Last week’s panic in stocks infected commodities as well. Concerns that the COVID-19 virus would cause a sharp slowdown in the global economy powered a “risk-off” washout that pummeled the entire commodity sector. Gold, energy and nearly every agricultural commodity got blasted as traders pulled their money off the table. One of the few markets to escape the carnage that began on February 20 was coffee. It has gained 6% (as of Friday’s close) since then. S&P 500 futures lost 12.4% over the same period.

Data Source: Reuters/Datastream

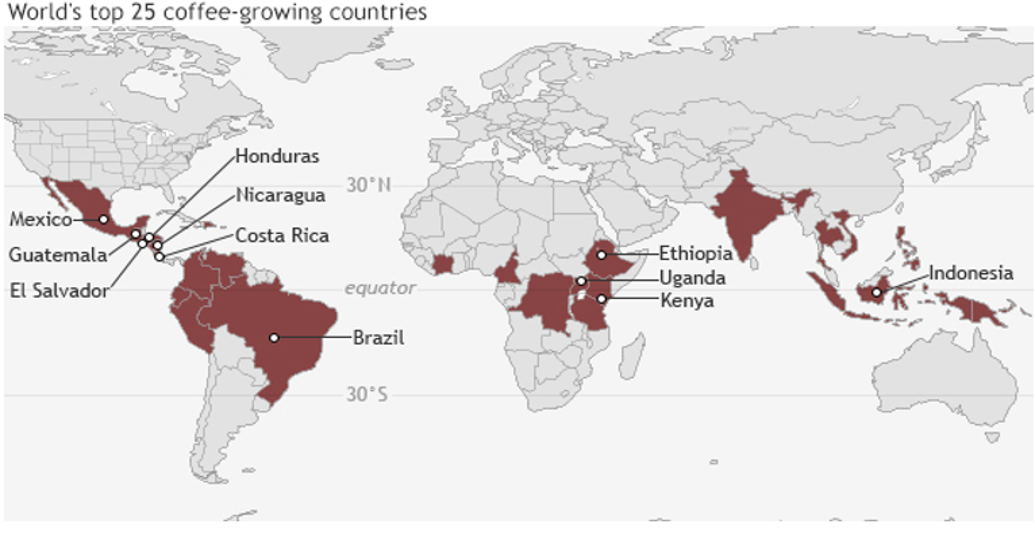

The second most heavily traded global commodity after crude oil, coffee is grown in 50 countries by approximately 20 million farmers. 100 million people are involved in the industry in one way or another. Global demand is at a record high, spurred in part by coffee-loving millennials and the growing coffee-cravings of formerly tea-drinking China and Asia.

Because much of new demand is coming from China and Asia, we didn’t expect coffee to weather the COVID-19 storm as well as it has. The fact that it has been able to rally despite the Far East being the epicenter of the epidemic has caused us to sit up and take notice. A market’s ability to rally in the face of what would normally be considered terrible news is often a sign that the worst has already been discounted and that better days lie ahead.

Coffee Getting No Help from the Real

This isn’t the first-time coffee is rallying in the face of what would normally be negative news. Brazil is the world’s largest supplier of Arabica coffee so its price in dollars is typically tied to the Brazilian real. Brazilian farmers get paid in reals, so a cheaper real means it takes fewer dollars to purchase the same amount of coffee.

The plummeting real (see chart below) has been a huge factor keeping a lid on coffee prices. Coffee was able to manage a huge rally last fall despite the very sick real and appears to be gearing up to do the same thing again. Something is happening that is offsetting the negative effect of the sick Brazilian currency. One wonders how far and how fast coffee could climb should the sick real manage to regain its strength.

Data Source: Reuters/Datastream

Mother Nature Always A Factor

Weather trumps everything when it comes to the price of coffee. Coffee is produced in a very narrow swath of the globe on both sides of the Equator. (See chart below.) Heat and rainfall play a huge part in determining crop size. Scarce rainfall in key growing areas of Brazil was responsible for much of coffee’s October 2019 rally. Rain’s return washed out that rally pretty quickly. Less-than-stellar conditions now are helping support prices again.

Excessive heat can also negatively affect coffee yields. Continuous exposure to temperatures over 86 degrees (30 degrees C) can damage beans and trees, making them more susceptible to diseases like “rust” and pests like the coffee bean borer. And while global climate change has not affected the tropics as much as the poles, warmer temperatures are already forcing coffee farmers to plant at higher altitudes.

Source: NOAA Climate.gov

Good harvests are typically followed by smaller harvests in accordance with coffee’s 2-year production cycle. The current crop year is expected to be the less productive one. The International Coffee Organization’s (ICO) November 2019 report forecast a global supply deficit of 502,000 bags. It expects total South American exports to fall 10.7% and Mexican and Central American exports to fall by 9.9%.

How High Can Coffee Go?

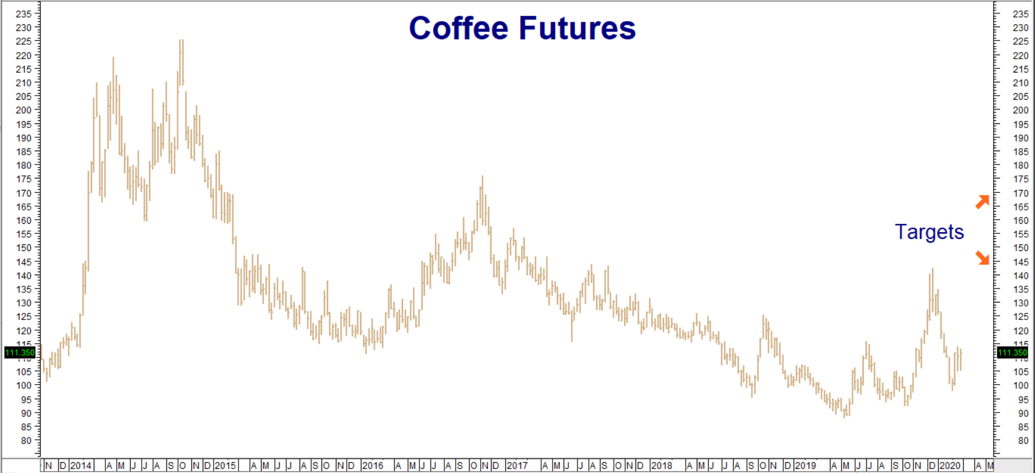

Data Source: Reuters/Datastream

Coffee is an extremely volatile market that can swing 20% to 50% at the drop of a hat. Our Fibonacci-derived upside targets of $1.45 and $1.70 per pound represent gains of 26% and 48% from current levels. Coffee options are anticipating a big move, pricing in swings of roughly 40% based on their implied volatility.

We can remove much of this volatility premium by using “bull call spreads” to take a limited risk long position. Bull call spreads are created by buying call options with strike prices close to the market and selling call options with strike prices further away. RMB trading customers may want to take a look at both the July $1.30 / $1.45 bull call spreads and the December $1.50 / $1.70 bull spreads. Both are currently trading for around $1,000 each.

The July spread has the potential to be worth as much as $5,625 should coffee reach our $1.45 objective prior to option expiration on June 12. The December spread has the potential to be worth as much as $7,500 should coffee hit our $1.70 objective on or prior to the expiration of the December options on November 12. Your maximum risk in both cases is the amount paid for the position plus transaction costs. Prices can and will change so contact your personal RMB Group broker for the latest.

Please be advised that you need a futures account to trade the markets in this post. The RMB Group has been helping its clientele trade futures and options since 1991. RMB Group brokers are familiar with the option strategies described in this report. Call us toll-free at 800-345-7026 or 312-373-4970 (direct) for more information and/or to open a trading account. Or visit our website at www.rmbgroup.com. Want to know more about trading futures and options? Download our FREE Report, the RMB Group “Short Course in Futures and Options.”

* * * * * * * *

The RMB Group

222 South Riverside Plaza, Suite 1200, Chicago, IL 60606

This material has been prepared by a sales or trading employee or agent of R.J. O’Brien & Associates (“RJO”)/RMB Group and is, or is in the nature of, a solicitation. This material is not a research report prepared by a Research Department. By accepting this communication, you agree that you are an experienced user of the futures markets, capable of making independent trading decisions, and agree that you are not, and will not, rely solely on this communication in making trading decisions.

DISTRIBUTION IN SOME JURISDICTIONS MAY BE PROHIBITED OR RESTRICTED BY LAW. PERSONS IN POSSESSION OF THIS COMMUNICATION INDIRECTLY SHOULD INFORM THEMSELVES ABOUT AND OBSERVE ANY SUCH PROHIBITION OR RESTRICTIONS. TO THE EXTENT THAT YOU HAVE RECEIVED THIS COMMUNICATION INDIRECTLY AND SOLICITATIONS ARE PROHIBITED IN YOUR JURISDICTION WITHOUT REGISTRATION, THE MARKET COMMENTARY IN THIS COMMUNICATION SHOULD NOT BE CONSIDERED A SOLICITATION.

The risk of loss in trading futures and/or options is substantial and each investor and/or trader must consider whether this is a suitable investment. Past performance, whether actual or indicated by simulated historical tests of strategies, is not indicative of future results. Trading advice is based on information taken from trades and statistical services and other sources that RJO/RMB believes are reliable. We do not guarantee that such information is accurate or complete and it should not be relied upon as such. Trading advice reflects our good faith judgment at a specific time and is subject to change without notice. There is no guarantee that the advice we give will result in profitable trades.