People need to eat — sick or not — unemployed or not. Whether you are Asian, European, North American, South American, African or Australian, you need to eat. There are roughly 7.6 billion human beings in the world and this number is growing rapidly. Corn and soybeans are two essential commodities that have been hammered in the global rush to cash caused by the coronavirus crisis. This is providing level-headed speculators with an opportunity to take low-cost-long positions in both.

Data Source: Reuters/Datastream

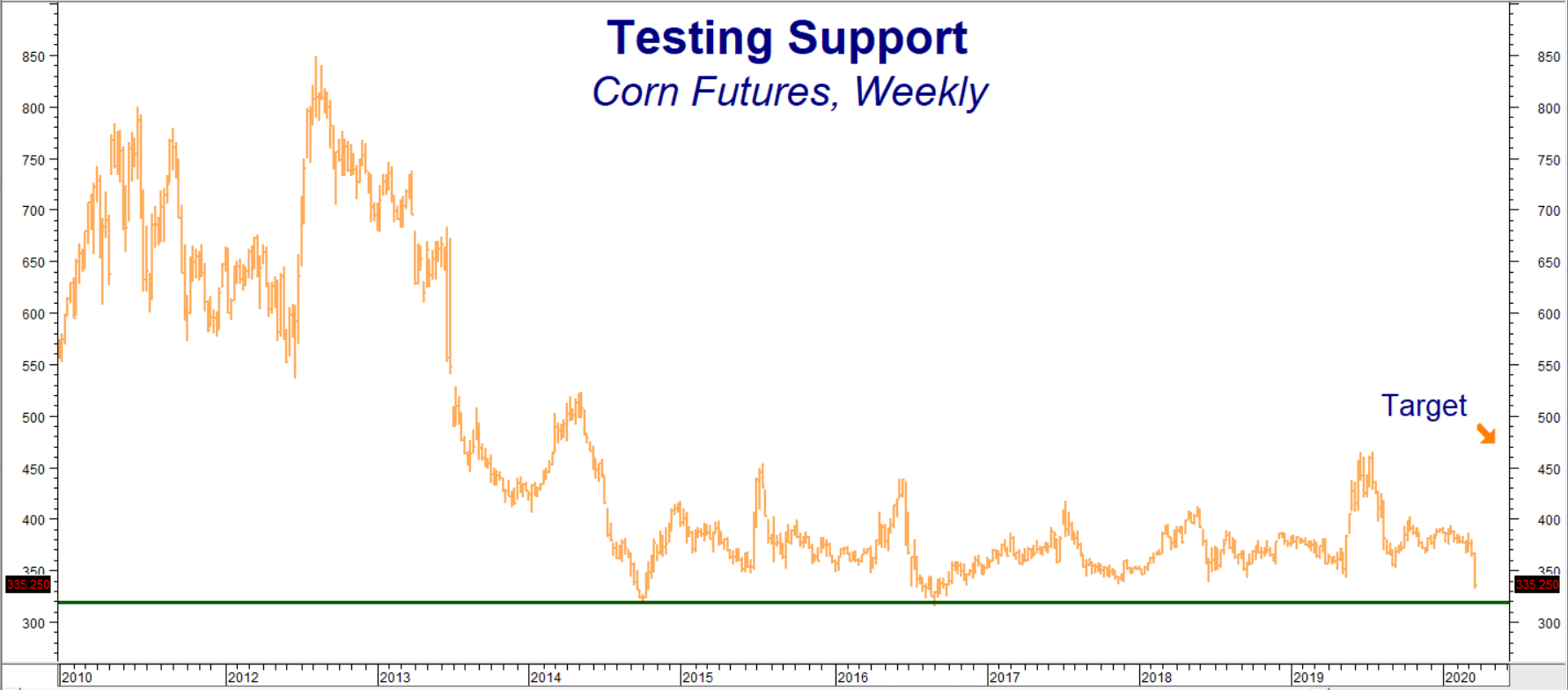

The chart above shows the past ten years of price history in corn. The yellow grain has traded sideways for the past six years, bottoming at around $3.30 per bushel and topping out at around $4.60 per bushel. Wednesday’s big washout drove prices as low as $3.32 per bushel. Thursday’s rebound indicates this long-term support level is still formidable.

Weather Will Determine Prices

If you trade agricultural commodities you know that when it comes to price, weather trumps everything. The rapidly expanding global population means demand is baked into the market. People are not going to stop eating. Global population will continue to expand, even if the coronavirus proves more deadly than expected. This means the only real variable is supply and supply is ruled by Mother Nature. We are now approaching a period of seasonal strength for corn. The South American crop is being harvested now and this is weighing on the market along with the global need for cash. Attention will now turn to the North American crop. The Chinese are also big producers of corn.

Corn often spends the months of April and May building in a “weather premium” to account for uncertain weather conditions during growing season. This played out in spades last year when torrential rains delayed the planting of the North American crop and sent price to the top of corn’s long-term trading range.

Will the same thing happen again this year? It is too early to tell. But with corn bouncing off long-term support and seasonal uncertainty in its favor, we believe now may be the perfect time to consider a low cost long position. Our target is a test of the top of corn’s trading range at $4.60 per bushel.

RMB trading customers may want to consider purchasing September $3.80 corn calls, looking for the yellow grain to make a run at the top end of its multi-year trading range prior to options expiration on August 21, 2020.

This gives us nearly the entire summer to be right. These options are currently trading for roughly $800 each and will be worth at least $4,000 should corn hit our $4.60 objective by then. Prices can and do change so check with your RMB broker for the latest.

Soybeans Also Testing Support

Data Source: Reuters/Datastream

The technical (chart-based) outlook for soybeans is similar to that of corn. Beans tested their multi-year lows at the $8.00 per bushel level on Wednesday before bouncing smartly on Thursday. And, while the North American growing season for soy is longer than that for corn, the same seasonal weather uncertainties tend to support prices during the spring. Consequently, we would not be surprised to see soybeans bounce further from these levels and pop to the top of their multi-year trading range of $9.60 per bushel by the end of the summer.

RMB Group trading customers may want to consider purchasing November $9.00 / $9.60 bull call spreads (currently trading for right around $650 each), looking for beans to hit our $9.60 objective prior to option expiration on October 23, 2020. Your maximum risk is the amount you pay for your spread plus transaction costs. These spreads have the potential to be worth as much $3,000 at our $9.60 objective.

Please be advised that you need a futures account to trade the markets in this post. The RMB Group has been helping its clientele trade futures and options since 1991. RMB Group brokers are familiar with the option strategies described in this report. Call us toll-free at 800-345-7026 or 312-373-4970 (direct) for more information and/or to open a trading account. Or visit our website at www.rmbgroup.com. Want to know more about trading futures and options? Download our FREE Report, the RMB Group “Short Course in Futures and Options.”

* * * * * * * *

The RMB Group

222 South Riverside Plaza, Suite 1200, Chicago, IL 60606

This material has been prepared by a sales or trading employee or agent of R.J. O’Brien & Associates (“RJO”)/RMB Group and is, or is in the nature of, a solicitation. This material is not a research report prepared by a Research Department. By accepting this communication, you agree that you are an experienced user of the futures markets, capable of making independent trading decisions, and agree that you are not, and will not, rely solely on this communication in making trading decisions.

DISTRIBUTION IN SOME JURISDICTIONS MAY BE PROHIBITED OR RESTRICTED BY LAW. PERSONS IN POSSESSION OF THIS COMMUNICATION INDIRECTLY SHOULD INFORM THEMSELVES ABOUT AND OBSERVE ANY SUCH PROHIBITION OR RESTRICTIONS. TO THE EXTENT THAT YOU HAVE RECEIVED THIS COMMUNICATION INDIRECTLY AND SOLICITATIONS ARE PROHIBITED IN YOUR JURISDICTION WITHOUT REGISTRATION, THE MARKET COMMENTARY IN THIS COMMUNICATION SHOULD NOT BE CONSIDERED A SOLICITATION.

The risk of loss in trading futures and/or options is substantial and each investor and/or trader must consider whether this is a suitable investment. Past performance, whether actual or indicated by simulated historical tests of strategies, is not indicative of future results. Trading advice is based on information taken from trades and statistical services and other sources that RJO/RMB believes are reliable. We do not guarantee that such information is accurate or complete and it should not be relied upon as such. Trading advice reflects our good faith judgment at a specific time and is subject to change without notice. There is no guarantee that the advice we give will result in profitable trades.