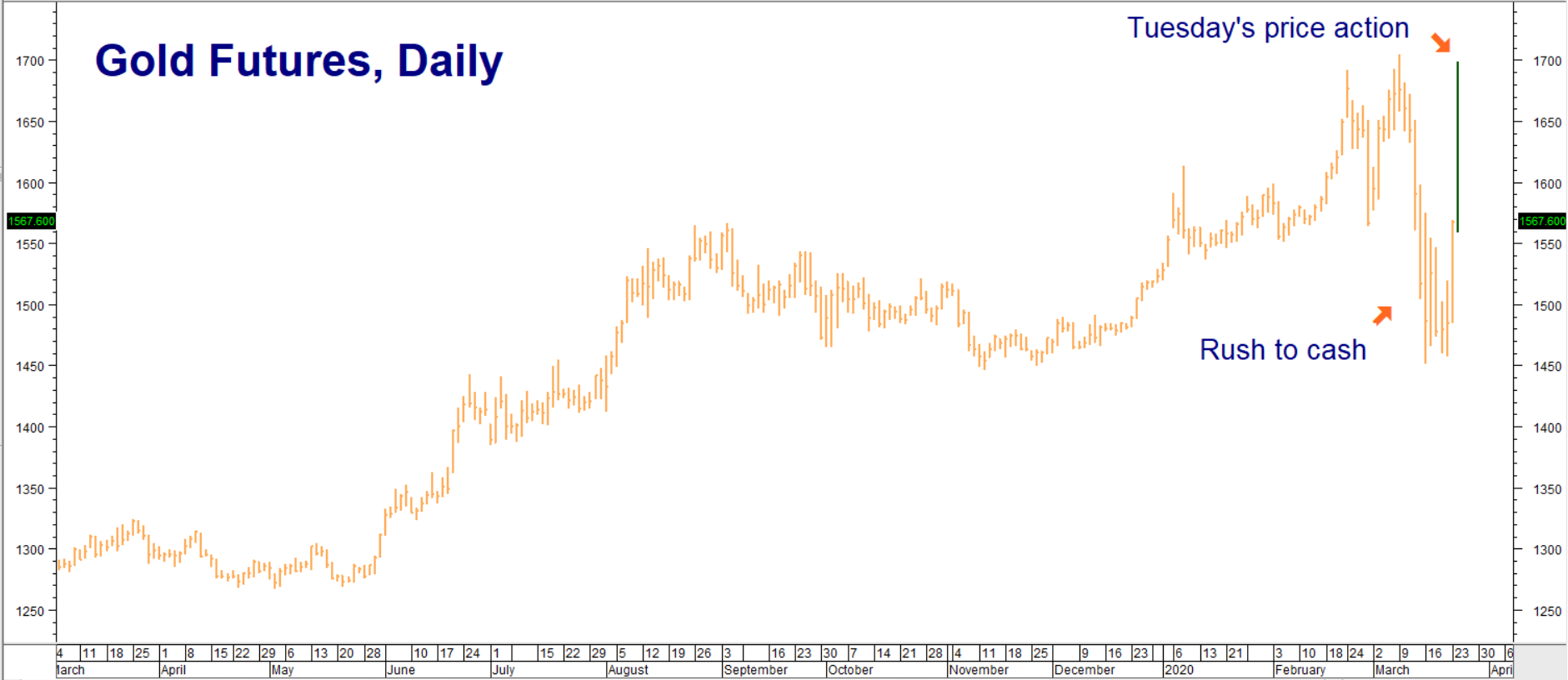

The chart below is the perfect illustration of why we love options — especially in this climate of heightened fear. RMB Group trading customers and readers who have been following our blog posts know that we’ve been recommending fixed-risk long positions in gold since late 2018 by using 100-ounce COMEX call options. This has allowed us to weather sharp, volatile downward corrections of the type experienced by gold in last week’s rush to cash that saw the yellow metal plummet 14.8 percent in a little over a week.

Data Source: Reuters/Datastream

It has taken gold just 3 days to negate last week’s down move. It exploded again today, soaring as high as $1,698 per ounce – testing old swing highs at $1,704 per ounce and putting it within striking distance of our next upside objective of $1,750 per ounce. What is behind today’s 8% pop in gold? The stimulus for starters. The prospect of trillions in helicopter money being injected into the economy will cause any hard-money advocate to stand up and take notice.

Stimulus & Supply Issues Supporting Gold

Depression fears may be running rampant, but the potentially inflationary impacts of these trillions sloshing around the economy isn’t being ignored either. Unlike past forms of Fed and Fiscal stimulus, a big chunk of what is currently being considered is being directed into people’s pockets. This increases the possibility that the inflationary effects of the stimulus bill being debated in Congress will impact the prices of goods and services.

Past stimulus (such as TARP in 2008) was funneled through the banking system and resulted in the inflation of financial assets. It could be different this time – especially if the COVID-19 crisis proves to be not as bad as the worst-case scenario many markets have already baked into prices. Stimulus is important and the need to go big is real, but that doesn’t mean there won’t be consequences down the road. Gold is adjusting accordingly.

The demand for bullion is also exploding. Dealers are running out of inventory at the same time the coronavirus crisis is causing refiners to shut down. This is also helping to keep a bid under gold. Some analysts believe this demand pressure could push gold as high as $2,000 per ounce all by itself. We are keeping our upside targets $1,750 and $1,950 per ounce for now but are ready to adjust them higher should the price action dictate.

RMB Group trading customers should continue to hold all remaining bull call spreads in gold. Consider “rolling up” your long positions if and when our $1,750 and $1,950 targets are hit. Those without positions may want to consider establishing bull call spread positions on setbacks. Contact your RMB Group broker for our latest suggestions.

Please be advised that you need a futures account to trade the markets in this post. The RMB Group has been helping its clientele trade futures and options since 1991. RMB Group brokers are familiar with the option strategies described in this report. Call us toll-free at 800-345-7026 or 312-373-4970 (direct) for more information and/or to open a trading account. Or visit our website at www.rmbgroup.com. Want to know more about trading futures and options? Download our FREE Report, the RMB Group “Short Course in Futures and Options.”

* * * * * * * *

The RMB Group

222 South Riverside Plaza, Suite 1200, Chicago, IL 60606

This material has been prepared by a sales or trading employee or agent of R.J. O’Brien & Associates (“RJO”)/RMB Group and is, or is in the nature of, a solicitation. This material is not a research report prepared by a Research Department. By accepting this communication, you agree that you are an experienced user of the futures markets, capable of making independent trading decisions, and agree that you are not, and will not, rely solely on this communication in making trading decisions.

DISTRIBUTION IN SOME JURISDICTIONS MAY BE PROHIBITED OR RESTRICTED BY LAW. PERSONS IN POSSESSION OF THIS COMMUNICATION INDIRECTLY SHOULD INFORM THEMSELVES ABOUT AND OBSERVE ANY SUCH PROHIBITION OR RESTRICTIONS. TO THE EXTENT THAT YOU HAVE RECEIVED THIS COMMUNICATION INDIRECTLY AND SOLICITATIONS ARE PROHIBITED IN YOUR JURISDICTION WITHOUT REGISTRATION, THE MARKET COMMENTARY IN THIS COMMUNICATION SHOULD NOT BE CONSIDERED A SOLICITATION.

The risk of loss in trading futures and/or options is substantial and each investor and/or trader must consider whether this is a suitable investment. Past performance, whether actual or indicated by simulated historical tests of strategies, is not indicative of future results. Trading advice is based on information taken from trades and statistical services and other sources that RJO/RMB believes are reliable. We do not guarantee that such information is accurate or complete and it should not be relied upon as such. Trading advice reflects our good faith judgment at a specific time and is subject to change without notice. There is no guarantee that the advice we give will result in profitable trades.