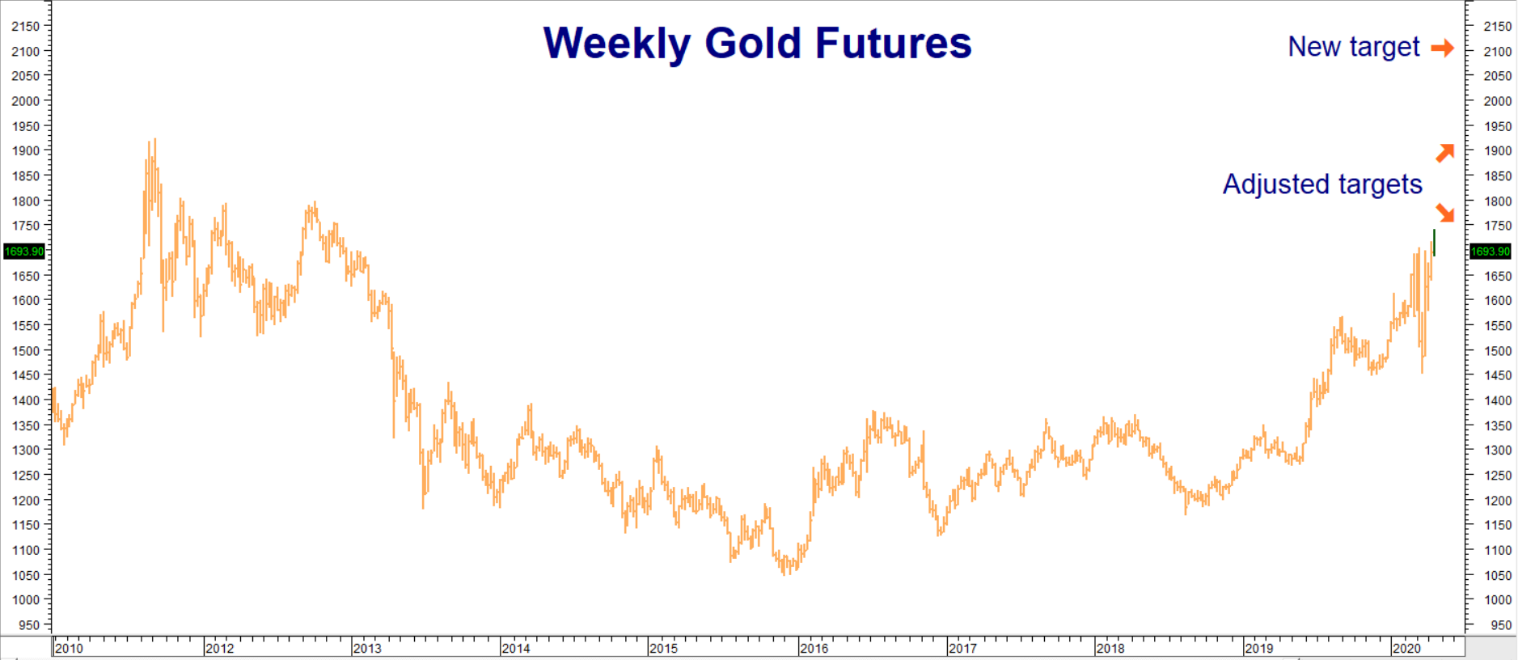

Gold blew through tough resistance at $1,700 per ounce yesterday and came within less than $8 of our $1,750 target price in overnight price action. $1,742.50 is now the new swing high for the front month futures contract. Gold is in “backwardation” as we write this, which means the front-month (June) futures contract is trading at a premium to the back-month contracts. This is extremely rare and potentially very bullish.

Data Source: Reuters/Datastream

Back-month futures contracts typically trade at a premium reflecting both the cost of insurance and storage of the physical metal as well as the opportunity cost of potential interest forfeited by holders of physical bullion. “Backwardation” in commodities tends to be bullish because it means buyers are having a hard time getting hold of physical product and are turning to the deliverable front month futures contract to meet their needs.

Holders of short COMEX gold futures positions are required to deliver 100-ounce bars to long position holders after a certain date. If the shorts cannot procure these 100-ounce bars they must buy back their futures contracts prior to the delivery period resulting in a “short squeeze.” A subdued short squeeze is what we are witnessing right now.

This slow-motion short squeeze has a lot to do with the differing size of deliverable gold bars in London and New York. London is a huge repository of gold. Good delivery gold in London is held in 400-ounce bars while good-delivery gold in New York (home of the COMEX futures exchange) must consist of 100-ounce bars. There are not enough 100-ounce bars in New York right now to meet potential COMEX delivery requirements.

This means London gold not only needs to be shipped to New York, it must also be melted down into 100 bars. COVID-19 has knocked many gold refiners off-line, making physical delivery of London gold against the 100-ounce COMEX futures extremely difficult. Shorts are being forced to buy back their futures contracts.

Short-Squeeze Not the Only Reason Gold is Higher

There wouldn’t be a short-squeeze in COMEX gold without significant underlying demand for the physical metal. There are four fundamental factors behind current demand in gold:

- Low interest rates have reduced the opportunity cost of holding physical gold to less than zero in some cases. Negative interest rates in Europe mean it is possible to get paid to borrow euros and then use that money to buy gold.

- Global currency debasement makes gold a critical financial hedge. Gold cannot be printed ad hoc. Investors wishing to protect their buying power are buying gold as a hedge against the shrinking real value of fiat currencies.

- America’s $4-trillion COVID-19 stimulus will probably grow by at least another $1 trillion and probably closer to $2 trillion of additional stimulus before it is all over. Unlike the TARP bailouts of 2009 which were funneled exclusively through the banking system, a good chunk of the COVID bailout is going directly into the pockets of the American consumer. It will probably be spent, not on buying back stock, but on actual goods and services. This increases the potential for traditional price inflation once the threat of the virus has passed. The sooner the globe recovers, the more inflationary this stimulus could be.

- The age of globalization is on indefinite hiatus. COVID-19 is likely to go down as one of the defining episodes of modern culture much like the assassination of John F. Kennedy, the September 11 attacks on the World Trade Center, and the 2008/2009 recession. The supply-chain disruptions caused by the Coronavirus will likely cause business to source their parts and labor closer to home. This will effectively remove a lot of the efficiency responsible for past two decades of subdued price inflation.

What to Do Now

RMB Group trading customers who have been following this blog know that we’ve been recommending long positions in gold (and silver) for the past few years. Our methodology is to set what we consider to be reasonable price targets based on our chart analysis and then design fixed-risk option strategies to meet those targets. While our old target of $1,750 wasn’t hit exactly, price got close enough to re-assess our chart analysis.

Gold is overbought and vulnerable to violent — albeit temporary — corrections. Recent price action has caused us to lower our next upside target from $1,950 per ounce to $1,920 (corresponding roughly to old contract highs) and add in a new, longer-term upside target of $2,100 per ounce.

Data Source: Reuters/Datastream

RMB trading customers owning bull call spreads designed to capitalize on a move to our old target of $1,750 per ounce should consider exiting at least half of your positions, rolling them up to ones designed to capitalize on a move to either our adjusted upside objective of $1,920 per ounce or our new, longer term objective of $2,100 per ounce. Gold is extremely volatile right now so please contact your RMB broker for the latest pricing.

Please be advised that you need a futures account to trade the markets in this post. The RMB Group has been helping its clientele trade futures and options since 1991. RMB Group brokers are familiar with the option strategies described in this report.

Call us toll-free at 800-345-7026 or 312-373-4970 (direct) for more information and/or to open a trading account. Or visit our website at www.rmbgroup.com. Want to know more about trading futures and options? Download our FREE Report, the RMB Group “Short Course in Futures and Options.”

* * * * * * * *

The RMB Group

222 South Riverside Plaza, Suite 1200, Chicago, IL 60606

This material has been prepared by a sales or trading employee or agent of R.J. O’Brien & Associates (“RJO”)/RMB Group and is, or is in the nature of, a solicitation. This material is not a research report prepared by a Research Department. By accepting this communication, you agree that you are an experienced user of the futures markets, capable of making independent trading decisions, and agree that you are not, and will not, rely solely on this communication in making trading decisions.

DISTRIBUTION IN SOME JURISDICTIONS MAY BE PROHIBITED OR RESTRICTED BY LAW. PERSONS IN POSSESSION OF THIS COMMUNICATION INDIRECTLY SHOULD INFORM THEMSELVES ABOUT AND OBSERVE ANY SUCH PROHIBITION OR RESTRICTIONS. TO THE EXTENT THAT YOU HAVE RECEIVED THIS COMMUNICATION INDIRECTLY AND SOLICITATIONS ARE PROHIBITED IN YOUR JURISDICTION WITHOUT REGISTRATION, THE MARKET COMMENTARY IN THIS COMMUNICATION SHOULD NOT BE CONSIDERED A SOLICITATION.

The risk of loss in trading futures and/or options is substantial and each investor and/or trader must consider whether this is a suitable investment. Past performance, whether actual or indicated by simulated historical tests of strategies, is not indicative of future results. Trading advice is based on information taken from trades and statistical services and other sources that RJO/RMB believes are reliable. We do not guarantee that such information is accurate or complete and it should not be relied upon as such. Trading advice reflects our good faith judgment at a specific time and is subject to change without notice. There is no guarantee that the advice we give will result in profitable trades.