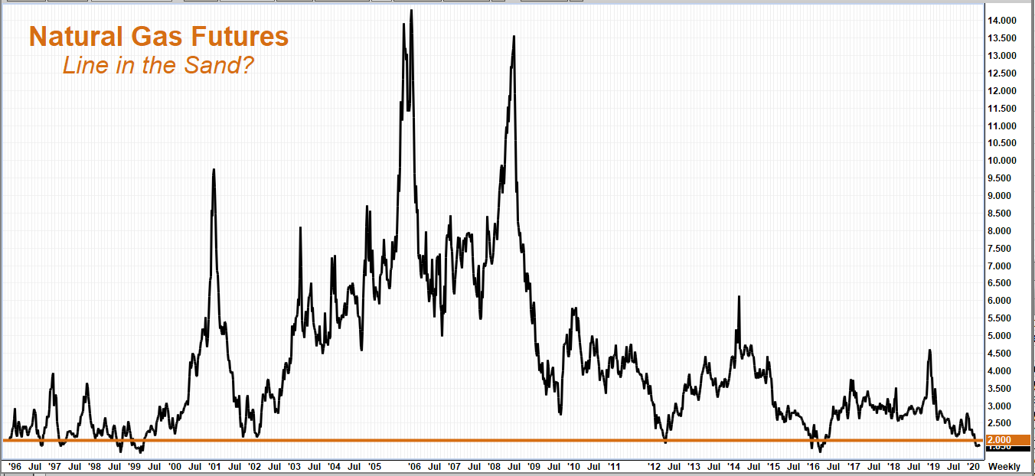

Natural gas below $2.00 is simply not natural. Its price has dipped slightly below $2.00 7 times since the mid-1990s. $2.00 natural gas has not been profitable in the past, and is certainly not now – especially when the expenses of modern-day fracking and horizontal drilling factor in. Frackers are losing money hand-over-fist, with many on the verge of bankruptcy, due to overproduction. The spread of Coronavirus has exacerbated market bearishness, pushing natural gas into bargain basement territory.

Data Source: FutureSource

The chart above shows market action for natural gas futures going back to the mid- 1990s. Natural gas has managed to bounce from the $2.00 level every time it has tested it. While there is no guarantee this will happen again, we believe gas is cheap enough and external factors potentially bullish enough for history to repeat.

“The best cure for low prices is low prices…”

This trading floor adage is key here. All commodities have a price at which the majority of producers lose money. Basic math tells them to stop producing once that price is reached. Supply drops and prices start to rise again. The same law applies to “natural.” Gas has been below the cost of production for a long time, but certain factors particular to natural gas have incentivized producers to continue producing. This keeps supplies higher and prices lower. Here are three of those factors:

- The high cost of modern drilling technology requires capital. Fracking and horizontal drilling have made the US the largest energy producer in the world, but this technology is expensive. Fracking companies tend to be smaller than the big energy producers and borrow a lot of money at relatively high interest rates in order to drill. Interest payments on their loans don’t go away just because prices are unprofitable. This forces these companies to keep pumping – hoping prices return to profitable levels.

Some energy-producing companies are funded through Master Limited Partnerships (MLPs) which represent an equity interest in production. MLPs tend to pay big dividends. This also requires constant cash flow and continuous production. - Low interest rates enable frackers to “extend and pretend” by taking on new loans and using the money to pay off old loans. This buys more time, but it adds more supply to a glutted market. It also adds to the debt burdens of marginal producers which, combined with burdensome supplies and a warmer winter, make them more vulnerable to default. Lenders know this. This means new loans are over twice as expensive as last year, with yields to maturity as high as 22.2%.

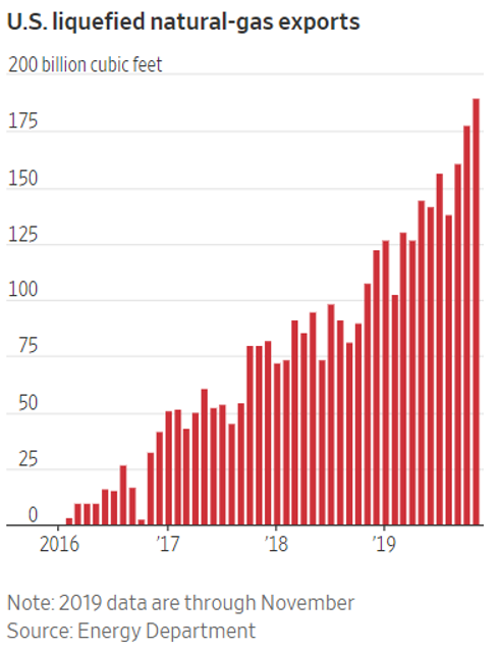

- The expanding liquid natural gas (LNG) market has given producers hope and an incentive to keep producing. Hope is never a good strategy. We believe LNG will eventually prove to be very bullish for both natural gas and gas producers who can avoid bankruptcy. This will be a much smaller group than exists now.

Capital, Rig Counts & Production All Declining

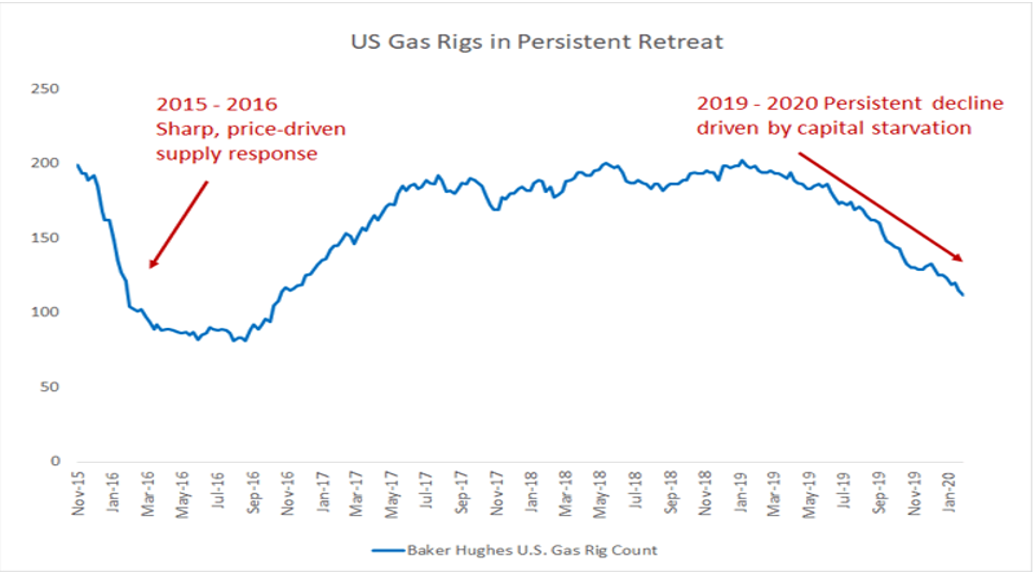

Low prices are causing energy investors to flee from the drilling space in droves, making natural gas one of the most hated commodities on the board. Drillers have torched hundreds of billions in investor capital since 2009, according to a recent article in the Wall Street Journal. (Non-subscribers may run in to WSJ’s paywall.) This dearth of new capital should speed up the number of driller bankruptcies leading to reduced supply.

Rig count and overall production are also in decline. Natural gas production in early December dropped 2.4%. This was before the latest drop below its $2.00 “line in the sand” support caused by a warmer-than-expected winter and demand fear driven by the spread of Coronavirus.

LNG to the Rescue?

LNG to the Rescue?

No question, the growing liquid natural gas market can be a game changer. Tanker and terminal capacity continue to grow. The Energy Information Agency (EIA) expects US LNG exports to nearly double by 2021. And while we believe LNG will be a huge bullish factor for natural gas and play a role in a recovery from today’s depressed levels, we do not believe a big increase in exports is necessary for a bullish turnaround. The seeds have been sown by today’s unnaturally low prices.

Nobody Likes Gas

Low prices and big supplies mean market sentiment in natural gas is about as negative as one can get. Relatively low volatility in this notoriously volatile market has helped reduce option premiums to reasonable levels. We are attracted to unloved markets – but we only take a position when we can do so for a justifiable risk. We believe the current risk in natural gas is justified.

We also like this market because of potentially bullish factors that nobody is talking about – at least not yet. It is looking more and more like Bernie Sanders will be the Democratic nomination. And while most don’t think he can beat Trump; most didn’t think Trump could beat Hillary either.

Bernie hates fracking and has vowed to do away with it. We are not saying Senator Sanders will win – he doesn’t need to for natural gas to bounce – but watch out if he does. Prices could retest 2017 highs just below $5.00 per million BTUs.

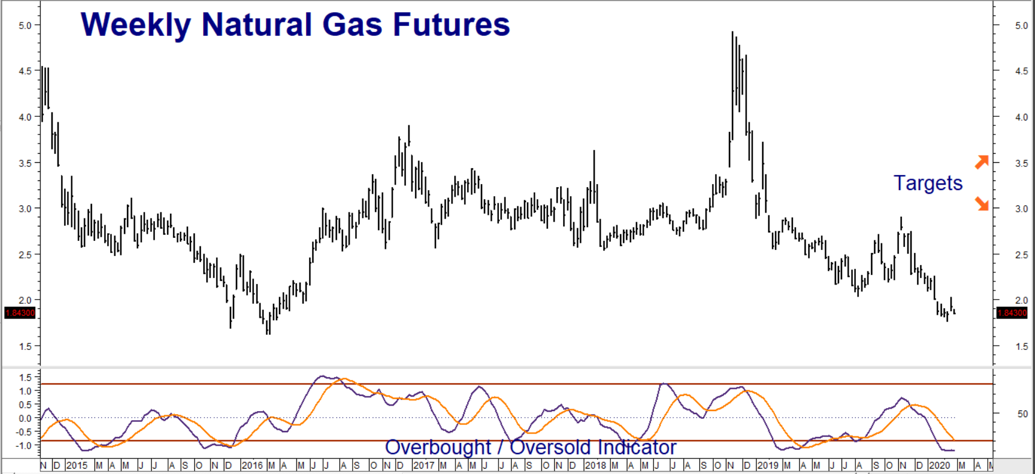

Natural’s current glut will take a while to work off, but supply and demand will eventually adjust. Expect prices to begin reflecting this about the same time the Coronavirus disappears from the news cycle. Natural gas futures are oversold (see chart below) and overdue for a bounce that could take prices higher 50% to 100% higher. It may take a bit longer, but if history is any guide, higher natural gas prices are in the cards.

Data source: Reuters/ Datastream

Our upside targets are $2.90 and $3.60 as we move into next winter’s heating season. A hot summer could keep air conditioners cranking in July and August, putting a dent in seasonal stockpiling as more gas is used to generate electricity. This could partially offset reduced demand caused by this year’s warm winter.

Relatively low volatility and extremely bearish sentiment mean the prices of October and December call options are surprisingly reasonable. RMB Group trading customers may want to take a look at October the NYMEX $2.50 calls which settled yesterday for $630 each. Your risk is the price you pay plus transaction cost.

These calls will be worth at least $4,000 should October natural gas futures hit our $2.90 objective prior to option expiration on September 25, 2020. Prices can and probably will change by the time you read this, so check with your personal RMB Group broker for the latest.

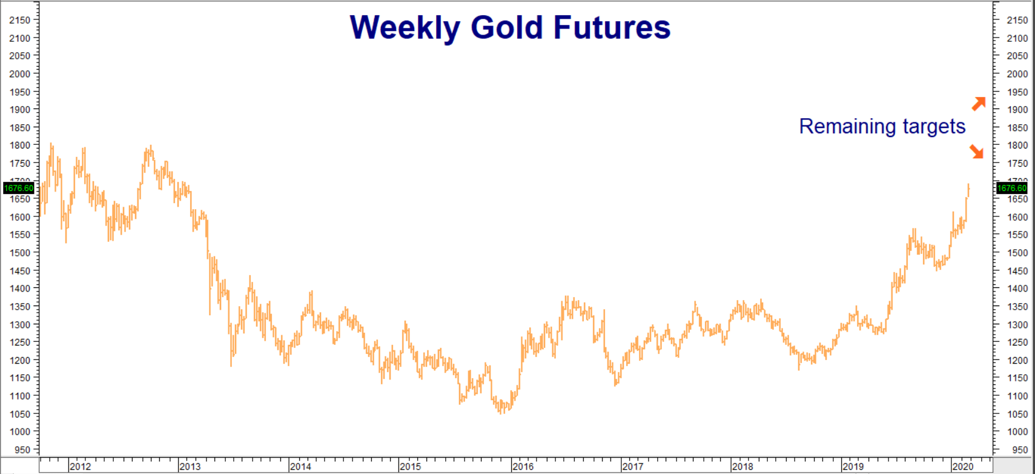

Gold Hits Our $1,650 Objective

Gold hit our $1,650 per ounce upside objective on Friday and rocketed higher in intraday trading yesterday. It soared as high as $1,691.70 per ounce before reversing late in the day. RMB Group trading customers who took our suggestion in early November to buy December 2020 $1,550 / $1,650 bull call spreads and December 2020 $1,600 / $1,650 bull calls spreads in the 100/oz COMEX options should have exited. If not, consider doing so now.

December 2020 $1,550 / $1,650 bull spreads closed yesterday for $6,510. December $1,600 / $1,650 bull spreads settled yesterday at $2,920. Consider replacing these positions with similar strategies using higher strike prices. Check with your RMB Group broker for the latest pricing.

RMB Group trading customers who took our suggestion to buy June 2020 $1,550 / $1,650 bull call spreads in early October should have exited these positions as well. If you haven’t, consider doing so now. These bull spreads finished yesterday at $7,300 each. Consider replacing them with similar spreads using higher strike prices, looking for gold to hit the $1,775 and $1,950 per ounce targets we identified in last Thursday’s blog post.

Data source: Reuters/ Datastream

Please be advised that you need a futures account to trade the markets in this post. The RMB Group has been helping its clientele trade futures and options since 1991. RMB Group brokers are familiar with the option strategies described in this report. Call us toll-free at 800-345-7026 or 312-373-4970 (direct) for more information and/or to open a trading account. Or visit our website at www.rmbgroup.com. Want to know more about trading futures and options? Download our FREE Report, the RMB Group “Short Course in Futures and Options.”

* * * * * * * *

The RMB Group

222 South Riverside Plaza, Suite 1200, Chicago, IL 60606

This material has been prepared by a sales or trading employee or agent of R.J. O’Brien & Associates (“RJO”)/RMB Group and is, or is in the nature of, a solicitation. This material is not a research report prepared by a Research Department. By accepting this communication, you agree that you are an experienced user of the futures markets, capable of making independent trading decisions, and agree that you are not, and will not, rely solely on this communication in making trading decisions.

DISTRIBUTION IN SOME JURISDICTIONS MAY BE PROHIBITED OR RESTRICTED BY LAW. PERSONS IN POSSESSION OF THIS COMMUNICATION INDIRECTLY SHOULD INFORM THEMSELVES ABOUT AND OBSERVE ANY SUCH PROHIBITION OR RESTRICTIONS. TO THE EXTENT THAT YOU HAVE RECEIVED THIS COMMUNICATION INDIRECTLY AND SOLICITATIONS ARE PROHIBITED IN YOUR JURISDICTION WITHOUT REGISTRATION, THE MARKET COMMENTARY IN THIS COMMUNICATION SHOULD NOT BE CONSIDERED A SOLICITATION.

The risk of loss in trading futures and/or options is substantial and each investor and/or trader must consider whether this is a suitable investment. Past performance, whether actual or indicated by simulated historical tests of strategies, is not indicative of future results. Trading advice is based on information taken from trades and statistical services and other sources that RJO/RMB believes are reliable. We do not guarantee that such information is accurate or complete and it should not be relied upon as such. Trading advice reflects our good faith judgment at a specific time and is subject to change without notice. There is no guarantee that the advice we give will result in profitable trades.